|

市場調查報告書

商品編碼

1871215

腫瘤生物製藥市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Oncology Biopharmaceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

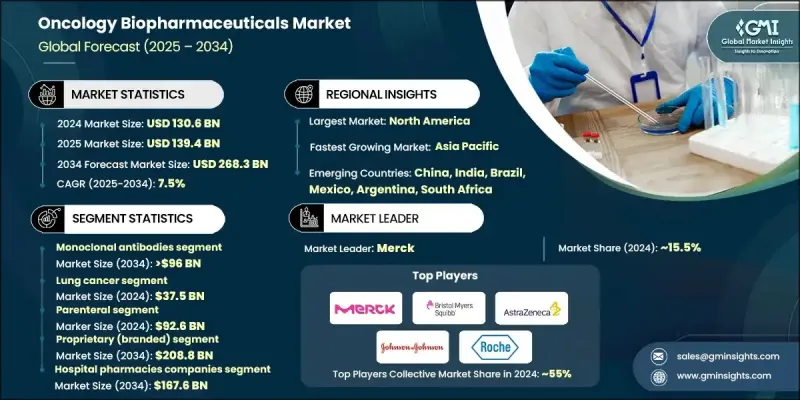

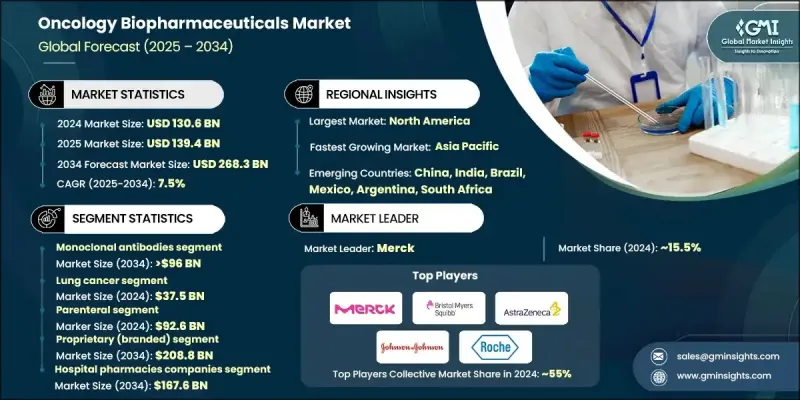

2024 年全球腫瘤生物製藥市場價值為 1,306 億美元,預計到 2034 年將以 7.5% 的複合年成長率成長至 2,683 億美元。

受全球癌症發病率不斷攀升以及對個人化和標靶治療方案日益成長的需求驅動,市場正經歷變革性階段。新一代定序、免疫療法和人工智慧驅動的藥物研發領域的持續突破正在重塑癌症的治療和檢測方式。過去一年,新的治療創新和先進生物製劑的可及性提升,重新定義了血液腫瘤和實體腫瘤的治療標準。精準腫瘤學技術正在加強早期診斷,並實現個人化治療,從而提高患者的存活率。有利的政府政策、不斷增加的醫療保健投資以及不斷完善的監管路徑,都為市場擴張提供了支持。腫瘤生物製藥產業透過根據每位患者的分子特徵客製化治療方案,持續引領精準醫療的轉型。生物製劑、免疫療法的進步以及精準醫療實踐的日益普及,進一步推動了該行業的成長,以滿足全球對更有效癌症管理的迫切需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1306億美元 |

| 預測值 | 2683億美元 |

| 複合年成長率 | 7.5% |

2024年,單株抗體市場佔37.6%的市場佔有率,預計到2034年將達到960億美元,年複合成長率達7%。單株抗體是現代腫瘤治療的基石,因為它們是高度特異性的生物製劑,能夠與癌細胞表面表達的獨特抗原結合。這些標靶療法透過直接攻擊腫瘤細胞、阻斷腫瘤生長訊號傳導以及刺激免疫活性來清除癌組織。與傳統化療相比,單株抗體具有更佳的安全性,能夠最大限度地減少脫靶效應並提高治療的精準性。

2024年,肺癌應用領域市場規模預計將達375億美元。肺癌仍然是全球最致命的癌症類型,其中非小細胞肺癌(NSCLC)約佔所有病例的85%。精準治療和免疫腫瘤療法的日益普及,推動了市場格局的重大變革。針對特定基因和分子標靶的現代治療進展,顯著改善了患者的治療效果和成功率。

預計到2024年,美國腫瘤生物製藥市場規模將達到519億美元。人工智慧技術的進步正在革新癌症診斷,並加速下一代腫瘤藥物的研發。然而,獲得這些先進療法的機會不均等仍然是一個持續存在的挑戰,尤其是在弱勢群體中。美國在推動生物相似藥和個人化療法方面持續取得進展,並大力投資以提高藥物可及性,增強患者獲得細胞療法和免疫療法的機會。

腫瘤生物製藥市場的主要參與者包括艾伯維(AbbVie)、安進(Amgen)、阿斯特捷利康(AstraZeneca)、拜耳(Bayer)、百健(Biogen)、百時美施貴寶(Bristol-Myers Squibb)、禮來(Eli Lilly)、羅氏(F.Hoffbb-La RocheK、Koffline) Johnson)、默克(Merck)、諾華(Novartis)、輝瑞(Pfizer)、賽諾菲(Sanofi)、武田製藥(Takeda Pharmaceutical)、山德士(Sandoz)、百康(Biocon)、賽爾特隆(Celltrion)、Adaptimmune、傳奇生物(Legend Biotech)和安賽樂樂(Arx)。為了鞏固其在全球腫瘤生物製藥市場的地位,各大公司正致力於策略合作、併購,以拓展其腫瘤產品線並加速藥物研發。各公司正在擴大與生物技術創新者的研究合作,共同開發標靶生物製劑和免疫療法。對人工智慧、基因組學和分子譜分析等先進技術的投資正被優先考慮,以增強精準醫療能力。各公司也在努力與監管機構達成一致,以加快產品核准速度並擴大地域覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 全球癌症發生率上升和人口老化

- 免疫療法和標靶生物製劑的進展

- 生物標記驅動和精準腫瘤學的擴展

- 加大監管力度,加速審核速度

- 產業陷阱與挑戰

- 生物製劑價格高昂,低收入地區難以負擔

- 複雜的製造和供應鏈物流

- 市場機遇

- 腫瘤非特異性和泛癌療法的擴展

- 數位健康和遠端監測工具的普及應用日益廣泛

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 管道分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 單株抗體

- 免疫檢查點抑制劑

- 細胞和基因療法

- 抗體藥物偶聯物(ADC)

- 癌症疫苗

- 其他產品類型

第6章:市場估計與預測:依癌症類型分類,2021-2034年

- 主要趨勢

- 肺癌

- 乳癌

- 大腸直腸癌

- 攝護腺癌

- 白血病和淋巴瘤

- 黑色素瘤

- 卵巢癌和子宮頸癌

- 其他癌症類型

第7章:市場估計與預測:依給藥途徑分類,2021-2034年

- 主要趨勢

- 口服

- 腸外

- 其他給藥途徑

第8章:市場估算與預測:依藥物類型分類,2021-2034年

- 主要趨勢

- 專有(品牌)

- 生物相似藥

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 醫院藥房

- 藥局和零售藥房

- 網路藥局

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- AbbVie

- Amgen

- AstraZeneca

- Bayer

- Biogen

- Bristol-Myers Squibb

- Eli Lilly

- F. Hoffmann-La Roche

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Sanofi

- Takeda Pharmaceutical

- Sandoz

- Biocon

- Celltrion

- Adaptimmune

- Legend Biotech

- Arcellx

The Global Oncology Biopharmaceuticals Market was valued at USD 130.6 Billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 268.3 Billion by 2034.

The market is witnessing a transformative phase driven by the growing worldwide incidence of cancer and the rising need for personalized and targeted treatment solutions. Continuous breakthroughs in next-generation sequencing, immunotherapy, and AI-powered drug development are reshaping how cancer is treated and detected. Over the past year, new treatment innovations and improved access to advanced biologics have redefined therapeutic standards for both hematologic and solid tumors. Precision oncology technologies are enhancing early diagnosis and individualizing treatments to improve patient survival. Market expansion is supported by favorable government programs, higher healthcare investments, and evolving regulatory pathways. The oncology biopharmaceuticals sector continues to lead the shift toward precision medicine by customizing therapies according to each patient's molecular profile. The industry's growth is further supported by advancements in biologics, immunotherapies, and the increasing adoption of precision-based medical practices to address the urgent need for more effective cancer management worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $130.6 Billion |

| Forecast Value | $268.3 Billion |

| CAGR | 7.5% |

The monoclonal antibodies segment held a 37.6% share in 2024 and is anticipated to reach USD 96 Billion by 2034, growing at a CAGR of 7%. Monoclonal antibodies remain a cornerstone of contemporary oncology, as they are highly specific biologic agents that bind to unique antigens expressed on cancer cells. These targeted therapies work by directly attacking tumor cells, interrupting tumor growth signaling, and stimulating immune activity to eliminate cancerous tissues. Compared to conventional chemotherapy, monoclonal antibodies offer a more favorable safety profile, minimizing off-target effects and enhancing treatment precision.

The lung cancer application segment generated USD 37.5 Billion in 2024. Lung cancer remains the most fatal cancer type globally, with non-small cell lung cancer (NSCLC) accounting for nearly 85% of all cases. The market has experienced a major transformation due to the growing availability of precision-based and immuno-oncology treatments. Modern therapeutic advancements focused on specific genetic and molecular targets have significantly improved patient outcomes and treatment success rates.

U.S. Oncology Biopharmaceuticals Market reached USD 51.9 Billion in 2024. Technological progress in artificial intelligence is revolutionizing cancer diagnostics and accelerating the development of next-generation oncology drugs. However, unequal access to these advanced treatments remains a persistent challenge, particularly among underrepresented groups. The U.S. continues to make strides in advancing biosimilars and personalized therapies, with strong investments aimed at improving affordability and enhancing patient access to cell-based and immune therapies.

Key participants in the Oncology Biopharmaceuticals Market include AbbVie, Amgen, AstraZeneca, Bayer, Biogen, Bristol-Myers Squibb, Eli Lilly, F. Hoffmann-La Roche, GlaxoSmithKline, Johnson & Johnson, Merck, Novartis, Pfizer, Sanofi, Takeda Pharmaceutical, Sandoz, Biocon, Celltrion, Adaptimmune, Legend Biotech, and Arcellx. To reinforce their position in the Global Oncology Biopharmaceuticals Market, major companies are focusing on strategic collaborations, mergers, and acquisitions to broaden their oncology pipelines and accelerate drug development. Firms are expanding their research partnerships with biotech innovators to co-develop targeted biologics and immunotherapies. Investment in advanced technologies such as AI, genomics, and molecular profiling is being prioritized to strengthen precision medicine capabilities. Companies are also working toward regulatory alignment to speed up product approvals and expand geographic reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Cancer type trends

- 2.2.4 Route of administration trends

- 2.2.5 Drug type trends

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global cancer incidence and aging population

- 3.2.1.2 Advancements in immunotherapy and targeted biologics

- 3.2.1.3 Expansion of biomarker-driven and precision oncology

- 3.2.1.4 Increasing regulatory support for accelerated approvals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biologics and limited affordability in low-income regions

- 3.2.2.2 Complex manufacturing and supply chain logistics

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of tumor-agnostic and pan-cancer therapies

- 3.2.3.2 Increased adoption of digital health and remote monitoring tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Monoclonal antibodies

- 5.3 Immune checkpoint inhibitors

- 5.4 Cell and gene therapies

- 5.5 Antibody-drug conjugates (ADCs)

- 5.6 Cancer vaccines

- 5.7 Other product types

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Lung cancer

- 6.3 Breast cancer

- 6.4 Colorectal cancer

- 6.5 Prostate cancer

- 6.6 Leukemia and lymphoma

- 6.7 Melanoma

- 6.8 Ovarian and cervical cancer

- 6.9 Other cancer types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Other route of administration

Chapter 8 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Proprietary (Branded)

- 8.3 Biosimilars

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Drug stores and retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Amgen

- 11.3 AstraZeneca

- 11.4 Bayer

- 11.5 Biogen

- 11.6 Bristol-Myers Squibb

- 11.7 Eli Lilly

- 11.8 F. Hoffmann-La Roche

- 11.9 GlaxoSmithKline

- 11.10 Johnson & Johnson

- 11.11 Merck

- 11.12 Novartis

- 11.13 Pfizer

- 11.14 Sanofi

- 11.15 Takeda Pharmaceutical

- 11.16 Sandoz

- 11.17 Biocon

- 11.18 Celltrion

- 11.19 Adaptimmune

- 11.20 Legend Biotech

- 11.21 Arcellx