|

市場調查報告書

商品編碼

1871319

益生元市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Prebiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

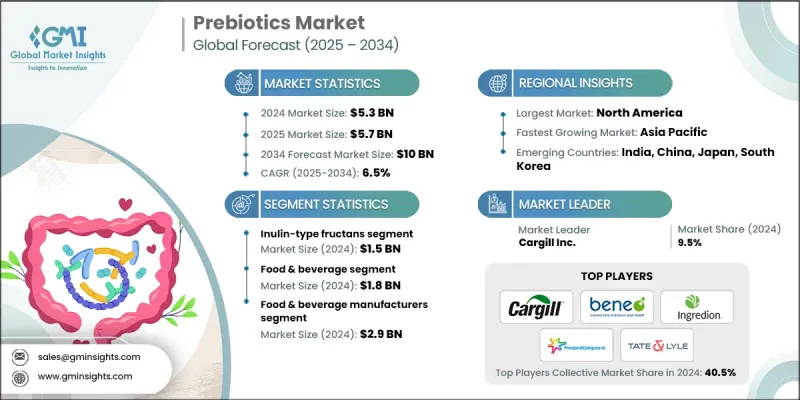

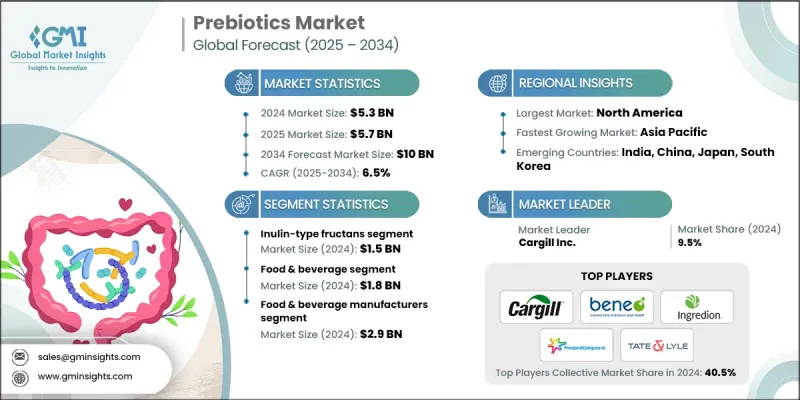

2024 年全球益生元市場價值為 53 億美元,預計到 2034 年將以 6.5% 的複合年成長率成長至 100 億美元。

益生元是不可消化的成分,有助於刺激腸道有益菌的生長,從而支持消化健康和整體健康。它們天然存在於多種植物來源中,並擴大被添加到功能性食品、飲料和膳食補充劑中。消費者對腸道健康、免疫力和預防保健日益成長的關注,使益生元成為更廣泛的健康和營養產業的重要組成部分。萃取和配方技術的進步提高了益生元的穩定性和效力,使其應用範圍更加廣泛。酵素法加工和微膠囊化等創新技術正在提高益生元成分的效率,並增強其與各種產品配方的兼容性。消費者對天然、植物性和清潔標籤產品的偏好不斷成長,進一步推動了市場需求。向預防保健和以生活方式為導向的健康理念的轉變,促使食品和膳食補充劑生產商推出添加益生元的產品,以改善消化平衡和增強免疫力。此外,人們對腸腦軸及其在身心健康中的作用的認知不斷提高,也持續擴大著全球市場,尤其是在城市化和已開發經濟體中。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 100億美元 |

| 複合年成長率 | 6.5% |

2024年,菊糖型果聚醣市場規模達15億美元。這些益生元化合物與低聚果糖一起,在維持腸道菌叢平衡和促進消化健康方面發揮著至關重要的作用。抗性澱粉和甘露寡糖(MOS)也因其促進代謝和增強免疫力的功效而需求不斷成長。 MOS在人類和動物營養領域日益受到關注,為功能性食品和飼料應用創造了機會。這些化合物共同代表著功能性和強化營養領域一個充滿前景的成長方向。

2024年,食品飲料產業創造了18億美元的收入。隨著消費者關注點轉向增強免疫力和消化功能的產品,食品飲料產業仍是益生元的主要應用領域。在個人化和預防性營養趨勢的推動下,膳食補充劑市場正經歷快速成長,消費者擴大將益生元融入日常健康生活中。嬰幼兒配方奶粉和營養品中也持續添加益生元,以促進嬰幼兒腸道菌叢健康,增強免疫力,從而推動了全球市場的持續需求。

美國益生元市場佔82.2%的市場佔有率,預計2024年市場規模將達到13.6億美元。北美地區仍然是益生元市場成長的強勁中心,這主要得益於消費者對腸道健康和免疫力的日益關注。在美國,消費者對功能性產品和清潔標章產品的偏好正在推動產品創新,並加速食品、飲料和膳食補充劑等類別的普及。製造商不斷改進配方,並豐富產品組合,以滿足該地區日益成長的健康意識消費者的需求。

全球益生元市場的主要活躍企業包括帝斯曼營養產品公司 (DSM Nutritional Products)、羅蓋特兄弟公司 (Roquette Freres)、貝內歐公司 (Beneo GmbH)、ADM(阿徹丹尼爾斯米德蘭公司)、嘉吉公司 (Cargill Inc.)、菲仕蘭坎皮納公司 (Friestland)、嘉吉公司 (Cargill Inc.)、菲仕蘭坎皮納公司 (Friestland), Nred吉公司 (Falient), &a圖片公司、英萊食品公司 (FriesS) (Ingredion Inc.)、第一製糖公司 (CJ CheilJedang)、凱瑞集團 (Kerry Group plc)、傑羅配方公司 (Jarrow Formulas)、克拉薩多生物科學公司 (Clasado Biosciences)、OptiBiotix Health、Tereos Group、三養控股公司 (Samyang Holdings)、Sensus(高科技公司) Chemicals)、寶靈寶生物公司 (BAOLINGBAO Biology)、Prenexus Health、明治控股公司 (Meiji Holdings)、Cosucra、養樂多本社株式會社 (Yakult Honsha Co., Ltd.) 和 Jennewein Biotechnologie。益生元市場的企業正透過策略併購、合作和產能擴張來擴大其全球影響力,以滿足不斷成長的消費者需求。領導企業正在加大研發投入,以開發新型益生元配方,從而提高其在各種食品和膳食補充劑應用中的消化效率、穩定性和功能整合性。目前,企業重點在於生產符合永續發展和健康趨勢的清潔標籤植物性益生元。許多公司正在加強供應鏈建設,以確保產品品質穩定和採購透明度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 消費者越來越重視健康和保健

- 功能性食品和飲料產業的擴張

- 萃取和配方方面的技術進步

- 成長促進因素

- 產業陷阱與挑戰

- 高昂的生產和加工成本

- 監管和標籤方面的挑戰

- 市場機遇

- 素食和植物性食品市場不斷成長

- 與益生菌產品整合

- 用於嬰兒配方奶粉和老年人營養

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 菊糖型果聚醣

- 低聚果糖(FOS)

- 低聚半乳糖(GOS)

- 人乳低聚醣(HMO)

- 抗性澱粉

- 甘露寡糖(MOS)

- 其他

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 食品飲料業

- 膳食補充劑

- 嬰兒配方奶粉和嬰兒食品

- 動物飼料與營養

- 化妝品及個人護理

- 醫藥應用

第7章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 食品飲料製造商

- 製藥公司

- 動物飼料生產商

- 化妝品和個人護理公司

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- ADM (Archer Daniels Midland)

- BAOLINGBAO Biology

- Beneo GmbH

- Cargill Inc.

- CJ CheilJedang

- Clasado Biosciences

- Cosucra

- DSM Nutritional Products

- FrieslandCampina Ingredients

- Ingredion Inc.

- Jarrow Formulas

- Jennewein Biotechnologie

- Kerry Group plc

- Meiji Holdings

- Nexira

- OptiBiotix Health

- Prenexus Health

- Quantum Hi-Tech

- Roquette Freres

- Samyang Holdings

- Sensus (Royal Cosun)

- Tate & Lyle PLC

- Tereos Group

- Tata Chemicals

- Yakult Honsha Co., Ltd.

The Global Prebiotics Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 10 billion by 2034.

Prebiotics are non-digestible ingredients that help stimulate the growth of beneficial gut bacteria, supporting digestive wellness and overall health. They are naturally present in several plant-based sources and are increasingly being incorporated into functional foods, beverages, and supplements. Rising consumer interest in gut health, immunity, and preventive wellness has positioned prebiotics as a crucial component in the broader health and nutrition industry. Advances in extraction and formulation technologies have improved the stability and potency of prebiotics, enabling their use in a wider range of applications. Innovations such as enzymatic processing and microencapsulation are enhancing the efficiency of prebiotic ingredients and boosting their compatibility with various product formulations. Growing preferences for natural, plant-based, and clean-label products are further fueling market demand. The shift toward preventive healthcare and lifestyle-driven wellness has encouraged food and supplement manufacturers to introduce prebiotic-enhanced offerings that address digestive balance and immunity. Additionally, increasing awareness of the gut-brain connection and its role in mental and physical health continues to expand the global market, particularly across urbanized and developed economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $10 Billion |

| CAGR | 6.5% |

In 2024, the inulin-type fructans segment generated USD 1.5 billion. Along with fructooligosaccharides, these prebiotic compounds play a crucial role in maintaining gut microbiota balance and promoting digestive well-being. Resistant starch and mannan-oligosaccharides (MOS) are also witnessing rising demand due to their metabolic and immune-boosting benefits. MOS is gaining traction in both human and animal nutrition, creating opportunities across functional foods and feed applications. Together, these compounds represent a promising growth avenue in the evolving field of functional and fortified nutrition.

The food & beverage segment generated USD 1.8 billion in 2024. It remains the primary application area for prebiotics, as consumer focus shifts toward products that enhance immunity and digestive function. Dietary supplements are experiencing rapid expansion driven by the rising trend of personalized and preventive nutrition, with consumers increasingly integrating prebiotics into their daily wellness routines. Infant formula and baby nutrition products continue to incorporate prebiotics to promote healthy gut flora and strengthen immune development in infants, fueling consistent demand across global markets.

U.S. Prebiotics Market held 82.2% and generated USD 1.36 billion in 2024. North America remains a strong hub for prebiotics growth, driven by heightened awareness of gut health and immunity among consumers. In the U.S., the preference for functional and clean-label products is shaping product innovation and accelerating adoption across food, beverage, and dietary supplement categories. Manufacturers are continuously improving formulations and diversifying product portfolios to meet the rising expectations of health-conscious consumers throughout the region.

Key companies active in the Global Prebiotics Market include DSM Nutritional Products, Roquette Freres, Beneo GmbH, ADM (Archer Daniels Midland), Cargill Inc., FrieslandCampina Ingredients, Tate & Lyle PLC, Nexira, Ingredion Inc., CJ CheilJedang, Kerry Group plc, Jarrow Formulas, Clasado Biosciences, OptiBiotix Health, Tereos Group, Samyang Holdings, Sensus (Royal Cosun), Quantum Hi-Tech, Tata Chemicals, BAOLINGBAO Biology, Prenexus Health, Meiji Holdings, Cosucra, Yakult Honsha Co., Ltd., and Jennewein Biotechnologie. Companies in the Prebiotics Market are enhancing their global footprint through strategic mergers, collaborations, and capacity expansions to meet growing consumer demand. Leading firms are investing in R&D to develop novel prebiotic formulations that improve digestive efficiency, stability, and functional integration across diverse food and supplement applications. Emphasis is placed on producing clean-label and plant-based prebiotics that align with sustainability and health trends. Many companies are strengthening their supply chains to ensure consistent product quality and sourcing transparency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 End use industry

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumer focus on health and wellness

- 3.2.1.2 Expansion of functional food & beverage sector

- 3.2.1.3 Technological advancements in extraction & formulation

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1 High production and processing costs

- 3.3.2 Regulatory and labeling challenges

- 3.4 Market opportunities

- 3.4.1 Growing vegan and plant-based market

- 3.4.2 Integration with synbiotic products

- 3.4.3 Use in infant formula and elderly nutrition

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product type

- 3.11 Future market trends

- 3.12 Technology and innovation landscape

- 3.12.1 Current technological trends

- 3.12.2 Emerging technologies

- 3.13 Patent landscape

- 3.14 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.14.1 Major importing countries

- 3.14.2 Major exporting countries

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.16 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Inulin-Type Fructans

- 5.3 Fructooligosaccharides (FOS)

- 5.4 Galactooligosaccharides (GOS)

- 5.5 Human Milk Oligosaccharides (HMOs)

- 5.6 Resistant starch

- 5.7 Mannan-oligosaccharides (MOS)

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Food & beverage industry

- 6.2 Dietary supplements

- 6.3 Infant formula & baby food

- 6.4 Animal feed & nutrition

- 6.5 Cosmetics & personal care

- 6.6 Pharmaceutical & medical applications

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage manufacturers

- 7.3 Pharmaceutical companies

- 7.4 Animal feed manufacturers

- 7.5 Cosmetics & personal care companies

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 ADM (Archer Daniels Midland)

- 9.2 BAOLINGBAO Biology

- 9.3 Beneo GmbH

- 9.4 Cargill Inc.

- 9.5 CJ CheilJedang

- 9.6 Clasado Biosciences

- 9.7 Cosucra

- 9.8 DSM Nutritional Products

- 9.9 FrieslandCampina Ingredients

- 9.10 Ingredion Inc.

- 9.11 Jarrow Formulas

- 9.12 Jennewein Biotechnologie

- 9.13 Kerry Group plc

- 9.14 Meiji Holdings

- 9.15 Nexira

- 9.16 OptiBiotix Health

- 9.17 Prenexus Health

- 9.18 Quantum Hi-Tech

- 9.19 Roquette Freres

- 9.20 Samyang Holdings

- 9.21 Sensus (Royal Cosun)

- 9.22 Tate & Lyle PLC

- 9.23 Tereos Group

- 9.24 Tata Chemicals

- 9.25 Yakult Honsha Co., Ltd.