|

市場調查報告書

商品編碼

1871163

航太低溫閥市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Cryogenic Valve for Aerospace Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

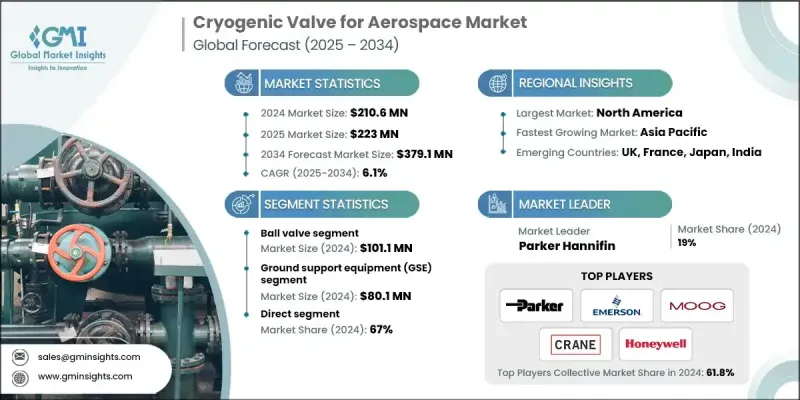

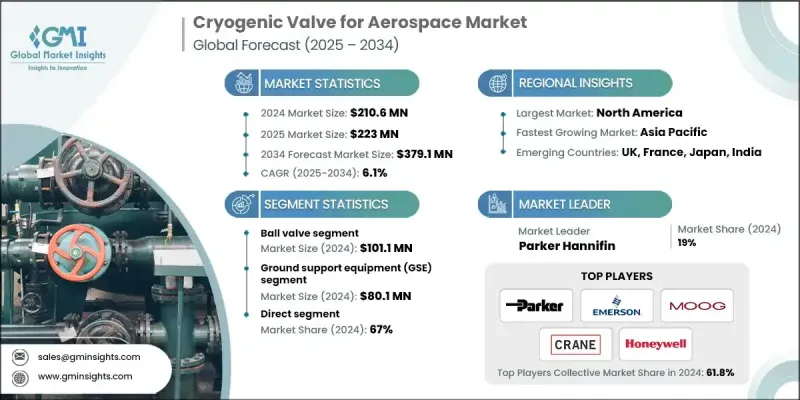

2024 年全球航太低溫閥市場價值為 2.106 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長至 3.791 億美元。

太空探索任務的持續成長以及液態氧、液態氫等低溫燃料的日益普及,是推動專用低溫閥門需求成長的關鍵因素。這些閥門在安全且有效率地處理極低溫流體方面發揮著至關重要的作用,確保了航太發射和推進過程中的精度和可靠性。隨著航太技術的不斷發展,低溫閥門系統也在不斷改進,以在高應力條件下提供更佳的控制性能、運行安全性和耐久性。材料、設計和自動化技術的進步提升了其性能,使其能夠在軌道和地面航太應用中實現精確的流量控制和無洩漏運行。商業航太專案、衛星部署和深空探索專案日益成長的需求,持續推動產品研發。此外,將智慧感測器和監控系統整合到低溫閥門中,透過實現即時追蹤和預測性維護,顯著提升了運作效率,這對於全球關鍵任務型航太運作至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.106億美元 |

| 預測值 | 3.791億美元 |

| 複合年成長率 | 6.1% |

2024年,球閥市場規模達1.011億美元。該市場領先地位主要歸功於其強大的密封性能和對航太嚴苛環境的適應性。球閥尤其因其在極端溫度變化、振動和壓力波動下仍能保持穩定性能而備受青睞。其可靠性使其成為推進系統、燃油管路和低溫儲罐等對流量控制要求極高的應用中不可或缺的部件。此外,業界也不斷致力於研發可在低溫下防止凍結或開裂的特殊合金和材料,進一步推動了球閥在航太系統中的應用。

2024年,地面支援設備(GSE)產業創造了8,010萬美元的產值。該行業透過加油、排氣和冷卻程序,為發射和維護作業提供至關重要的支援。 GSE系統的效率直接影響航太任務的發射頻率和周轉時間。 GSE設計和性能的持續升級顯著提高了航太專案的運作準備度和安全性。它們有助於減少發射前準備週期,從而鞏固了其作為現代航太基礎設施關鍵組成部分的地位,並增強了可靠性和任務一致性。

2024年,美國航太低溫閥門市佔率高達87.5%。這一領先地位得益於美國先進的航太能力、對低溫系統的持續投資以及眾多主要製造企業的存在。美國之所以保持競爭優勢,在於其對研發、技術創新以及商業和政府航太專案的持續拓展的高度重視。強大的國內供應鏈,加上完善的低溫燃料處理監管框架和基礎設施,進一步鞏固了美國在區域和全球市場成長中的領先地位。

航太低溫閥門市場的主要企業包括伍德沃德(Woodward)、福斯(Flowserve)、穆格(Moog)、派克漢尼汾(Parker Hannifin)、貝克休斯(Baker Hughes)、精密流體控制(Precision Fluid Controls)、赫羅斯(Herose)、SAMSON、Cryofab, Inc.、國際( 航太標準)、克萊茲公司(Bryofab, Inc.Ary) Company)、BAC閥門、Honeywell(Honeywell)和艾默生(Emerson)。這些主要企業採取的關鍵策略著重於創新、策略合作和技術進步。行業領導者正投資於先進材料和智慧閥門技術,以提高極端條件下的可靠性和即時性能監控。與航太機構和私人航太企業的合作有助於為推進和燃料管理等高精度應用客製化解決方案。此外,各公司也正在擴大全球製造能力,以滿足日益成長的低溫系統需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 太空探索和發射計畫的成長

- 商用航太和衛星部署的興起

- 低溫技術的進步

- 產業陷阱與挑戰

- 極端運轉條件

- 高成本和長開發週期

- 機會

- 氫動力飛機研發

- 高成本和長開發週期

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按閥門類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 差距分析

- 風險評估與緩解

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依閥門類型分類,2021-2034年

- 主要趨勢

- 球閥

- 球閥

- 閘閥

- 止回閥

- 蝶閥

- 其他

第6章:市場估算與預測:依閥門尺寸分類,2021-2034年

- 主要趨勢

- 小閥門(≤2英吋)

- 中型閥門(2-6吋)

- 大閥門(6-12吋)

- 特大號閥門(>12吋)

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 飛機系統

- 地面支援設備(GSE)

- 航太製造與測試

- 國防和軍事應用

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Baker Hughes

- Bray International

- BAC Valves

- Crane Company

- Cryofab, Inc.

- Emerson

- Flowserve

- Honeywell

- Herose

- Kitz

- SAMSON

- Moog

- Parker Hannifin

- Precision Fluid Controls

- Woodward

The Global Cryogenic Valve for Aerospace Market was valued at USD 210.6 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 379.1 million by 2034.

The continuous rise in space exploration missions and the increasing use of cryogenic fuels such as liquid oxygen and hydrogen are key drivers boosting the need for specialized cryogenic valves. These valves play a vital role in handling extremely low-temperature fluids safely and efficiently, ensuring precision and reliability during space launches and propulsion processes. As aerospace technology evolves, cryogenic valve systems are being refined to deliver enhanced control, operational safety, and durability under high-stress conditions. Advancements in materials, design, and automation have improved their performance, enabling precise flow control and leak-free operation across both orbital and terrestrial aerospace applications. Growing demand from commercial space programs, satellite deployments, and deep-space exploration projects continues to fuel product development. Furthermore, the integration of smart sensors and monitoring systems into cryogenic valves is transforming operational efficiency by enabling real-time tracking and predictive maintenance, which are essential for mission-critical aerospace operations worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $210.6 Million |

| Forecast Value | $379.1 Million |

| CAGR | 6.1% |

The ball valve segment generated USD 101.1 million in 2024. The segment's leadership can be attributed to its robust sealing capabilities and adaptability to the demanding conditions of aerospace environments. Ball valves are particularly valued for their ability to maintain stable performance under extreme temperature shifts, vibration, and pressure variations. Their reliability makes them indispensable in propulsion systems, fuel lines, and cryogenic storage tanks where consistent flow regulation is crucial. Additionally, the industry's ongoing efforts to develop specialized alloys and materials that prevent freezing or cracking under cryogenic temperatures further enhance the adoption of ball valves in aerospace systems.

The ground support equipment (GSE) segment generated USD 80.1 million in 2024. This segment is integral to supporting launch and maintenance operations through refueling, venting, and cooling procedures. The efficiency of GSE systems directly impacts launch frequency and turnaround times for aerospace missions. Continuous upgrades in GSE design and performance have significantly improved operational readiness and safety in space programs. Their contribution to reducing pre-launch cycles has strengthened their role as an essential component of modern aerospace infrastructure, enhancing reliability and mission consistency.

United States Cryogenic Valve for Aerospace Market held an 87.5% share in 2024. This leadership is driven by the country's advanced aerospace capabilities, ongoing investment in cryogenic systems, and the presence of major manufacturing players. The U.S. maintains a competitive advantage due to its strong focus on research, technological innovation, and the continuous expansion of both commercial and government space programs. The robust domestic supply chain, combined with an established regulatory framework and infrastructure for cryogenic fuel handling, reinforces the country's leading role in regional and global market growth.

Prominent companies operating in the Cryogenic Valve for Aerospace Market include Woodward, Flowserve, Moog, Parker Hannifin, Baker Hughes, Precision Fluid Controls, Herose, SAMSON, Cryofab, Inc., Bray International, Kitz, Crane Company, BAC Valves, Honeywell, and Emerson. Key strategies adopted by major companies in the Cryogenic Valve for Aerospace Market focus on innovation, strategic partnerships, and technological advancement. Industry leaders are investing in advanced materials and smart valve technologies to enhance reliability and real-time performance monitoring under extreme conditions. Collaborations with aerospace agencies and private space enterprises are helping tailor solutions for high-precision applications like propulsion and fuel management. Companies are also expanding global manufacturing capabilities to meet the increasing demand for cryogenic systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Valve size

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in space exploration & launch programs

- 3.2.1.2 Rise of commercial aerospace & satellite deployment

- 3.2.1.3 Advancements in cryogenic technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Extreme operating conditions

- 3.2.2.2 High cost & long development cycles

- 3.2.3 Opportunities

- 3.2.3.1 Hydrogen-powered aircraft development

- 3.2.3.2 High cost & long development cycles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Valve type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Valve type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Ball valves

- 5.3 Globe valves

- 5.4 Gate valves

- 5.5 Check valves

- 5.6 Butterfly valves

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Valve size, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Small Valves (≤2 inches)

- 6.3 Medium Valves (2-6 inches)

- 6.4 Large Valves (6-12 inches)

- 6.5 Extra-Large Valves (>12 inches)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Aircraft systems

- 7.3 Ground support equipment (GSE)

- 7.4 Aerospace manufacturing and testing

- 7.5 Defense and military applications

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baker Hughes

- 10.2 Bray International

- 10.3 BAC Valves

- 10.4 Crane Company

- 10.5 Cryofab, Inc.

- 10.6 Emerson

- 10.7 Flowserve

- 10.8 Honeywell

- 10.9 Herose

- 10.10 Kitz

- 10.11 SAMSON

- 10.12 Moog

- 10.13 Parker Hannifin

- 10.14 Precision Fluid Controls

- 10.15 Woodward