|

市場調查報告書

商品編碼

1858828

以個人化產品為導向的情感人工智慧市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Emotion AI for Personalized Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

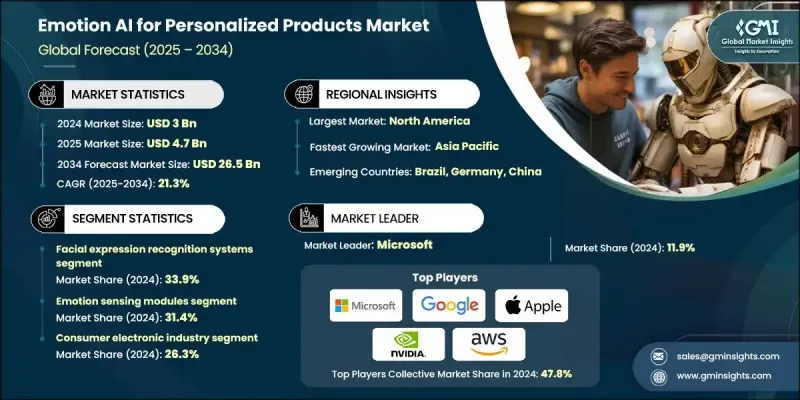

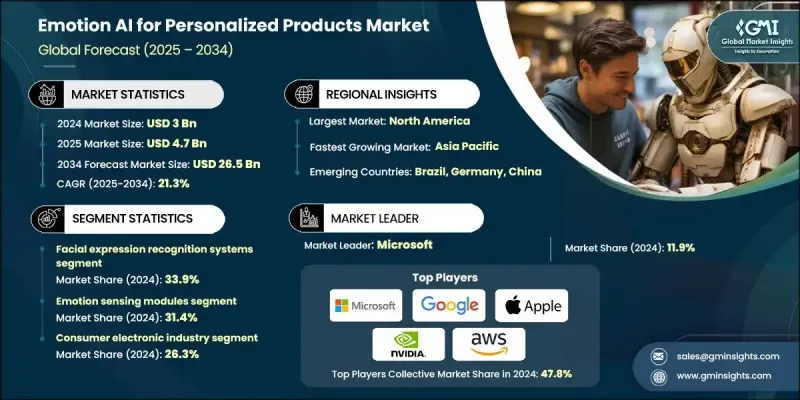

2024 年全球個人化產品情感人工智慧市場價值為 30 億美元,預計到 2034 年將以 21.3% 的複合年成長率成長至 265 億美元。

隨著企業將情感辨識技術融入數位體驗,連結人機互動與人工智慧,情感人工智慧市場正在迅速發展。客戶服務、醫療保健、零售和汽車等行業對即時情感追蹤的需求日益成長,促使企業開發更先進、更注重隱私的工具。主要廠商正在投資多模式人工智慧系統,這些系統結合了臉部分析、語音語調和文字情緒分析,以提供精準的情感洞察。同時,邊緣運算和去中心化資料處理的興起,正在解決人們日益關注的資料隱私和延遲問題。新的法規,尤其是在歐洲等地區,正在影響設計決策,推動合規人工智慧架構的創新。情感人工智慧如今已深度整合到消費品、數位助理、穿戴式裝置和企業解決方案中,實現更深層的個人化體驗,並提升跨平台互動。隨著科技巨頭和新創公司競相提供可擴展的情緒智慧系統,市場競爭日益激烈。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30億美元 |

| 預測值 | 265億美元 |

| 複合年成長率 | 21.3% |

到2024年,臉部表情辨識市佔率將達到33.9%,預計到2034年將以22.3%的複合年成長率成長。這一成長主要得益於日常產品和系統中攝影機設備的廣泛應用,使得非接觸式情緒分析成為可能。這些工具依靠深度學習演算法來分析臉部結構、動作和表情,從而提供即時情緒回饋。零售、汽車、消費性電子和安防等行業正在加速採用臉部辨識技術,因為這些工具易於整合且準確率高。

2024年,情緒感知模組市佔率達到31.4%,預計在預測期內將以20.6%的複合年成長率成長。這些模組整合了感測器、相機、麥克風和處理器等硬體和軟體組件,能夠收集和解讀情緒資料。隨著市場向邊緣系統轉型,對能夠進行即時離線情緒處理的模組的需求日益成長。這些組件構成了情緒人工智慧基礎設施的基石,並且正變得越來越精密、節能,以支援穿戴式裝置、車載系統和消費性電子設備等各種應用場景。

預計到2024年,北美個人化產品情感人工智慧市場將佔據39.3%的佔有率,複合年成長率(CAGR)將達到20.5%。光是美國就佔據了該地區近85%的市場佔有率,這主要得益於其高額的研發投入、各垂直領域對人工智慧的早期應用以及完善的創新生態系統。 Meta Platforms、NVIDIA、微軟、亞馬遜網路服務和蘋果等主要科技公司正透過持續的產品開發和對人工智慧新創公司的投資,塑造著該地區的市場格局。醫療保健和汽車等行業正在快速採用情感人工智慧,它在心理健康應用、患者監測和車載駕駛員警報系統等領域發揮著越來越重要的作用。

全球個人化產品情感人工智慧市場的主要參與者包括軟銀機器人集團、Affectiva、Kairos AR、國際商業機器公司(IBM)、Realeyes Data Services、英偉達(NVIDIA)、audEERING、微軟、Element Human、亞馬遜網路服務(AWS)、Meta Platforms、Eyesight Technologies、Nemesysco、NemephaingNemepha)和蘋果。為了保持在該市場的領先地位,領導企業正優先開發多模式演算法,以同時分析臉部、語音和文字線索,從而提高辨識精度。他們還在擴展邊緣人工智慧功能,使情感處理能夠直接在本地設備上進行,從而降低延遲並保護用戶隱私。策略性收購和與新創公司的合作正在加速創新週期。此外,各組織正透過整合差分隱私、聯邦學習和合規架構,使解決方案與全球監管趨勢保持一致。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 企業人工智慧應用加速與數位轉型

- 多模態人工智慧發展與技術能力提升

- 汽車安全法規和駕駛員監控要求

- 產業陷阱與挑戰

- 隱私問題和監管合規的複雜性

- 情緒辨識系統中的技術與文化偏見

- 機會

- 將情感人工智慧擴展到消費產品領域

- 即時個人化體驗平台

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 透過技術

- 監管環境

- 標準和合規要求

- 區域監理框架

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 臉部表情辨識系統

- 語音情緒辨識解決方案

- 生理訊號處理平台

- 多模態融合系統

- 自然語言處理情感分析

第6章:市場估算與預測:依部署模式分類,2021-2034年

- 主要趨勢

- 基於雲端(SaaS/API)

- 設備端/邊緣端

- 混合

第7章:市場估算與預測:依解法分類,2021-2034年

- 主要趨勢

- 情緒感知模組

- 情緒分析/模型(人工智慧)

- 個人化引擎/決策

- 最終用途/產品

- 服務

第8章:市場估算與預測:依優先矩陣分類,2021-2034年

- 主要趨勢

- 高優先級

- 中等優先級

- 選擇性

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 醫療保健和健康應用

- 汽車與運輸解決方案

- 零售與電子商務個人化

- 教育與培訓應用

- 娛樂和遊戲解決方案

- 客戶服務與支援提升

第10章:市場估計與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 消費性電子產業

- 醫療保健和生命科學領域

- 汽車和運輸業

- 零售和消費品產業

- 媒體與娛樂產業

- 金融服務業

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Affectiva

- Amazon Web Services

- Apple

- audEERING

- Element Human

- Eyesight Technologies

- Google (Alphabet)

- International Business Machines

- Kairos AR

- Meta Platforms

- Microsoft

- Nemesysco

- NVIDIA

- Realeyes Data Services

- SoftBank Robotics Group

The Global Emotion AI for Personalized Products Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 26.5 billion by 2034.

This market is evolving rapidly as companies integrate emotion recognition into digital experiences, bridging human interaction with artificial intelligence. The growing need for real-time emotion tracking across customer service, healthcare, retail, and automotive sectors is pushing companies to develop more sophisticated, privacy-conscious tools. Major players are investing in multimodal AI systems that combine facial analysis, voice tonality, and text sentiment to deliver accurate emotional insights. At the same time, the shift toward edge computing and decentralized data processing is addressing growing concerns around data privacy and latency. New regulations, especially in regions like Europe are influencing design decisions, prompting innovation in compliant AI architecture. Emotion AI is now deeply integrated into consumer products, digital assistants, wearables, and enterprise solutions, creating deeper personalization and improving engagement across platforms. The market is becoming increasingly competitive as tech giants and startups alike race to provide scalable, emotionally intelligent systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $26.5 Billion |

| CAGR | 21.3% |

The facial expression recognition segment held a 33.9% share in 2024, growing at a CAGR of 22.3% through 2034. This growth is fueled by the widespread use of camera-equipped devices across everyday products and systems, enabling non-contact emotional analysis. These tools rely on deep learning algorithms to analyze facial structures, movements, and expressions, offering real-time emotion feedback. Industries like retail, automotive, consumer electronics, and security are accelerating adoption due to the ease of integration and high accuracy levels of facial recognition tools.

The emotion sensing modules segment held 31.4% share in 2024 and is expected to grow at a CAGR of 20.6% during the forecast period. These modules combine hardware and software elements such as sensors, cameras, microphones, and processors that enable emotional data collection and interpretation. As the market shifts toward edge-based systems, the demand for modules capable of real-time, offline emotion processing is increasing. These components form the backbone of emotion AI infrastructure and are becoming more sophisticated and power-efficient to support a wide range of use cases across wearables, in-vehicle systems, and consumer devices.

North America Emotion AI for Personalized Products Market held 39.3% share in 2024 with a projected CAGR of 20.5%. The United States alone accounts for nearly 85% of this regional market, fueled by high R&D spending, early adoption of AI across verticals, and supportive innovation ecosystems. Major technology companies such as Meta Platforms, NVIDIA, Microsoft, Amazon Web Services, and Apple are shaping the regional landscape with continuous product development and investments in AI startups. Sectors like healthcare and automotive are witnessing fast adoption, with emotion AI playing a growing role in mental health apps, patient monitoring, and in-car driver alert systems.

Prominent companies operating in the Global Emotion AI for Personalized Products Market include SoftBank Robotics Group, Affectiva, Kairos AR, International Business Machines, Realeyes Data Services, NVIDIA, audEERING, Microsoft, Element Human, Amazon Web Services, Meta Platforms, Eyesight Technologies, Nemesysco, Google (Alphabet), and Apple. To maintain a strong position in the emotion AI for personalized products market, leading companies are prioritizing the development of multimodal algorithms that analyze facial, voice, and textual cues simultaneously for greater accuracy. They're also expanding edge AI capabilities, allowing emotion processing to occur directly on local devices, reducing latency and preserving user privacy. Strategic acquisitions and partnerships with startups are helping accelerate innovation cycles. Moreover, organizations are aligning solutions with global regulatory trends by integrating differential privacy, federated learning, and compliance-ready architectures.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Deployment mode

- 2.2.4 Solution

- 2.2.5 Prioritization matrix

- 2.2.6 Application

- 2.2.7 End use industry

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enterprise ai adoption acceleration & digital transformation

- 3.2.1.2 Multimodal ai advancement & technical capability enhancement

- 3.2.1.3 Automotive safety regulations & driver monitoring requirements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Privacy concerns & regulatory compliance complexity

- 3.2.2.2 Technical & cultural bias in emotion recognition systems

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of emotion AI into consumer products

- 3.2.3.2 Real-time personalized experience platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Technology

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Facial expression recognition systems

- 5.3 Speech emotion recognition solutions

- 5.4 Physiological signal processing platforms

- 5.5 Multimodal fusion systems

- 5.6 Natural language processing for sentiment

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Cloud-based (SaaS / API)

- 6.3 On-device / edge

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Emotion sensing modules

- 7.3 Emotion analytics / models (AI)

- 7.4 Personalization engine / decisioning

- 7.5 End use applications / products

- 7.6 Services

Chapter 8 Market Estimates & Forecast, By Prioritization Matrix, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 High priority

- 8.3 Medium priority

- 8.4 Selective

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Healthcare & wellness applications

- 9.3 Automotive & transportation solutions

- 9.4 Retail & e-commerce personalization

- 9.5 Education & training applications

- 9.6 Entertainment & gaming solutions

- 9.7 Customer service & support enhancement

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Consumer electronics industry

- 10.3 Healthcare & life sciences sector

- 10.4 Automotive & transportation industry

- 10.5 retail & consumer goods sector

- 10.6 Media & entertainment industry

- 10.7 Financial services sector

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Affectiva

- 12.2 Amazon Web Services

- 12.3 Apple

- 12.4 audEERING

- 12.5 Element Human

- 12.6 Eyesight Technologies

- 12.7 Google (Alphabet)

- 12.8 International Business Machines

- 12.9 Kairos AR

- 12.10 Meta Platforms

- 12.11 Microsoft

- 12.12 Nemesysco

- 12.13 NVIDIA

- 12.14 Realeyes Data Services

- 12.15 SoftBank Robotics Group