|

市場調查報告書

商品編碼

1871314

生物分解聚合物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Biodegradable Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

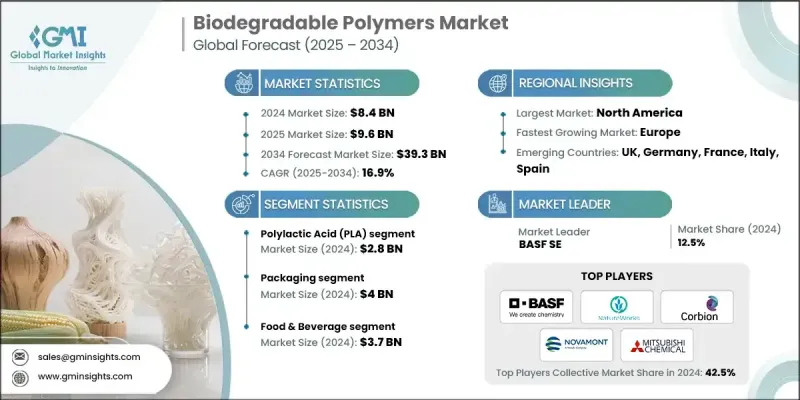

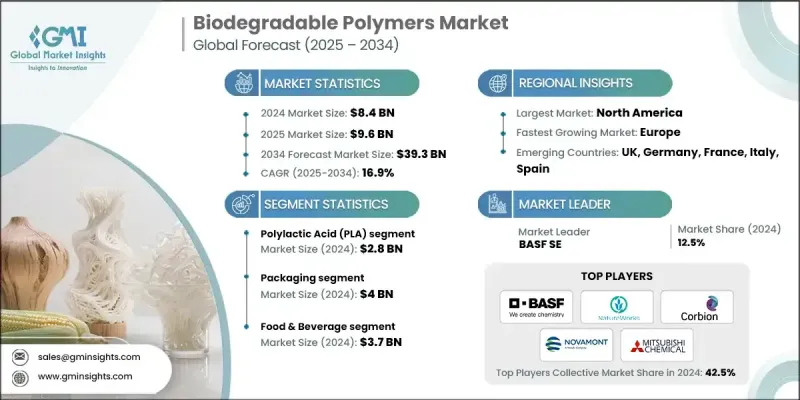

2024 年全球可生物分解聚合物市場價值為 84 億美元,預計到 2034 年將以 16.9% 的複合年成長率成長至 393 億美元。

生物分解聚合物是指在微生物、熱、濕氣和有氧條件下能夠自然分解成水、二氧化碳和生質能的材料。與會在環境中存在數百年的傳統塑膠不同,這些聚合物是永續的替代品,它們來自可再生資源或透過合成生產。日益增強的環保意識和日益嚴格的塑膠污染法規正在推動各行業採用生物分解聚合物。世界各國政府都在限制一次性塑膠的使用,鼓勵企業轉向環保產品。消費者對永續包裝、農業薄膜和一次性產品的需求不斷成長,進一步加速了生物分解聚合物的發展。技術進步正在提升生物分解聚合物的性能、加工性和耐久性。目前的研究重點是最佳化化學結構,以提高其強度、柔韌性和熱穩定性,同時確保其保持自然分解性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 393億美元 |

| 複合年成長率 | 16.9% |

聚乳酸(PLA)在包裝、一次性產品和生物醫學領域的應用推動了其在2024年的市場規模,預計將達到28億美元。 PLA可進行工業堆肥,並能與現有生產設施無縫銜接,因此深受追求永續解決方案的企業青睞。聚羥基脂肪酸酯(PHA)因其優異的生物分解性和多功能性,在醫療器材和特殊塑膠市場也日益受到關注。

2024年,包裝產業市場規模預計將達到40億美元,這主要得益於可生物分解聚合物應用的日益廣泛。食品、飲料和零售業的公司正擴大用聚乳酸(PLA)、澱粉基薄膜和纖維素產品取代傳統塑膠,以滿足監管要求和消費者期望。該行業兼具高用量和顯著的永續性優勢,使其成為可生物分解聚合物商業化應用最成熟的領域。

2024年,美國可生物分解聚合物市場規模達21億美元。隨著企業和消費者優先考慮環保解決方案,北美繼續保持領先地位。聯邦和州政府的政策,以及人們對塑膠污染日益成長的認知,都促進了可生物分解材料在包裝、農業和消費品領域的應用。聚合物科學的進步提高了成本效益和性能,使可生物分解聚合物成為致力於降低環境影響的行業的理想選擇。這使得北美成為永續聚合物解決方案創新和廣泛應用的中心。

全球可生物分解聚合物市場的主要參與者包括巴斯夫公司 (BASF SE)、NatureWorks LLC、Novamont SpA、Corbion NV、三菱化學集團、Kaneka Corporation、Biome Bioplastics Limited、FKuR Kunststoff GmbH、Braskem SA、金發科技股份有限公司 (Kingfa Sci. & Tech. Co., Malk、Bromer Ltd、金髮科技股份有限公司 (Kingfas Sci. & Tech. Co. Inc.、Full Cycle Bioplastics Inc.、RWDC Industries Pte Ltd.、Bioplastics Feedstock Alliance 和 CJ CheilJedang Corporation。這些公司正透過多種策略舉措鞏固其市場地位。他們大力投資研發,致力於開發具有更高強度、熱穩定性和生物分解性的新型聚合物配方。與包裝、消費品和農業企業建立策略合作夥伴關係和開展合作,有助於他們拓展市場並開發客製化解決方案。此外,他們也積極尋求併購機會,以整合技術能力並擴大生產規模。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 生產技術的進步

- 包裝產業需求不斷成長

- 在醫療和農業領域的應用日益增多

- 消費者偏愛環保產品

- 產業陷阱與挑戰

- 高昂的生產成本

- 性能限制

- 市場機遇

- 醫療和農業領域的擴張

- 技術創新

- 循環經濟模式的發展

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按聚合物類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依聚合物類型分類,2021-2034年

- 主要趨勢

- 聚乳酸(PLA)

- 聚羥基脂肪酸酯(PHA)

- 聚丁二酸丁二醇酯(PBS)

- 聚己內酯(PCL)

- 澱粉基聚合物

- 纖維素衍生物

- 新興類型

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 包裝

- 農業

- 醫療保健

- 紡織纖維

- 消費品

- 其他應用

第7章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 餐飲

- 農業與園藝

- 醫療保健

- 汽車

- 電子及消費品

- 紡織服裝

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- BASF SE

- NatureWorks LLC

- Novamont SpA

- Corbion NV

- Mitsubishi Chemical Group

- Kaneka Corporation

- Biome Bioplastics Limited

- FKuR Kunststoff GmbH

- Braskem SA

- Kingfa Sci. & Tech.Co.,Ltd.

- Bio On SpA

- Plantic Technologies Limited

- Genomatica Inc.

- Mango Materials Inc.

- Full Cycle Bioplastics Inc.

- RWDC Industries Pte Ltd.

- Bioplastics Feedstock Alliance

- CJ CheilJedang Corporation

The Global Biodegradable Polymers Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 39.3 billion by 2034.

Biodegradable polymers are materials capable of breaking down naturally through exposure to microorganisms, heat, moisture, and aerobic conditions into water, carbon dioxide, and biomass. Unlike conventional plastics that persist in the environment for centuries, these polymers offer sustainable alternatives derived from renewable sources or produced synthetically. Growing environmental awareness and stricter regulations on plastic pollution are driving their adoption across industries. Governments worldwide are imposing restrictions on single-use plastics, encouraging companies to switch to eco-friendly options. Rising consumer demand for sustainable packaging, agricultural films, and disposable products further accelerates growth. Technological advancements are enhancing the performance, processability, and durability of biodegradable polymers. Current research focuses on optimizing chemical structures to improve strength, flexibility, and thermal stability while ensuring they remain naturally degradable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $39.3 Billion |

| CAGR | 16.9% |

The polylactic Acid (PLA) accounted for USD 2.8 billion in 2024, driven by its application in packaging, disposable products, and biomedical uses. Its ability to compost industrially and integrate with existing manufacturing setups makes it highly favored by companies pursuing sustainable solutions. Polyhydroxyalkanoates (PHAs) are gaining traction in medical devices and specialty plastics markets due to their excellent biodegradability and versatility.

The packaging segment generated USD 4 billion in 2024, driven by the growing application of biodegradable polymers. Companies in the food, beverage, and retail sectors are increasingly replacing conventional plastics with PLA, starch-based films, and cellulose products to meet regulatory requirements and consumer expectations. This segment combines high-volume usage with visible sustainability benefits, making it the most commercially advanced area for biodegradable polymer adoption.

U.S. Biodegradable Polymers Market generated USD 2.1 billion in 2024. North America continues to lead as companies and consumers prioritize eco-friendly solutions. Federal and state policies, along with growing awareness of plastic pollution, have encouraged the integration of biodegradable materials in packaging, agriculture, and consumer products. Advances in polymer science have enhanced cost-efficiency and performance, making biodegradable polymers an attractive option for industries aiming to lower their environmental impact. This positions North America as a hub for innovation and widespread adoption of sustainable polymer solutions.

Key players operating in the Global Biodegradable Polymers Market include BASF SE, NatureWorks LLC, Novamont S.p.A., Corbion N.V., Mitsubishi Chemical Group, Kaneka Corporation, Biome Bioplastics Limited, FKuR Kunststoff GmbH, Braskem S.A., Kingfa Sci. & Tech. Co., Ltd., Bio On S.p.A., Plantic Technologies Limited, Genomatica Inc., Mango Materials Inc., Full Cycle Bioplastics Inc., RWDC Industries Pte Ltd., Bioplastics Feedstock Alliance, and CJ CheilJedang Corporation. Companies in the Biodegradable Polymers Market are strengthening their presence through multiple strategic approaches. They are investing heavily in research and development to innovate new polymer formulations with improved strength, thermal stability, and biodegradability. Strategic partnerships and collaborations with packaging, consumer goods, and agricultural firms allow them to expand market reach and develop tailored solutions. Mergers and acquisitions are being pursued to consolidate technological capabilities and scale production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Polymer type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in production technology

- 3.2.1.2 Rising demand in packaging industry

- 3.2.1.3 Increasing use in medical and agricultural applications

- 3.2.1.4 Consumer preference for eco-friendly products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Performance limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in medical and agriculture sectors

- 3.2.3.2 Technological innovations

- 3.2.3.3 Development of circular economy models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By polymer type

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polylactic acid (PLA)

- 5.3 Polyhydroxyalkanoates (PHA)

- 5.4 Polybutylene succinate (PBS)

- 5.5 Polycaprolactone (PCL)

- 5.6 Starch-based polymers

- 5.7 Cellulose derivatives

- 5.8 Emerging types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Packaging

- 6.3 Agricultural

- 6.4 Medical & healthcare

- 6.5 Textile & fiber

- 6.6 Consumer goods

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Agriculture & horticulture

- 7.4 Healthcare & medical

- 7.5 Automotive

- 7.6 Electronics & consumer

- 7.7 Textile & apparel

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 NatureWorks LLC

- 9.3 Novamont S.p.A

- 9.4 Corbion N.V.

- 9.5 Mitsubishi Chemical Group

- 9.6 Kaneka Corporation

- 9.7 Biome Bioplastics Limited

- 9.8 FKuR Kunststoff GmbH

- 9.9 Braskem S.A.

- 9.10 Kingfa Sci. & Tech.Co.,Ltd.

- 9.11 Bio On S.p.A.

- 9.12 Plantic Technologies Limited

- 9.13 Genomatica Inc.

- 9.14 Mango Materials Inc.

- 9.15 Full Cycle Bioplastics Inc.

- 9.16 RWDC Industries Pte Ltd.

- 9.17 Bioplastics Feedstock Alliance

- 9.18 CJ CheilJedang Corporation