|

市場調查報告書

商品編碼

1892715

地下水管理市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Groundwater Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

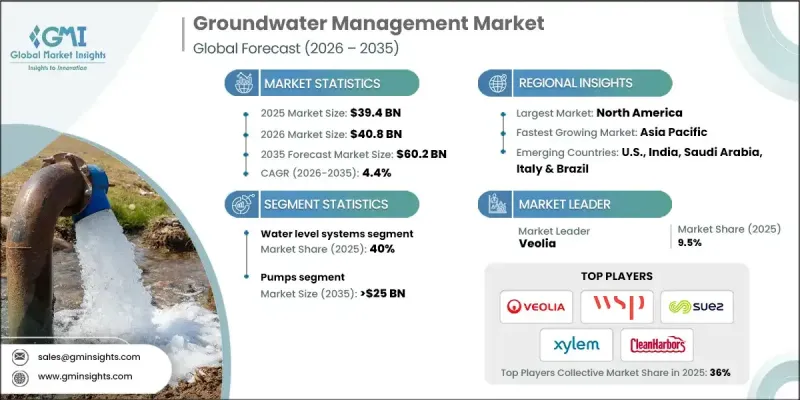

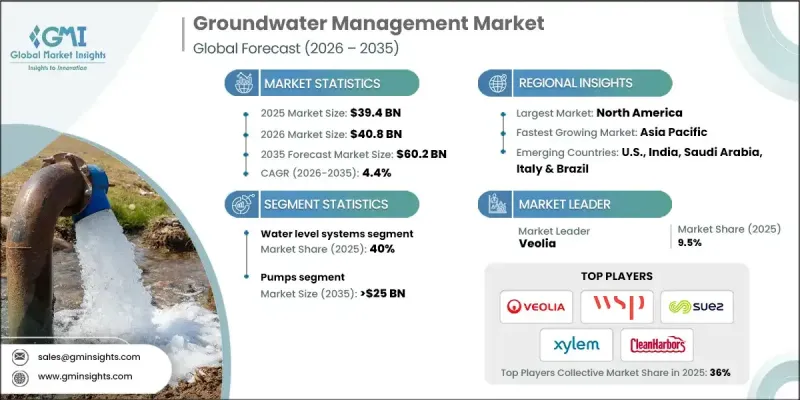

2025 年全球地下水管理市場價值為 394 億美元,預計到 2035 年將以 4.4% 的複合年成長率成長至 602 億美元。

市場成長的驅動力來自模組化和簡化設計的持續創新以及先進的自動化技術。智慧感測器和遙測系統的部署使操作人員能夠即時監測地下水位、水質和補給率。預測分析提供可操作的洞察,以防止過度開採和污染,從而推動了對地下水管理解決方案的需求。地下水管理涵蓋旨在確保地下水資源永續利用和保護的專門技術和系統。其功能包括監測含水層水位、調節開採速率、防止污染和支持補給過程。該行業已從基本的水資源開採發展成為在最佳化資源效率、控制污染風險和支持永續發展目標方面發揮戰略作用的領域。採用補給策略和處理後水的再利用進一步提高了營運效率和成本效益。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 394億美元 |

| 預測值 | 602億美元 |

| 複合年成長率 | 4.4% |

預計到2025年,水位監測系統市佔率將達到40%。日益嚴格的監管要求和對永續用水的重視正在推動先進水位監測系統的應用。對攜帶式、經濟高效且易於安裝的感測器的需求不斷成長,正在促進其普及,尤其是在農村地區。這些設備現在可以精確測量pH值、濁度、溶解氧和污染物,從而確保符合嚴格的水質標準。

2025年,泵類設備市佔率佔45%,預計到2035年將成長至250億美元。變頻驅動和自動流量調節技術的整合提高了泵送效率並減少了浪費。市場對符合碳減排計劃的太陽能和混合動力泵系統的需求正在成長。製造商正致力於模組化設計和耐腐蝕材料,以確保在各種水文地質條件下都能可靠運作。

到2035年,北美地下水管理市場規模將達到180億美元。市政和工業營運商正擴大部署先進感測器和自動化抽水系統,以符合嚴格的環境法規。公共機構和私人企業之間的密切合作,以及持續的基礎設施投資,正在加速市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 地下水管理成本結構分析

- 新興機會與趨勢

- 數位化與物聯網整合

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭性標竿分析

- 創新與永續發展格局

第5章:市場規模及預測:按監測數據,2022-2035年

- 水質感測器

- 水位系統

- 物聯網日誌記錄器

- 地理空間分析

第6章:市場規模及預測:以開採方式分類,2022-2035年

- 水泵浦

- 鑽井作業

- 井套管和篩管

- 整合式滲透系統

第7章:市場規模及預測:基於 Recharge 的數據,2022-2035 年

- 人工補給結構

- MAR系統

- 回灌井

- 雨水滲透

第8章:市場規模及預測:依治療方法分類,2022-2035年

- 過濾系統

- 泵送和治療

- 海水淡化和化學處理

- 生物修復和原位修復

第9章:市場規模及預測:依最終用途分類,2022-2035年

- 農業

- 市政

- 工業的

第10章:市場規模及預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印尼

- 印度

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第11章:公司簡介

- Arcadis

- Black & Veatch

- Clean Harbors Environmental Services

- DMT Group

- Envirogen Technologies

- GEI Consultants

- Grundfos

- HEPACO

- HPC AG

- iFLUX

- INDUS Environmental Services

- Koop Wasserbau

- Minetek

- Remedial Construction Services

- Sensoil Innovations

- Stantec

- SUEZ

- Sweco AB

- Tetra Tech

- The Groundwater Company

- Veolia

- WJ Group

- WSP Global

- Xylem Water Solutions

The Global Groundwater Management Market was valued at USD 39.4 billion in 2025 and is estimated to grow at a CAGR of 4.4% to reach USD 60.2 billion by 2035.

Market growth is driven by continuous innovations in modular and simplified designs combined with advanced automation technologies. The deployment of smart sensors and telemetry systems allows operators to monitor groundwater levels, water quality, and recharge rates in real time. Predictive analytics provide actionable insights to prevent over-extraction and contamination, which fuels demand for groundwater management solutions. Groundwater management encompasses specialized techniques and systems designed to ensure sustainable utilization and protection of subsurface water resources. Its functions include monitoring aquifer levels, regulating extraction rates, preventing contamination, and supporting recharge processes. The sector has evolved beyond basic water extraction to a strategic role in optimizing resource efficiency, controlling contamination risks, and supporting sustainability goals. Incorporating recharge strategies and treated water reuse further enhances operational efficiency and cost-effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $39.4 Billion |

| Forecast Value | $60.2 Billion |

| CAGR | 4.4% |

The water level systems segment held a 40% share in 2025. Increasing regulatory mandates and emphasis on sustainable water use are driving the adoption of advanced water level monitoring systems. Rising demand for portable, cost-effective, and easy-to-install sensors is boosting penetration, particularly in rural areas. These devices now provide accurate measurements of pH, turbidity, dissolved oxygen, and contaminants, ensuring compliance with strict water quality standards.

The pumps segment held a 45% share in 2025 and is expected to grow to USD 25 billion by 2035. The integration of variable frequency drives and automated flow regulation improves pumping efficiency and reduces wastage. Demand is rising for solar and hybrid pump systems that align with carbon reduction initiatives. Manufacturers are focusing on modular designs and corrosion-resistant materials to ensure reliability across diverse hydrogeological conditions.

North America Groundwater Management Market will reach USD 18 billion by 2035. Municipal and industrial operators are increasingly deploying advanced sensors and automated pumping systems to comply with strict environmental regulations. Strong collaboration between public agencies and private enterprises, coupled with ongoing infrastructure investments, is accelerating market growth.

Key players in the Groundwater Management Market include Arcadis, Black & Veatch, Clean Harbors Environmental Services, DMT Group, Envirogen Technologies, GEI Consultants, Grundfos, HEPACO, HPC AG, iFLUX, INDUS Environmental Services, Koop Wasserbau, Minetek, Remedial Construction Services, Sensoil Innovations, Stantec, SUEZ, Sweco AB, Tetra Tech, The Groundwater Company, Veolia, WJ Group, WSP Global, and Xylem Water Solutions.

Companies in the Groundwater Management Market are employing several strategies to enhance their market presence. They are investing in R&D to develop smart, automated, and modular systems with improved monitoring and predictive capabilities. Strategic partnerships with municipalities, industrial operators, and environmental agencies expand market reach and accelerate adoption. Businesses are also focusing on geographic expansion into regions facing water scarcity. Integration of renewable-powered pumps and corrosion-resistant materials ensures adaptability in diverse hydrogeological conditions. Additionally, companies are offering value-added services such as data analytics, maintenance support, and training programs to strengthen client relationships, enhance operational efficiency, and drive long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Monitoring trends

- 2.4 Extraction trends

- 2.5 Recharge trends

- 2.6 Treatment trends

- 2.7 End use trends

- 2.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of groundwater management

- 3.8 Emerging opportunities & trends

- 3.9 Digitalization & IoT integration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Monitoring, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Water quality sensors

- 5.3 Water level systems

- 5.4 IoT loggers

- 5.5 Geospatial analysis

Chapter 6 Market Size and Forecast, By Extraction, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Pumps

- 6.3 Borewell drilling

- 6.4 Well casing & screens

- 6.5 Integrated infiltration systems

Chapter 7 Market Size and Forecast, By Recharge, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Artificial recharge structures

- 7.3 MAR systems

- 7.4 Recharge wells

- 7.5 Stormwater infiltration

Chapter 8 Market Size and Forecast, By Treatment, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Filtration systems

- 8.3 Pump & treat

- 8.4 Desalination & chemical treatment

- 8.5 Biological & in-situ remediation

Chapter 9 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Agriculture

- 9.3 Municipal

- 9.4 Industrial

Chapter 10 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 Indonesia

- 10.4.4 India

- 10.4.5 Australia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Iran

- 10.5.4 South Africa

- 10.5.5 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

- 10.6.3 Chile

Chapter 11 Company Profiles

- 11.1 Arcadis

- 11.2 Black & Veatch

- 11.3 Clean Harbors Environmental Services

- 11.4 DMT Group

- 11.5 Envirogen Technologies

- 11.6 GEI Consultants

- 11.7 Grundfos

- 11.8 HEPACO

- 11.9 HPC AG

- 11.10 iFLUX

- 11.11 INDUS Environmental Services

- 11.12 Koop Wasserbau

- 11.13 Minetek

- 11.14 Remedial Construction Services

- 11.15 Sensoil Innovations

- 11.16 Stantec

- 11.17 SUEZ

- 11.18 Sweco AB

- 11.19 Tetra Tech

- 11.20 The Groundwater Company

- 11.21 Veolia

- 11.22 WJ Group

- 11.23 WSP Global

- 11.24 Xylem Water Solutions