|

市場調查報告書

商品編碼

1871140

自旋電子元件在汽車應用領域的市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Spintronics Devices for Automotive Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

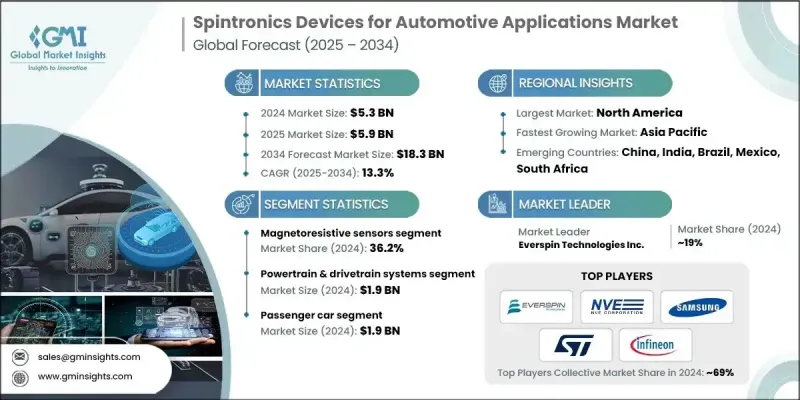

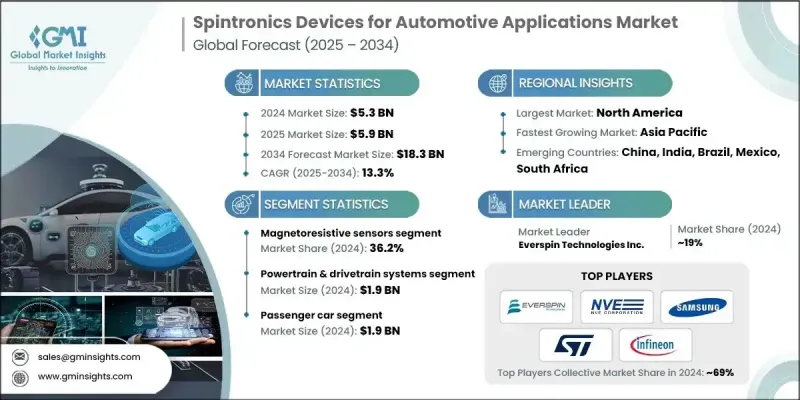

2024 年全球汽車應用自旋電子裝置市場價值為 53 億美元,預計到 2034 年將以 13.3% 的複合年成長率成長至 183 億美元。

自旋電子技術的成長主要得益於電動車和自動駕駛汽車的日益普及、對節能電子元件的需求以及用於車輛安全和控制的磁性感測器技術的不斷進步。降低功耗、增強資料儲存能力以及提升資訊娛樂和導航系統性能的日益重視,正在加速自旋電子技術在汽車領域的應用。先進電子設備在車輛(尤其是電動和混合動力車型)中的整合度不斷提高,進一步推動了對自旋電子裝置的需求。基於自旋電子技術的感測器和儲存解決方案能夠實現更快的資料處理速度、更低的能耗以及更卓越的磁感能力。汽車製造商正在利用這些技術來提升電動動力系統、高級駕駛輔助系統(ADAS)和電池管理系統的效率、可靠性和性能。智慧汽車架構的日益普及,也進一步推動了對自旋電子元件的需求,以支援下一代汽車的設計和功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 183億美元 |

| 複合年成長率 | 13.3% |

2024年,磁阻感測器佔了36.2%的市場。這些感測器因其高效的磁場偵測能力而備受青睞,能夠實現汽車系統的精準控制。 TMR和GMR等變體因其靈敏度高、耐久性強以及在各種溫度和工作條件下均能保持優異的性能而備受青睞,使其成為電動車、高級駕駛輔助系統(ADAS)和自動駕駛系統不可或缺的一部分。

2024年,動力總成和傳動系統市場規模預計將達到19億美元。自旋電子裝置能夠增強馬達控制和能量分配,從而提升電池管理、能量回收煞車和扭力系統的性能。磁阻隨機存取記憶體(MRAM)技術、先進感測器和基於人工智慧的控制模組的整合,顯著提高了自旋電子裝置在汽車應用中的精度、可靠性和響應速度。

2024年,美國汽車應用自旋電子裝置市場規模預計將達15億美元。憑藉強大的汽車產業、先進的半導體生態系統、充足的研發資金和完善的監管環境,美國在該領域持續佔據主導地位。美國領先的汽車製造商、技術供應商和半導體公司受益於豐富的創新自旋電子裝置產品線以及先進的感測器和MRAM解決方案。

全球汽車應用自旋電子元件市場的主要參與者包括東芝公司、瑞薩電子株式會社、佳能公司、西部數據公司、意法半導體公司、美光科技公司、Ficosa International SA、NVE公司、Everspin Technologies公司、Spin Memory公司、日立電子有限公司、高通技術公司、英特爾公司、三星公司、三星公司、三星公司。為了鞏固在汽車應用自旋電子元件市場的地位,各公司正加大研發投入,推出針對汽車應用最佳化的下一代自旋電子感測器和MRAM裝置。此外,各公司也透過建立策略合作關係來拓展全球分銷和整合能力。同時,各公司也不斷豐富產品組合,以滿足不斷變化的汽車需求,包括電動車和自動駕駛汽車系統。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 電動車和混合動力車的普及率不斷提高。

- 提高高階駕駛輔助系統(ADAS)的整合度。

- 對節能型、小巧汽車電子產品的需求。

- MRAM 和 TMR/GMR 感測器的技術進步。

- 產業陷阱與挑戰

- 高昂的研發和製造成本

- 用於汽車應用的自旋電子裝置的複雜性、交付和潛在副作用

- 市場機遇

- 高昂的製造成本和研發成本。

- 大規模生產基礎設施有限。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前趨勢

- 新興技術

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依設備類型分類,2021-2034年

- 主要趨勢

- 磁阻感測器

- 各向異性磁阻(AMR)感測器

- 巨磁阻(GMR)感測器

- 隧道磁阻(TMR)感測器

- 磁隨機存取記憶體(MRAM)

- 切換 MRAM

- 自旋轉移力矩磁隨機存取記憶體(STT-MRAM)

- 自旋軌道力矩磁隨機存取記憶體(SOT-MRAM)

- 自旋邏輯元件

- 自旋場效電晶體(Spin-FET)

- 磁隧道結邏輯

- 全自旋邏輯元件

- 基於自旋的射頻和振盪器元件

- 自旋力矩振盪器

- 自旋波裝置

第6章:市場估算與預測:依汽車應用領域分類,2021-2034年

- 主要趨勢

- 動力總成和傳動系統

- 安全與ADAS系統

- 身體和舒適系統

- 其他

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 商用車輛

- 非公路車輛

- 其他

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- NVE Corporation

- Everspin Technologies Inc.

- Crocus Technology Inc.

- Spin Memory Inc.

- IBM Corporation

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Toshiba Corporation

- STMicroelectronics NV

- Infineon Technologies AG

- Qualcomm Technologies Inc.

- Micron Technology, Inc.

- Renesas Electronics Corporation

- Hitachi Ltd.

- Canon Inc.

- Fujitsu Ltd.

- Western Digital Technologies, Inc.

- Visteon Corporation

- Ficosa International SA

- TDK Corporation

The Global Spintronics Devices for Automotive Applications Market was valued at USD 5.3 Billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 18.3 Billion by 2034.

The growth is primarily driven by the rising adoption of electric and autonomous vehicles, the demand for energy-efficient electronic components, and continuous advancements in magnetic sensor technologies for vehicle safety and control. Increasing focus on reducing power consumption, enhancing data storage, and improving the performance of infotainment and navigation systems is accelerating the use of spintronics technology in automotive applications. The rising integration of advanced electronics in vehicles, particularly electric and hybrid models, is boosting demand for spintronics devices. Spintronics-based sensors and memory solutions deliver faster data processing, lower energy consumption, and superior magnetic sensing capabilities. Automakers are leveraging these technologies to enhance efficiency, reliability, and performance across electric powertrains, ADAS, and battery management systems. The growing adoption of intelligent vehicle architecture is further driving the need for spintronic components to support next-generation automotive design and functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $18.3 Billion |

| CAGR | 13.3% |

In 2024, the magnetoresistive sensors held a 36.2% share. These sensors are highly valued for their efficiency in detecting magnetic fields, enabling precise control in automotive systems. Variants such as TMR and GMR are preferred due to their sensitivity, durability, and performance under diverse temperatures and operating conditions, making them essential for electric vehicles, ADAS, and autonomous driving systems.

The powertrain and drivetrain systems segment generated USD 1.9 Billion in 2024. Spintronics devices enhance motor control and energy distribution, improving performance across battery management, regenerative braking, and torque systems. The integration of MRAM technology, advanced sensors, and AI-based control modules has significantly increased the precision, reliability, and responsiveness of spintronic components in automotive applications.

U.S. Spintronics Devices for Automotive Applications Market was valued at USD 1.5 Billion in 2024. The country continues to dominate due to its strong automotive industry, advanced semiconductor ecosystem, substantial research funding, and supportive regulatory framework. Leading automakers, technology providers, and semiconductor companies in the U.S. benefit from a robust pipeline of innovative spintronic devices and state-of-the-art sensor and MRAM solutions.

Key players in the Global Spintronics Devices for Automotive Applications Market include Toshiba Corporation, Renesas Electronics Corporation, Canon Inc., Western Digital Technologies, Inc., STMicroelectronics N.V., Micron Technology, Inc., Ficosa International S.A., NVE Corporation, Everspin Technologies Inc., Spin Memory Inc., Hitachi Ltd., Qualcomm Technologies Inc., Intel Corporation, Samsung Electronics Co., Ltd., Fujitsu Ltd., TDK Corporation, Visteon Corporation, IBM Corporation, and Infineon Technologies AG. To strengthen Spintronics Devices for Automotive Applications Market presence, companies are investing in research and development to introduce next-generation spintronic sensors and MRAM devices optimized for automotive applications. Strategic collaborations and partnerships are being formed to expand global distribution and integration capabilities. Firms are also diversifying product portfolios to meet evolving automotive requirements, including electric and autonomous vehicle systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vector trends

- 2.2.3 Delivery method trends

- 2.2.4 Gene type trends

- 2.2.5 Indication trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric and hybrid vehicles.

- 3.2.1.2 Increasing integration of advanced driver-assistance systems (ADAS).

- 3.2.1.3 Demand for energy-efficient and compact automotive electronics.

- 3.2.1.4 Technological advancements in MRAM and TMR/GMR sensors.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Complexity of spintronics devices for automotive applications delivery and potential side effects

- 3.2.3 Market opportunities

- 3.2.3.1 High manufacturing and development costs.

- 3.2.3.2 Limited large-scale production infrastructure.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Magnetoresistive Sensors

- 5.2.1 Anisotropic Magnetoresistance (AMR) Sensors

- 5.2.2 Giant Magnetoresistance (GMR) Sensors

- 5.2.3 Tunneling Magnetoresistance (TMR) Sensors

- 5.3 Magnetic Random Access Memory (MRAM)

- 5.3.1 Toggle MRAM

- 5.3.2 Spin-Transfer Torque MRAM (STT-MRAM)

- 5.3.3 Spin-Orbit Torque MRAM (SOT-MRAM)

- 5.4 Spin Logic Devices

- 5.4.1 Spin Field-Effect Transistors (Spin-FETs)

- 5.4.2 Magnetic Tunnel Junction Logic

- 5.4.3 All-Spin Logic Devices

- 5.5 Spin-Based RF & Oscillator Devices

- 5.5.1 Spin-Torque Oscillators

- 5.5.2 Spin-Wave Devices

Chapter 6 Market Estimates and Forecast, By Automotive Application, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Powertrain & drivetrain systems

- 6.3 Safety & ADAS systems

- 6.4 Body & comfort systems

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.3 Commercial vehicles

- 7.4 Off-Highway vehicles

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 NVE Corporation

- 9.2 Everspin Technologies Inc.

- 9.3 Crocus Technology Inc.

- 9.4 Spin Memory Inc.

- 9.5 IBM Corporation

- 9.6 Intel Corporation

- 9.7 Samsung Electronics Co., Ltd.

- 9.8 Toshiba Corporation

- 9.9 STMicroelectronics N.V.

- 9.10 Infineon Technologies AG

- 9.11 Qualcomm Technologies Inc.

- 9.12 Micron Technology, Inc.

- 9.13 Renesas Electronics Corporation

- 9.14 Hitachi Ltd.

- 9.15 Canon Inc.

- 9.16 Fujitsu Ltd.

- 9.17 Western Digital Technologies, Inc.

- 9.18 Visteon Corporation

- 9.19 Ficosa International S.A.

- 9.20 TDK Corporation