|

市場調查報告書

商品編碼

1885806

人工智慧資料中心市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)AI Data Center Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

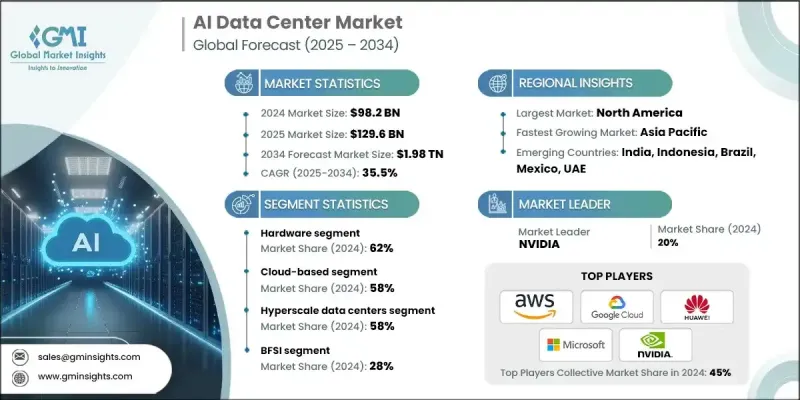

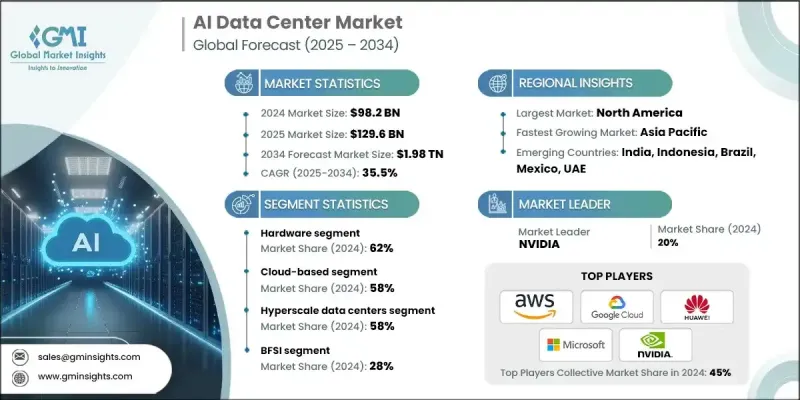

2024 年全球人工智慧資料中心市場價值為 982 億美元,預計到 2034 年將以 35.5% 的複合年成長率成長至 1.98 兆美元。

生成式人工智慧和機器學習工具的日益普及對處理能力和儲存容量提出了極高的要求,因此對專門針對人工智慧工作負載最佳化的資料中心的依賴性也日益增強。這些環境依賴先進的GPU、可擴展的系統架構和超低延遲網路,以支援金融、醫療保健和零售等行業複雜的模型訓練和推理。巨量資料分析也在加速這一需求,因為企業需要處理大量的結構化和非結構化資訊流,必須快速處理這些資訊。專注於人工智慧的設施能夠為即時工作負載提供高效能運算,從而鞏固其作為全球數位轉型關鍵基礎設施的地位。雲端運算的快速擴張以及超大規模設施數量的不斷成長,持續推動對人工智慧就緒型基礎設施的需求。服務供應商正在投資建造先進的人工智慧資料平台,為企業和開發者提供可擴展的服務,進一步增強了市場發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 982億美元 |

| 預測值 | 1.98兆美元 |

| 複合年成長率 | 35.5% |

2024年,硬體領域市場規模將達611億美元。成長主要得益於人工智慧晶片、GPU加速器、先進散熱技術、高密度伺服器系統和光網路解決方案的廣泛應用。 GPU能耗的不斷攀升、機架密度向30-120千瓦的轉變,以及領先科技公司推出的大規模部署策略,正在塑造該行業的長期資本配置格局。

2024年,雲端運算領域佔據了58%的市場佔有率,預計2025年至2034年將以35.2%的複合年成長率成長。該領域之所以領先,是因為其無與倫比的可擴展性、靈活的消費選項以及無需前期投資即可使用最新的AI加速計算硬體。超大規模服務供應商正投入數十億美元加強全球AI基礎設施建設,從而推動AI驅動型服務的普及,並增加對GPU、TPU和專用處理器的需求。

2024年,美國人工智慧資料中心市場規模預計將達332億美元。憑藉眾多超大規模營運商的支援以及在GPU集群、液冷技術和大規模人工智慧資料中心建設方面的巨額投資,美國在該領域保持領先地位。聯邦政府的激勵措施、區域稅收優惠和基礎設施建設資金進一步鞏固了美國作為人工智慧運算能力最強地區的地位。

人工智慧資料中心市場的主要參與者包括華為、AWS、英偉達、HPE、Digital Realty、Google、聯想、微軟、Equinix 和戴爾科技。這些公司正致力於拓展在人工智慧資料中心市場的佔有率,並專注於基礎設施現代化、大規模GPU部署和節能系統設計。許多公司正在投資高密度機架、整合液冷系統和新一代網路,以支援先進的人工智慧工作負載。與晶片製造商、雲端服務供應商和託管營運商建立策略合作夥伴關係,有助於加速容量擴張並確保獲得尖端人工智慧硬體。服務供應商也正在擴大全球資料中心規模,增強自動化能力,並透過整合再生能源最佳化電力利用率。與企業簽訂長期合約、提供人工智慧即服務 (AIaaS) 產品以及建立專用人工智慧集群,進一步鞏固了其競爭地位和市場主導地位。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 採用生成式人工智慧和機器學習

- 巨量資料分析領域的成長

- 雲端擴充和超大規模部署

- GPU和晶片技術的進步

- 產業陷阱與挑戰

- 高昂的資本和營運成本

- 能源消耗與永續性議題

- 市場機遇

- 邊緣人工智慧資料中心

- 液冷和綠色技術

- 人工智慧即服務平台

- 新興市場採用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- GPU 與加速器技術演進

- 液冷技術進步

- 電源分配創新(48V架構、模組化UPS)

- 新興技術

- 軟體定義基礎設施

- 邊緣運算整合

- 當前技術趨勢

- 定價分析

- 託管定價趨勢(每千瓦,每機架)

- 雲端運算人工智慧運算定價演變

- 能源成本對總擁有成本的影響

- 冷卻技術成本比較

- 成本細分分析

- 專利分析

- 冷卻技術專利

- 人工智慧晶片架構專利

- 電源管理創新

- 資料中心設計專利

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

- 互聯互通及網路基礎設施分析

- 資料中心互連架構

- 高速織物要求

- 超大規模企業對海底電纜的投資

- 網際網路交換點鄰近性與對等互聯

- 各區域的光纖回程可用性

- 5G與邊緣網路整合

- 軟體定義網路採用

- 投資與融資分析

- 超大規模資本支出趨勢

- 私募股權和基礎設施基金活動

- 政府投資計劃

- 人工智慧基礎設施新創企業的創投

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

- 新增產能及場地公告

- 供應商選擇標準

- 產品和服務基準測試

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 硬體

- 伺服器

- GPU

- 貯存

- 網路裝置

- 軟體

- 人工智慧框架

- 編排工具

- 管理平台

- 服務

- 專業服務

- 部署與整合

- 諮詢

- 支援與維護

- 託管服務

- 專業服務

第6章:市場估算與預測:依部署模式分類,2021-2034年

- 主要趨勢

- 基於雲端的

- 現場

- 混合

第7章:市場估算與預測:依資料中心分類,2021-2034年

- 主要趨勢

- 超大規模資料中心

- 企業資料中心

- 託管資料中心

- 邊緣資料中心

第8章:市場估算與預測:依產業垂直領域分類,2021-2034年

- 主要趨勢

- 金融服務業

- 政府

- 衛生保健

- 資訊科技與電信

- 汽車

- 媒體與娛樂

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Global companies

- AWS

- Dell Technologies

- Digital Realty

- Equinix

- Google Cloud

- HPE

- Huawei

- Lenovo

- Microsoft

- NVIDIA

- 區域玩家

- Ascenty (Digital Realty/Brookfield)

- China Telecom

- Cirion Technologies

- Elea Data Centers

- ST Telemedia Global Data Centres (STT GDC)

- Telehouse (KDDI)

- TierPoint

- 新興玩家

- Applied Digital

- CoreWeave

- Crusoe Energy

- Lambda Labs

- Nebius AI

The Global AI Data Center Market was valued at USD 98.2 billion in 2024 and is estimated to grow at a CAGR of 35.5% to reach USD 1.98 trillion by 2034.

Growing adoption of generative AI and machine learning tools requires extraordinary processing power and storage capabilities, increasing reliance on data centers specifically optimized for AI workloads. These environments depend on advanced GPUs, scalable system architecture, and ultra-low-latency networking to support complex model training and inference across industries such as finance, healthcare, and retail. Big data analytics is also accelerating demand, as organizations handle massive streams of structured and unstructured information that must be processed rapidly. AI-focused facilities enable high-performance computing for real-time workloads, strengthening their role as essential infrastructure for global digital transformation. The rapid expansion of cloud computing, along with the rising number of hyperscale facilities, continues to amplify the need for AI-ready infrastructures. Providers are investing in advanced AI data platforms that offer scalable services to enterprises and developers, further increasing market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $98.2 Billion |

| Forecast Value | $1.98 Trillion |

| CAGR | 35.5% |

The hardware segment accounted for USD 61.1 billion in 2024. Growth is driven by expanding use of AI chips, GPU accelerators, advanced cooling technologies, high-density server systems, and optical networking solutions. Rising GPU energy requirements, the shift toward rack densities between 30-120 kW, and large-scale deployment strategies introduced by leading technology companies are shaping long-term capital allocation in the sector.

The cloud-based category held a 58% share in 2024 and is projected to grow at a CAGR of 35.2% from 2025 through 2034. This segment leads due to its unmatched scalability, flexible consumption options, and access to the latest AI-accelerated computing hardware without upfront investment. Hyperscale providers are making multi-billion-dollar commitments to strengthen global AI infrastructures, propelling adoption of AI-driven services and increasing demand for GPUs, TPUs, and specialized processors.

US AI Data Center Market generated USD 33.2 billion in 2024. The country maintains a leading position supported by prominent hyperscale operators and substantial investments in GPU clusters, liquid cooling, and large-scale AI-aligned builds. Federal incentives, regional tax advantages, and infrastructure funding have further solidified the United States as the most capacity-rich region for AI computing.

Key participants in the AI Data Center Market include Huawei, AWS, NVIDIA, HPE, Digital Realty, Google, Lenovo, Microsoft, Equinix, and Dell Technologies. Companies expanding their foothold in the AI data center market are focusing on infrastructure modernization, large-scale GPU deployments, and energy-efficient system design. Many firms are investing in high-density racks, integrated liquid cooling, and next-generation networking to support advanced AI workloads. Strategic partnerships with chipmakers, cloud providers, and colocation operators help accelerate capacity expansion and ensure access to cutting-edge AI hardware. Providers are also scaling global data center footprints, enhancing automation capabilities, and optimizing power utilization through renewable-energy integration. Long-term contracts with enterprises, AI-as-a-service offerings, and the buildout of specialized AI clusters further reinforce competitive positioning and market dominance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment mode

- 2.2.4 Data center

- 2.2.5 Industry vertical

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Adoption of generative AI & machine learning

- 3.2.1.2 Growth in big data analytics

- 3.2.1.3 Cloud expansion & hyperscale deployments

- 3.2.1.4 Advancements in GPU & chip technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital & operational costs

- 3.2.2.2 Energy consumption & sustainability issues

- 3.2.3 Market opportunities

- 3.2.3.1 Edge AI data centers

- 3.2.3.2 Liquid cooling & green technologies

- 3.2.3.3 AI-as-a-service platforms

- 3.2.3.4 Emerging markets adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 GPU & accelerator technology evolution

- 3.7.1.2 Liquid cooling technology advancement

- 3.7.1.3 Power distribution innovation (48V Architecture, Modular UPS)

- 3.7.2 Emerging technologies

- 3.7.2.1 Software-defined infrastructure

- 3.7.2.2 Edge computing integration

- 3.7.1 Current technological trends

- 3.8 Pricing analysis

- 3.8.1 Colocation pricing trends (per kw, per rack)

- 3.8.2 Cloud AI compute pricing evolution

- 3.8.3 Energy cost impact on total cost of ownership

- 3.8.4 Cooling technology cost comparison

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.10.1 Cooling technology patents

- 3.10.2 AI chip architecture patents

- 3.10.3 Power management innovations

- 3.10.4 Data center design patents

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Use cases

- 3.14 Best case scenario

- 3.15 Interconnection & network infrastructure analysis

- 3.15.1 Data center interconnection architecture

- 3.15.2 High-speed fabric requirements

- 3.15.3 Submarine cable investments by hyperscalers

- 3.15.4 Internet exchange point proximity & peering

- 3.15.5 Fiber backhaul availability by region

- 3.15.6. 5 g & edge network integration

- 3.15.7 Software-defined networking adoption

- 3.16 Investment & funding analysis

- 3.16.1 Hyperscale capital expenditure trends

- 3.16.2 Private equity & infrastructure fund activity

- 3.16.3 Government investment programs

- 3.16.4 Venture capital in AI infrastructure startups

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 New capacity & site announcements

- 4.8 Vendor selection criteria

- 4.9 Product & service benchmarking

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Servers

- 5.2.2 GPUs

- 5.2.3 Storage

- 5.2.4 Networking equipment

- 5.3 Software

- 5.3.1 AI frameworks

- 5.3.2 Orchestration tools

- 5.3.3 Management platforms

- 5.4 Services

- 5.4.1 Professional services

- 5.4.1.1 Deployment & Integration

- 5.4.1.2 Consulting

- 5.4.1.3 Support & maintenance

- 5.4.2 Managed services

- 5.4.1 Professional services

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Hyperscale data centers

- 7.3 Enterprise data centers

- 7.4 Colocation data centers

- 7.5 Edge data centers

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Government

- 8.4 Healthcare

- 8.5 IT & telecom

- 8.6 Automotive

- 8.7 Media & entertainment

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 AWS

- 10.1.2 Dell Technologies

- 10.1.3 Digital Realty

- 10.1.4 Equinix

- 10.1.5 Google Cloud

- 10.1.6 HPE

- 10.1.7 Huawei

- 10.1.8 Lenovo

- 10.1.9 Microsoft

- 10.1.10 NVIDIA

- 10.2 Regional players

- 10.2.1 Ascenty (Digital Realty/Brookfield)

- 10.2.2 China Telecom

- 10.2.3 Cirion Technologies

- 10.2.4 Elea Data Centers

- 10.2.5 ST Telemedia Global Data Centres (STT GDC)

- 10.2.6 Telehouse (KDDI)

- 10.2.7 TierPoint

- 10.3 Emerging players

- 10.3.1 Applied Digital

- 10.3.2 CoreWeave

- 10.3.3 Crusoe Energy

- 10.3.4 Lambda Labs

- 10.3.5 Nebius AI