|

市場調查報告書

商品編碼

1773257

鑽井廢棄物控制與處理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Containment and Handling Drilling Waste Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

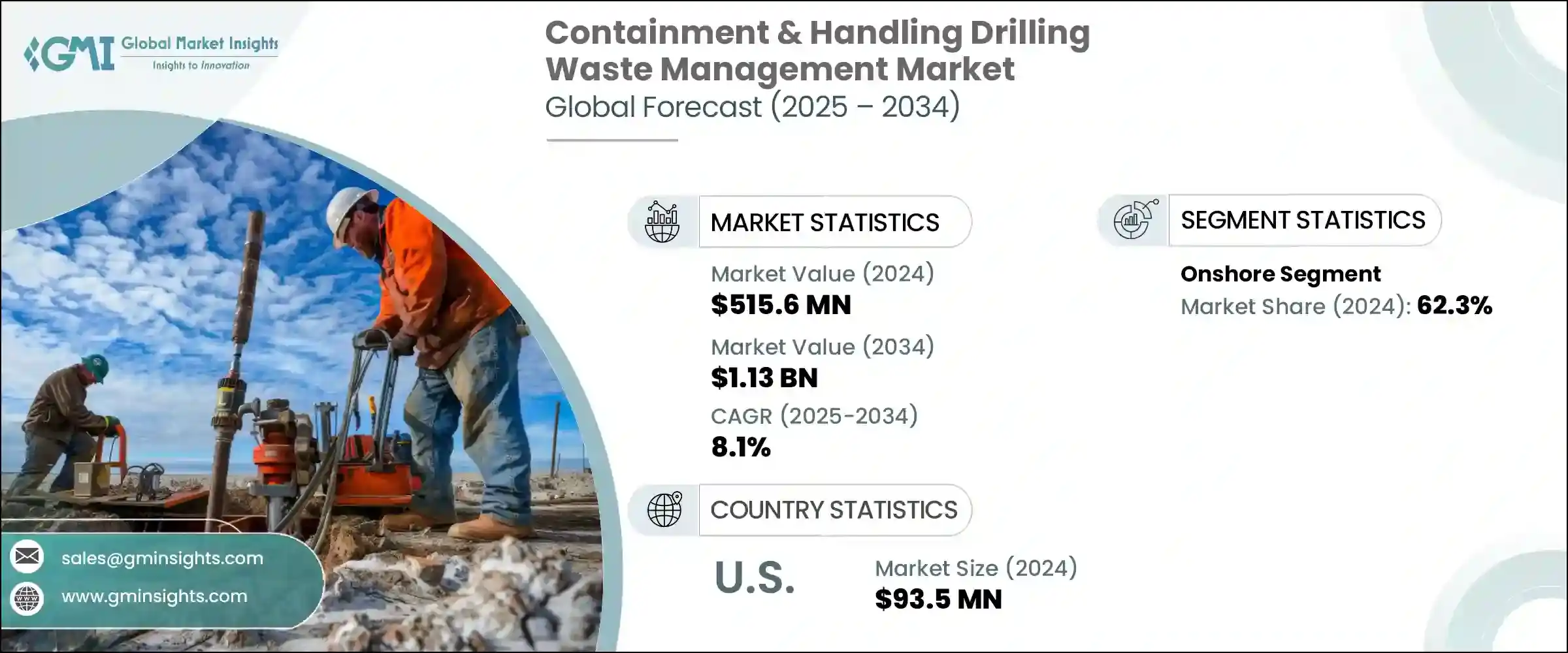

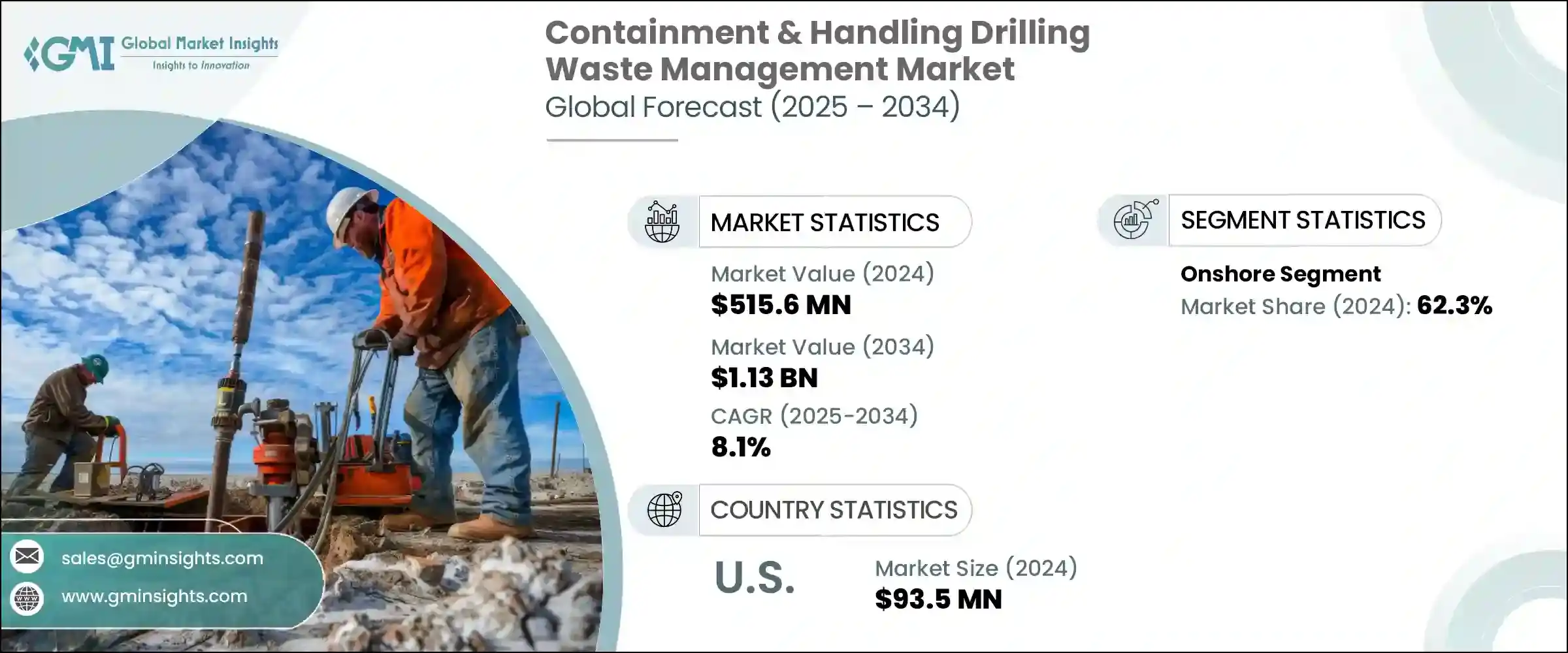

2024年,全球鑽井廢棄物控制與處理市場規模達5.156億美元,預計年複合成長率將達8.1%,2034年將達到11.3億美元。日益嚴格的鑽井廢棄物處理環境法規是推動市場成長的主要力量。世界各國政府正在實施更嚴格的政策,以規範鑽井泥漿、岩屑及相關污染物的管理、控制和最終處置,從而最大限度地減少生態損害。日益嚴格的監管架構迫使企業採用更先進的廢棄物處理解決方案。

此外,現場廢棄物處理的改進以及向水基鑽井液的轉變(與傳統的油基或合成泥漿相比,水基鑽井液產生的危險廢棄物更少)正在影響市場動態。然而,一些油基鑽井廢棄物仍被環保部門列為危險廢棄物,導致處理要求更加複雜且成本更高。日益嚴格的環保審查正在推動創新浪潮,並吸引整個產業的大量投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.156億美元 |

| 預測值 | 11.3億美元 |

| 複合年成長率 | 8.1% |

企業積極開發先進技術和更智慧的解決方案,不僅滿足監管要求,甚至超越監管要求。這種動力正推動企業採用人工智慧驅動的分析、即時監控和自動報告系統等尖端工具。投資者認知到永續實踐的長期價值,將資金投向那些優先考慮環境合規和營運效率的公司。因此,該行業正在加速研發工作,建立策略合作夥伴關係,並擴展產品組合,旨在應對不斷變化的環境挑戰,同時支持業務成長。

2024年,陸上作業板塊佔了62.3%的市場佔有率,這得益於水力壓裂技術在各新興經濟體的不斷擴張。這些高產量鑽井活動會產生大量的鑽屑、返排液和採出水,所有這些都需要在進行任何下游處理或處置之前,採用安全的現場圍堵解決方案。隨著資源豐富地區的鑽井活動日益頻繁,對可擴展且合規的廢棄物處理系統的需求急劇成長。營運商正在優先投資圍堵設備和現場專用基礎設施,以符合環境合規性和營運效率標準。

2024年,美國鑽井廢棄物控制與處理市場規模達9,350萬美元。美國和加拿大持續面臨來自聯邦和地區嚴格環境法規的日益成長的壓力,尤其是在排放、水安全和土地使用方面。加之頁岩油氣儲量豐富的地層鑽井活動日益增多,這種監管環境加速了先進控制技術和永續廢棄物處理架構的轉變。該地區注重在保持產量的同時降低生態風險,這進一步鞏固了北美在製定全球鑽井廢棄物管理實踐標準方面的作用。

活躍於市場的公司包括貝克休斯、斯倫貝謝、Clean Harbors、哈里伯頓、GN Solids Control、Newpark Resources、TWMA、Derrick Equipment Company、Secure Energy Services、Imdex、Ridgeline Canada、Soli-Bond、Select Water Solutions、Weatherford、Augean 和 NOV。為了鞏固市場地位,領先企業專注於拓展技術能力,包括根據監管要求量身定做的先進現場廢棄物處理和控制系統。

他們優先遵守不斷發展的環境標準,並開發更安全、更有效率的處理解決方案,以減少對生態的影響。策略夥伴關係和收購是拓展服務範圍和地理覆蓋範圍的常見方式。許多公司投資研發以增強產品創新,尤其是在處理黏性或危險材料等高難度廢棄物流方面。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新和技術格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 陸上

- 海上

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- Augean

- Baker Hughes

- Clean Harbors

- Derrick Equipment Company

- Geminor

- GN Solids Control

- Halliburton

- Imdex

- Newpark Resources

- NOV

- Ridgeline Canada

- Schlumberger

- Secure Energy Services

- Select Water Solutions

- Soli-Bond

- TWMA

- Weatherford

The Global Containment and Handling Drilling Waste Management Market was valued at USD 515.6 million in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 1.13 billion by 2034. Increasingly stringent environmental regulations around the disposal of drilling waste are a primary force shaping market growth. Governments worldwide are enforcing tougher policies on the management, containment, and final disposal of drilling muds, cuttings, and related pollutants to minimize ecological harm. This tightening regulatory framework is compelling companies to adopt more advanced waste-handling solutions.

Additionally, improvements in on-site waste treatment and a shift toward water-based drilling fluids, which produce less hazardous waste compared to traditional oil-based or synthetic muds, are influencing market dynamics. However, some oil-based drilling waste remains classified as hazardous by environmental authorities, leading to more complex and costly disposal requirements. This increasing environmental scrutiny is fueling a surge in innovation and attracting significant investment across industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $515.6 Million |

| Forecast Value | $1.13 Billion |

| CAGR | 8.1% |

Companies are motivated to develop advanced technologies and smarter solutions that not only meet but exceed regulatory demands. This push is encouraging the adoption of cutting-edge tools such as AI-driven analytics, real-time monitoring, and automated reporting systems. Investors recognize the long-term value in sustainable practices, directing capital toward firms that prioritize environmental compliance and operational efficiency. As a result, the industry is witnessing accelerated research and development efforts, strategic partnerships, and expanded product portfolios designed to address evolving environmental challenges while supporting business growth.

In 2024, the onshore operations segment captured a 62.3% share, driven by the expanding footprint of hydraulic fracturing across various emerging economies. These high-volume drilling activities result in significant amounts of drill cuttings, flowback fluids, and produced water-all of which require secure on-site containment solutions before any downstream processing or disposal. As drilling intensifies in resource-rich territories, the demand for scalable and compliant waste-handling systems is rising sharply. Operators are prioritizing investments in containment equipment and site-specific infrastructure to align with both environmental compliance and operational efficiency standards.

United States Containment and Handling Drilling Waste Management Market was valued at USD 93.5 million in 2024. The U.S. and Canada continue to face mounting pressure from rigorous federal and regional environmental regulations, particularly around emissions, water safety, and land use. Combined with heightened drilling activity in shale-rich formations, this regulatory environment has accelerated the shift toward advanced containment technologies and sustainable waste-handling frameworks. The region's focus on reducing ecological risks while maintaining production output further solidifies North America's role in shaping global standards for drilling waste management practices.

Companies actively operating in this market include Baker Hughes, Schlumberger, Clean Harbors, Halliburton, GN Solids Control, Newpark Resources, TWMA, Derrick Equipment Company, Secure Energy Services, Imdex, Ridgeline Canada, Soli-Bond, Select Water Solutions, Weatherford, Augean, and NOV. To solidify their market position, leading players focus on expanding technological capabilities, including advanced on-site waste treatment and containment systems tailored to regulatory demands.

They prioritize compliance with evolving environmental standards by developing safer, more efficient handling solutions that reduce ecological impact. Strategic partnerships and acquisitions are common to broaden service offerings and geographic reach. Many companies invest in RandD to enhance product innovation, particularly around handling challenging waste streams like viscous or hazardous materials.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Market estimates and forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls and challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation and technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Onshore

- 5.3 Offshore

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 UK

- 6.3.4 Spain

- 6.3.5 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.5 Middle East and Africa

- 6.5.1 Saudi Arabia

- 6.5.2 South Africa

- 6.5.3 UAE

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Augean

- 7.2 Baker Hughes

- 7.3 Clean Harbors

- 7.4 Derrick Equipment Company

- 7.5 Geminor

- 7.6 GN Solids Control

- 7.7 Halliburton

- 7.8 Imdex

- 7.9 Newpark Resources

- 7.10 NOV

- 7.11 Ridgeline Canada

- 7.12 Schlumberger

- 7.13 Secure Energy Services

- 7.14 Select Water Solutions

- 7.15 Soli-Bond

- 7.16 TWMA

- 7.17 Weatherford