|

市場調查報告書

商品編碼

1833622

半導體管材及配件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Semiconductor Tubing and Fittings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

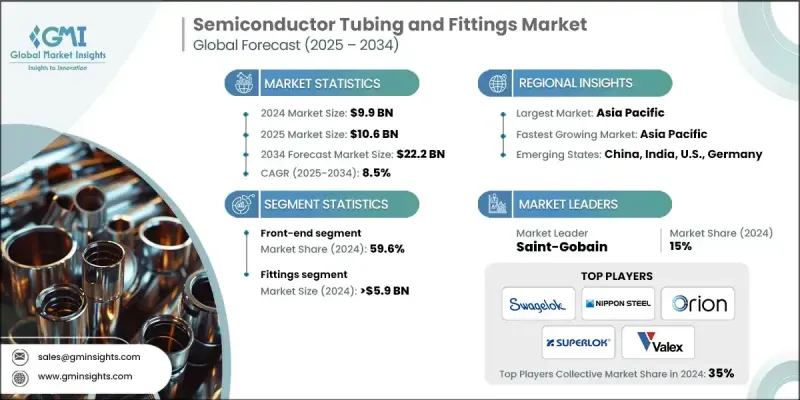

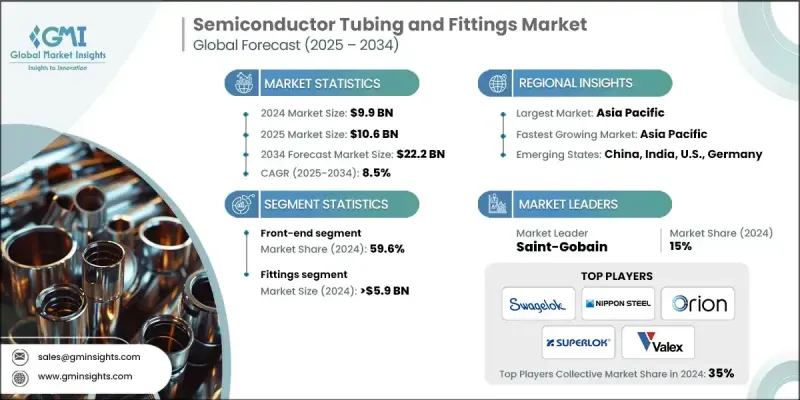

根據 Global Market Insights Inc. 發布的最新報告,全球半導體管道和配件市場規模在 2024 年估計為 99 億美元,預計將從 2025 年的 106 億美元成長到 2034 年的 222 億美元,複合年成長率為 8.5%。

半導體製程使用腐蝕性化學品和特殊氣體,必須安全、清潔地輸送。這增加了對耐化學腐蝕、高純度管道和配件的需求,例如由 PFA、PTFE 和 PVDF 製成的管道和配件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 99億美元 |

| 預測值 | 222億美元 |

| 複合年成長率 | 8.5% |

前端半導體的採用率不斷上升

2024年,前端市場將佔據顯著佔有率,這主要得益於晶圓製造程序,因為工藝對純度和精度的要求至關重要。此階段涉及複雜的化學品輸送系統,需要超潔淨管道和耐腐蝕配件來維持製程的完整性。隨著晶圓廠在極端的污染控制標準下營運,對前端流體處理組件的需求持續激增,尤其是在晶片製造商向更小節點和更複雜架構轉型的情況下。

配件獲得青睞

2024年,配件業務板塊創造了可觀的收入,因為即使是最輕微的洩漏或材料劣化,也可能危及整個半導體生產流程。配件需要能夠耐受腐蝕性化學物質,在不同壓力下保持防漏連接,並保持長期穩定性。市場對由高純度金屬和工程塑膠製成的精密工程、可焊接和快速連接的配件的需求日益成長。

亞太地區將成為利潤豐厚的地區

2024年,亞太地區半導體管材及配件市場佔有相當大的佔有率。台灣、韓國、中國大陸和日本等國家和地區擁有多家領先的晶圓代工廠和整合設備製造商 (IDM),對高純度流體處理系統的需求龐大。政府支持的晶片製造投資以及本地和全球企業積極的產能擴張,正在推動對超級淨管材及配件的需求。晶圓產量的提升、新晶圓廠的建設以及原始設備製造商 (OEM) 和零件供應商之間的戰略合作夥伴關係,共同推動著市場的成長。

半導體管道和配件市場的主要參與者有 Rensa Tubes、Swagelok、Advance Fittings Corp、FITOK Group Co Ltd、Ihara Science Corporation、Valex Corp、Orion、FUJIKIN、Masterflex Group、Superlok、Dibert Valve & Fitting Co Inc、Saint-Gobain、APT、Superlok、Dibert Valve & Fitting Covanus、Saint-Gobain、APT、Nippon Corptics 和 HerNvanus Covanus Covanus。

為了鞏固在半導體管材和配件市場的立足點,各公司正在採取創新、合作和區域擴張等一系列策略。領先的企業正在大力投資研發,以開發具有更強耐化學性、溫度穩定性和零顆粒產生的下一代材料。許多企業也在關鍵客戶所在地附近建造或擴大無塵室製造設施,以縮短交貨時間並提高服務響應能力。與半導體原始設備製造商 (OEM) 和晶圓廠設備製造商的策略合作,使管材和配件供應商能夠更無縫地融入系統級設計。此外,企業正在尋求併購,以多元化產品組合併進入新的區域市場,尤其是在半導體投資激增的亞洲和北美。這些積極主動的策略有助於企業在技術含量高且對品質要求高的市場中脫穎而出。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 半導體產業的成長

- 技術進步

- 增加研發活動

- 產業陷阱與挑戰

- 專用材料成本高

- 製造和品質控制的複雜性

- 機會

- 先進材料的開發

- 客製化和模組化解決方案

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 管道

- 金屬管

- 氟聚合物管

- 石英管

- 複合管

- 特種聚合物管

- 配件

- 壓縮配件

- 喇叭口配件

- 面密封配件

- 焊接配件

- 超高純度(UHP)配件

- 快速連接配件

- 螺紋配件

- 其他

第6章:市場估計與預測:按工藝,2021 - 2034 年

- 主要趨勢

- 前端

- 後端

第7章:市場估計與預測:按設備類型,2021 - 2034 年

- 主要趨勢

- 半導體設計

- 掩模版/光罩製造

- 晶圓製造/加工

- 表面處理

- 組裝和包裝

- 測試/檢驗

- 製造工廠

- 熱處理

- 沉積

- 其他

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Advance Fittings Corp

- APT

- Dibert Valve & Fitting Co Inc

- FITOK Group Co Ltd

- FUJIKIN

- Heraeus Covantics

- Ihara Science Corporation

- Masterflex Group

- Nippon Steel Corp

- Orion

- Rensa Tubes

- Saint-Gobain

- Superlok

- Swagelok

- Valex Corp

The global semiconductor tubing and fittings market was estimated at USD 9.9 billion in 2024 and is expected to grow from USD 10.6 billion in 2025 to USD 22.2 billion by 2034, at a CAGR of 8.5%, according to the latest report published by Global Market Insights Inc.

Semiconductor processes use aggressive chemicals and specialty gases that must be transported safely and cleanly. This increases demand for chemically resistant and high-purity tubing and fittings, such as those made from PFA, PTFE, and PVDF.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $22.2 Billion |

| CAGR | 8.5% |

Rising Adoption of Front-End Semiconductor

The front-end segment held a significant share in 2024, driven by wafer fabrication processes, where purity and precision are non-negotiable. This stage involves complex chemical delivery systems that require ultra-clean tubing and corrosion-resistant fittings to maintain process integrity. With fabs operating under extreme contamination control standards, demand for front-end fluid handling components continues to surge, particularly as chipmakers transition to smaller nodes and more complex architectures.

Fittings to Gain Traction

The fittings segment generated substantial revenues in 2024, as even the slightest leakage or material degradation can compromise the entire semiconductor production process. Fittings are expected to withstand aggressive chemicals, maintain leak-proof connections under varying pressures, and remain stable over time. The market is witnessing a growing preference for precision-engineered, weldable, and quick-connect fittings made from high-purity metals and engineered plastics.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific semiconductor tubing and fittings market held a sizeable share in 2024. Countries like Taiwan, South Korea, China, and Japan are home to several leading foundries and integrated device manufacturers (IDMs), demanding high-purity fluid handling systems. Government-backed investments in chip fabrication and aggressive capacity expansions by local and global players are fueling the need for ultra-clean tubing and fittings. The market growth is driven by rising wafer production, the construction of new fabs, and strategic partnerships between OEMs and component suppliers.

Major players in the semiconductor tubing and fittings market are Rensa Tubes, Swagelok, Advance Fittings Corp, FITOK Group Co Ltd, Ihara Science Corporation, Valex Corp, Orion, FUJIKIN, Masterflex Group, Superlok, Dibert Valve & Fitting Co Inc, Saint-Gobain, APT, Nippon Steel Corp, Heraeus Covantics.

To strengthen their foothold in the semiconductor tubing and fittings market, companies are adopting a mix of innovation, partnerships, and regional expansion strategies. Leading players are heavily investing in R&D to develop next-generation materials that offer enhanced chemical resistance, temperature stability, and zero particle generation. Many are also building or expanding cleanroom manufacturing facilities near key customer locations to shorten lead times and improve service responsiveness. Strategic collaborations with semiconductor OEMs and fab equipment manufacturers allow tubing and fittings suppliers to integrate more seamlessly into system-level designs. Additionally, businesses are pursuing mergers and acquisitions to diversify product portfolios and enter new regional markets, particularly in Asia and North America, where semiconductor investment is surging. These proactive strategies help firms differentiate themselves in a highly technical and quality-sensitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Process

- 2.2.4 Equipment type

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of the semiconductor industry

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increase in R&D activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of specialized materials

- 3.2.2.2 Complexity of manufacturing and quality control

- 3.2.3 Opportunities

- 3.2.3.1 Development of advanced materials

- 3.2.3.2 Customization and modular solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Tubing

- 5.2.1 Metal tubing

- 5.2.2 Fluoropolymer tubing

- 5.2.3 Quartz tubing

- 5.2.4 Composite tubing

- 5.2.5 Specialty polymer tubing

- 5.3 Fittings

- 5.3.1 Compression fittings

- 5.3.2 Flare fittings

- 5.3.3 Face seal fittings

- 5.3.4 Weld fittings

- 5.3.5 Ultra-high purity (UHP) fittings

- 5.3.6 Quick-connect fittings

- 5.3.7 Threaded fittings

- 5.3.8 Others

Chapter 6 Market Estimates and Forecast, By Process, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Front-end

- 6.3 Back-end

Chapter 7 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Semiconductor design

- 7.3 Mask/Reticle manufacturing

- 7.4 Wafer manufacturing/processing

- 7.5 Surface conditioning

- 7.6 Assembly & packaging

- 7.7 Test/Inspection

- 7.8 Fabrication facility

- 7.9 Thermal processing

- 7.10 Deposition

- 7.11 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advance Fittings Corp

- 10.2 APT

- 10.3 Dibert Valve & Fitting Co Inc

- 10.4 FITOK Group Co Ltd

- 10.5 FUJIKIN

- 10.6 Heraeus Covantics

- 10.7 Ihara Science Corporation

- 10.8 Masterflex Group

- 10.9 Nippon Steel Corp

- 10.10 Orion

- 10.11 Rensa Tubes

- 10.12 Saint-Gobain

- 10.13 Superlok

- 10.14 Swagelok

- 10.15 Valex Corp