|

市場調查報告書

商品編碼

1822579

萃取設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Extraction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

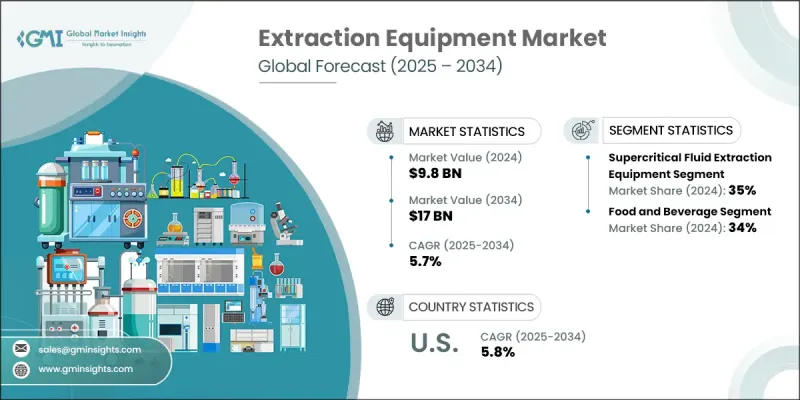

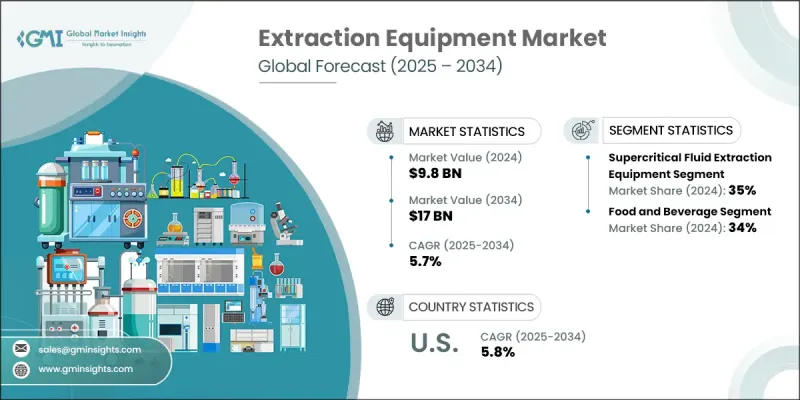

2024 年全球提取設備市場價值為 98 億美元,預計將以 5.7% 的複合年成長率成長,到 2034 年達到 170 億美元。

穩定的市場成長反映出各行各業日益重視高效且永續地獲取高純度化合物。製藥、營養保健品、化學品以及食品飲料行業的企業正在持續採用創新的提取技術,以提高產品品質、提升加工能力並滿足嚴格的監管基準。對清潔標籤產品、功能性化合物和永續生產實踐日益成長的需求也推動了高性能設備的採用。同時,各行各業(尤其是製藥和營養保健品產業)的投資趨勢正在加速提取系統的創新步伐。先進萃取技術的廣泛應用凸顯了向精準度、環境責任和生產最佳化的更廣泛轉變。隨著各行各業不斷推動提取流程的自動化和標準化,設備供應商正在根據不斷變化的客戶需求調整其產品。這使得提取技術對於在保持營運效率的同時實現穩定的產品性能至關重要,從而增強了其在新興市場和成熟市場中的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 98億美元 |

| 預測值 | 170億美元 |

| 複合年成長率 | 5.7% |

超音波萃取設備憑藉其在更快處理時間和更佳化合物保存方面的操作優勢,持續保持領先地位。此方法在較低溫度下也能有效運行,非常適合萃取對熱敏感的精細成分。此外,它還能減少所需溶劑的用量,符合永續和綠色加工的原則。這些優勢使超音波系統成為追求更清潔、更經濟高效的生產的製造商的首選。其高效性和適應性使其成為注重性能和永續性的行業中的關鍵技術。

超臨界流體萃取設備市場在2024年佔據35%的市場佔有率,預計到2034年將以5.9%的複合年成長率成長。該領域的成長源於其能夠生產高純度萃取物,同時提供卓越的環境效益。該技術在高溫高壓下使用超臨界流體(通常為二氧化碳),在化合物萃取過程中實現深度滲透和高選擇性。這些特性非常適合注重維持生物活性成分完整性的產業,包括食品、營養保健品和製藥業。其能夠提供清潔、無殘留的提取物,這增強了其對在受監管且注重品質的市場中營運的公司的吸引力。

食品飲料產業在2024年佔據了34%的市場佔有率,預計到2034年將以6%的複合年成長率成長。對天然調味劑、功能性食品添加劑和有機成分的需求不斷成長,促使製造商整合先進的萃取解決方案。消費者越來越青睞標籤透明、化學添加劑含量極低的產品,激發了人們對無殘留、環保萃取方法的興趣。企業正在採用新一代系統來應對這項挑戰,該系統能夠從植物來源中分離出高品質的化合物,同時又符合環境和安全標準。

2024年,德國萃取設備市場佔18%,貢獻了6.956億美元的市場規模。該國的工業和技術格局正在推動對先進萃取解決方案的強勁需求。合規驅動的創新、工業現代化以及對製造業永續性的持續推動,進一步推動了德國和整個歐洲的成長。與法國等鄰近市場一起,該地區正逐漸成為下一代萃取技術的關鍵樞紐。對精度、可靠性和高通量性能的需求正鼓勵歐洲企業投資可擴展的先進萃取系統。

全球萃取設備市場的領導公司包括島津公司、阿法拉伐、沃特世公司、蘇爾壽有限公司和步琪實驗室技術有限公司。這些關鍵參與者不斷影響技術進步,並樹立著業界新標準。頂級萃取設備製造商正透過專注於研發來推出效率更高、支持環保加工的系統,從而鞏固其市場地位。許多公司正在投資自動化技術和模組化設備設計,以滿足不同規模的生產需求,同時最佳化能源使用和原料消耗。各公司也透過策略合作夥伴關係、收購和在地化生產能力來擴大其全球影響力。對法規遵循和品質保證的關注正在推動清潔萃取方法和無溶劑技術的創新。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對天然和植物產品的需求不斷成長

- 提取效率的技術進步

- 跨多個行業的應用日益增加。

- 人們越來越關注永續的提取方法。

- 產業陷阱與挑戰

- 初期投資成本高

- 技術複雜性與營運挑戰

- 某些應用中的監管障礙

- 市場機會

- 新興市場和應用

- 自動化與物聯網技術的融合

- 混合提取系統的開發

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按提取方法,2021 - 2034 年

- 主要趨勢

- 超音波萃取設備

- 聚焦超音波系統

- 傳統超音波系統

- 化學萃取設備

- 溶劑型體系

- 酸鹼萃取系統

- 高壓萃取設備

- 液壓系統

- 機械壓力機系統

- 超臨界流體萃取設備

- CO2萃取系統

- 其他超臨界流體系統

- 微波輔助萃取設備

- 水蒸餾設備

- 其他提取方法

第6章:市場估計與預測:依設備類型,2021 - 2034 年

- 實驗室規模的設備

- 中試設備

- 工業規模設備

- 手動提取系統

- 半自動提取系統

- 全自動提取系統

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 食品和飲料

- 精油

- 香精和香料

- 食用油

- 茶和咖啡萃取物

- 水果和蔬菜萃取物

- 製藥和生物技術

- API擷取

- 植物藥物

- 營養保健品

- 細胞萃取

- 粒線體擷取

- DNA/RNA萃取

- 化妝品和個人護理

- 活性成分

- 天然萃取物

- 化學加工

- 精細化學品

- 特種化學品

- 大麻和麻類加工

- CBD萃取

- THC萃取

- 環境應用

- 污染物去除

- 廢水處理

- 其他

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 韓國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 多邊環境協定

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Alfa Laval

- Sulzer Ltd

- Waters Corporation

- BUCHI Labortechnik

- Shimadzu Corporation

- Hielscher Ultrasonics

- Sonomechanics

- Sonics & Materials

- Qsonica

- FUST Lab

- Accudyne Systems

- Separeco

- SFE Process

- Apeks Supercritical

- Eden Labs

- Vitalis Extraction

- Pure Extraction

- Isolate Extraction

- Joda Technology

- De Dietrich Process Systems

- Koch Modular Process Systems

- Flottweg SE

- French Oil Mill Machinery

- CPM Holdings

- Anderson International

- Harburg-Freudenberger

- Allgaier Process Technology

The Global Extraction Equipment Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 17 billion by 2034.

This steady market growth reflects the increasing emphasis across industries on obtaining high-purity compounds efficiently and sustainably. Businesses operating in pharmaceuticals, nutraceuticals, chemicals, and food and beverage are consistently adopting innovative extraction technologies to boost output quality, improve processing capabilities, and meet strict regulatory benchmarks. The rising demand for clean-label products, functional compounds, and sustainable manufacturing practices is also encouraging the implementation of high-performance equipment. At the same time, investment trends across sectors-particularly in pharmaceutical and nutraceutical operations-are accelerating the pace of innovation in extraction systems. This widespread adoption of advanced extraction technologies underlines a broader shift toward precision, environmental responsibility, and production optimization. With industries pushing for greater automation and standardization in extraction processes, equipment providers are aligning their offerings with evolving customer needs. This has made extraction technologies essential for achieving consistent product performance while maintaining operational efficiency, thereby reinforcing their importance across both emerging and mature markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $17 Billion |

| CAGR | 5.7% |

Ultrasonic extraction equipment continues to lead due to its operational edge in terms of faster processing times and improved compound preservation. This method operates effectively at lower temperatures, making it suitable for extracting delicate ingredients that are sensitive to heat. Moreover, it reduces the volume of solvents required, aligning well with the principles of sustainable and green processing. These advantages make ultrasonic systems a preferred choice among manufacturers striving for cleaner and more cost-efficient production. Their efficiency and adaptability have positioned them as crucial technologies across industries that value both performance and sustainability.

The supercritical fluid extraction equipment segment accounted for a 35% share in 2024 and is expected to grow at a CAGR of 5.9% through 2034. This segment's growth is anchored in its ability to produce high-purity extracts while offering superior environmental benefits. Using supercritical fluids-typically carbon dioxide-at elevated pressure and temperature, the technology achieves deep penetration and high selectivity during compound extraction. These properties are ideal for industries focused on preserving the integrity of bioactive ingredients, including those in the food, nutraceutical, and pharmaceutical sectors. Its capability to deliver clean, residue-free extracts enhances its appeal among companies operating in regulated, quality-sensitive markets.

The food & beverage sector held a 34% share in 2024 and is projected to grow at a 6% CAGR through 2034. Increased demand for natural flavoring agents, functional food additives, and organic ingredients is driving manufacturers to integrate advanced extraction solutions. Consumers are increasingly favoring products with transparent labeling and minimal chemical additives, which is fueling interest in residue-free, eco-friendly extraction methods. Companies are responding by adopting next-generation systems capable of isolating high-quality compounds from plant-based sources while adhering to environmental and safety standards.

Germany Extraction Equipment Market held an 18% share in 2024, contributing USD 695.6 million. The country's industrial and technological landscape is fostering strong demand for advanced extraction solutions. Growth in Germany and across Europe is further supported by compliance-driven innovation, industrial modernization, and a consistent push for sustainability in manufacturing. Together with neighboring markets such as France, the region is shaping up to be a key hub for next-generation extraction technologies. Demand for precision, reliability, and high-throughput performance is encouraging European businesses to invest in scalable, state-of-the-art extraction systems.

Leading companies in the Global Extraction Equipment Market include Shimadzu Corporation, Alfa Laval, Waters Corporation, Sulzer Ltd, and BUCHI Labortechnik. These key players are consistently influencing technological advancements and setting new standards in the industry. Top extraction equipment manufacturers are strengthening their market foothold by focusing on R&D to introduce systems that deliver higher efficiency and support eco-friendly processing. Many are investing in automation technologies and modular equipment design to cater to different scales of production while optimizing energy use and raw material consumption. Companies are also expanding their global footprint through strategic partnerships, acquisitions, and localized production capabilities. A focus on regulatory compliance and quality assurance is driving innovations in clean extraction methods and solvent-free technologies.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Extraction method

- 2.2.3 Equipment type

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Executive decision points

- 2.3.2 Critical success factors

- 2.4 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for natural and plant-based products

- 3.2.1.2 Technological advancements in extraction efficiency

- 3.2.1.3 Increasing applications across multiple industries.

- 3.2.1.4 Rising focus on sustainable extraction methods.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Technical complexity and operational challenges

- 3.2.2.3 Regulatory hurdles in certain applications

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets and applications

- 3.2.3.2 Integration of automation and IoT technologies

- 3.2.3.3 Development of hybrid extraction systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Extraction Method, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Ultrasonic Extraction Equipment

- 5.2.1 Focused Ultrasonic Systems

- 5.2.2 Conventional Ultrasonic Systems

- 5.3 Chemical Extraction Equipment

- 5.3.1 Solvent-Based Systems

- 5.3.2 Acid-Base Extraction Systems

- 5.4 High Pressure Extraction Equipment

- 5.4.1 Hydraulic Press Systems

- 5.4.2 Mechanical Press Systems

- 5.5 Supercritical Fluid Extraction Equipment

- 5.5.1 CO2 Extraction Systems

- 5.5.2 Other Supercritical Fluid Systems

- 5.6 Microwave-Assisted Extraction Equipment

- 5.7 Hydrodistillation Equipment

- 5.8 Other Extraction Methods

Chapter 6 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Laboratory-scale equipment

- 6.2 Pilot-scale equipment

- 6.3 Industrial-scale equipment

- 6.4 Manual extraction systems

- 6.5 Semi-automated extraction systems

- 6.6 Fully automated extraction systems

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Food and Beverage

- 7.2.1 Essential Oils

- 7.2.2 Flavors & Fragrances

- 7.2.3 Edible Oils

- 7.2.4 Tea and Coffee Extracts

- 7.2.5 Fruit and Vegetable Extracts

- 7.3 Pharmaceutical and Biotechnology

- 7.3.1 API Extraction

- 7.3.2 Phytopharmaceuticals

- 7.3.3 Nutraceuticals

- 7.3.4 Cell Extraction

- 7.3.5 Mitochondria Extraction

- 7.3.6 DNA/RNA Extraction

- 7.4 Cosmetics and Personal Care

- 7.4.1 Active Ingredients

- 7.4.2 Natural Extracts

- 7.5 Chemical Processing

- 7.5.1 Fine chemicals

- 7.5.2 Specialty Chemicals

- 7.6 Cannabis and Hemp Processing

- 7.6.1 CBD Extraction

- 7.6.2 THC Extraction

- 7.7 Environmental Applications

- 7.7.1 Pollutant Removal

- 7.7.2 Wastewater Treatment

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 South Korea

- 9.4.3 Japan

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Alfa Laval

- 10.2 Sulzer Ltd

- 10.3 Waters Corporation

- 10.4 BUCHI Labortechnik

- 10.5 Shimadzu Corporation

- 10.6 Hielscher Ultrasonics

- 10.7 Sonomechanics

- 10.8 Sonics & Materials

- 10.9 Qsonica

- 10.10 FUST Lab

- 10.11 Accudyne Systems

- 10.12 Separeco

- 10.13 SFE Process

- 10.14 Apeks Supercritical

- 10.15 Eden Labs

- 10.16 Vitalis Extraction

- 10.17 Pure Extraction

- 10.18 Isolate Extraction

- 10.19 Joda Technology

- 10.20 De Dietrich Process Systems

- 10.21 Koch Modular Process Systems

- 10.22 Flottweg SE

- 10.23 French Oil Mill Machinery

- 10.24 CPM Holdings

- 10.25 Anderson International

- 10.26 Harburg-Freudenberger

- 10.27 Allgaier Process Technology