|

市場調查報告書

商品編碼

1892843

精品鹽市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Gourmet Salts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

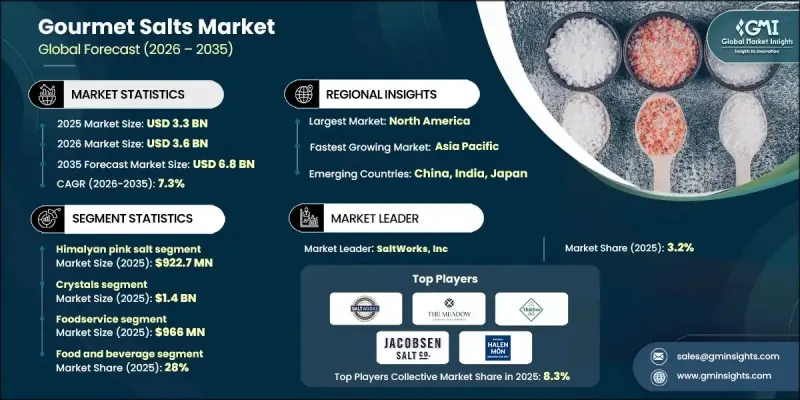

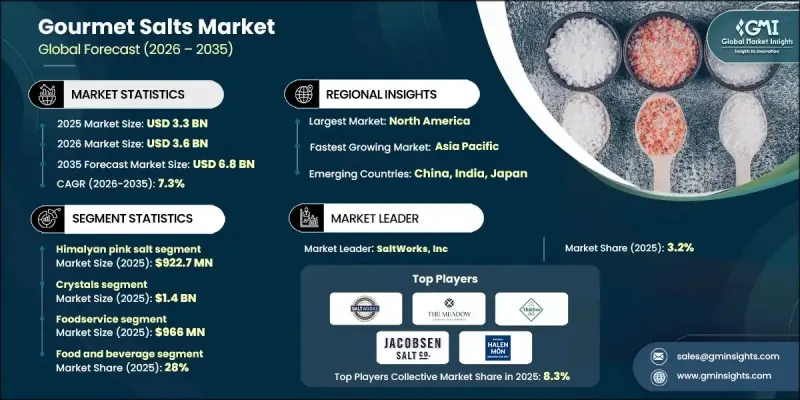

2025 年全球高級鹽市場價值為 33 億美元,預計到 2035 年將以 7.3% 的複合年成長率成長至 68 億美元。

精品鹽以其獨特的礦物成分、色澤、質地和風味而著稱,與普通食鹽截然不同。這些鹽通常含有天然微量礦物質或特定的結晶模式,從而提升口感和外觀。許多精品鹽產自特定的海洋環境、古老鹽床或火山地區,賦予其獨特的風土,如同特色食品或優質葡萄酒一般。採收、脫水和結晶製程的進步使生產商能夠精確控制這些鹽的顆粒大小、質地和品質。更先進的礦物分析技術和電子商務平台擴大了全球市場的覆蓋範圍,而從粗粒到細粒的不同質地也滿足了各種烹飪需求。例如,片狀鹽能帶來細膩的酥脆口感,因此在烹飪中常被用作點綴鹽。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 33億美元 |

| 預測值 | 68億美元 |

| 複合年成長率 | 7.3% |

預計到2025年,喜馬拉雅粉紅鹽市場規模將達到9.227億美元。該市場涵蓋多種鹽類,包括海鹽、片狀鹽和其他特色品種,這主要得益於消費者對天然、加工最少、富含礦物質的食材日益成長的需求。這些鹽不僅因其口感和外觀而備受青睞,更因其能夠提升專業廚房和家庭廚房的整體烹飪體驗而備受推崇。

預計到2025年,餐飲服務業市場規模將達9.66億美元。餐廳和餐飲服務業的需求成長主要得益於廚師們對高品質食材的重視,他們致力於提升用餐體驗。家庭消費者擴大使用高檔食鹽進行烹飪和餐桌擺設,而化妝品和個人護理行業則將富含礦物質的食鹽應用於沐浴和護膚產品中。廣泛的應用領域支撐著市場的穩定成長和創新,而不斷變化的消費者偏好和健康趨勢也為其註入了動力。

預計到2025年,美國高檔食鹽市場規模將達到10.7億美元。北美消費者越來越青睞食鹽,不僅因為其風味和美觀,更因為其功能性益處。煙燻鹽和風味鹽因其能為日常菜餚增添層次感而廣受歡迎,而富含礦物質的食鹽則被廣泛應用於健康產品中。專業零售商和線上商城的普及使得優質食鹽觸手可及,從而促進了市場成長並提升了市場知名度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 消費者對天然產品的偏好日益成長

- 來自高階餐飲領域的需求

- 電子商務和零售通路的擴張

- 產業陷阱與挑戰

- 品質和真實性問題

- 儲存和保存期限問題

- 市場機遇

- 產品創新和風味鹽

- 永續環保的做法

- 拓展新興市場

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2022-2035年

- 海鹽

- 海鹽之花

- 凱爾特灰鹽(Sel Gris)

- 喜馬拉雅粉紅鹽

- 片狀鹽

- 夏威夷鹽(紅/黑)

- 煙燻鹽

- 黑鹽(Kala Namak)

- 風味鹽和浸泡鹽

第6章:市場估算與預測:依產品形式分類,2022-2035年

- 晶體

- 薄片

- 粉末

第7章:市場估算與預測:依應用領域分類,2022-2035年

- 麵包糕點店

- 肉類和家禽產品

- 海鮮產品

- 醬汁和鹹味小吃

- 食品加工

- 餐飲服務

- 家庭/零售

- 化妝品和個人護理

第8章:市場估算與預測:依最終用途產業分類,2022-2035年

- 食品飲料業

- 專業烹飪和高級餐飲

- 特種食品製造

- 飯店業

- 零售消費者

- 健康與保健

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Alaska Pure Sea Salt Company

- Amagansett Sea Salt Co.

- Bitterman Salt Co.

- Brittany Sea Salt

- Celtic Sea Salt

- Cargill Inc. / Morton Salt

- Cheetham Salt Limited

- Gilles Hervy

- Halen Mon

- Infosa

- Jacobsen Salt Co.

- Le Guerandais

- Louis Sel

- Maldon Crystal Salt Company Ltd.

- Murray River Salt (Sun Salt Pty Ltd)

- Pyramid Salt (Sun Salt / Pyramid Hill)

- Redmond Real Salt (Redmond Life)

- SaltWorks, Inc.

- San Francisco Salt Company

- Sassi Salts

- The Meadow

- The Salt Table

The Global Gourmet Salts Market was valued at USD 3.3 billion in 2025 and is estimated to grow at a CAGR of 7.3% to reach USD 6.8 billion by 2035.

Gourmet salts are distinguished by their unique mineral compositions, colors, textures, and flavors, setting them apart from standard table salt. These salts often contain natural trace minerals or specific crystallization patterns that enhance both taste and presentation. Many are sourced from specific marine environments, ancient salt beds, or volcanic regions, giving them a distinctive terroir, like specialty foods or fine wines. Technological advancements in harvesting, dehydration, and crystal formation have allowed producers to control the size, texture, and quality of these salts with precision. Enhanced mineral analysis and e-commerce platforms have expanded global access, while different textures from coarse to fine serve various culinary purposes. Flaky salts, for instance, provide a delicate crunch, making them highly sought after as finishing salts in culinary applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.3 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 7.3% |

The Himalayan pink salt segment generated USD 922.7 million in 2025. The market encompasses a wide range of salts, including sea salts, flake salts, and other specialty varieties, driven by rising consumer preference for natural, minimally processed, and mineral-rich ingredients. These salts are valued not only for their taste and visual appeal but also for enhancing the overall culinary experience in both professional and home kitchens.

The foodservice segment reached USD 966 million in 2025. Restaurants and catering services drive demand as chefs prioritize high-quality ingredients to elevate dining experiences. Household consumers are increasingly using gourmet salts for cooking and tabletop purposes, while the cosmetics and personal care industry leverages mineral-rich salts in bath and skincare products. The broad range of applications supports steady growth and innovation, fueled by changing consumer preferences and wellness trends.

U.S. Gourmet Salts Market garnered USD 1.07 billion in 2025. North American consumers are increasingly drawn to salts for their flavor, aesthetic appeal, and functional benefits. Smoked and flavored varieties are popular for adding complexity to everyday dishes, while mineral-enriched salts are incorporated into wellness products. Specialty retailers and online marketplaces make premium salts widely accessible, supporting market growth and visibility.

Key players in the Global Gourmet Salts Market include Redmond Real Salt (Redmond Life), SaltWorks, Inc., Murray River Salt (Sun Salt Pty Ltd), The Meadow, Alaska Pure Sea Salt Company, San Francisco Salt Company, Brittany Sea Salt, Sassi Salts, Le Guerandais, Halen Mon, Jacobsen Salt Co., Cargill Inc. / Morton Salt, Cheetham Salt Limited, The Salt Table, Louis Sel, Maldon Crystal Salt Company Ltd., Gilles Hervy, Amagansett Sea Salt Co., Celtic Sea Salt, and B Medical Systems. Market leaders focus on strategies such as expanding product lines with unique textures, flavors, and mineral compositions to meet diverse culinary and personal care demands. Companies invest in technological innovations in harvesting, drying, and crystallization to ensure consistent quality and enhance the sensory experience of their salts. Branding and storytelling around terroir, purity, and artisanal methods help differentiate offerings. Firms also leverage e-commerce platforms, social media campaigns, and partnerships with specialty retailers and restaurants to broaden reach and accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Physical form

- 2.2.3 Application

- 2.2.4 End Use industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer preference for natural products

- 3.2.1.2 Demand from premium culinary segments

- 3.2.1.3 Expansion of e-commerce and retail channels

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Quality and authenticity concerns

- 3.2.2.2 Storage and shelf-life issues

- 3.2.3 Market opportunities

- 3.2.3.1 Product innovation and flavored salts

- 3.2.3.2 Sustainable and eco-friendly practices

- 3.2.3.3 Expansion into emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sea Salt

- 5.3 Fleur de Sel

- 5.4 Sel Gris (Celtic Grey Salt)

- 5.5 Himalayan Pink Salt

- 5.6 Flake Salt

- 5.7 Hawaiian Salt (Red/Black)

- 5.8 Smoked Salt

- 5.9 Black Salt (Kala Namak)

- 5.10 Flavored & Infused Salts

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Crystals

- 6.3 Flakes

- 6.4 Powder

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery and confectionery

- 7.3 Meat and Poultry Products

- 7.4 Seafood products

- 7.5 Sauces and savories

- 7.6 Food processing

- 7.7 Foodservice

- 7.8 Household / retail

- 7.9 Cosmetics and personal care

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food and beverage industry

- 8.3 Professional culinary and fine dining

- 8.4 Specialty food manufacturing

- 8.5 Hospitality sector

- 8.6 Retail consumers

- 8.7 Health and wellness

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Alaska Pure Sea Salt Company

- 10.2 Amagansett Sea Salt Co.

- 10.3 Bitterman Salt Co.

- 10.4 Brittany Sea Salt

- 10.5 Celtic Sea Salt

- 10.6 Cargill Inc. / Morton Salt

- 10.7 Cheetham Salt Limited

- 10.8 Gilles Hervy

- 10.9 Halen Mon

- 10.10 Infosa

- 10.11 Jacobsen Salt Co.

- 10.12 Le Guerandais

- 10.13 Louis Sel

- 10.14 Maldon Crystal Salt Company Ltd.

- 10.15 Murray River Salt (Sun Salt Pty Ltd)

- 10.16 Pyramid Salt (Sun Salt / Pyramid Hill)

- 10.17 Redmond Real Salt (Redmond Life)

- 10.18 SaltWorks, Inc.

- 10.19 San Francisco Salt Company

- 10.20 Sassi Salts

- 10.21 The Meadow

- 10.22 The Salt Table