|

市場調查報告書

商品編碼

1773413

汽車整合起動發電機組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Integrated Starter-Generator Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

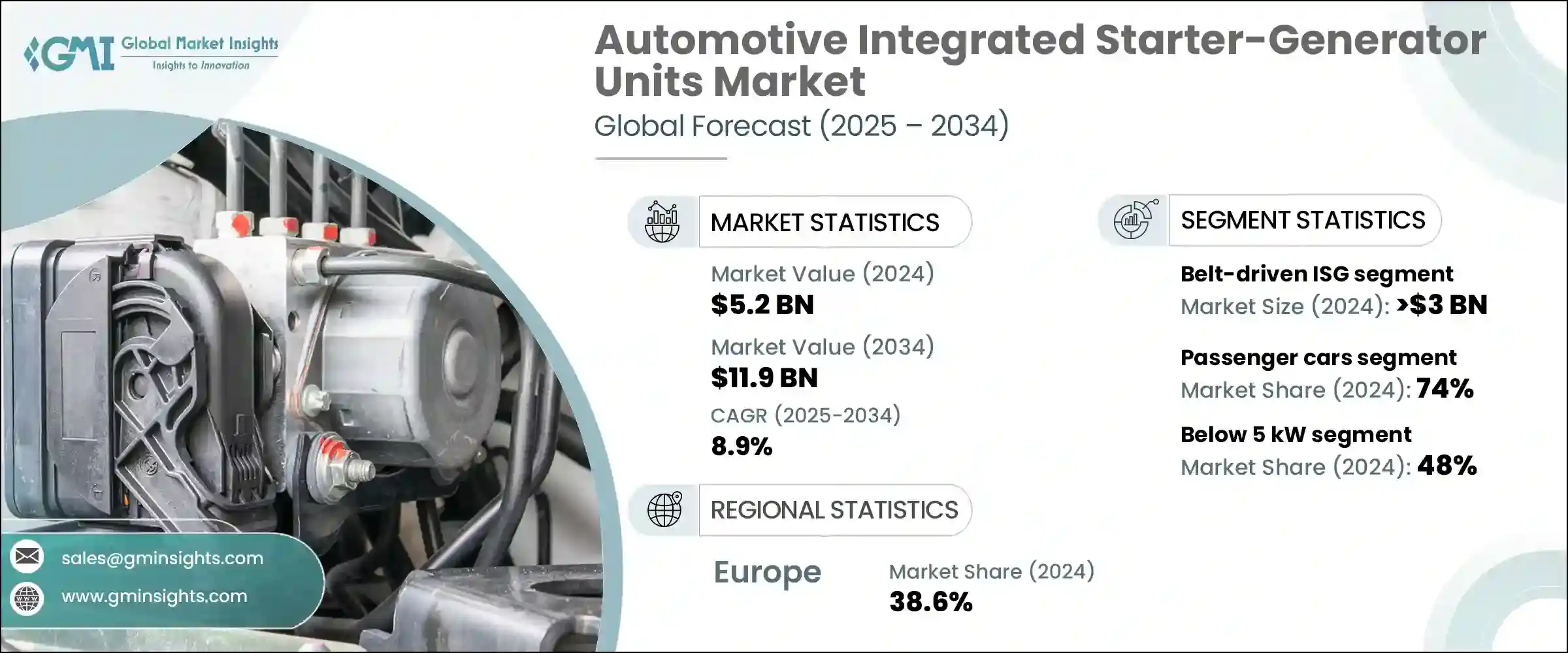

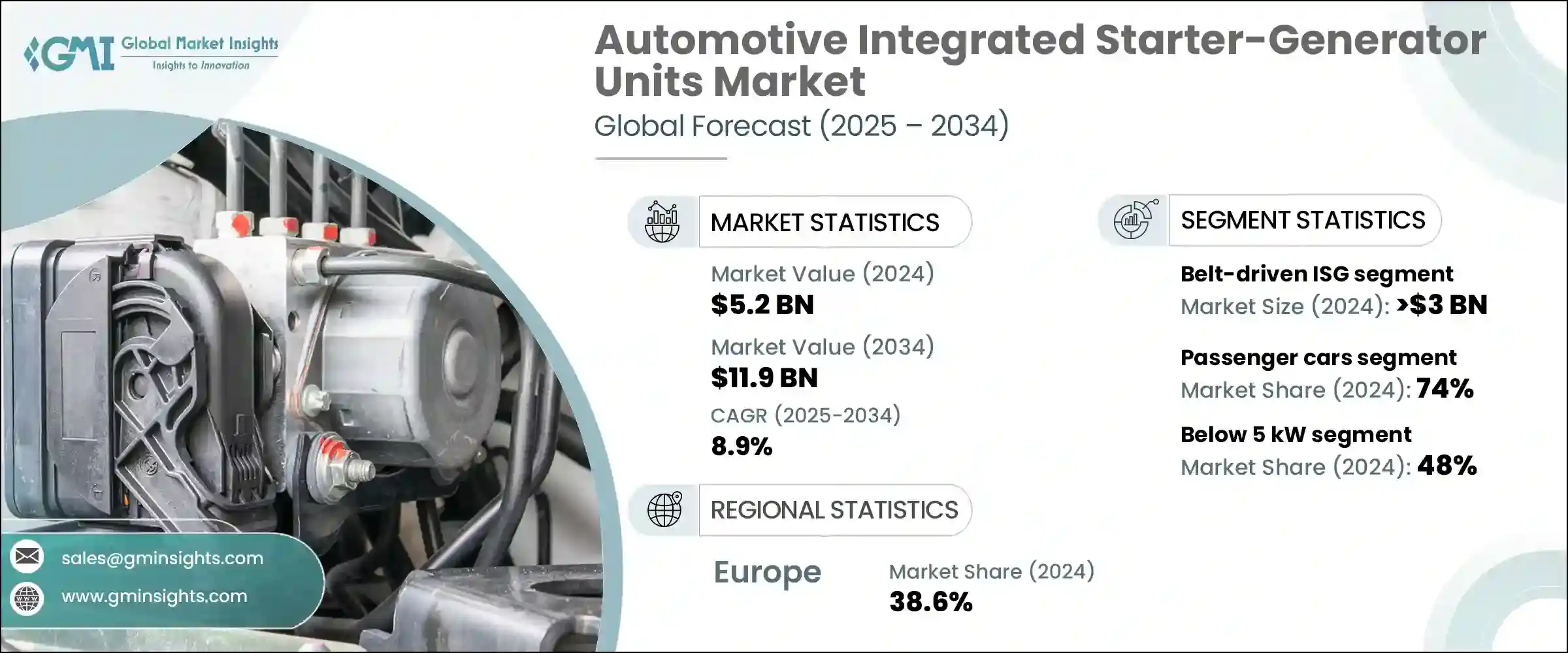

2024年,全球汽車整合起動發電機市場規模達52億美元,預計到2034年將以8.9%的複合年成長率成長,達到119億美元。這一成長主要源於對兼具高能源效率和低環境影響的汽車日益成長的需求。隨著全球排放法規日益嚴格,汽車製造商正在加緊推出搭載ISG技術的輕度混合動力車型。這些系統對於那些追求更高燃油經濟性,但又不想承擔全混合動力或插電式混合動力汽車高昂價格的消費者來說極具吸引力。配備ISG的動力系統提供了一種折衷方案——在顯著節省燃油的同時,對傳統車輛設計的干擾最小。

人們對高階高性能車日益成長的需求也加速了ISG裝置的普及,因為它們有助於提升引擎啟動停止平順性,並帶來低速扭力提升,從而提升駕駛體驗。這完全符合高階買家的需求——既追求高效,又不犧牲動力和豪華體驗。隨著城市交通堵塞加劇,對降低怠速和頻繁停車油耗的系統的需求激增。 ISG裝置有助於應對這些挑戰,同時減少排放,使其成為推動更智慧、更環保的城市交通發展的熱門選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 52億美元 |

| 預測值 | 119億美元 |

| 複合年成長率 | 8.9% |

2024年,皮帶傳動ISG系統市場規模達30億美元,憑藉為汽車製造商提供實用且經濟高效的電氣化途徑,佔據了市場主導地位。這些裝置安裝在引擎前端,並透過皮帶連接到曲軸,使製造商無需重新設計主要部件即可整合它們。對於希望快速實現現有車輛平台電氣化的品牌而言,這種簡化的整合方式是一大優勢,可節省時間和金錢。

輕度混合動力車在2024年佔據了最大的市場佔有率,預計仍將是關鍵的成長領域。這些車輛採用緊湊型電池,並帶來駕駛員能夠立即感受到的性能優勢——從滑行時的安靜運行到引擎的無縫重啟。低階扭力提升提升了駕駛性能,尤其是在走走停停的交通中。此外,輕度混合動力車不依賴外部充電,非常適合那些希望在不改變駕駛習慣的情況下獲得環保選擇的消費者。因此,這些系統在商用車隊和個人車輛中正變得越來越普遍。

2024年,德國汽車整合起動發電機組市場規模達4.967億美元。該國的主導地位得益於其成熟的汽車製造基礎以及48伏系統在各車型中的早期應用。領先的製造商已積極在其產品線中應用皮帶傳動ISG技術,以滿足法規要求和消費者期望。德國強大的供應鏈,包括博世、大陸集團和採埃孚等主要供應商,進一步支持了本地生產和創新,並幫助其在全球ISG市場保持競爭優勢。

活躍於全球汽車整合起動發電機組市場的主要參與者包括博世、三菱電機、電裝、博格華納、麥格納國際、採埃孚、索恩格汽車、大陸集團、日立阿斯泰莫和法雷奧。為了確保在汽車 ISG 市場的領先地位,各公司正專注於幾個策略領域。核心策略涉及投資研發,以提高性能、減輕重量並提高 ISG 系統的能源效率。製造商還瞄準平台可擴展性,以允許 ISG 整合到各種車輛類別中。與原始設備製造商的合作在為特定動力傳動系統客製化解決方案方面發揮關鍵作用。此外,公司正在透過在地化製造來增強生產能力,以縮短交貨時間並遵守區域採購政策。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 燃油效率需求激增

- 全球排放法規更加嚴格

- 經濟高效的電氣化解決方案

- 豪華和中高階市場的需求不斷成長

- 產業陷阱與挑戰

- 入門級車輛的初始整合成本較高

- 消費者意識和感知價值有限

- 市場機會

- 48V輕度混合動力車在新興市場的擴張

- 商用車電氣化

- 適用於高階/豪華車輛的高性能 ISG

- 售後市場和傳統車隊的改造

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 皮帶傳動 ISG(B-ISG)

- 曲軸安裝式ISG

- 雙離合器變速箱ISG

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 越野車

- 掀背車

- 商用車

- LCV(輕型商用車)

- MCV(中型商用車)

- HCV(重型商用車)

第7章:市場估計與預測:依功率等級,2021 年至 2034 年

- 主要趨勢

- 5千瓦以下

- 5–10千瓦

- 10千瓦以上

第8章:市場估計與預測:依推進類型,2021 - 2034 年

- 主要趨勢

- 輕度混合動力電動車(MHEV)

- 內燃機(ICE)車輛

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Aisin Corporation

- BorgWarner

- Bosch

- Continental

- Denso Corporation

- Hitachi Astemo

- Hyundai Mobis Co

- Johnson Electric Holdings

- Magna International

- MAHLE Group

- Mando Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- Prestolite Electric Incorporated

- Schaeffler AG

- SEG Automotive

- Toyota Industries

- Woory Industrial Co

- Valeo

- ZF Friedrichshafen

The Global Automotive Integrated Starter-Generator Units Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 11.9 billion by 2034. This growth is largely fueled by rising demand for vehicles that offer both improved efficiency and reduced environmental impact. As global regulations surrounding emissions become stricter, automakers are ramping up the rollout of mild hybrid models that incorporate ISG technology. These systems are attractive to consumers seeking better fuel economy without the steep price tag associated with full or plug-in hybrids. ISG-equipped powertrains provide a middle ground-delivering noticeable fuel savings with minimal disruption to conventional vehicle designs.

The growing appetite for premium and performance vehicles is also accelerating the adoption of ISG units, as they contribute to smoother engine start-stop operations and deliver low-end torque improvements that enhance driving feel. This aligns perfectly with what high-end buyers want-efficiency without sacrificing power or luxury. As congestion increases in urban areas, demand for systems that reduce fuel use during idling and frequent stops has surged. ISG units help manage these challenges while also reducing emissions, making them a favored option in the push for smarter, greener urban transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 8.9% |

In 2024, the belt-driven ISG systems segment generated USD 3 billion, dominating the market by offering automakers a practical and cost-effective route to electrification. These units are mounted on the engine's front and connected via a belt to the crankshaft, allowing manufacturers to integrate them without redesigning major components. This streamlined integration is a major advantage for brands looking to electrify existing vehicle platforms quickly, saving both time and capital.

Mild hybrid-electric vehicles represented the largest market share in 2024 and are projected to remain a key growth area. These vehicles incorporate a compact battery and deliver performance benefits that drivers can immediately notice-from quiet operation during coasting to seamless engine restarts. The low-end torque boost improves drivability, particularly in stop-and-go traffic. Additionally, mild hybrids do not rely on external charging, making them ideal for consumers who want eco-friendly options without changing their driving habits. As a result, these systems are becoming more common across both commercial fleets and personal vehicles.

Germany Automotive Integrated Starter-Generator Units Market generated USD 496.7 million in 2024. The country's dominant position is supported by a mature automotive manufacturing base and early adoption of 48-volt systems across various vehicle classes. Leading manufacturers have aggressively implemented belt-driven ISG technology across their lineups to meet both regulatory demands and consumer expectations. Germany's robust supply chain, with major contributors such as Bosch, Continental, and ZF Friedrichshafen, further supports local production and innovation, helping the country maintain a competitive edge in the global ISG market.

Key players active in the Global Automotive Integrated Starter-Generator Units Market include Bosch, Mitsubishi Electric, Denso, BorgWarner, Magna International, ZF Friedrichshafen, SEG Automotive, Continental, Hitachi Astemo, and Valeo. To secure a leading position in the automotive ISG market, companies are focusing on several strategic areas. One core strategy involves investment in R&D to enhance performance, reduce weight, and improve the energy efficiency of ISG systems. Manufacturers are also targeting platform scalability to allow ISG integration across various vehicle categories. Collaborations with OEMs play a key role in customizing solutions for specific drivetrains. In addition, firms are strengthening their production capabilities through localized manufacturing to reduce lead times and comply with regional sourcing policies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Power rating

- 2.2.5 Propulsion type

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in demand for fuel efficiency

- 3.2.1.2 Stricter emission regulations worldwide

- 3.2.1.3 Cost-effective electrification solution

- 3.2.1.4 Growing demand in the luxury and mid-premium segment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial integration cost for entry-level vehicles

- 3.2.2.2 Limited consumer awareness and perceived value

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of 48V mild hybrids in emerging markets

- 3.2.3.2 Commercial vehicle electrification

- 3.2.3.3 High-performance ISGs for premium/luxury vehicles

- 3.2.3.4 Aftermarket & retrofits for legacy fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Belt-driven ISG (B-ISG)

- 5.3 Crankshaft-mounted ISG

- 5.4 Dual-clutch transmission ISG

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 LCVs (light commercial vehicles)

- 6.3.2 MCVs (medium commercial vehicles)

- 6.3.3 HCVs (heavy commercial vehicles)

Chapter 7 Market Estimates & Forecast, By Power rating, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Below 5 kW

- 7.3 5–10 kW

- 7.4 Above 10 kW

Chapter 8 Market Estimates & Forecast, By Propulsion type, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Mild hybrid electric vehicles (MHEVs)

- 8.3 Internal combustion engine (ICE) vehicles

Chapter 9 Market Estimates & Forecast, By Sales channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aisin Corporation

- 11.2 BorgWarner

- 11.3 Bosch

- 11.4 Continental

- 11.5 Denso Corporation

- 11.6 Hitachi Astemo

- 11.7 Hyundai Mobis Co

- 11.8 Johnson Electric Holdings

- 11.9 Magna International

- 11.10 MAHLE Group

- 11.11 Mando Corporation

- 11.12 Mitsubishi Electric Corporation

- 11.13 Nidec Corporation

- 11.14 Prestolite Electric Incorporated

- 11.15 Schaeffler AG

- 11.16 SEG Automotive

- 11.17 Toyota Industries

- 11.18 Woory Industrial Co

- 11.19 Valeo

- 11.20 ZF Friedrichshafen