|

市場調查報告書

商品編碼

1892759

寵物科技市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Pet Tech Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

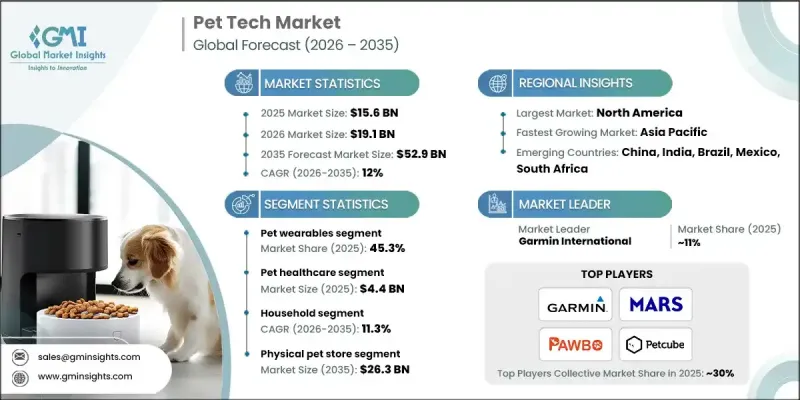

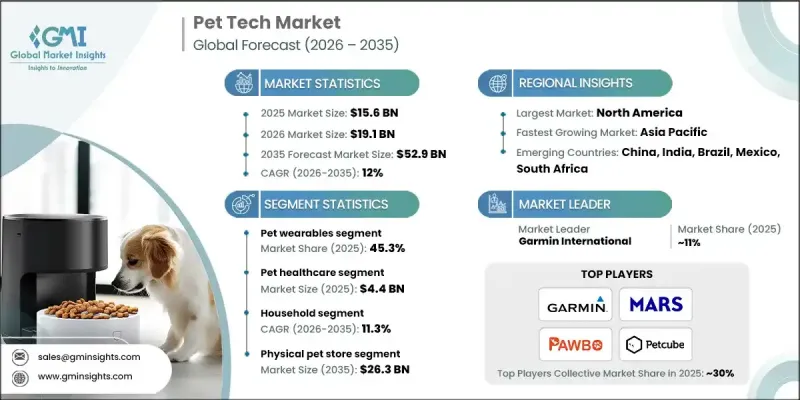

2025年全球寵物科技市場價值156億美元,預計2035年將以12%的複合年成長率成長至529億美元。

全球寵物飼養量的快速成長、可支配收入的增加、寵物照護支出的提高以及創新科技寵物解決方案的湧現,共同推動了寵物科技市場的成長。寵物科技專注於智慧型裝置和數位平台,旨在監測寵物健康、保障寵物安全,並為主人提供互動和便利。這些解決方案能夠實現即時監測,提升寵物整體健康水平,並簡化日常護理流程。 Petcube、瑪氏公司、Garmin International 和 Pawbo 等行業領導者正透過推出智慧項圈、餵食器、攝影機和健康監測設備來推動市場成長,這些設備能夠提供關於寵物健康狀況的準確、可操作的資訊。物聯網和人工智慧整合設備的應用,使主人能夠遠端追蹤寵物的行為、活動和健康指標,從而在提高護理品質的同時,減少人工監測工作量。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 156億美元 |

| 預測值 | 529億美元 |

| 複合年成長率 | 12% |

預計到2025年,寵物穿戴裝置市佔率將達到45.3%。這些設備,包括智慧項圈、胸背帶和背心,能夠讓主人即時追蹤寵物的心率、體溫、活動量和位置。與人工智慧和物聯網技術的融合,增強了資料收集和遠端監控能力,從而能夠更好地進行預防性護理和及時干預。

預計到2025年,寵物醫療保健市場規模將達到44億美元。人們對寵物健康的日益關注以及將寵物視為家庭成員的觀念,正在推動對健康科技解決方案的需求。智慧項圈、健身追蹤器和配套應用程式可以幫助主人監測寵物的健康指標,並有效地管理它們的日常健康護理。

2025年北美寵物科技市場規模達86億美元,預計2035年將達297億美元,複合年成長率(CAGR)為12.2%。寵物擁有率高、先進技術應用廣泛以及寵物護理支出不斷成長,均推動了市場的強勁成長。現有成熟企業的存在以及創新設備的普及,也進一步促進了區域市場的擴張。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 寵物飼養和人性化程度的提高

- 人們越來越關注寵物健康和福祉

- 寵物護理的便利性和物聯網、人工智慧和資料分析等技術進步

- 政府透過資金和監管支持技術進步。

- 產業陷阱與挑戰

- 設備可靠性和故障

- 前期成本高

- 市場機遇

- 人工智慧驅動的寵物行為和訓練解決方案

- 遠端獸醫和遠端診斷平台

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 技術與創新格局

- 目前技術

- 新興技術

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2022-2035年

- 寵物穿戴裝置

- 智慧項圈

- 智慧背心

- 智慧線束

- 智慧型相機

- 智慧寵物籠和床

- 智慧寵物門

- 智慧寵物餵食器和食盆

- 智慧寵物圍欄

- 智慧寵物飲水器

- 智慧寵物玩具

第6章:市場估算與預測:依應用領域分類,2022-2035年

- 寵物醫療保健

- 寵物主人便利

- 通訊與娛樂

- 寵物安全

第7章:市場估算與預測:依最終用途分類,2022-2035年

- 家庭

- 商業的

第8章:市場估算與預測:依配銷通路分類,2022-2035年

- 實體寵物店

- 僅限線上銷售的零售商

- 實體大型零售商

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Actijoy

- CleverPet

- Dogtra

- Felcana

- Fitbark

- Furbo

- Garmin International

- Halo Collar

- Link My Pet

- Loc8tor

- Mars Incorporated

- Pawbo

- Pawscout

- Petcube

- Pet Huhou

- PETKIT

- PetPace

- Qpets

- Tianjin Smart Pets Technology

- Tractive

The Global Pet Tech Market was valued at USD 15.6 billion in 2025 and is estimated to grow at a CAGR of 12% to reach USD 52.9 billion by 2035.

The market growth is fueled by the rapid rise in pet ownership worldwide, increasing disposable incomes, higher spending on pet care, and the availability of innovative, technology-driven solutions for pets. Pet tech focuses on smart devices and digital platforms designed to monitor pets' health, ensure their safety, and provide engagement and convenience for owners. These solutions enable real-time monitoring, enhance overall pet wellness, and simplify care routines. Key players such as Petcube, Mars, Inc., Garmin International, and Pawbo are driving growth by launching smart collars, feeders, cameras, and health-monitoring devices that provide accurate, actionable insights on pets' wellbeing. Adoption of IoT-enabled and AI-integrated devices allows owners to remotely track behavior, activity, and health metrics, improving care quality while reducing manual monitoring efforts.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15.6 Billion |

| Forecast Value | $52.9 Billion |

| CAGR | 12% |

The pet wearables segment held a 45.3% share in 2025. These devices, including smart collars, harnesses, and vests, enable owners to track heart rate, body temperature, activity levels, and location in real time. Integration with AI and IoT technologies enhances data collection and remote monitoring, allowing for improved preventive care and timely interventions.

The pet healthcare segment reached USD 4.4 billion in 2025. Growing awareness about pet wellness and the perception of pets as family members are driving demand for health-focused tech solutions. Smart collars, fitness trackers, and companion apps help owners monitor pets' health parameters and manage wellness routines effectively.

North America Pet Tech Market generated USD 8.6 billion in 2025 and is projected to reach USD 29.7 billion by 2035, at a CAGR of 12.2%. High pet ownership rates, advanced technological adoption, and growing expenditure on pet care contribute to strong market growth. The presence of established players and the widespread availability of innovative devices further support regional expansion.

Key players operating in the Global Pet Tech Market include Furbo, Actijoy, CleverPet, Dogtra, Felcana, Fitbark, Garmin International, Halo Collar, Link My Pet, Loc8tor, Mars, Inc., Pawbo, Pawscout, Petcube, Pet Huhou, PETKIT, PetPace, Qpets, Tianjin Smart Pets Technology, and Tractive. Companies in the Pet Tech Market are strengthening their presence through continuous innovation, launching new wearable devices, health trackers, and AI-integrated solutions that enhance pet monitoring capabilities. Strategic partnerships with veterinarians, pet retailers, and technology firms expand distribution channels and customer outreach. Firms are also focusing on user-friendly mobile apps and cloud-based platforms to improve real-time monitoring and data management. Expanding into emerging markets and offering customized solutions for different pet species helps capture a wider audience. Marketing campaigns emphasizing pet wellness, safety, and convenience further enhance brand recognition and consumer trust, supporting long-term market growth and competitive positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased pet ownership and humanization

- 3.2.1.2 Growing awareness of pet health and wellness

- 3.2.1.3 Convenience and technological advancements like IoT, AI and data analytics for pet care

- 3.2.1.4 Governments supporting tech advancements through funding and regulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Device reliability and malfunctioning

- 3.2.2.2 High upfront cost

- 3.2.3 Market opportunities

- 3.2.3.1 AI-driven pet behavior and training solutions

- 3.2.3.2 Tele-veterinary and remote diagnostics platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology and innovation landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Pet wearables

- 5.2.1 Smart collar

- 5.2.2 Smart vest

- 5.2.3 Smart harness

- 5.2.4 Smart camera

- 5.3 Smart pet crates and beds

- 5.4 Smart pet doors

- 5.5 Smart pet feeders and bowls

- 5.6 Smart pet fence

- 5.7 Smart pet water dispenser

- 5.8 Smart pet toys

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Pet healthcare

- 6.3 Pet owner convenience

- 6.4 Communication and entertainment

- 6.5 Pet safety

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Household

- 7.3 Commercial

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Physical pet store

- 8.3 Online-only retailer

- 8.4 Physical mass merchant store

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn and Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Actijoy

- 10.2 CleverPet

- 10.3 Dogtra

- 10.4 Felcana

- 10.5 Fitbark

- 10.6 Furbo

- 10.7 Garmin International

- 10.8 Halo Collar

- 10.9 Link My Pet

- 10.10 Loc8tor

- 10.11 Mars Incorporated

- 10.12 Pawbo

- 10.13 Pawscout

- 10.14 Petcube

- 10.15 Pet Huhou

- 10.16 PETKIT

- 10.17 PetPace

- 10.18 Qpets

- 10.19 Tianjin Smart Pets Technology

- 10.20 Tractive