|

市場調查報告書

商品編碼

1876632

智慧工業照明燈具市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Smart Industrial Lighting Fixtures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

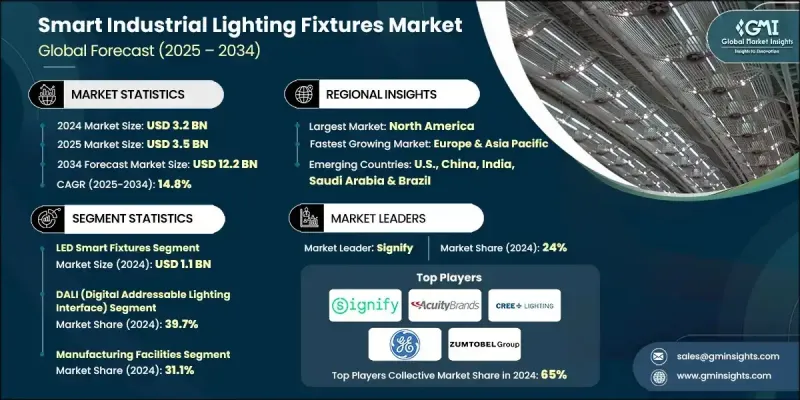

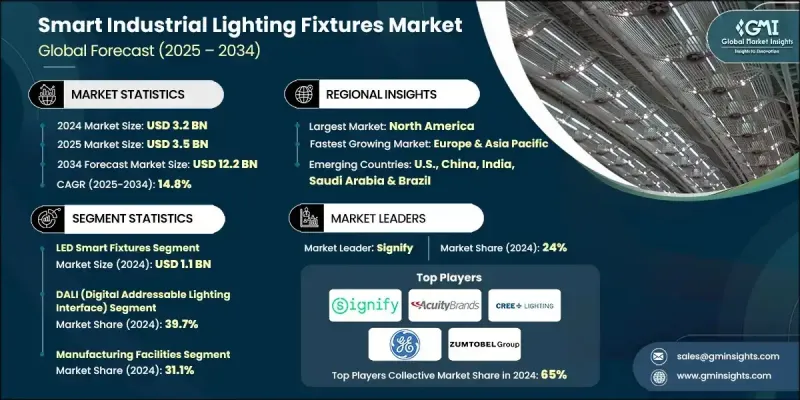

2024 年全球智慧工業照明燈具市場價值為 32 億美元,預計到 2034 年將以 14.8% 的複合年成長率成長至 122 億美元。

工業領域對節能、經濟且環保的照明解決方案的需求日益成長,推動了智慧照明的普及。工業設施面臨越來越大的營運成本削減和碳排放減少的壓力,而智慧LED照明系統提供了有效的解決方案。這些系統融合了運動偵測、自動調光和日光採集等先進技術,可顯著節省能源並帶來營運效益。不斷上漲的能源成本和永續發展措施進一步推動了智慧照明的普及,因為企業希望在實現長期節能的同時,也能達到環保目標。世界各國政府正在實施更嚴格的能源效率標準,逐步淘汰低效照明,並提供獎勵措施鼓勵採用智慧照明。這些政策在工業環境中尤其重要,因為遵守能源法規對於確保業務的持續運作至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 122億美元 |

| 複合年成長率 | 14.8% |

2024年,LED智慧燈具市場規模達到11億美元,預計2025年至2034年將以15.1%的複合年成長率成長。與傳統照明相比,LED技術的成熟使其擁有更高的流明輸出、更低的發熱量和更少的維護需求。與感測器和智慧控制器的日益整合,使得運動感應、日光採集和自動調光等功能得以實現,從而顯著提升了能源效率和運作效率。 LED組件和生產成本的下降,也讓包括小型企業在內的更多工業用戶能夠輕鬆使用LED產品。

製造設施領域佔31.1%的市場佔有率,預計到2034年將以15.5%的複合年成長率成長。工業製造環境需要能夠承受惡劣條件、持續運作並能根據工作流程需求動態調整的照明系統。整合感測器的智慧照明解決方案能夠根據人員佔用情況、特定任務需求和環境光照自動調節照明,從而在確保為工人提供持續、最佳照明的同時,降低能耗並提高生產效率和安全性。

2024年美國智慧工業照明燈具市場規模達10億美元,預計2025年至2034年將以15.3%的複合年成長率成長。製造商和工業營運商正擴大採用智慧照明系統,以提高能源效率、降低營運成本並遵守嚴格的環境法規。國家永續發展計劃和減碳目標正在推動從傳統照明向物聯網賦能的智慧LED解決方案轉型。主要市場參與者的存在、強大的研發實力以及政府對節能升級的激勵措施,為市場擴張創造了有利條件。

全球智慧工業照明燈具市場的主要企業包括Cima Lighting、Zumtobel Group、Holophane、Acuity Brands、Luminis Lighting、Eaton、Cree Lighting、AGC Lighting、LSI Industries、GE Current、Panasonic Lighting、Dialight、Osram (ams OSRAM)、PureLid、effient、CureLiHub、BientsLED、TureLis OSRAM.、PureLiHub、effienting、HureLid、TybyTLED、TureLi、Hurek、TureLiT、TureSTJ、T這些企業積極追求技術創新和產品差異化,以增強其競爭優勢。他們大力投資研發,致力於推出節能、物聯網賦能的智慧照明解決方案,以滿足不斷變化的產業需求。與工業營運商、系統整合商和政府機構的策略合作,有助於企業加速市場滲透並確保合規性。拓展區域製造和分銷網路,增強了企業高效滿足不斷成長的需求的能力。此外,企業還利用永續發展行銷、產品客製化和智慧照明服務來吸引企業客戶。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 能源效率和成本節約

- 智慧城市與都市化計劃

- 政府法規和永續發展指令

- 改造趨勢與基礎建設現代化

- 產業陷阱與挑戰

- 複雜的安裝與改造挑戰

- 高昂的前期成本和投資報酬率問題

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- LED智慧燈具

- 物聯網系統

- 人工智慧/機器學習賦能的燈具

- 以人為中心的照明系統

- 支援LiFi技術的燈具

第6章:市場估算與預測:依控制協議與連結方式分類,2021-2034年

- 主要趨勢

- DALI(數位可尋址照明介面)

- 無線協定

- 乙太網路供電(PoE)

- 物質/線通用標準

第7章:市場估算與預測:依智慧功能與效能分類,2021-2034年

- 主要趨勢

- 佔用感知和運動偵測

- 日光採集系統

- 能源監控與分析

- 預測性維護能力

- 應急與安全整合

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 製造工廠

- 倉儲和配送中心

- 食品加工廠

- 製藥生產

- 汽車工廠

- 重工業應用

- 危險場所

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第11章:公司簡介

- Acuity Brands

- AGC Lighting

- Cima Lighting

- Cree Lighting

- Dialight

- Eaton

- GE Current

- Holophane

- Hubbell Lighting

.11.10. LSI 工業

- 高效率發光

- 魯米尼斯照明

- 歐司朗(ams OSRAM)

- 松下照明

.11.15. PureLiFi

- 表示

- 超亮LED燈

- Zumtobel集團

The Global Smart Industrial Lighting Fixtures Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 14.8% to reach USD 12.2 billion by 2034.

The surge is fueled by the growing demand for energy-efficient, cost-effective, and environmentally responsible lighting solutions in industrial settings. Industrial facilities face increasing pressure to cut operational expenses and reduce carbon emissions, and smart LED lighting systems provide an effective solution. These systems incorporate advanced technologies such as motion detection, automated dimming, and daylight harvesting, offering substantial energy savings and operational benefits. Rising energy costs and sustainability initiatives further drive adoption, as businesses aim to achieve long-term savings while meeting environmental targets. Governments worldwide are enforcing stricter energy efficiency standards, phasing out inefficient lighting, and offering incentives to encourage smart lighting adoption. These policies are especially impactful in industrial environments where compliance with energy regulations is critical for uninterrupted operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 14.8% |

The LED smart fixtures segment accounted for USD 1.1 billion in 2024 and is forecasted to grow at a CAGR of 15.1% from 2025 to 2034. The maturity of LED technology has enabled higher lumen output, reduced heat production, and lower maintenance demands compared to traditional lighting. Increasing integration with sensors and intelligent controllers allows features like motion sensing, daylight harvesting, and automated dimming, which together drive notable energy savings and operational efficiency. Falling costs of LED components and production have expanded accessibility to a wider range of industrial users, including smaller enterprises.

The manufacturing facilities segment held a 31.1% share and is expected to grow at a CAGR of 15.5% through 2034. Industrial manufacturing environments demand lighting systems that can endure harsh conditions, provide continuous operation, and adjust dynamically to workflow requirements. Smart lighting solutions with sensor integration enable automated adjustments based on occupancy, task-specific needs, and ambient lighting, reducing energy consumption while improving productivity and safety by ensuring consistent, optimal illumination for workers.

U.S. Smart Industrial Lighting Fixtures Market was valued at USD 1 billion in 2024 and is anticipated to grow at a CAGR of 15.3% from 2025 to 2034. Manufacturers and industrial operators are increasingly adopting intelligent lighting systems to enhance energy efficiency, cut operational costs, and comply with strict environmental regulations. National sustainability initiatives and carbon reduction goals are driving the transition from conventional lighting to IoT-enabled and smart LED solutions. The presence of major market players, robust research and development, and government incentives for energy-efficient upgrades have created favorable conditions for market expansion.

Key companies in the Global Smart Industrial Lighting Fixtures Market include Cima Lighting, Zumtobel Group, Holophane, Acuity Brands, Luminis Lighting, Eaton, Cree Lighting, AGC Lighting, LSI Industries, GE Current, Panasonic Lighting, Dialight, Osram (ams OSRAM), PureLiFi, Hubbell Lighting, Signify, SuperBrightLEDs, and Lumefficient. Companies in the Smart Industrial Lighting Fixtures Market are actively pursuing technology innovation and product differentiation to strengthen their competitive position. They are investing heavily in research and development to introduce energy-efficient, IoT-enabled, and intelligent lighting solutions that meet evolving industrial requirements. Strategic collaborations with industrial operators, system integrators, and government initiatives allow companies to accelerate market penetration and ensure regulatory compliance. Expanding regional manufacturing and distribution networks enhances their ability to meet rising demand efficiently. Firms are also leveraging sustainability-driven marketing, product customization, and smart lighting service offerings to attract enterprise clients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Control protocol & connectivity

- 2.2.4 Smart features & capabilities

- 2.2.5 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Energy efficiency & cost savings

- 3.2.1.2 Smart city & urbanization initiatives

- 3.2.1.3 Government regulations & sustainability mandates

- 3.2.1.4 Retrofit trends & infrastructure modernization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Complex installation & retrofit challenges

- 3.2.2.2 High upfront costs & ROI concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 LED smart fixtures

- 5.3 IoT-enabled systems

- 5.4 AI/ML-enabled fixtures

- 5.5 Human-centric lighting systems

- 5.6 LiFi-enabled fixtures

Chapter 6 Market Estimates & Forecast, By Control Protocol & Connectivity, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 DALI (Digital addressable lighting interface)

- 6.3 Wireless protocol

- 6.4 Power over Ethernet (PoE)

- 6.5 Matter/thread universal standard

Chapter 7 Market Estimates & Forecast, By Smart Features & Capabilities, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Occupancy sensing & motion detection

- 7.3 Daylight harvesting systems

- 7.4 Energy monitoring & analytics

- 7.5 Predictive maintenance capabilities

- 7.6 Emergency & safety integration

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Manufacturing facilities

- 8.3 Warehousing & distribution centers

- 8.4 Food processing plants

- 8.5 Pharmaceutical manufacturing

- 8.6 Automotive plants

- 8.7 Heavy industrial applications

- 8.8 Hazardous location

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Acuity Brands

- 11.2 AGC Lighting

- 11.3 Cima Lighting

- 11.4 Cree Lighting

- 11.5 Dialight

- 11.6 Eaton

- 11.7 GE Current

- 11.8 Holophane

- 11.9 Hubbell Lighting

.11.10. LSI Industries

- 11.11 Lumefficient

- 11.12 Luminis Lighting

- 11.13 Osram (ams OSRAM)

- 11.14 Panasonic Lighting

.11.15. PureLiFi

- 11.16 Signify

- 11.17 SuperBrightLEDs

- 11.18 Zumtobel Group