|

市場調查報告書

商品編碼

1892882

數位貨運經紀市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Digital Freight Brokerage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

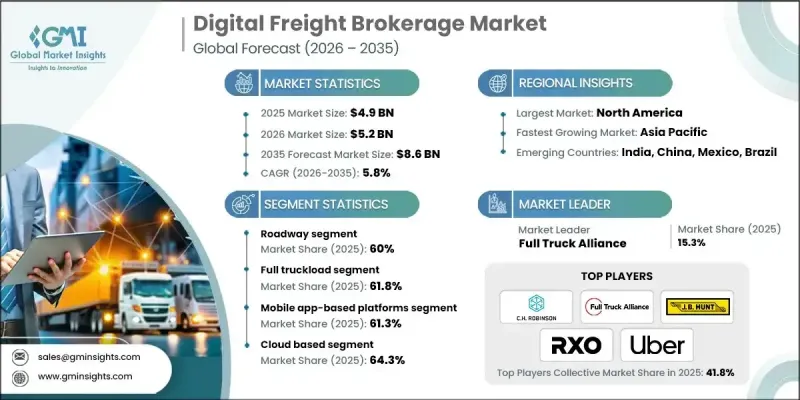

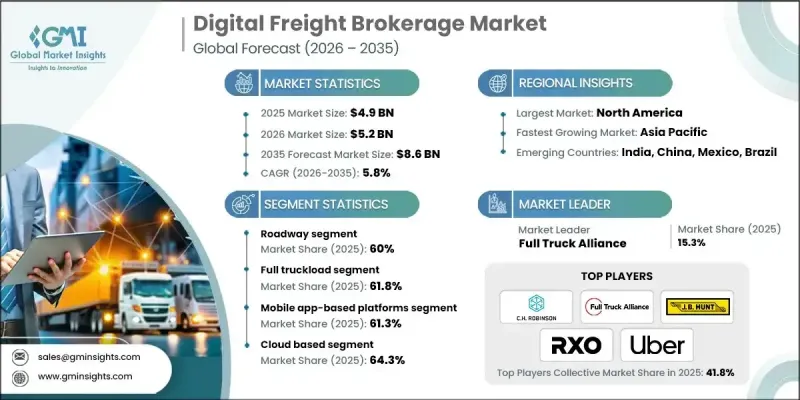

2025 年全球數位貨運經紀市場價值 49 億美元,預計到 2035 年將以 5.8% 的複合年成長率成長至 86 億美元。

隨著托運人越來越依賴自動化貨運匹配系統和能夠即時獲取承運商運力資訊的數位工具,市場成長正在加速。成本效益仍然是主要驅動力,托運人紛紛轉向線上平台以簡化營運、減少人工流程並降低運輸成本。數位經紀平台透過最佳化裝載分配來幫助減少空駛里程,從而提高資產利用率、增加承運商收益並提升整體服務可靠性。國際貨運數位化處理的成長以及對更嚴格合規監管的推動也促進了自動化分配技術的應用。同時,業界正迅速向人工智慧驅動的預測模型轉型,以提高定價準確性和線路級績效可視性。這些預測能力有助於穩定成本並提高服務效率,進一步提升了所有貨運類別對數位經紀工具的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 49億美元 |

| 預測值 | 86億美元 |

| 複合年成長率 | 5.8% |

到2025年,基於雲端的貨運解決方案將佔據64.3%的市場佔有率,這主要得益於貨運系統向雲端快速轉型。目前,相當一部分新型貨運管理平台仰賴雲端架構,而全球雲端投資的持續成長也加速了物流營運的現代化進程。

到 2025 年,基於行動應用程式的平台市佔率將達到 61.3%。智慧型手機的廣泛普及和司機互動工具將繼續推動使用,使用戶能夠即時存取貨運資訊、文件和基於位置的匹配功能。

美國數位貨運經紀市場佔86.2%的市場佔有率,預計到2025年市場規模將達到17.6億美元。強大的數位網路、高公路貨運量以及不斷成長的末端物流需求支援平台在整個地區的普及應用,都推動了這個市場的發展。獨立卡車司機和小型車隊擴大使用行動端貨運通知和遠端資訊處理技術來確保穩定的運力。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電子商務貨運量成長

- 向自動化經紀工作流程轉變

- 擴展可見性和追蹤工具

- 遠端資訊處理和車隊資料的整合

- 產業陷阱與挑戰

- 分散的營運商生態系統

- 對資料隱私和平台依賴的擔憂

- 市場機遇

- 擴展綜合多模式平台

- 採用基於人工智慧的定價和匹配

- 跨境數位走廊的發展

- 成長潛力分析

- 監管環境

- 北美洲

- FMCSA法規

- 加拿大交通局 (CTA) 指南

- 歐洲

- 歐盟運輸法規

- 電子貨運指令

- 一般資料保護規範(GDPR)

- 英國GDPR

- 數位式行車記錄器規則

- 亞太地區

- 公路貨運行政措施

- 網路安全法

- 關於提高物流效率的法案

- 2019年機動車輛法

- 運輸業務法

- 智慧物流計劃

- 拉丁美洲

- 國家陸路運輸管理局(ANTT)規章

- 聯邦道路運輸法

- 美墨加協定規定

- 中東和非洲

- 阿拉伯聯合大公國聯邦交通法

- 沙烏地阿拉伯運輸和物流法規

- 道路交通法

- 北美洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 成本細分分析

- 運輸成本

- 技術和平台成本

- 營運成本

- 監理和合規成本

- 燃料和能源成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 定價分析

- 按地區

- 透過服務

- 用例

- 最佳情況

- 市場進入策略

- 針對特定區域的市場滲透策略

- 新進入者需要考慮的關鍵監管因素

- 定價、服務和差異化策略

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依運輸方式分類,2022-2035年

- 道路

- 航道

- 氣道

- 鐵路

第6章:市場估算與預測:依服務類型分類,2022-2035年

- 整車運輸 (FTL)

- 零擔貨運 (LTL)

- 多式聯運

第7章:市場估計與預測:依平台分類,2022-2035年

- 基於行動應用的平台

- 網路為基礎的平台

第8章:市場估算與預測:依部署模式分類,2022-2035年

- 基於雲端的

- 本地部署

- 混合

第9章:市場估算與預測:依組織規模分類,2022-2035年

- 中小企業

- 大型企業

第10章:市場估計與預測:依應用領域分類,2022-2035年

- 貨運管理

- 承運人和托運人匹配

- 價格競價拍賣

- 即時追蹤與分析

- 自動化文件

- 其他

第11章:市場估計與預測:依最終用途分類,2022-2035年

- 零售與電子商務

- 汽車

- 製造業

- 消費品

- 衛生保健

- 食品和飲料

- 其他

第12章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第13章:公司簡介

- 全球參與者

- CH Robinson

- Coyote Logistics

- Echo Global Logistics

- Hub Group

- JB Hunt

- Landstar System

- Total Quality Logistics

- Uber

- Worldwide Express

- XPO

- 區域玩家

- Allen Lund

- ArcBest

- BNSF Logistics

- England Logistics

- GlobalTranz Enterprises

- MATSON Logistics

- Schneider

- Transplace

- Werner Enterprises

- 新興參與者/顛覆者

- Armstrong Transport Group

- Ascent Global Logistics

- Expeditors International

- NTG Freight

- Trinity Logistics

The Global Digital Freight Brokerage Market was valued at USD 4.9 billion in 2025 and is estimated to grow at a CAGR of 5.8% to reach USD 8.6 billion by 2035.

Market growth is accelerating as shippers increasingly rely on automated freight-matching systems and digital tools that provide real-time access to carrier capacity. Cost efficiency remains a major motivation, with shippers turning to online platforms to streamline operations, minimize manual processes, and lower transportation expenses. Digital brokerage platforms help reduce empty miles by optimizing load assignments, which enhances asset utilization, raises carrier earnings, and improves overall service dependability. The rise in international shipments processed digitally and the push for stronger compliance oversight have also reinforced the adoption of automated allocation technologies. At the same time, the industry is moving rapidly toward AI-driven forecasting models that improve pricing accuracy and lane-level performance visibility. These predictive capabilities help stabilize costs while strengthening service efficiency, further boosting the demand for digital brokerage tools across all freight categories.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.9 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.8% |

The cloud-based category accounted for a 64.3% share in 2025, strengthened by the rapid shift toward cloud-enabled freight systems. A significant portion of new freight management platforms now depend on cloud architecture, supported by global cloud investments that are accelerating the modernization of logistics operations.

The mobile app-based platforms segment held a 61.3% share in 2025. Widespread smartphone adoption and driver engagement tools continue to drive usage, allowing instant access to load postings, documents, and location-based matching capabilities.

U.S. Digital Freight Brokerage Market held 86.2% share and generated USD 1.76 billion in 2025. Strong digital networks, high road freight volumes, and expanding last-mile demand support platform adoption throughout the region. Independent truckers and smaller fleets are increasingly using mobile-enabled load notifications and telematics connectivity to secure consistent capacity.

Key companies in the Global Digital Freight Brokerage Market include C.H. Robinson, Coyote Logistics, Echo Global Logistics, Full Truck Alliance, J.B. Hunt, Landstar System, RXO, Total Quality Logistics (TQL), Uber, and XPO. Market leaders are strengthening their competitive positions by investing in AI-based matching engines, predictive analytics, and automated pricing tools that enhance operational accuracy and provide faster load-to-carrier pairing. Companies are expanding cloud-native platforms to improve scalability and reliability for shippers and carriers. Many are integrating telematics data, real-time tracking, and digital documentation to create seamless end-to-end workflows. Strategic partnerships with carriers, logistics service providers, and supply chain software companies also help expand network density and load availability. Businesses are focusing on mobile-first solutions to support driver engagement and speed up transactions. Continuous enhancements in compliance automation, platform security, and user experience further support market differentiation and long-term customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Transportation Mode

- 2.2.3 Service

- 2.2.4 Platform

- 2.2.5 Deployment Model

- 2.2.6 Organization Size

- 2.2.7 Application

- 2.2.8 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growth in E-commerce freight volumes

- 3.2.1.3 Shift toward automated brokerage workflows

- 3.2.1.4 Expansion of visibility and tracking tools

- 3.2.1.5 Integration of telematics and fleet data

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fragmented carrier ecosystem

- 3.2.2.2 Concerns about data privacy and platform dependence

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of integrated multimodal platforms

- 3.2.3.2 Adoption of AI based pricing and matching

- 3.2.3.3 Growth of cross border digital corridors

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 FMCSA Regulations

- 3.4.1.2 Canadian Transportation Agency (CTA) Guidelines

- 3.4.2 Europe

- 3.4.2.1 EU transport regulations

- 3.4.2.2 E-freight directive

- 3.4.2.3 General data protection regulation (GDPR)

- 3.4.2.4 UK GDPR

- 3.4.2.5 Digital tachograph rules

- 3.4.3 Asia Pacific

- 3.4.3.1 Administrative measures for road freight

- 3.4.3.2 Cybersecurity law

- 3.4.3.3 Act on Improvement of Logistics Efficiency

- 3.4.3.4 Motor Vehicles Act 2019

- 3.4.3.5 Transport Business Act

- 3.4.3.6 Smart Logistics Initiative

- 3.4.4 Latin America

- 3.4.4.1 National land transport agency (ANTT) regulations

- 3.4.4.2 Federal road transportation law

- 3.4.4.3 Usmca regulations

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE federal transport law

- 3.4.5.2 Saudi transport and logistics regulations

- 3.4.5.3 Road traffic act

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Transportation costs

- 3.8.2 Technology & platform costs

- 3.8.3 Operational costs

- 3.8.4 Regulatory & compliance costs

- 3.8.5 Fuel and energy costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Pricing analysis

- 3.11.1 By region

- 3.11.2 By service

- 3.12 Use cases

- 3.13 Best case scenarios

- 3.14 Go-to-Market strategies

- 3.14.1 Region-specific market penetration strategies

- 3.14.2 Key regulatory considerations for new entrants

- 3.14.3 Pricing, service, and differentiation strategies

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Transportation Mode, 2022- 2035 (USD Mn)

- 5.1 Key trends

- 5.2 Roadway

- 5.3 Seaway

- 5.4 Airway

- 5.5 Railway

Chapter 6 Market Estimates & Forecast, By Service, 2022 - 2035 (USD Mn)

- 6.1 Key trends

- 6.2 Full Truckload (FTL)

- 6.3 Less than Truckload (LTL)

- 6.4 Intermodal

Chapter 7 Market Estimates & Forecast, By Platform, 2022 - 2035 (USD Mn)

- 7.1 Key trends

- 7.2 Mobile app-based platforms

- 7.3 Web-based platforms

Chapter 8 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 (USD Mn)

- 8.1 Key trends

- 8.2 Cloud-Based

- 8.3 On-Premises

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Organization Size, 2022 - 2035 (USD Mn)

- 9.1 Key trends

- 9.2 Small & Medium Enterprises (SMEs)

- 9.3 Large Enterprises

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Mn)

- 10.1 Key trends

- 10.2 Freight management

- 10.3 Carrier & shipper matching

- 10.4 Price bidding & auction

- 10.5 Real-time tracking & analytics

- 10.6 Automated documentation

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By End Use, 2022 - 2035 (USD Mn)

- 11.1 Key trends

- 11.2 Retail & e-commerce

- 11.3 Automotive

- 11.4 Manufacturing

- 11.5 Consumer goods

- 11.6 Healthcare

- 11.7 Food & beverages

- 11.8 Others

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Netherlands

- 12.3.9 Sweden

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Singapore

- 12.4.7 Thailand

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Turkey

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 C.H. Robinson

- 13.1.2 Coyote Logistics

- 13.1.3 Echo Global Logistics

- 13.1.4 Hub Group

- 13.1.5 J.B. Hunt

- 13.1.6 Landstar System

- 13.1.7 Total Quality Logistics

- 13.1.8 Uber

- 13.1.9 Worldwide Express

- 13.1.10 XPO

- 13.2 Regional Players

- 13.2.1 Allen Lund

- 13.2.2 ArcBest

- 13.2.3 BNSF Logistics

- 13.2.4 England Logistics

- 13.2.5 GlobalTranz Enterprises

- 13.2.6 MATSON Logistics

- 13.2.7 Schneider

- 13.2.8 Transplace

- 13.2.9 Werner Enterprises

- 13.3 Emerging Players / Disruptors

- 13.3.1 Armstrong Transport Group

- 13.3.2 Ascent Global Logistics

- 13.3.3 Expeditors International

- 13.3.4 NTG Freight

- 13.3.5 Trinity Logistics