|

市場調查報告書

商品編碼

1876535

精準益生元市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Precision Prebiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

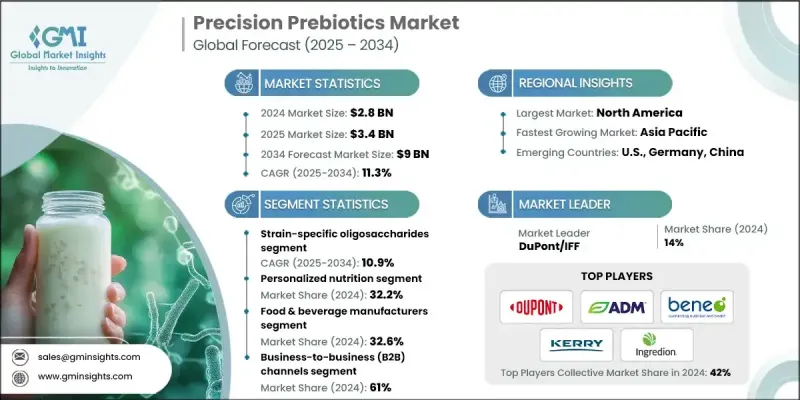

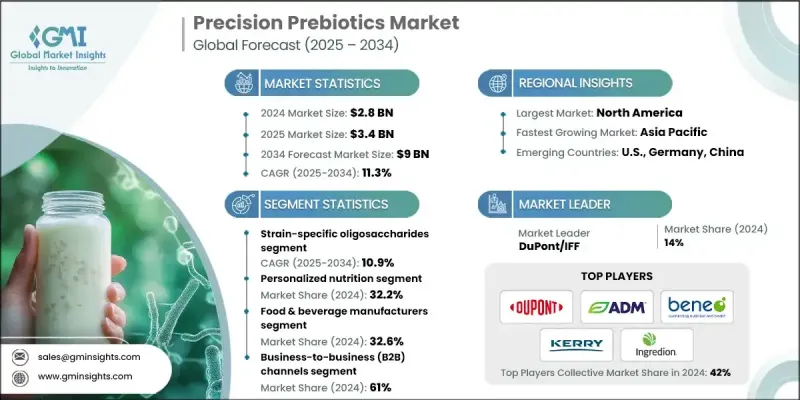

2024 年全球精準益生元市場價值為 28 億美元,預計到 2034 年將以 11.3% 的複合年成長率成長至 90 億美元。

益生元干預措施的科學驗證不斷增多,以及其在多個行業的應用日益廣泛,正推動市場成長。各公司正迅速將精準益生元納入其產品組合,旨在調節腸道菌叢並改善特定健康結果。發酵技術和個人化營養平台的進步,使得開發高標靶性和高效益生元成為可能。與更廣泛的功能性成分類別相比,精準益生元因其與健康和保健趨勢的直接關聯而表現更佳。在個人化營養、臨床和治療應用以及功能性食品和飲料領域的應用,正引領市場成長。這些益生元專注於對結腸健康、免疫力、新陳代謝和消化產生精準的益處,契合了消費者對基於實證醫學的個人化健康解決方案的需求。監管政策的明確化進一步加速了商業化進程,尤其是在那些擁有完善支援框架和簡化核准流程的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 90億美元 |

| 複合年成長率 | 11.3% |

2024年,菌株特異性寡糖市佔率達到39.5%,預計到2034年將以10.9%的複合年成長率成長。這些益生元利用結構精確的化合物,選擇性地滋養有益腸道細菌,例如雙歧桿菌和乳酸桿菌,這些化合物的設計旨在與微生物的酶活性相匹配。大量的臨床證據表明,這些標靶干預措施能夠調節腸道菌群,從而帶來持續且可預測的健康益處。

個人化營養領域在2024年佔了32.2%的市場佔有率,預計在2025年至2034年間將以10.9%的複合年成長率成長。透過結合微生物組分析、基因檢測和代謝譜分析,企業能夠提供量身訂製的健康建議,滿足個人化的健康需求。消費者對個人化健康策略的興趣日益濃厚,促使企業創造整合診斷技術和精準益生元輸送的平台。皮膚健康和抗衰老等新興領域可望透過與外用和口服產品產生協同效應,進一步提升市場機會。

2024年,北美精準益生元市佔率達39.5%。該地區受益於完善的監管環境,鼓勵創新和快速產品開發。先進的新成分核准流程使企業能夠更有信心地投資研發,從而確保高價值益生元產品更快實現商業化。消費者對個人化營養的強烈需求進一步鞏固了北美在該領域的領先地位。

全球精準益生元市場的主要參與者包括養樂多本社株式會社、Seed Health、Kerry Group plc、Viome Life Sciences、ADM(Archer Daniels Midland)、Cosucra Group Warcoing SA、杜邦/IFF、Deerland Enzymes、OptibioA Limited、Roquette Freres、BENEO(Sudz. Genomics。精準益生元市場的企業正透過多種策略鞏固其市場地位。他們大力投資研發,以開發菌株特異性且經過臨床驗證的益生元。與個人化營養平台和診斷公司建立合作關係,有助於整合數據驅動型解決方案,為消費者提供個人化建議。遵守監管規定並積極與政府機構溝通,有助於加速產品核准和市場准入。各公司正在利用先進的發酵和生物加工技術來提高生產效率和穩定性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 健康意識和養生趨勢的提升

- 個人化營養與精準醫療的成長

- 微生物組研究進展及科學證據

- 產業陷阱與挑戰

- 高昂的開發成本和資金需求

- 監理複雜性和核准時間

- 市場機遇

- 新型應用開發與創新

- 技術融合與平台整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 透過技術

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 菌株特異性寡糖

- 低聚果糖(FOS)

- 低聚半乳糖(GOS)

- 木寡糖(XOS)

- 甘露寡糖(MOS)

- 阿拉伯木寡糖(AXOS)

- 人乳低聚醣(HMO)

- 2'-岩藻糖基乳糖(2'-FL)

- 乳糖-N-新四糖(LNnT)

- 3-岩藻糖基乳糖(3-FL)

- 6'-唾液酸乳糖(6'-SL)

- 複雜的HMO結構

- 精準發酵產品

- 微生物發酵

- 酵素生產

- 合成生物學

- 無細胞生產

- 改良及工程化益生元

- 化學修飾的寡糖

- 酵素修飾結構

- 混合益生元分子

- 功能化遞送系統

- 新型益生元技術

- 基於噬菌體

- 後生元-益生元組合

- 微膠囊化益生元

- 標靶釋放系統

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 個人化營養

- 臨床與治療

- 功能性食品和飲料

- 動物營養

- 藥物應用

- 個人護理及化妝品

- 農業應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 食品飲料製造商

- 營養保健品公司

- 製藥公司

- 動物飼料業

- 個人護理行業

- 合約製造組織

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 企業對企業 (B2B) 管道

- 企業對消費者 (B2C) 管道

- 電子商務與數位平台

- 醫療保健和臨床頻道

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- DuPont/IFF

- ADM (Archer Daniels Midland)

- BENEO (Sudzucker Group)

- Kerry Group plc

- Ingredion Incorporated

- Cargill Incorporated

- Tate & Lyle PLC

- Cosucra Group Warcoing SA

- Roquette Freres

- Yakult Honsha Co., Ltd.

- Deerland Enzymes

- Optibiotix Limited

- Sun Genomics

- Viome Life Sciences

- Seed Health

The Global Precision Prebiotics Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 9 billion by 2034.

Growth is being driven by increasing scientific validation of prebiotic interventions and expanding applications across multiple industries. Companies are rapidly incorporating precision prebiotics into their product portfolios, targeting microbiome modulation and specific health outcomes. Advances in fermentation technologies and personalized nutrition platforms are enabling the development of highly targeted and effective prebiotics. Compared to broader functional ingredient categories, precision prebiotics are outperforming due to their direct connection with health and wellness trends. Applications in personalized nutrition, clinical and therapeutic use, and functional foods and beverages are leading to market growth. These prebiotics focus on precise benefits for colonic health, immunity, metabolism, and digestion, aligning with consumer demand for evidence-based, personalized wellness solutions. Regulatory clarity is further accelerating commercialization, particularly in regions with supportive frameworks and streamlined approval processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $9 Billion |

| CAGR | 11.3% |

The strain-specific oligosaccharides segment held a 39.5% share in 2024 and is expected to grow at a CAGR of 10.9% through 2034. These prebiotics selectively nourish beneficial gut bacteria, such as Bifidobacterium and Lactobacillus, using structurally precise compounds designed to align with microbial enzymatic capabilities. Substantial clinical evidence supports the ability of these targeted interventions to modulate microbiomes, delivering consistent and predictable health benefits.

The personalized nutrition segment held a 32.2% share in 2024 and is projected to grow at a CAGR of 10.9% during 2025-2034. By combining microbiome analysis, genetic testing, and metabolic profiling, companies are providing tailored recommendations that address individual health needs. Consumer interest in customized health strategies is rising, prompting companies to create platforms that integrate diagnostics with precision prebiotic delivery. Emerging areas such as skin health and anti-aging are expected to further enhance market opportunities by creating synergies with topical and ingestible applications.

North America Precision Prebiotics Market held a 39.5% share in 2024. The region benefits from an established regulatory environment, encouraging innovation and rapid product development. Advanced approval processes for novel ingredients allow companies to confidently invest in research and development, ensuring faster commercialization of high-value prebiotic products. Strong consumer preference for personalized nutrition further reinforces North America's leadership in this sector.

Key players in the Global Precision Prebiotics Market include Yakult Honsha Co., Ltd., Seed Health, Kerry Group plc, Viome Life Sciences, ADM (Archer Daniels Midland), Cosucra Group Warcoing SA, DuPont/IFF, Deerland Enzymes, Optibiotix Limited, Roquette Freres, BENEO (Sudzucker Group), Tate & Lyle PLC, Ingredion Incorporated, Cargill Incorporated, and Sun Genomics. Companies in the Precision Prebiotics Market are strengthening their foothold through a combination of strategies. They are investing heavily in research and development to create strain-specific and clinically validated prebiotics. Partnerships with personalized nutrition platforms and diagnostic firms allow integration of data-driven solutions for individualized consumer recommendations. Regulatory compliance and proactive engagement with government agencies accelerate product approvals and market entry. Firms are leveraging advanced fermentation and bioprocessing technologies to enhance production efficiency and consistency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness & wellness trends

- 3.2.1.2 Personalized nutrition & precision medicine growth

- 3.2.1.3 Microbiome research advances & scientific evidence

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development costs & capital requirements

- 3.2.2.2 Regulatory complexity & approval timelines

- 3.2.3 Market opportunities

- 3.2.3.1 Novel application development & innovation

- 3.2.3.2 Technology convergence & platform integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By technology

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Strain-specific Oligosaccharides

- 5.2.1 Fructooligosaccharides (FOS)

- 5.2.2 Galactooligosaccharides (GOS)

- 5.2.3 Xylooligosaccharides (XOS)

- 5.2.4 Mannanoligosaccharides (MOS)

- 5.2.5 Arabinoxylanoligosaccharides (AXOS)

- 5.3 Human milk Oligosaccharides (HMOs)

- 5.3.1 2'-Fucosyllactose (2'-FL)

- 5.3.2 Lacto-N-neotetraose (LNnT)

- 5.3.3 3-Fucosyllactose (3-FL)

- 5.3.4 6'-Sialyllactose (6'-SL)

- 5.3.5 Complex HMO Structures

- 5.4 Precision fermentation products

- 5.4.1 Microbial fermentation

- 5.4.2 Enzymatic production

- 5.4.3 Synthetic biology

- 5.4.4 Cell-free production

- 5.5 Modified & engineered prebiotics

- 5.5.1 Chemically modified oligosaccharides

- 5.5.2 Enzymatically modified structures

- 5.5.3 Hybrid prebiotic molecules

- 5.5.4 Functionalized delivery systems

- 5.6 Novel prebiotic technologies

- 5.6.1 Bacteriophage-based

- 5.6.2 Postbiotic-prebiotic combinations

- 5.6.3 Microencapsulated prebiotics

- 5.6.4 Targeted release systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Personalized nutrition

- 6.3 Clinical & therapeutic

- 6.4 Functional foods & beverages

- 6.5 Animal nutrition

- 6.6 Pharmaceutical applications

- 6.7 Personal care & cosmetics

- 6.8 Agricultural applications

Chapter 7 Market Estimates and Forecast, By End use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage manufacturers

- 7.3 Nutraceutical companies

- 7.4 Pharmaceutical companies

- 7.5 Animal feed industry

- 7.6 Personal care industry

- 7.7 Contract manufacturing organizations

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Business-to-business (B2B) channels

- 8.3 Business-to-consumer (B2C) channels

- 8.4 E-commerce & digital platforms

- 8.5 Healthcare & clinical channels

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 DuPont/IFF

- 10.2 ADM (Archer Daniels Midland)

- 10.3 BENEO (Sudzucker Group)

- 10.4 Kerry Group plc

- 10.5 Ingredion Incorporated

- 10.6 Cargill Incorporated

- 10.7 Tate & Lyle PLC

- 10.8 Cosucra Group Warcoing SA

- 10.9 Roquette Freres

- 10.10 Yakult Honsha Co., Ltd.

- 10.11 Deerland Enzymes

- 10.12 Optibiotix Limited

- 10.13 Sun Genomics

- 10.14 Viome Life Sciences

- 10.15 Seed Health