|

市場調查報告書

商品編碼

1858814

汽車鋰離子電池回收市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Lithium-Ion Battery Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

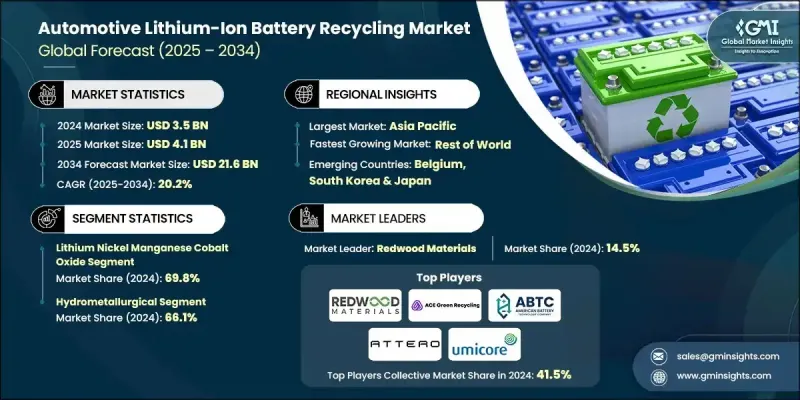

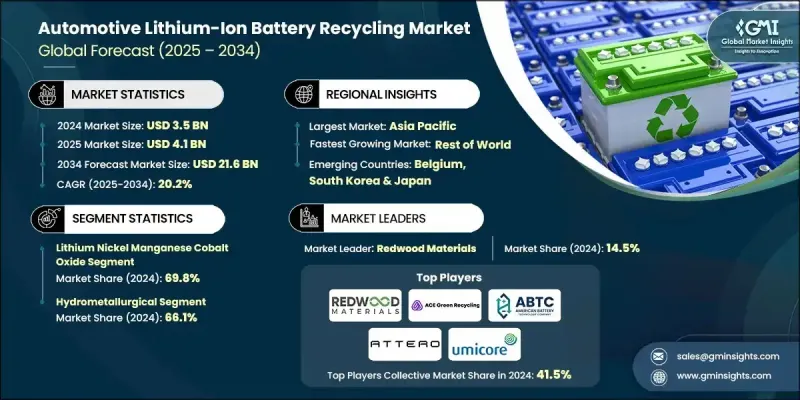

2024 年全球汽車鋰離子電池回收市場價值為 35 億美元,預計到 2034 年將以 20.2% 的複合年成長率成長至 216 億美元。

推動這一成長的主要因素是汽車產業面臨的日益成長的減少環境足跡的壓力。電動車常用的鋰離子電池含有鋰、鈷和鎳等有害物質,如果處理不當,會造成土壤和水污染。這促使人們更積極地採用回收技術,以回收有價值的金屬,減少採礦活動,並最大限度地減少對環境的破壞。隨著電動車需求的成長,對有效回收的需求也隨之增加,這有助於保護自然資源,並支持汽車產業的循環經濟。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 216億美元 |

| 複合年成長率 | 20.2% |

各國政府和環保組織也發揮關鍵作用,他們鼓勵循環經濟舉措,並將回收定位為永續發展的核心策略。汽車製造商正日益將電池回收納入其長期環境規劃,以提升品牌形象並滿足嚴格的監管標準。回收過程不僅有助於安全處置,還能促進關鍵材料的回收利用,進而強化永續製造實務。汽車鋰離子電池回收利用日益重要的作用,是支持電動車轉型和減少交通運輸產業環境足跡的關鍵一步。

預計到2034年,磷酸鐵鋰(LFP)電池市場將以20.6%的複合年成長率成長,這主要得益於LFP電池在首次使用壽命結束後仍能維持較高的容量。這使得LFP電池成為性能要求不高的應用領域的理想再利用選擇,不僅減少了廢棄物,也提升了回收過程的整體經濟價值。 LFP電池的再利用潛力與回收活動密切相關,這將促進業務成長並推動更永續實踐的發展。

預計到2034年,物理/機械回收領域將以18.4%的複合年成長率成長。與更複雜的化學或熱力回收方法相比,物理/機械回收工藝所需的資本投入較低,因此越來越受歡迎。此外,物理回收方法在常溫常壓下進行,最大限度地減少了有害排放、用水量和二次廢棄物的產生。這對於那些注重遵守環境法規和實現永續發展目標的回收企業來說極具吸引力,從而提振了市場前景。

美國汽車鋰離子電池回收市場佔86.3%的佔有率。預計到2034年,美國市場收入將超過30億美元,主要得益於國內電動車產量的擴張,從而增加了廢棄舊材料和報廢電池的供應。消費者對更環保技術的需求也促使製造商採用循環經濟模式,進一步推動了市場成長。

全球汽車鋰離子電池回收市場的主要企業包括ACE Green Recycling、Altilium Metals、American Battery Technology Company、Attero Recycling、Cirba Solutions、Ecobat、Eramet、Fortum、趙鋒鋰業、嘉能可、Northvolt、Re.Lion.Bat、Redwood Materials、Recyclus、Re.Lion.Bat、Redwood Materials、Recyc、Re. Recycling、SungEel Hitech和優美科。為了鞏固其在汽車鋰離子電池回收市場的地位,各公司正採取多種策略,例如擴大回收能力、改進技術以提高材料回收效率,以及與汽車製造商建立合作關係以確保廢棄電池的穩定供應。這些公司也投資於先進的研發,以開發經濟高效且永續的回收技術,在處理更大批量電池的同時,減少對環境的影響。

目錄

第1章:方法論與範圍

第2章:行業洞察

- 產業概況,2021-2034年

- 商業趨勢

- 化學趨勢

- 過程趨勢

- 區域趨勢

第3章:行業洞察

- 產業生態系分析

- 收集和運輸基礎設施

- 預處理和拆卸作業

- 黑人群眾生產與特徵

- 物料回收與純化

- 最終產品製造和分銷

- 成本結構分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 戰略儀錶板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依化學品類別分類,2021-2034年

- 主要趨勢

- 鋰鎳錳鈷氧化物(NMC)

- 磷酸鐵鋰(LFP)

- 鈷酸鋰(LCO)

- 其他

第6章:市場規模及預測:依製程分類,2021-2034年

- 主要趨勢

- 火法冶金

- 濕式冶金

- 物理/機械

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 比利時

- 瑞士

- 德國

- 亞太地區

- 中國

- 韓國

- 日本

- 世界其他地區

第8章:公司簡介

- ACE Green Recycling

- Altilium Metals

- American Battery Technology Company

- Attero Recycling

- Cirba Solution

- Ecobat

- Eramet

- Fortum

- Ganfeng Lithium

- Glencore

- Northvolt

- Re.Lion.Bat

- Redwood Materials

- Recyclus Group

- ReBAT

- RecycleKaro

- SK TES

- Stena Recycling

- SungEel Hitech

- Umicore

The Global Automotive Lithium-Ion Battery Recycling Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 20.2% to reach USD 21.6 billion by 2034.

A primary driver for this surge is the increasing pressure on the automotive sector to reduce its environmental footprint. Lithium-ion batteries, commonly used in electric vehicles (EVs), contain hazardous materials such as lithium, cobalt, and nickel, which pose risks of soil and water contamination if not disposed of properly. This has intensified the adoption of recycling technologies to recover valuable metals, reduce mining activities, and minimize environmental damage. As the demand for electric vehicles rises, so does the need for effective recycling, allowing for the conservation of natural resources and supporting a circular economy in the automotive industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $21.6 Billion |

| CAGR | 20.2% |

Governments and environmental organizations are also playing a pivotal role by encouraging circular economy initiatives, positioning recycling as a core strategy for sustainable development. Automakers are increasingly integrating battery recycling into their long-term environmental plans to enhance their brand image and meet stringent regulatory standards. The recycling process not only aids in safe disposal but also fosters the recovery of critical materials, reinforcing sustainable manufacturing practices. The growing role of automotive lithium-ion battery recycling is an essential step in supporting the EV transition and reducing the environmental footprint of the transportation sector.

The lithium iron phosphate (LFP) battery segment is expected to grow at a CAGR of 20.6% through 2034, driven by the high retention capacity of LFP batteries at the end of their first life. This makes them an ideal candidate for reuse in less demanding applications, which not only reduces waste but also contributes to the overall economic value of the recycling process. The potential for LFP battery reuse is strongly linked to recycling activities, promoting business growth and the development of more sustainable practices.

The physical/mechanical recycling segment is expected to grow at an 18.4% CAGR through 2034. This process is becoming increasingly popular due to its lower capital requirements when compared to more complex chemical or thermal methods. Additionally, the physical method operates under ambient conditions, minimizing harmful emissions, water usage, and secondary waste. This is appealing to recyclers focused on compliance with environmental regulations and sustainability goals, thereby boosting the market outlook.

United States Automotive Lithium-Ion Battery Recycling Market held an 86.3% share. The U.S. is expected to generate over USD 3 billion in revenue by 2034, driven by the expansion of domestic EV production, which increases the availability of scrap materials and end-of-life batteries. Consumer demand for greener technologies is also pushing manufacturers to adopt circular economy models, further driving market growth.

Key companies operating in the Global Automotive Lithium-Ion Battery Recycling Market include ACE Green Recycling, Altilium Metals, American Battery Technology Company, Attero Recycling, Cirba Solutions, Ecobat, Eramet, Fortum, Ganfeng Lithium, Glencore, Northvolt, Re.Lion.Bat, Redwood Materials, Recyclus Group, ReBAT, RecycleKaro, SK TES, Stena Recycling, SungEel Hitech, and Umicore. To strengthen their position in the Automotive Lithium-Ion Battery Recycling Market, companies are adopting various strategies such as expanding their recycling capacity, improving technology for better efficiency in material recovery, and forging partnerships with automakers to ensure a steady supply of end-of-life batteries. These companies are also investing in advanced research and development to develop cost-effective and sustainable recycling technologies, which can handle a larger volume of batteries while reducing environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Chemistry trends

- 2.4 Process trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Collection and transportation infrastructure

- 3.1.2 Pre-treatment and dismantling operations

- 3.1.3 Black mass production and characterization

- 3.1.4 Material recovery and purification

- 3.1.5 End product manufacturing and distribution

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Chemistry, 2021 - 2034 (USD Billion & Thousand Tons)

- 5.1 Key trends

- 5.2 Lithium nickel manganese cobalt oxide (NMC)

- 5.3 Lithium iron phosphate (LFP)

- 5.4 Lithium cobalt oxide (LCO)

- 5.5 Others

Chapter 6 Market Size and Forecast, By Process, 2021 - 2034 (USD Billion & Thousand Tons)

- 6.1 Key trends

- 6.2 Pyrometallurgical

- 6.3 Hydrometallurgical

- 6.4 Physical/Mechanical

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & Thousand Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Belgium

- 7.3.4 Switzerland

- 7.3.5 Germany

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 South Korea

- 7.4.3 Japan

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 ACE Green Recycling

- 8.2 Altilium Metals

- 8.3 American Battery Technology Company

- 8.4 Attero Recycling

- 8.5 Cirba Solution

- 8.6 Ecobat

- 8.7 Eramet

- 8.8 Fortum

- 8.9 Ganfeng Lithium

- 8.10 Glencore

- 8.11 Northvolt

- 8.12 Re.Lion.Bat

- 8.13 Redwood Materials

- 8.14 Recyclus Group

- 8.15 ReBAT

- 8.16 RecycleKaro

- 8.17 SK TES

- 8.18 Stena Recycling

- 8.19 SungEel Hitech

- 8.20 Umicore