|

市場調查報告書

商品編碼

1833643

醫療保健市場中的擴增實境和虛擬實境機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Augmented and Virtual Reality in Healthcare Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

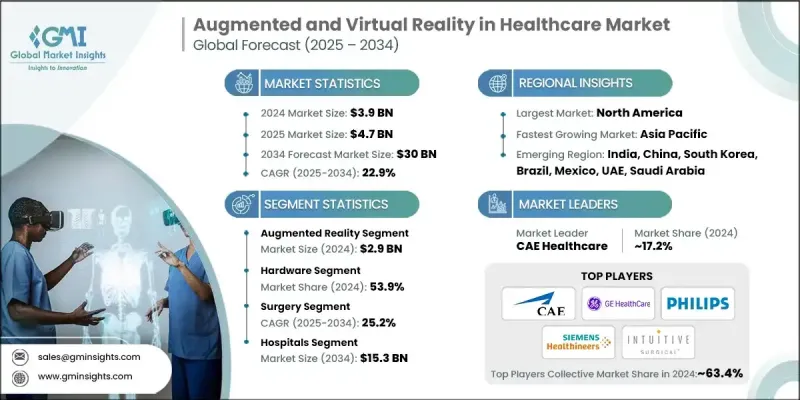

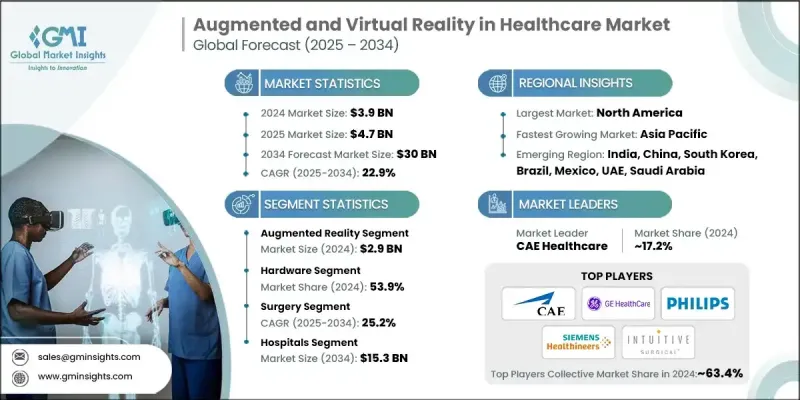

2024 年全球醫療保健擴增實境和虛擬實境市場價值為 39 億美元,預計到 2034 年將以 22.9% 的複合年成長率成長至 300 億美元。

醫療保健行業正擴大採用數位技術進行診斷、治療計劃和患者互動。 AR 和 VR 提供了創新的解決方案,可增強醫療保健服務,為外科醫生、醫學實習生和患者提供沉浸式體驗,推動其在行業中的廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 300億美元 |

| 複合年成長率 | 22.9% |

擴增實境需求不斷成長

擴增實境 (AR) 領域在 2024 年佔據了顯著的佔有率,這得益於其能夠透過即時資料疊加增強醫療流程的能力。這項技術正擴大應用於醫學影像、診斷和病患教育,為醫療專業人員提供更準確、更有效率的治療工具。該領域的公司採取的關鍵策略包括與醫療服務提供者合作,將 AR 解決方案整合到臨床環境中,以及持續研發以提高 AR 應用的精確度和互動性。

硬體的採用率不斷提高

隨著專用耳機、感測器和計算設備的發展,沉浸式體驗成為可能,硬體領域在2024年將佔據相當大的佔有率。各公司正致力於打造輕便、舒適、高效能的設備,以滿足各種醫療保健需求,例如手術模擬、物理治療和病患監護。

手術獲得牽引力

2024年,外科手術領域佔了顯著佔有率。外科醫生現在使用VR模擬進行術前規劃,並在手術過程中使用AR工具來視覺化關鍵結構,從而提高手術精度並降低出錯風險。推動該領域發展的關鍵策略包括開發與手術器材整合的專用軟體解決方案,以及與領先的醫療器材公司結盟,以確保AR/VR工具更順暢地融入現有的手術工作流程。

北美將成為推動力地區

在2025年至2034年期間,北美醫療保健市場的擴增實境和虛擬實境將以可觀的複合年成長率成長,這得益於高昂的醫療保健支出、技術進步以及該地區領先醫療機構對AR/VR解決方案的早期採用。美國和加拿大在將AR/VR融入醫療培訓、外科手術和患者護理方面處於領先地位。

醫療保健市場增強和虛擬實境的主要參與者有 MindMaze、虛擬實境醫療中心 (VRMC)、Augmedix、CAE Healthcare、Vicarious Surgical、HoloAnatomy、GE HealthCare、Surgical Theater、Bioflight VR、Proprio Vision、Augmedics、SentiAR運動、XR Health、Intuitive Surgical、Intuitox、Moticoncan、Makoo、Mugkak Aunak Aun影響 A影響 A影響 Ai5555555 VR、FundamentalVR、Health Scholars、Koninklijke Philips NV、AppliedVR 和 In vivo。

企業正透過與大學和醫療保健提供者合作、專注於擴大研發活動以及確保遵守地區法規來增強其影響力。此外,他們還利用遠距醫療服務和虛擬諮詢日益成長的需求,進一步推動了AR/VR解決方案的普及。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 心理健康和疼痛管理需求不斷成長

- 遠距醫療和遠距護理的成長

- AR/VR 硬體和軟體的快速進步提高了可用性、真實感和可負擔性

- 政府和機構支持

- 產業陷阱與挑戰

- 前期成本高

- 資料隱私和安全問題

- 市場機會

- AI與5G融合

- 擴展數位孿生和個人化醫療

- 向新興市場擴張

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 技術格局

- 現有技術

- 新興技術

- 價值鏈分析

- 產品生命週期分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按技術分類,2021 - 2034 年

- 主要趨勢

- 擴增實境

- 虛擬實境

第6章:市場估計與預測:按組件,2021 - 2034

- 主要趨勢

- 硬體

- 軟體

- 服務

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 手術

- 培訓和教育

- 行為療法

- 醫學影像

- 其他應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 學術機構

- 醫院

- 診所/牙醫

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AppliedVR

- Augmedics

- Augmedix

- Bioflight VR

- CAE Healthcare

- FundamentalVR

- GE HealthCare

- Health Scholars

- HoloAnatomy

- Intuitive Surgical

- Invivo

- Koninklijke Philips NV

- Medical Augmented Intelligence

- Medivis

- MindMaze

- Mobiliya

- OSSO VR

- Proprio Vision

- SentiAR

- Siemens Healthineers

- Surgical Theater

- Vicarious Surgical

- Virtual Reality Medical Center (VRMC)

- VRHealth

- XR Health

The Global Augmented and Virtual Reality in Healthcare Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 22.9% to reach USD 30 billion by 2034.

The healthcare industry is increasingly adopting digital technologies for diagnostics, treatment planning, and patient engagement. AR and VR offer innovative solutions for enhancing healthcare delivery, providing immersive experiences for surgeons, medical trainees, and patients, driving their widespread adoption in the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $30 Billion |

| CAGR | 22.9% |

Rising Demand for Augmented Reality

The augmented reality (AR) segment held a notable share in 2024 owing to its ability to enhance medical procedures with real-time data overlays. This technology is being increasingly used in medical imaging, diagnostics, and patient education, providing healthcare professionals with more accurate and efficient tools for treatment. Key strategies adopted by companies in this segment include partnerships with healthcare providers to integrate AR solutions into clinical settings, along with continuous R&D to improve the precision and interactivity of AR applications.

Increasing Adoption of Hardware

The hardware segment held a sizeable share in 2024, as the development of specialized headsets, sensors, and computing devices enables immersive experiences. Companies are focusing on creating lightweight, comfortable, and high-performance devices that cater to various healthcare needs, such as surgical simulation, physical therapy, and patient monitoring.

Surgery to Gain Traction

The surgery segment held a notable share in 2024. Surgeons now use VR simulations for preoperative planning and AR tools during surgery to visualize critical structures, improving precision and reducing the risk of errors. Key strategies driving this segment include the development of specialized software solutions that integrate with surgical instruments, as well as forming alliances with leading medical device companies to ensure smoother integration of AR/VR tools into existing surgical workflows.

North America to Emerge as a Propelling Region

North American augmented and virtual reality in healthcare market is expected to grow at a decent CAGR during 2025-2034, driven by high healthcare spending, technological advancements, and early adoption of AR/VR solutions by leading healthcare institutions across the region. The U.S. and Canada are at the forefront of integrating AR/VR into medical training, surgical procedures, and patient care.

Major players in the augmented and virtual reality in healthcare market are MindMaze, Virtual Reality Medical Center (VRMC), Augmedix, CAE Healthcare, Vicarious Surgical, HoloAnatomy, GE HealthCare, Surgical Theater, Bioflight VR, Proprio Vision, Augmedics, SentiAR, XR Health, Intuitive Surgical, Siemens, Medical Augmented Intelligence, Medivis, Mobiliya, Osso VR, FundamentalVR, Health Scholars, Koninklijke Philips N.V., AppliedVR, and In vivo.

Companies are strengthening their presence by collaborating with universities and healthcare providers, focusing on expanding their research and development activities, and ensuring compliance with regional regulations. Additionally, they are capitalizing on the growing demand for remote healthcare services and virtual consultations, which further propels the adoption of AR/VR solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Component

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising mental health and pain management needs

- 3.2.1.2 Growth in telemedicine and remote care

- 3.2.1.3 Rapid advancements in AR/VR hardware and software enhancing usability, realism, and affordability

- 3.2.1.4 Government and institutional support

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs

- 3.2.2.2 Data privacy and security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 AI and 5G integration

- 3.2.3.2 Expanding digital twins and personalized medicine

- 3.2.3.3 Expansion into emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Rest of the world

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Product lifecycle analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Augmented reality

- 5.3 Virtual reality

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Surgery

- 7.3 Training and education

- 7.4 Behavioral therapy

- 7.5 Medical imaging

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Academic institutions

- 8.3 Hospitals

- 8.4 Clinics/dentists

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AppliedVR

- 10.2 Augmedics

- 10.3 Augmedix

- 10.4 Bioflight VR

- 10.5 CAE Healthcare

- 10.6 FundamentalVR

- 10.7 GE HealthCare

- 10.8 Health Scholars

- 10.9 HoloAnatomy

- 10.10 Intuitive Surgical

- 10.11 Invivo

- 10.12 Koninklijke Philips N.V.

- 10.13 Medical Augmented Intelligence

- 10.14 Medivis

- 10.15 MindMaze

- 10.16 Mobiliya

- 10.17 OSSO VR

- 10.18 Proprio Vision

- 10.19 SentiAR

- 10.20 Siemens Healthineers

- 10.21 Surgical Theater

- 10.22 Vicarious Surgical

- 10.23 Virtual Reality Medical Center (VRMC)

- 10.24 VRHealth

- 10.25 XR Health