|

市場調查報告書

商品編碼

1892845

膳食纖維市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Dietary Fibers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

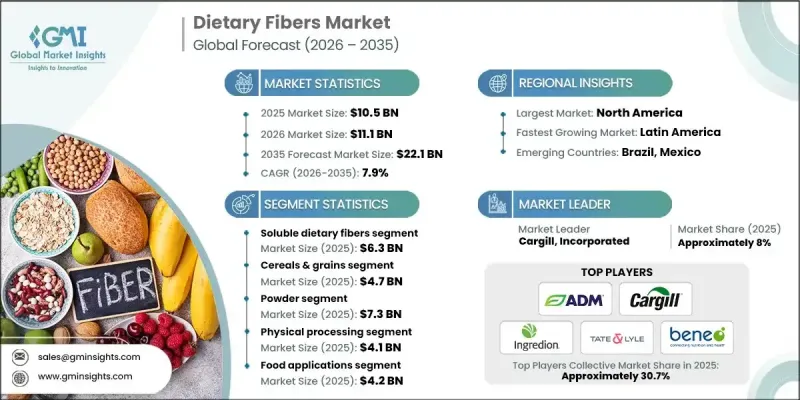

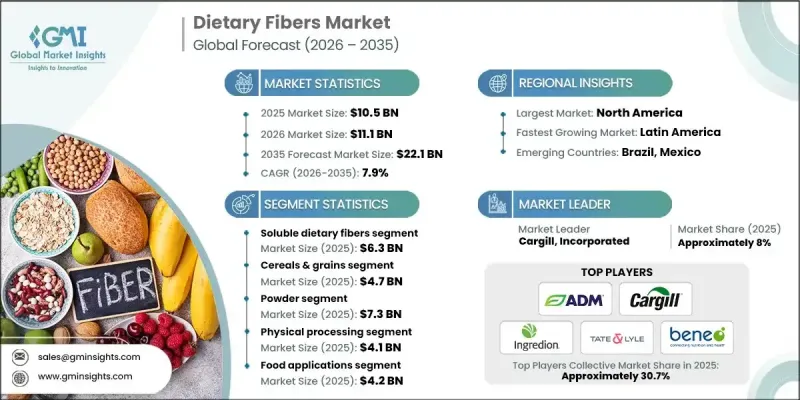

2025 年全球膳食纖維市場價值為 105 億美元,預計到 2035 年將以 7.9% 的複合年成長率成長至 221 億美元。

市場成長的驅動力在於消費者健康意識的不斷提高,尤其是對腸道健康和整體健康重要性的日益重視。消費者積極尋求改善消化功能、預防肥胖、糖尿病和心血管疾病等生活型態相關慢性病的方法。這種對預防性營養的重視促使食品飲料生產商不斷創新,生產富含膳食纖維的產品,以滿足注重健康的消費者的需求。消費者對富含膳食纖維的功能性食品、補充劑和飲料的興趣日益濃厚,也推動了市場的快速擴張,因為他們擴大選擇富含膳食纖維的飲食來控制體重、血糖並降低患慢性病的風險。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 105億美元 |

| 預測值 | 221億美元 |

| 複合年成長率 | 7.9% |

2025年,可溶性膳食纖維市場規模達63億美元,預計2026年至2035年將以8.2%的複合年成長率成長。可溶性膳食纖維因其在消化健康、膽固醇管理和血糖控制方面的益處而備受關注。隨著消費者對預防性營養的日益重視,功能性食品、飲料和膳食補充劑中可溶性膳食纖維的添加量也不斷增加。

2025年,穀物市場規模達到47億美元,預計2026年至2035年間將以8.1%的複合年成長率成長。穀物中的膳食纖維廣泛應用於烘焙食品、休閒食品和飲料領域,使生產商能夠開發出各種滿足功能性營養需求的強化食品。穀物加工的多樣性也促進了多個產品類別的創新。

預計2025年,北美膳食纖維市場規模將達31億美元。人們對腸道健康、體重管理和預防性營養的日益關注,推動了該地區對富含膳食纖維的功能性食品、飲料和膳食補充劑的需求。完善的零售體系和消費者較高的健康意識,也為市場的穩定成長提供了支撐。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2022-2035年

- 可溶性膳食纖維

- BETA-葡聚醣

- 燕麥BETA-葡聚醣

- 大麥BETA-葡聚醣

- 酵母BETA-葡聚醣

- 蘑菇BETA-葡聚醣

- 車前子殼

- 菊糖和菊糖型果聚醣

- 菊苣根菊粉

- 菊芋菊粉

- 龍舌蘭菊粉

- 果膠

- 高甲氧基果膠

- 低甲氧基果膠

- 聚葡萄糖

- 低聚果糖(FOS)

- 低聚半乳糖(GOS)

- 抗性麥芽糊精/糊精

- 可溶性玉米纖維

- 瓜爾膠

- 刺槐豆膠

- 阿拉伯膠(阿拉伯樹膠)

- 海藻酸鹽

- 阿拉伯木聚醣

- 葡甘露聚醣

- BETA-葡聚醣

- 不溶性膳食纖維

- 纖維素

- 微晶纖維素(MCC)

- 粉狀纖維素

- 半纖維素

- 木質素

- 抗性澱粉

- RS1(物理上無法存取)

- RS2(顆粒狀澱粉)

- RS3(回生澱粉)

- RS4(化學改質)

- RS5(直鏈澱粉-脂質複合物)

- 幾丁質和殼聚醣

- 小麥麩皮/穀物麩皮

- 玉米麩皮

- 羥丙基甲基纖維素(HPMC)

- 混合植物細胞壁纖維

- 甘蔗纖維

- 蘋果纖維

- 柑橘纖維

- 纖維素

第6章:市場估算與預測:依來源分類,2022-2035年

- 穀物和穀類

- 小麥

- 燕麥

- 大麥

- 玉米

- 米

- 黑麥

- 水果和蔬菜

- 柑橘

- 蘋果

- 香蕉

- 根莖類蔬菜(菊苣、馬鈴薯)

- 其他水果(莓果、番石榴)

- 豆類

- 豆子

- 豌豆

- 扁豆

- 大豆

- 堅果和種子

- 奇亞籽

- 亞麻籽

- 車前子

- 杏仁

- 其他來源

- 海藻/藻類

- 真菌/蘑菇

- 酵母菌

- 微生物/發酵衍生的

第7章:市場估計與預測:依形式分類,2022-2035年

- 粉末

- 細/超細粉末

- 粗粉

- 調味粉

- 無味粉末

- 液體/凝膠

- 液體濃縮物

- 糖漿

- 固體劑型

- 膠囊

- 膠囊/片劑

- 軟糖

- 晶圓

- 便捷格式

- 單份包裝

- 攜帶式格式

第8章:市場估算與預測:依加工方式分類,2022-2035年

- 物理處理

- 機械銑削/研磨

- 蒸氣爆炸

- 擠壓

- 單螺桿擠出

- 雙螺桿擠出

- 噴砂擠壓

- 高靜水壓(HHP)

- 微波輔助萃取

- 超細/極細研磨

- 高壓均質化(HPH)

- 化學加工

- 酸萃取

- 鹼萃取

- 氧化

- 化學改性

- 酵素法加工

- 纖維素酶處理

- 半纖維素酶/木聚醣酶處理

- 果膠酶處理

- 澱粉酶/蛋白酶處理

- 生物/發酵加工

- 乳酸菌發酵

- 真菌發酵

- 酵母發酵

- 固態發酵(SSF)

- 混合/聯合方法

- 發酵 + 微流體化

- 酵素法+超音波

- 擠壓成型+鹼處理

- 其他

第9章:市場估算與預測:依應用領域分類,2022-2035年

- 食品應用

- 麵包店

- 麵包和捲餅

- 餅乾和曲奇

- 蛋糕和鬆餅

- 糕點

- 早餐穀物和零食

- 即食穀物

- 熱麥片

- 穀物棒

- 營養棒

- 零食餅乾

- 糖果

- 巧克力

- 糖果和軟糖

- 無糖糖果

- 乳製品及乳製品替代品

- 優格

- 冰淇淋和冷凍甜點

- 起司及起司替代品

- 液態奶及乳製品替代品

- 植物性乳製品替代品

- 肉類及肉類替代品

- 香腸

- 加工肉製品

- 植物肉替代品

- 嬰幼兒營養

- 嬰兒配方奶粉

- 嬰兒食品

- 幼兒營養產品

- 其他食品應用

- 義大利麵和麵條

- 湯和醬料

- 調味品和佐料

- 即食餐

- 麵包店

- 飲料應用

- 功能性飲料

- 營養奶昔

- 冰沙

- 碳酸飲料

- 果汁及果汁飲料

- 粉狀飲料混合物

- 藥物應用

- 瀉藥

- 膽固醇管理

- 糖尿病管理

- 醫學營養(腸內/腸外)

- 膳食補充劑

- 消化系統健康補充劑

- 體重管理補充劑

- 益生元補充劑

- 運動營養

- 動物營養

- 伴侶動物(寵物食品)

- 牲畜飼料

- 水產養殖

- 其他應用

- 個人護理及化妝品

- 可生物分解包裝材料

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- BENEO GmbH

- Sudzucker Group

- Roquette Freres

- Kerry Group

- J. Rettenmaier & Sohne GmbH & Co. KG

- SunOpta, Inc.

- Taiyo Kagaku Co., Ltd.

- Nexira

- Fiberstar, Inc.

- Emsland Group

- AGT Food and Ingredients

- Shandong Minqiang Biotechnology Co., Ltd.

- Grain Processing Corporation

- Tereos Syral

- Farbest-Tallman Foods Corporation

- Cosucra Groupe Warcoing SA

The Global Dietary Fibers Market was valued at USD 10.5 billion in 2025 and is estimated to grow at a CAGR of 7.9% to reach USD 22.1 billion by 2035.

The market growth is fueled by increasing consumer awareness about health and wellness, particularly the importance of gut health and overall well-being. Consumers are actively seeking ways to improve digestive function and prevent lifestyle-related and chronic diseases such as obesity, diabetes, and cardiovascular disorders. This shift toward preventive nutrition is driving food and beverage manufacturers to innovate and produce fiber-enriched products that meet the demands of health-conscious buyers. The rising interest in functional foods, supplements, and beverages fortified with dietary fibers is also contributing to the market's rapid expansion, as consumers increasingly adopt fiber-rich diets to manage weight, control blood sugar, and reduce the risk of chronic illnesses.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $10.5 Billion |

| Forecast Value | $22.1 Billion |

| CAGR | 7.9% |

The soluble dietary fibers segment was valued at USD 6.3 billion in 2025 and is expected to grow at a CAGR of 8.2% from 2026 to 2035. Soluble fibers are gaining traction due to their benefits in digestive health, cholesterol management, and glycemic control. Functional foods, beverages, and dietary supplements are increasingly incorporating soluble fibers as consumer interest in preventive nutrition grows.

The cereals and grains segment reached USD 4.7 billion in 2025 and is projected to grow at a CAGR of 8.1% during 2026-2035. Fibers from cereals and grains are widely used in bakery, snack, and beverage applications, allowing manufacturers to develop a variety of fortified foods that address functional nutrition needs. Their versatility in processing enables innovation across multiple product categories.

North America Dietary Fibers Market accounted for USD 3.1 billion in 2025. Increasing awareness of gut health, weight management, and preventive nutrition is driving the region's demand for fiber-enriched functional foods, beverages, and dietary supplements. A well-established retail infrastructure and high consumer health awareness are supporting steady market growth.

Key players in the Global Dietary Fibers Market include Tate & Lyle PLC, Archer Daniels Midland Company (ADM), Ingredion Incorporated, BENEO GmbH, and Cargill, Incorporated. Companies in the Global Dietary Fibers Market are employing strategies such as investing in research and development to create novel fiber types with enhanced functional properties and health benefits. They are expanding product portfolios to include ready-to-use functional ingredients for food and beverage applications. Strategic partnerships with food manufacturers and ingredient suppliers help broaden market reach, while acquisitions and collaborations strengthen regional presence. Companies are also focusing on consumer education campaigns, marketing fiber-rich solutions for weight management, digestive health, and chronic disease prevention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Source

- 2.2.4 Form

- 2.2.5 Processing Method

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Soluble Dietary Fibers

- 5.2.1 Beta-Glucan

- 5.2.1.1 Oat Beta-Glucan

- 5.2.1.2 Barley Beta-Glucan

- 5.2.1.3 Yeast Beta-Glucan

- 5.2.1.4 Mushroom Beta-Glucan

- 5.2.2 Psyllium Husk

- 5.2.3 Inulin & Inulin-Type Fructans

- 5.2.3.1 Chicory Root Inulin

- 5.2.3.2 Jerusalem Artichoke Inulin

- 5.2.3.3 Agave Inulin

- 5.2.4 Pectin

- 5.2.4.1 High-Methoxyl Pectin

- 5.2.4.2 Low-Methoxyl Pectin

- 5.2.5 Polydextrose

- 5.2.6 Fructooligosaccharides (FOS)

- 5.2.7 Galactooligosaccharides (GOS)

- 5.2.8 Resistant Maltodextrin/Dextrin

- 5.2.9 Soluble Corn Fiber

- 5.2.10 Guar Gum

- 5.2.11 Locust Bean Gum

- 5.2.12 Acacia (Gum Arabic)

- 5.2.13 Alginate

- 5.2.14 Arabinoxylan

- 5.2.15 Glucomannan

- 5.2.1 Beta-Glucan

- 5.3 Insoluble Dietary Fibers

- 5.3.1 Cellulose

- 5.3.1.1 Microcrystalline Cellulose (MCC)

- 5.3.1.2 Powdered Cellulose

- 5.3.2 Hemicellulose

- 5.3.3 Lignin

- 5.3.4 Resistant Starch

- 5.3.4.1 RS1 (Physically Inaccessible)

- 5.3.4.2 RS2 (Granular Starch)

- 5.3.4.3 RS3 (Retrograded Starch)

- 5.3.4.4 RS4 (Chemically Modified)

- 5.3.4.5 RS5 (Amylose-Lipid Complex)

- 5.3.5 Chitin & Chitosan

- 5.3.6 Wheat Bran/Cereal Bran

- 5.3.7 Corn Bran

- 5.3.8 Hydroxypropylmethylcellulose (HPMC)

- 5.3.9 Mixed Plant Cell Wall Fibers

- 5.3.9.1 Sugar Cane Fiber

- 5.3.9.2 Apple Fiber

- 5.3.9.3 Citrus Fiber

- 5.3.1 Cellulose

Chapter 6 Market Estimates and Forecast, By Source, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Cereals & Grains

- 6.2.1 Wheat

- 6.2.2 Oats

- 6.2.3 Barley

- 6.2.4 Corn

- 6.2.5 Rice

- 6.2.6 Rye

- 6.3 Fruits & Vegetables

- 6.3.1 Citrus

- 6.3.2 Apple

- 6.3.3 Banana

- 6.3.4 Root Vegetables (Chicory, Potato)

- 6.3.5 Other Fruits (Berries, Guava)

- 6.4 Legumes

- 6.4.1 Beans

- 6.4.2 Peas

- 6.4.3 Lentils

- 6.4.4 Soybeans

- 6.5 Nuts & Seeds

- 6.5.1 Chia Seeds

- 6.5.2 Flaxseed

- 6.5.3 Psyllium

- 6.5.4 Almonds

- 6.6 Other Sources

- 6.6.1 Seaweed/Algae

- 6.6.2 Fungi/Mushrooms

- 6.6.3 Yeast

- 6.6.4 Microbial/Fermentation-Derived

Chapter 7 Market Estimates and Forecast, By Form, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.2.1 Fine/Ultrafine Powder

- 7.2.2 Coarse Powder

- 7.2.3 Flavored Powder

- 7.2.4 Unflavored Powder

- 7.3 Liquid/Gel

- 7.3.1 Liquid Concentrate

- 7.3.2 Syrup

- 7.4 Solid Dosage Forms

- 7.4.1 Capsules

- 7.4.2 Caplets/Tablets

- 7.4.3 Gummies

- 7.4.4 Wafers

- 7.5 Convenience Formats

- 7.5.1 Single-Serve Packets

- 7.5.2 On-the-Go Formats

Chapter 8 Market Estimates and Forecast, By Processing Method, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Physical Processing

- 8.2.1 Mechanical Milling/Grinding

- 8.2.2 Steam Explosion

- 8.2.3 Extrusion

- 8.2.3.1 Single-Screw Extrusion

- 8.2.3.2 Twin-Screw Extrusion

- 8.2.3.3 Blasting Extrusion

- 8.2.4 High Hydrostatic Pressure (HHP)

- 8.2.5 Microwave-Assisted Extraction

- 8.2.6 Ultrafine/Superfine Grinding

- 8.2.7 High-Pressure Homogenization (HPH)

- 8.3 Chemical Processing

- 8.3.1 Acid Extraction

- 8.3.2 Alkaline Extraction

- 8.3.3 Oxidation

- 8.3.4 Chemical Modification

- 8.4 Enzymatic Processing

- 8.4.1 Cellulase Treatment

- 8.4.2 Hemicellulase/Xylanase Treatment

- 8.4.3 Pectinase Treatment

- 8.4.4 Amylase/Protease Treatment

- 8.5 Biological/Fermentation Processing

- 8.5.1 Lactic Acid Bacteria Fermentation

- 8.5.2 Fungal Fermentation

- 8.5.3 Yeast Fermentation

- 8.5.4 Solid-State Fermentation (SSF)

- 8.6 Hybrid/Combined Methods

- 8.6.1 Fermentation + Microfluidization

- 8.6.2 Enzymatic + Ultrasound

- 8.6.3 Extrusion + Alkaline Treatment

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Food Applications

- 9.2.1 Bakery

- 9.2.1.1 Bread & Rolls

- 9.2.1.2 Biscuits & Cookies

- 9.2.1.3 Cakes & Muffins

- 9.2.1.4 Pastries

- 9.2.2 Breakfast Cereals & Snacks

- 9.2.2.1 Ready-to-Eat Cereals

- 9.2.2.2 Hot Cereals

- 9.2.2.3 Cereal Bars

- 9.2.2.4 Nutrition Bars

- 9.2.2.5 Snack Crackers

- 9.2.3 Confectionery

- 9.2.3.1 Chocolate

- 9.2.3.2 Candies & Gummies

- 9.2.3.3 Sugar-Free Confectionery

- 9.2.4 Dairy & Dairy Alternatives

- 9.2.4.1 Yogurt

- 9.2.4.2 Ice Cream & Frozen Desserts

- 9.2.4.3 Cheese & Cheese Alternatives

- 9.2.4.4 Fluid Milk & Milk Alternatives

- 9.2.4.5 Plant-Based Dairy Alternatives

- 9.2.5 Meat & Meat Alternatives

- 9.2.5.1 Sausages

- 9.2.5.2 Processed Meat Products

- 9.2.5.3 Plant-Based Meat Alternatives

- 9.2.6 Infant & Toddler Nutrition

- 9.2.6.1 Infant Formula

- 9.2.6.2 Baby Food

- 9.2.6.3 Toddler Nutrition Products

- 9.2.7 Other Food Applications

- 9.2.7.1 Pasta & Noodles

- 9.2.7.2 Soups & Sauces

- 9.2.7.3 Dressings & Condiments

- 9.2.7.4 Ready Meals

- 9.2.1 Bakery

- 9.3 Beverage Applications

- 9.3.1 Functional Beverages

- 9.3.2 Nutrition Shakes

- 9.3.3 Smoothies

- 9.3.4 Carbonated Beverages

- 9.3.5 Juice & Juice Drinks

- 9.3.6 Powdered Beverage Mixes

- 9.4 Pharmaceutical Applications

- 9.4.1 Laxatives

- 9.4.2 Cholesterol Management

- 9.4.3 Diabetes Management

- 9.4.4 Medical Nutrition (Enteral/Parenteral)

- 9.5 Dietary Supplements

- 9.5.1 Digestive Health Supplements

- 9.5.2 Weight Management Supplements

- 9.5.3 Prebiotic Supplements

- 9.5.4 Sports Nutrition

- 9.6 Animal Nutrition

- 9.6.1 Companion Animal (Pet Food)

- 9.6.2 Livestock Feed

- 9.6.3 Aquaculture

- 9.7 Other Applications

- 9.7.1 Personal Care & Cosmetics

- 9.7.2 Biodegradable Packaging Materials

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Archer Daniels Midland Company (ADM)

- 11.2 Cargill, Incorporated

- 11.3 Ingredion Incorporated

- 11.4 Tate & Lyle PLC

- 11.5 BENEO GmbH

- 11.6 Sudzucker Group

- 11.7 Roquette Freres

- 11.8 Kerry Group

- 11.9 J. Rettenmaier & Sohne GmbH & Co. KG

- 11.10 SunOpta, Inc.

- 11.11 Taiyo Kagaku Co., Ltd.

- 11.12 Nexira

- 11.13 Fiberstar, Inc.

- 11.14 Emsland Group

- 11.15 AGT Food and Ingredients

- 11.16 Shandong Minqiang Biotechnology Co., Ltd.

- 11.17 Grain Processing Corporation

- 11.18 Tereos Syral

- 11.19 Farbest-Tallman Foods Corporation

- 11.20 Cosucra Groupe Warcoing SA