|

市場調查報告書

商品編碼

1876793

免疫療法藥物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Immunotherapy Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年全球免疫療法藥物市場價值為2013億美元,預計到2034年將以10.2%的複合年成長率成長至5265億美元。

慢性疾病(包括癌症、自體免疫疾病和傳染病)的盛行率上升,以及抗體工程技術的持續創新,共同推動了市場擴張。 CAR-T細胞療法、雙特異性抗體和免疫檢查點抑制劑等先進治療技術正在改變治療模式,與傳統療法相比,它們具有更高的療效和安全性。人工智慧正在加速藥物研發,而生物標記驅動的臨床開發則提高了患者篩選率和治療成功率。隨著基於基因和分子譜設計的療法在全球範圍內獲得認可,精準醫療和個人化醫療的持續發展也進一步促進了市場成長。基於新抗原的疫苗和生物標記指導的治療方案等新興方法正在快速發展,這得益於基因組學、蛋白質組學和診斷工具的進步,這些進步改善了監測和治療效果。免疫療法藥物旨在透過活化或抑制免疫反應來幫助人體對抗各種疾病,其作用機制是透過生物工程物質(例如抗體或蛋白質)。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2013億美元 |

| 預測值 | 5265億美元 |

| 複合年成長率 | 10.2% |

2024年,單株抗體市場佔63.3%的市場佔有率,預計到2034年將達到3,400億美元,年複合成長率達10.4%。慢性病發病率的不斷上升持續推動著對標靶生物製劑的強勁需求。與傳統藥物相比,單株抗體具有更高的選擇性和更低的副作用,已成為治療的基石。它們針對特定分子路徑的能力使其成為現代醫學療法中不可或缺的一部分,並使其成為全球免疫療法開發中最有價值的組成部分之一。

預計到2024年,癌症領域市場規模將達到1,304億美元,繼續維持在全球免疫療法藥物市場的領先地位。全球癌症病例的激增以及先進生物療法的不斷發展是市場擴張的關鍵因素。包括免疫檢查點調節劑、單株抗體和新一代細胞療法在內的創新療法,透過提高患者存活率和緩解率,重新定義了腫瘤治療。自體免疫疾病領域也呈現快速成長,因為治療重點正從普遍的免疫抑制轉向精準靶向的生物療法,從而更好地控制疾病並減少不良反應。

預計到2024年,美國免疫療法藥物市場規模將達到831億美元,鞏固其在全球研發和臨床創新領域的領先地位。美國擁有強大的生技新創公司、製藥巨頭以及聯邦政府的大力支持,這為新型免疫療法的快速商業化提供了有力保障。安進、輝瑞和強生等公司的持續投資正在拓展下一代生物製劑和細胞療法的研發管線,許多在研新藥的獲批也凸顯了美國致力於加速免疫療法發展的決心。

全球免疫療法藥物市場的主要參與者包括百時美施貴寶、阿斯特捷利康、吉利德科學、羅氏、強生、諾華、葛蘭素史克、賽諾菲、默克、莫德納、輝瑞、安進、Kite Pharma、Adaptimmune Therapeutics 和 Bluebird Bio。這些關鍵企業正採取多元化策略來提升其全球影響力並增強競爭力。它們正在擴大針對新型免疫路徑的研究項目,並投資於下一代生物製劑,例如雙特異性抗體和 CAR-T 平台。策略聯盟、併購使它們能夠獲得尖端技術並加速臨床開發進程。此外,各公司也專注於區域擴張,尤其是在新興經濟體,以增加患者獲得先進療法的機會。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 慢性病盛行率上升

- 抗體工程技術進步

- 對個人化和標靶治療的需求日益成長

- 拓展至非腫瘤領域

- 產業陷阱與挑戰

- 成本高且取得途徑有限

- 患者反應和抗藥性存在個體差異

- 市場機遇

- 分散式製造和區域中心

- 個人化新抗原疫苗

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 臨床試驗分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依藥物類型分類,2021-2034年

- 主要趨勢

- 單株抗體

- 疫苗

- 干擾素α和BETA

- 白血球介素

- 其他藥物類型

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 癌症

- 自體免疫疾病

- 傳染病

- 其他應用

第7章:市場估計與預測:依給藥途徑分類,2021-2034年

- 主要趨勢

- 靜脈

- 皮下

- 口服

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院和診所

- 癌症研究機構

- 製藥和生物技術公司

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Adaptimmune Therapeutics

- Amgen

- AstraZeneca

- Bristol Myers Squibb

- Bluebird Bio

- F. Hoffmann La Roche

- GlaxoSmithKline

- Gilead Sciences

- Johnson & Johnson

- Kite Pharma

- Merck & Co.

- Moderna

- Novartis

- Pfizer

- Sanofi

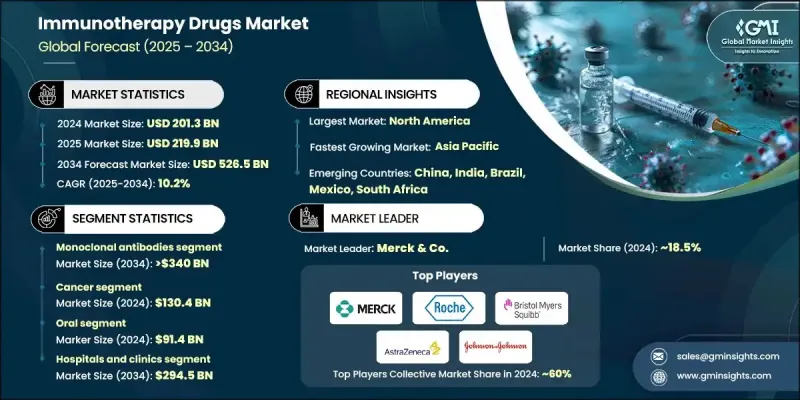

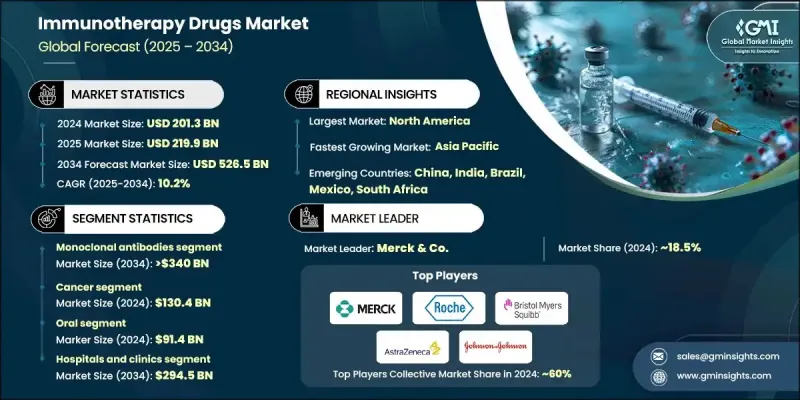

The Global Immunotherapy Drugs Market was valued at USD 201.3 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 526.5 billion by 2034.

The market expansion is influenced by the rising prevalence of chronic illnesses, including cancer, autoimmune, and infectious diseases, coupled with continuous innovation in antibody engineering. Advanced therapeutic technologies such as CAR-T cell therapy, bispecific antibodies, and immune checkpoint inhibitors are transforming treatment paradigms, offering improved efficacy and safety over conventional therapies. Artificial intelligence is accelerating drug discovery, while biomarker-driven clinical development is enhancing patient selection and treatment success rates. The ongoing shift toward precision and personalized medicine continues to strengthen market growth, as therapies designed around genetic and molecular profiles gain global acceptance. Emerging approaches such as neoantigen-based vaccines and biomarker-guided regimens are advancing rapidly, supported by progress in genomics, proteomics, and diagnostic tools that improve monitoring and outcomes. Immunotherapy drugs are designed to modify or regulate immune responses, helping the body combat various diseases through either immune activation or suppression mechanisms using biologically engineered substances such as antibodies or proteins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $201.3 Billion |

| Forecast Value | $526.5 Billion |

| CAGR | 10.2% |

The monoclonal antibodies segment accounted for 63.3% share in 2024 and is expected to reach USD 340 billion by 2034, growing at a CAGR of 10.4%. The rising incidence of chronic conditions continues to drive strong demand for targeted biologics. Monoclonal antibodies have become a cornerstone of treatment due to their superior selectivity and reduced side effects compared to traditional pharmaceuticals. Their ability to target specific molecular pathways has made them indispensable in modern medical therapies and positioned them as one of the most valuable components of immunotherapy development worldwide.

The cancer segment generated USD 130.4 billion in 2024, maintaining its position as the leading therapeutic area within the global immunotherapy drugs market. The surge in global cancer cases and the ongoing evolution of advanced biological therapies are central to market expansion. Innovative treatments, including immune checkpoint modulators, monoclonal antibodies, and next-generation cell therapies, have redefined oncology care by improving patient survival and response rates. The autoimmune disease segment is also recording rapid growth as the focus shifts from generalized immune suppression to precision-targeted biologic therapies, resulting in better disease management and fewer adverse effects.

U.S. Immunotherapy Drugs Market reached USD 83.1 billion in 2024, reinforcing its global leadership position in research, development, and clinical innovation. The country's ecosystem of biotechnology startups, pharmaceutical giants, and strong federal support enables rapid commercialization of novel immunotherapies. Ongoing investments by companies such as Amgen, Pfizer, and Johnson & Johnson are expanding the pipeline of next-generation biologics and cellular therapies, with numerous investigational new drug approvals highlighting the nation's commitment to accelerating immunotherapy advancements.

Major participants in the Global Immunotherapy Drugs Market include Bristol Myers Squibb, AstraZeneca, Gilead Sciences, F. Hoffmann La Roche, Johnson & Johnson, Novartis, GlaxoSmithKline, Sanofi, Merck & Co., Moderna, Pfizer, Amgen, Kite Pharma, Adaptimmune Therapeutics, and Bluebird Bio. Key companies in the Global Immunotherapy Drugs Market are employing diverse strategies to enhance their global presence and strengthen competitiveness. They are expanding R&D programs targeting novel immune pathways and investing in next-generation biologics such as bispecific antibodies and CAR-T platforms. Strategic alliances, mergers, and acquisitions are enabling them to access cutting-edge technologies and accelerate clinical development timelines. Firms are also focusing on regional expansion, particularly in emerging economies, to increase access to advanced treatments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Application trends

- 2.2.4 Route of administration trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Technological advancement in antibody engineering

- 3.2.1.3 Growing demand for personalized and targeted therapies

- 3.2.1.4 Expansion into non-oncology applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and limited accessibility

- 3.2.2.2 Variable patient response and resistance

- 3.2.3 Market opportunities

- 3.2.3.1 Decentralized manufacturing and regional hubs

- 3.2.3.2 Personalized neoantigen vaccines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Monoclonal antibodies

- 5.3 Vaccines

- 5.4 Interferons alpha & beta

- 5.5 Interleukins

- 5.6 Other drug types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Cancer

- 6.3 Autoimmune diseases

- 6.4 Infectious diseases

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Intravenous

- 7.3 Subcutaneous

- 7.4 Oral

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Cancer research institutes

- 8.4 Pharmaceutical and biotechnology companies

- 8.5 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adaptimmune Therapeutics

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Bristol Myers Squibb

- 10.5 Bluebird Bio

- 10.6 F. Hoffmann La Roche

- 10.7 GlaxoSmithKline

- 10.8 Gilead Sciences

- 10.9 Johnson & Johnson

- 10.10 Kite Pharma

- 10.11 Merck & Co.

- 10.12 Moderna

- 10.13 Novartis

- 10.14 Pfizer

- 10.15 Sanofi