|

市場調查報告書

商品編碼

1844279

奈米機電系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nanoelectromechanical Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

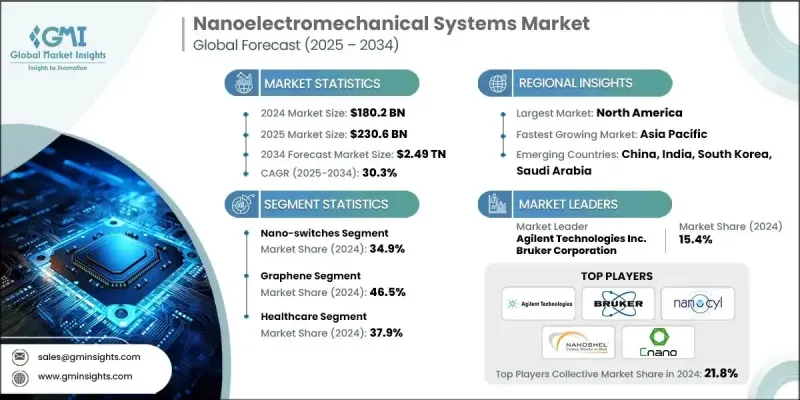

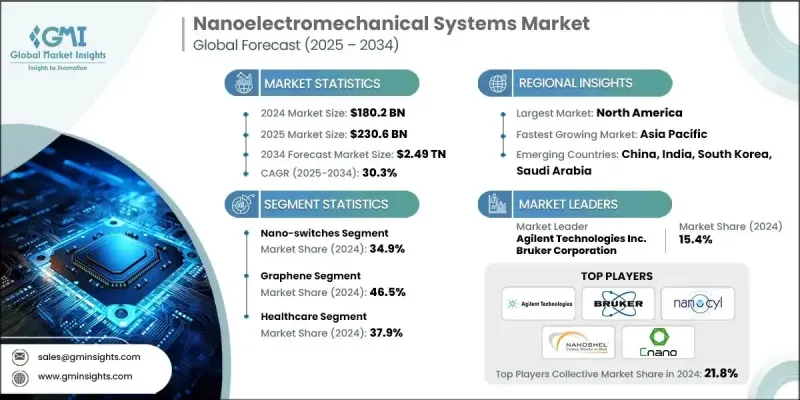

2024 年全球奈米機電系統市值為 1,802 億美元,預計到 2034 年將以 30.3% 的複合年成長率成長至 2.49 兆美元。

強勁的成長源自於對功能卓越的超小型設備的需求。隨著電子元件日益緊湊,NEMS 憑藉其在奈米級驅動、感測和訊號處理方面無與倫比的能力,正日益受到青睞。消費性電子、生物醫學設備、下一代穿戴式裝置和智慧植入物等產業正在向小型化發展,促使製造商將 NEMS 融入其創新中。由於小型化仍然是現代設備設計和工程的促進因素,其應用範圍不斷擴大。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1802億美元 |

| 預測值 | 2.49兆美元 |

| 複合年成長率 | 30.3% |

材料科學的重大進展,尤其是石墨烯、碳奈米管和先進矽奈米結構的發展,正在進一步提升NEMS技術的性能。這些材料在奈米尺度上具有卓越的機械性能、高效的能源利用率和優異的電氣性能。隨著製造技術和功能設計的不斷創新,NEMS正在發展成為醫療診斷、環境監測和計算系統等領域的商業化可行解決方案。隨著開發規模的擴大,對能夠即時監測、微米級精度和自主運作的系統的需求也日益成長。

2024年,奈米開關市場規模達628億美元。奈米開關之所以被廣泛採用,是因為它們能夠在超小型設備中可靠運行,同時提供高速切換和低功耗。同時,由於奈米鑷子在分子生物學和奈米醫學等研究領域能夠精確處理奈米級材料,其需求持續成長。這些裝置如今對於操縱單一分子和細胞至關重要,有助於單細胞診斷和標靶治療的突破。

2024年,石墨烯市場產值達498億美元。石墨烯以其卓越的強度、導電性和柔韌性而聞名,正迅速成為製造高頻電晶體、奈米級感測器和高效奈米開關的關鍵材料。它滿足了運算和通訊領域對更快、更低功耗電子設備日益成長的需求。此外,石墨烯的生物相容性也推動了其在生物感測和醫療NEMS應用中的應用,這些應用對精確度和安全性至關重要。

2024年,美國奈米機電系統市場規模達567億美元,複合年成長率為29.4%。這一成長得益於政府對奈米技術研究的持續支持、科技公司與學術機構之間的深度合作,以及奈米機電系統在國防、醫療保健、航太和消費電子等行業的不斷擴展。良好的投資環境和強大的智慧財產權保護也鞏固了美國在該領域的領先地位。

影響奈米機電系統市場競爭格局的關鍵參與者包括 Ubiquiti Inc.、Interuniversity Microelectronics Centre、Inframat Advanced Materials LLC、Bruker Corporation、Broadcom Corporation、Showa Denko KK、Merck KGaA、Sun Innovations, Inc.、Fraunhofer-Gesans Incman. SL 和 Electron Microscopy Sciences。

為了在不斷發展的奈米機電系統市場中站穩腳跟,各公司正優先考慮材料創新方面的研發投入,尤其關注石墨烯和碳基複合材料等奈米材料。他們也不斷擴大與學術研究實驗室和公共機構的合作,以加速技術開發和商業化。相關策略包括將應用組合多元化,拓展至航太、生物科學和智慧基礎設施等領域,同時提升製造的可擴展性。一些公司專注於精密奈米製造方法,以提高設備的靈敏度和耐用性,而其他公司則致力於降低能耗,以提供高效的解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 電子設備小型化

- 奈米技術和材料科學的進步

- 生物醫學和生物感測領域的新興應用

- 與物聯網和智慧型設備的整合

- 國防和航太領域的需求不斷成長

- 產業陷阱與挑戰

- 複雜且昂貴的製造程序

- 可靠性和標準化問題

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 歷史價格分析(2021-2024)

- 價格趨勢促進因素

- 區域價格差異

- 價格預測(2025-2034)

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 奈米鑷子

- 奈米懸臂樑

- 奈米開關

- 奈米加速度計

- 奈米流體模組

第6章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 石墨烯

- 碳奈米管(CNT)

- 碳化矽(SiC)

- 二氧化矽(SiO2)

- 其他

第7章:市場估計與預測:按製造技術,2021 - 2034 年

- 主要趨勢

- 表面微加工

- 絕緣體上矽(SOI)技術

- LIGA(光刻、電鍍和成型)

- 體微加工

- 其他

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 感測與控制應用

- 工具和設備

- 固態電子學

- 生物醫學設備

- 消費性電子產品

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 汽車

- 消費性電子產品

- 工業的

- 衛生保健

- 其他

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aeotec Limited

- Agilent Technologies

- Amprius Technologies

- Analog Devices, Inc.

- Applied Nanotools Inc.

- Asylum Research Corporation

- Broadcom Corporation

- Bruker Corporation

- Cnano Technology Limited

- Electron Microscopy Sciences

- Fraunhofer-Gesellschaft

- Inframat Advanced Materials LLC

- Interuniversity Microelectronics Centre

- JBC SL

- Merck KGaA

- Nanoshell Company, LLC

- onex technologies inc

- Raymor Industries Inc.

- Showa Denko KK

- Sun Innovations, Inc.

- Ubiquiti Inc.

- Vistec Electron Beam GmbH

The Global Nanoelectromechanical Systems Market was valued at USD 180.2 billion in 2024 and is estimated to grow at a CAGR of 30.3% to reach USD 2.49 trillion by 2034.

The robust growth is owing to the demand for ultra-miniaturized devices with superior functionality. As electronic components become increasingly compact, NEMS are gaining traction for their unmatched capabilities in nanoscale actuation, sensing, and signal processing. Industries such as consumer electronics, biomedical devices, next-gen wearables, and smart implants are pushing toward reduced form factors, prompting manufacturers to integrate NEMS into their innovations. Their application scope continues to expand as miniaturization remains a driving factor in modern device design and engineering.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.2 Billion |

| Forecast Value | $2.49 Trillion |

| CAGR | 30.3% |

Significant strides in materials science, particularly with graphene, carbon nanotubes, and advanced silicon nanostructures, are further enhancing the performance of NEMS technologies. These materials deliver superior mechanical properties, efficient energy utilization, and high electrical performance at the nano scale. With continuous innovation in fabrication techniques and functional design, NEMS are evolving into commercially viable solutions across sectors like medical diagnostics, environmental monitoring, and computing systems. As development scales, demand is surging for systems capable of real-time monitoring, micro-level precision, and autonomous operation.

In 2024, the nano-switches segment generated USD 62.8 billion. Their widespread adoption stems from their ability to function reliably in ultra-small devices while delivering high-speed switching and low-power consumption. Meanwhile, demand for nano-tweezers continues to grow due to their precision handling of nanoscale materials in research fields like molecular biology and nanomedicine. These devices are now critical for manipulating individual molecules and cells, enabling breakthroughs in single-cell diagnostics and targeted therapy delivery.

The graphene segment generated USD 49.8 billion in 2024. Known for its exceptional strength, conductivity, and flexibility, graphene is rapidly becoming essential for manufacturing high-frequency transistors, nanoscale sensors, and efficient nano-switches. It meets the increasing demand for faster, low-power electronics in computing and communication. Additionally, graphene's biocompatibility is propelling its use in biosensing and medical NEMS applications where precision and safety are vital.

U.S. Nanoelectromechanical Systems Market generated USD 56.7 billion in 2024 with a CAGR of 29.4%. This growth is driven by ongoing government support for nanotech research, deep collaboration among tech firms and academic institutions, and the expanding footprint of NEMS across industries like defense, healthcare, aerospace, and consumer electronics. A favorable investment environment and strong IP protections also reinforce U.S. leadership in this space.

Key players shaping the competitive landscape of the Nanoelectromechanical Systems Market include Ubiquiti Inc., Interuniversity Microelectronics Centre, Inframat Advanced Materials LLC, Bruker Corporation, Broadcom Corporation, Showa Denko K.K., Merck KGaA, Sun Innovations, Inc., Fraunhofer-Gesellschaft, Raymor Industries Inc., Nanoshell Company, LLC, onex technologies Inc., Cnano Technology Limited, JBC S.L., and Electron Microscopy Sciences.

To build a stronger foothold in the evolving Nanoelectromechanical Systems Market, companies are prioritizing R&D investments in material innovation, focusing particularly on nanomaterials like graphene and carbon-based composites. They are also expanding partnerships with academic research labs and public institutions to accelerate technology development and commercialization. Strategies include diversifying application portfolios into sectors like aerospace, bioscience, and smart infrastructure, while also improving manufacturing scalability. Some players are focusing on precision nanofabrication methods to enhance device sensitivity and durability, while others aim to reduce energy consumption for high-efficiency solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspective: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Miniaturization of electronic devices

- 3.2.1.2 Advancements in nanotechnology and materials science

- 3.2.1.3 Emerging applications in biomedical and biosensing

- 3.2.1.4 Integration with IoT and smart devices

- 3.2.1.5 Growing demand from defense and aerospace sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex and costly manufacturing processes

- 3.2.2.2 Reliability and standardization concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nano-tweezers

- 5.3 Nano-cantilevers

- 5.4 Nano-switches

- 5.5 Nano-accelerometers

- 5.6 Nano-fluidic modules

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Graphene

- 6.3 Carbon Nanotubes (CNTs)

- 6.4 Silicon Carbide (SiC)

- 6.5 Silicon Dioxide (SiO2)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Fabrication Technology, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Surface micromachining

- 7.3 Silicon on Insulator (SOI) technology

- 7.4 LIGA (Lithography, Electroplating, and Molding)

- 7.5 Bulk micromachining

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Sensing & control applications

- 8.3 Tools & equipment

- 8.4 Solid-state electronics

- 8.5 Biomedical devices

- 8.6 Consumer electronics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Consumer electronics

- 9.4 Industrial

- 9.5 Healthcare

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aeotec Limited

- 11.2 Agilent Technologies

- 11.3 Amprius Technologies

- 11.4 Analog Devices, Inc.

- 11.5 Applied Nanotools Inc.

- 11.6 Asylum Research Corporation

- 11.7 Broadcom Corporation

- 11.8 Bruker Corporation

- 11.9 Cnano Technology Limited

- 11.10 Electron Microscopy Sciences

- 11.11 Fraunhofer-Gesellschaft

- 11.12 Inframat Advanced Materials LLC

- 11.13 Interuniversity Microelectronics Centre

- 11.14 JBC S.L

- 11.15 Merck KGaA

- 11.16 Nanoshell Company, LLC

- 11.17 onex technologies inc

- 11.18 Raymor Industries Inc.

- 11.19 Showa Denko K.K.

- 11.20 Sun Innovations, Inc.

- 11.21 Ubiquiti Inc.

- 11.22 Vistec Electron Beam GmbH