|

市場調查報告書

商品編碼

1844362

牛奶蛋白水解物市場機會、成長動力、產業趨勢分析及2025-2034年預測Milk Protein Hydrolysate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

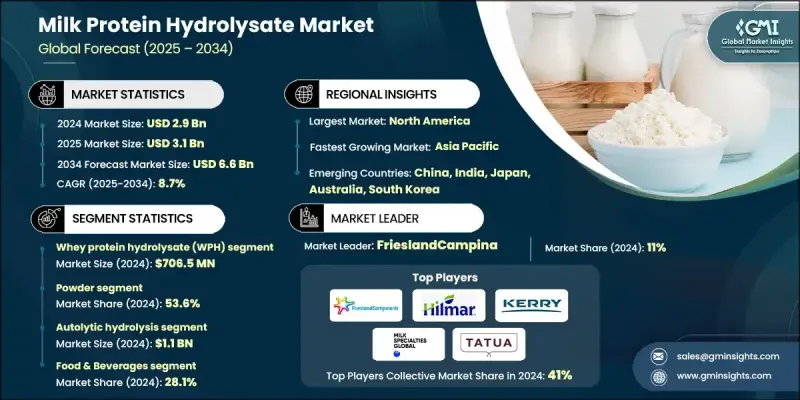

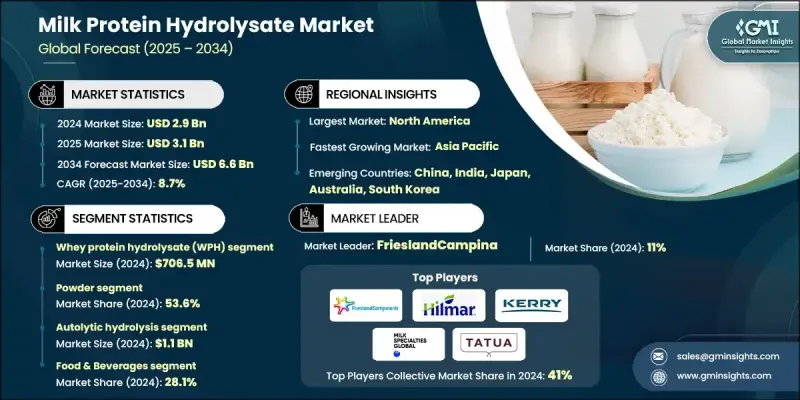

2024 年全球牛奶蛋白水解物市場價值為 29 億美元,預計到 2034 年將以 8.7% 的複合年成長率成長至 66 億美元。

這一成長反映了消費者對高消化率、低過敏原蛋白質解決方案日益成長的需求。牛奶蛋白水解物是透過將牛奶蛋白酶解成更小的胜肽和氨基酸而產生的,從而提高消化率並降低致敏性。日益增強的健康意識,尤其是在食物不耐症和易消化營養方面,正在推動市場發展。本產品的主要應用包括針對牛奶過敏兒童量身訂製的嬰兒配方奶粉、需要快速吸收蛋白質的運動補充劑,以及為需要易消化蛋白質攝取的患者設計的醫療營養品。酶水解和過濾方法的技術創新提高了產品的稠度、口感和營養輸送。這些進步使生產商能夠精細控制水解程度,並根據從早期生命到臨床復健支援的不同需求量身定做產品。隨著營養科學和消費者需求的不斷發展,製造商正在擴大生產規模並推出多功能產品。支持肌肉恢復、免疫支持和易於消化等益處的臨床研究,持續增強了人們對該產品在消費者健康類別中的使用信心。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 66億美元 |

| 複合年成長率 | 8.7% |

2024年,乳清蛋白水解物市佔率為24.5%。其快速的吸收率、極低的致敏性以及卓越的生物利用度使其成為專業營養產品中不可或缺的成分。運動員、注重健康的人士以及接受治療性飲食的患者都依賴乳清蛋白水解物,因為它能夠快速輸送氨基酸,並有助於肌肉修復和健康。該細分市場的崛起反映了人們日益轉向注重運動表現、針對特定膳食且具有可衡量健康效果的產品。

2024年,粉狀產品佔了53.6%的市場。粉末狀水解物保存期限長、儲存和運輸成本低,並且適用於從運動營養、嬰兒配方奶粉到臨床食品等各種應用,因此成為製造商和最終用戶的首選。其穩定性和多功能性進一步使其在全球市場廣泛應用。

2024年,美國牛奶蛋白水解物市場規模達8.703億美元,鞏固了在北美牛奶蛋白水解物領域的領先地位。完善的乳製品基礎設施、日益成長的消化健康意識以及公眾對食品過敏症的認知度提升是推動市場發展的關鍵因素。高昂的醫療保健支出以及老化和嬰幼兒群體對功能性營養的濃厚興趣,也推動了美國對水解牛奶蛋白產品的需求不斷成長。

推動全球牛奶蛋白水解物市場發展的關鍵參與者包括 Hilmar Ingredients、Arla Foods Ingredients Group、FrieslandCampina、Kerry Ingredients、AMCO Proteins、Glanbia Nutritionals、Havero Hoogwealis、Milk Specialties Global、A. Costantino & D.、Agroator Cooperative、Lactalis、Milk該領域的公司正在透過擴大產能和投資研發來鞏固其市場地位,以創造高度特異性和功能性的水解物變體。與臨床營養品牌和運動補充劑公司的策略合作正變得越來越普遍,從而實現了精準的產品置入。 FrieslandCampina 和 Glanbia Nutritionals 等製造商專注於清潔標籤宣傳和改進風味,以提高消費者的接受度。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 轉向低過敏性營養

- 對清潔標籤產品的需求

- 融入功能性食品

- 嬰兒和臨床營養需求的擴大

- 產業陷阱與挑戰

- 風味和適口性問題

- 市場競爭激烈

- 市場機會

- 運動營養需求不斷成長

- 個人化營養的成長

- 人們對腸道健康和免疫力的興趣日益濃厚

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021-2034

- 主要趨勢

- 乳清蛋白水解物(WPH)

- 酪蛋白水解物(CPH)

- 總乳蛋白水解物

- 乳鐵蛋白水解物

- 免疫球蛋白水解物

- α-乳白蛋白水解物

- BETA-乳球蛋白水解物

第6章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 粉末

- 貼上

第7章:市場估計與預測:按技術,2021-2034

- 主要趨勢

- 酸水解

- 酵素水解

- 微生物發酵

- 自溶水解

- 超音波水解

第 8 章:市場估計與預測:按最終用途,2021-2034 年

- 主要趨勢

- 食品和飲料

- 蛋白質補充劑

- 嬰兒營養

- 運動營養

- 烘焙和食品配料

- 飲料

- 其他

- 動物飼料

- 家禽

- 肉雞

- 圖層

- 豬

- 牛

- 水產養殖

- 鮭魚

- 鱒魚

- 蝦

- 其他

- 馬

- 寵物

- 家禽

- 製藥

- 藥物製劑

- 臨床營養

- 其他

- 化妝品和個人護理

- 保養

- 護髮

- 其他

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Arla Foods Ingredients Group

- AMCO Proteins

- A. Costantino & C.

- Armor Proteines

- Agropur Cooperative

- FrieslandCampina

- Glanbia Nutritionals

- Hilmar Ingredients

- Havero Hoogwegt

- Kerry Ingredients

- Lactalis Group

- Milk Specialties Global

- Tatua Co-operative Dairy Company

- Others

The Global Milk Protein Hydrolysate Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 6.6 billion by 2034.

This growth reflects rising consumer demand for highly digestible and low-allergen protein solutions. Milk protein hydrolysate is created through the enzymatic breakdown of milk proteins into smaller peptides and amino acids, improving digestibility and reducing allergenic effects. Growing health awareness, especially around food intolerances and digestion-friendly nutrition, is fueling market momentum. The product's primary applications include infant formulas tailored for children with milk allergies, sports supplements requiring fast protein absorption, and medical nutrition designed for patients needing easily digestible protein intake. Technological innovations in enzymatic hydrolysis and filtration methods have improved consistency, taste, and nutrient delivery. These advancements allow producers to finely control the degree of hydrolysis and tailor products to different needs-from early life to clinical recovery support. With nutrition science and consumer demand evolving, manufacturers are scaling production and introducing multi-functional variants. Clinical research supporting benefits like muscle recovery, immune support, and ease of digestion continues to build confidence in the product's use across consumer health categories.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 8.7% |

The whey protein hydrolysate segment held a 24.5% share in 2024. Its fast absorption rate, minimal allergenic potential, and superior bioavailability have made it an essential ingredient in specialized nutritional products. Athletes, health-conscious individuals, and patients on therapeutic diets rely on whey protein hydrolysate for its quick delivery of amino acids and its role in muscle repair and wellness. This segment's rise reflects the growing shift toward performance-focused and dietary-specific products with measurable health outcomes.

The powder-based formats segment held 53.6% share in 2024. Their long shelf life, cost-effective storage and transport, and compatibility with diverse applications from sports nutrition and infant formulas to clinical foods have made powdered hydrolysates the preferred form for both manufacturers and end-users. Their stability and versatility further enable widespread adoption across global markets.

United States Milk Protein Hydrolysate Market generated USD 870.3 million in 2024, reinforcing its leadership position in North America's milk protein hydrolysate sector. A well-established dairy infrastructure, growing focus on digestive wellness, and heightened public awareness around food sensitivities are key market drivers. High healthcare spending and strong interest in functional nutrition among aging and infant populations also contribute to the country's increasing demand for hydrolyzed milk protein products.

Key players driving the Global Milk Protein Hydrolysate Market include Hilmar Ingredients, Arla Foods Ingredients Group, FrieslandCampina, Kerry Ingredients, AMCO Proteins, Glanbia Nutritionals, Havero Hoogwegt, Milk Specialties Global, A. Costantino & C., Agropur Cooperative, Lactalis Group, Armor Proteines, and Tatua Co-operative Dairy Company. Companies in this space are strengthening their positions by expanding production capacities and investing in R&D to create highly specific and functional hydrolysate variants. Strategic collaborations with clinical nutrition brands and sports supplement companies are becoming common, enabling targeted product placement. Manufacturers like FrieslandCampina and Glanbia Nutritionals focus on clean-label claims and improving flavor profiles to increase consumer acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Form trends

- 2.2.3 Technology trends

- 2.2.4 End Use trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift to hypoallergenic nutrition

- 3.2.1.2 Demand for clean-label products

- 3.2.1.3 Integration into functional foods

- 3.2.1.4 Expansion of infant and clinical nutrition needs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Flavor and palatability issues

- 3.2.2.2 Intense market competition

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand in sports nutrition

- 3.2.3.2 Growth in personalized nutrition

- 3.2.3.3 Rising interest in gut health and immunity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Whey protein hydrolysate (WPH)

- 5.3 Casein hydrolysate (CPH)

- 5.4 Total milk protein hydrolysate

- 5.5 Lactoferrin hydrolysate

- 5.6 Immunoglobulin hydrolysate

- 5.7 Alpha-lactalbumin hydrolysate

- 5.8 Beta-lactoglobulin hydrolysate

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Paste

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Acid hydrolysis

- 7.3 Enzymatic hydrolysis

- 7.4 Microbial fermentation

- 7.5 Autolytic hydrolysis

- 7.6 Ultrasonic hydrolysis

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Protein supplement

- 8.2.2 Infant nutrition

- 8.2.3 Sports nutrition

- 8.2.4 Bakery & food ingredients

- 8.2.5 Beverages

- 8.2.6 Others

- 8.3 Animal feed

- 8.3.1 Poultry

- 8.3.1.1 Broilers

- 8.3.1.2 Layers

- 8.3.2 Swine

- 8.3.3 Cattle

- 8.3.4 Aquaculture

- 8.3.4.1 Salmon

- 8.3.4.2 Trouts

- 8.3.4.3 Shrimps

- 8.3.4.4 Others

- 8.3.5 Equine

- 8.3.6 Pet

- 8.3.1 Poultry

- 8.4 Pharmaceutical

- 8.4.1 Pharmaceutical formulations

- 8.4.2 Clinical nutrition

- 8.4.3 Others

- 8.5 Cosmetics & Personal Care

- 8.5.1 Skincare

- 8.5.2 Haircare

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arla Foods Ingredients Group

- 10.2 AMCO Proteins

- 10.3 A. Costantino & C.

- 10.4 Armor Proteines

- 10.5 Agropur Cooperative

- 10.6 FrieslandCampina

- 10.7 Glanbia Nutritionals

- 10.8 Hilmar Ingredients

- 10.9 Havero Hoogwegt

- 10.10 Kerry Ingredients

- 10.11 Lactalis Group

- 10.12 Milk Specialties Global

- 10.13 Tatua Co-operative Dairy Company

- 10.14 Others