|

市場調查報告書

商品編碼

1822575

申請人追蹤系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Applicant Tracking System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

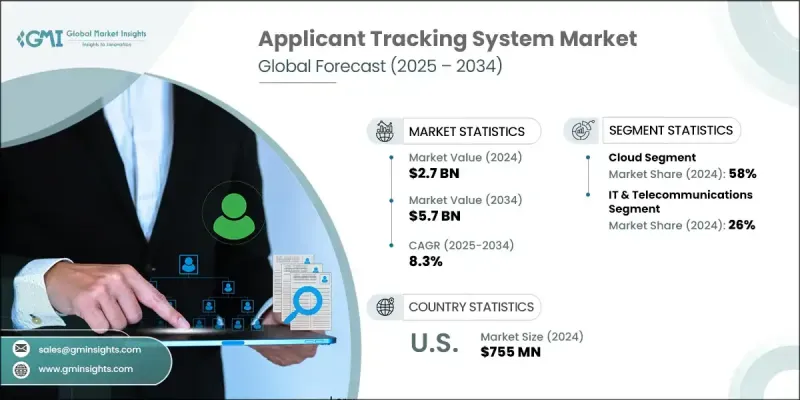

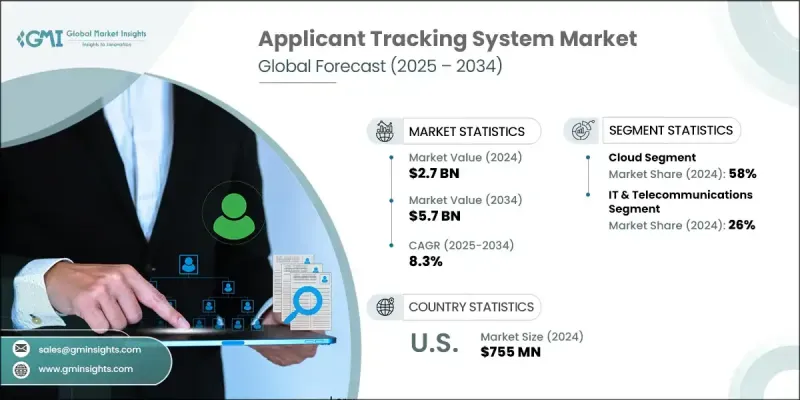

2024 年全球申請人追蹤系統市場價值為 27 億美元,預計將以 8.3% 的複合年成長率成長,到 2034 年達到 57 億美元。

這一成長主要得益於人工智慧日益融入 ATS 平台,這正在徹底改變招募格局。智慧自動化、數據驅動的決策和增強的協作工具,使企業能夠加快招募流程並提升候選人體驗。隨著企業越來越重視敏捷性、可擴展性和高品質的招聘,人工智慧系統正成為數位化招聘策略的核心。從預測分析到即時求職者洞察,這些創新減少了人工工作量,同時提高了決策的速度和準確性。隨著企業尋求簡化招聘流程並更快地響應不斷變化的勞動力需求,該市場正在多個行業中廣泛應用。自動化工作流程和集中式儀錶板正在取代分散的系統,降低營運成本,同時確保招募流程的端到端視覺性。這些進步正在強化 ATS 平台作為現代人力資本管理關鍵資產的作用。可擴展性、即時分析和自動化的結合,使這些系統不僅僅是工具,更是推動全球長期招募成功的策略解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 27億美元 |

| 預測值 | 57億美元 |

| 複合年成長率 | 8.3% |

能夠最大程度減少碎片化、簡化招聘流程並降低營運成本的解決方案正在推動 ATS 市場的發展。透過將招募任務集中到一個系統中,企業可以提高招募人員的效率,並騰出更多時間與候選人互動。自動化履歷篩選、面試安排和候選人跟進等耗時流程,可以讓團隊專注於建立更牢固的人才關係。這種方法不僅提高了招募速度,還增加了獲得頂尖候選人的可能性。

基於雲端的 ATS 解決方案細分市場在 2024 年佔據了 58% 的市場佔有率,預計在 2025 年至 2034 年期間的複合年成長率將達到 8%。這些系統因其可擴展性、成本效益和靈活性而廣受歡迎。雲端解決方案的訂閱模式能夠滿足不同規模的企業和不斷變化的招募需求,使企業能夠更輕鬆地根據需求變化添加或減少功能。這種適應性使得雲端 ATS 平台對於招募週期動態變化的公司尤其具有吸引力,無論是季節性招募還是持續擴張。

2024年,IT和電信業佔據了26%的市場佔有率,預計到2034年將以9%的複合年成長率成長。由於全球科技人才短缺,該行業的企業嚴重依賴ATS平台來加速招募流程、實現候選人匹配自動化並支援高速招募。在競爭激烈的招募環境中,這些功能至關重要,因為頂尖技術人才往往在幾天內就被市場淘汰。隨著IT和電信公司跨境擴展業務,對快速、大量招募工具的需求預計將會加劇。

美國申請人追蹤系統市場佔了90%的市場佔有率,2024年市場規模達到7.55億美元。推動這一成長的主要因素是向混合辦公和遠距辦公的轉變,這增加了對能夠管理分散勞動力的招聘平台的需求。雇主正在採用數位招募工具來簡化虛擬面試流程、追蹤候選人互動並做出明智的招募決策。美國持續不斷的技能型人才競爭也促使企業利用人工智慧驅動的功能,以實現更智慧的篩選、更快的篩選和更強大的預測匹配。

全球求職者追蹤系統 (ATS) 市場的主要領導者包括 SAP、Greenhouse Software、SmartRecruiters、iCIMS、Workday、BrassRing、Jobvite、ADP、Bullhorn 和 UKG。這些公司在塑造招募技術和擴展現代求職者追蹤系統 (ATS) 平台功能方面處於領先地位。求職者追蹤系統市場的領先公司專注於透過人工智慧驅動的創新和工作流程自動化來增強產品功能。透過整合預測分析和機器學習,這些公司可以提供更精確的候選人匹配和更快的篩選速度。另一個關鍵策略是建立模組化和可擴展的雲端解決方案,以支援各行各業不斷變化的招募需求。各公司也正在投資使用者友善的介面,以簡化招募人員和招募經理的互動,從而提高平台的整體採用率。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 宏觀經濟和產業背景

- 全球經濟環境與人力資源技術投資

- 經濟成長對人力資源技術支出的影響

- 勞動市場動態與人才短缺危機

- 遠距工作革命與數位轉型

- 疫情後的招募趨勢與勞動力演變

- 人力資源產業轉型

- 人力資源職能從行政到策略的演變

- 人才招募現代化和技術採用

- 員工體驗與候選人旅程最佳化

- 多元化、公平與包容性(DEI)整合

- 技術生態系統和數位基礎設施

- 人力資源技術中的雲端運算應用

- API整合和HR技術棧整合

- 行動優先的招募和申請流程

- 數據分析與商業智慧整合

- 全球經濟環境與人力資源技術投資

- 產業衝擊力

- 成長動力

- 人工智慧和自動化在招募中的應用日益增多

- 對集中招募平台的需求日益成長

- 遠距和混合工作文化日益發展

- 與 CRM 和 HRIS 系統整合

- 轉向數據驅動的招募決策

- 產業陷阱與挑戰

- 高昂的初始設定和訂閱成本

- 資料隱私和合規性問題

- 與遺留系統的整合複雜性

- 過度使用自動化導致候選人體驗問題

- 針對利基行業的有限客製化

- 市場機會

- 人工智慧驅動的候選人搜尋和技能匹配

- 新興市場的擴張

- 與視訊面試和評估工具整合

- 自由職業和零工經濟招聘

- 以行動優先的 ATS 採用

- 人力資源技術生態系合作夥伴關係

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術創新與先進功能

- 人工智慧與機器學習整合

- 進階分析和商業智慧

- 整合和互通技術

- 新興科技與未來創新

- 價格趨勢分析

- 定價模型演變與市場動態

- 區域定價差異和市場因素

- 價格彈性和客戶敏感度分析

- 成本分解分析

- 軟體開發及維護成本

- 市場進入和客戶獲取成本

- 營運成本結構與最佳化

- 專利分析

- 依技術領域分析專利組合

- 專利申請趨勢與創新活動

- 競爭專利情報

- 用例

- 最佳情況

- 使用者行為和採用模式

- HR專業用戶細分與需求分析

- 候選人體驗和期望的演變

- 組織採用模式與變革管理

- 監理環境與合規框架

- 資料隱私和保護條例

- 勞動法與反歧視合規

- 行業特定的監管要求

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依部署模式,2021-2034

- 主要趨勢

- 雲

- 本地

- 混合

第6章:市場估計與預測:依組件,2021-2034

- 主要趨勢

- 軟體

- 服務

- 專業服務

- 諮詢服務

- 整合與實施

- 培訓和支持

- 託管服務

- 專業服務

第7章:市場估計與預測:依組織規模,2021-2034

- 主要趨勢

- 中小企業

- 大型企業

第 8 章:市場估計與預測:按產業垂直,2021-2034 年

- 主要趨勢

- 資訊科技和電信

- 衛生保健

- 金融服務業協會

- 製造業

- 零售

- 政府

- 教育

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Global Leaders

- ADP

- Cornerstone OnDemand

- Greenhouse Software

- iCIMS

- Lever

- Oracle

- SAP

- SmartRecruiters

- Ultimate Software

- Workday

- Regional Champions

- BambooHR

- Bullhorn

- JazzHR

- PageUp

- Personio

- Recruitee

- Talentsoft

- Zoho

- 新興參與者/顛覆者

- Ashby

- Dover

- Freshworks

- Gem

- Jobvite

- Manatal

- Teamtailor

The Global Applicant Tracking System Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 5.7 billion by 2034.

This growth is largely driven by the increasing integration of artificial intelligence into ATS platforms, which is transforming the recruitment landscape. Intelligent automation, data-driven decision-making, and enhanced collaboration tools are allowing organizations to accelerate hiring processes and boost candidate experience. As businesses prioritize agility, scalability, and high-quality hires, AI-powered systems are becoming core to digital recruitment strategies. From predictive analytics to real-time applicant insights, these innovations reduce manual workloads while improving the speed and accuracy of decision-making. The market is seeing broad adoption across multiple sectors as companies look to streamline hiring operations and respond faster to evolving workforce demands. Automated workflows and centralized dashboards are replacing fragmented systems, reducing operational costs while ensuring end-to-end visibility in the recruitment pipeline. These advancements are strengthening the role of ATS platforms as a critical asset in modern human capital management. The combination of scalability, real-time analytics, and automation is making these systems more than just tools-they are strategic solutions driving long-term hiring success globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 8.3% |

Solutions that minimize fragmentation, simplify recruitment, and lower operational costs are propelling the ATS market forward. By centralizing recruitment tasks into a single system, organizations improve recruiter efficiency and allow more time for candidate engagement. Automating time-consuming processes like resume screening, interview scheduling, and candidate follow-ups frees up teams to focus on building stronger talent relationships. This approach not only enhances the speed of hiring but also increases the likelihood of securing top-tier candidates.

The cloud-based ATS solutions segment held a 58% share in 2024 and is projected to grow at a CAGR of 8% between 2025 and 2034. These systems are popular due to their scalability, cost-efficiency, and flexibility. With subscription models that cater to varied business sizes and fluctuating hiring needs, cloud solutions make it easier for enterprises to add or reduce features as demand shifts. This adaptability makes cloud ATS platforms especially attractive for companies with dynamic recruitment cycles, whether for seasonal hires or ongoing expansions.

In 2024, the IT and Telecommunications sector held a 26% share and is expected to grow at a CAGR of 9% through 2034. With a global talent shortage in tech roles, organizations in this sector are leaning heavily on ATS platforms to accelerate sourcing, automate candidate matching, and support high-speed hiring. These capabilities are vital in a competitive hiring environment where top technical talent is often off the market within days. As IT and telecom companies scale operations across borders, the demand for fast, high-volume recruitment tools is expected to intensify.

United States Applicant Tracking System Market held a 90% share and generated USD 755 million in 2024. A major factor driving this growth is the shift toward hybrid and remote work, which has increased the need for recruitment platforms that manage dispersed workforces. Employers are adopting digital recruitment tools to streamline virtual interviews, track candidate interactions, and make informed hiring decisions. The ongoing competition for skilled talent in the US is also pushing businesses to leverage AI-driven features that enable smarter screening, faster filtering, and enhanced predictive matching.

Major companies leading the Global Applicant Tracking System Market include SAP, Greenhouse Software, SmartRecruiters, iCIMS, Workday, BrassRing, Jobvite, ADP, Bullhorn, and UKG. These players are at the forefront of shaping recruitment technology and expanding the capabilities of modern ATS platforms. Leading companies in the applicant tracking system market are focused on enhancing product capabilities through AI-driven innovation and workflow automation. By integrating predictive analytics and machine learning, these firms are delivering more precise candidate matching and faster screening. Another key strategy involves building modular and scalable cloud solutions that can support evolving recruitment needs across industries. Companies are also investing in user-friendly interfaces that simplify recruiter and hiring manager interactions, improving overall platform adoption.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Deployment Mode

- 2.2.3 Component

- 2.2.4 Organization size

- 2.2.5 Industry vertical

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Macro-Economic and Industry Context

- 3.2.1 Global Economic Environment and HR Technology Investment

- 3.2.1.1 Economic Growth Impact on HR Technology Spending

- 3.2.1.2 Labor Market Dynamics and Talent Shortage Crisis

- 3.2.1.3 Remote Work Revolution and Digital Transformation

- 3.2.1.4 Post-Pandemic Hiring Trends and Workforce Evolution

- 3.2.2 Human Resources Industry Transformation

- 3.2.2.1 HR Function Evolution from Administrative to Strategic

- 3.2.2.2 Talent Acquisition Modernization and Technology Adoption

- 3.2.2.3 Employee Experience and Candidate Journey Optimization

- 3.2.2.4 Diversity, Equity, and Inclusion (DEI) Integration

- 3.2.3 Technology Ecosystem and Digital Infrastructure

- 3.2.3.1 Cloud Computing Adoption in HR Technology

- 3.2.3.2 API Integration and HR Tech Stack Consolidation

- 3.2.3.3 Mobile-First Recruitment and Application Processes

- 3.2.3.4 Data Analytics and Business Intelligence Integration

- 3.2.1 Global Economic Environment and HR Technology Investment

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising adoption of AI & automation in recruitment

- 3.3.1.2 Increasing need for centralized recruitment platforms

- 3.3.1.3 Growing remote & hybrid work culture

- 3.3.1.4 Integration with CRM and HRIS systems

- 3.3.1.5 Shift toward data-driven hiring decisions

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial setup and subscription costs

- 3.3.2.2 Data privacy & compliance concerns

- 3.3.2.3 Integration complexity with legacy systems

- 3.3.2.4 Candidate experience issues from automation overuse

- 3.3.2.5 Limited customization for niche industries

- 3.3.3 Market opportunities

- 3.3.3.1 AI-driven candidate sourcing & skill-matching

- 3.3.3.2 Expansion in emerging markets

- 3.3.3.3 Integration with video interviewing & assessment tools

- 3.3.3.4 Freelance & gig economy recruitment

- 3.3.3.5 Mobile-first ATS adoption

- 3.3.3.6 HR tech ecosystem partnerships

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology innovation and advanced features

- 3.8.1 Artificial Intelligence and Machine Learning Integration

- 3.8.2 Advanced Analytics and Business Intelligence

- 3.8.3 Integration and Interoperability Technologies

- 3.8.4 Emerging Technologies and Future Innovation

- 3.9 Price trend analysis

- 3.9.1 Pricing Model Evolution and Market Dynamics

- 3.9.2 Regional Pricing Variations and Market Factors

- 3.9.3 Price Elasticity and Customer Sensitivity Analysis

- 3.10 Cost breakdown analysis

- 3.10.1 Software Development and Maintenance Costs

- 3.10.2 Go-to-Market and Customer Acquisition Costs

- 3.10.3 Operational Cost Structure and Optimization

- 3.11 Patent analysis

- 3.11.1 Patent Portfolio Analysis by Technology Area

- 3.11.2 Patent Filing Trends and Innovation Activity

- 3.11.3 Competitive Patent Intelligence

- 3.12 Use cases

- 3.13 Best-case scenario

- 3.14 User Behavior and Adoption Patterns

- 3.14.1 HR Professional User Segmentation and Needs Analysis

- 3.14.2 Candidate Experience and Expectations Evolution

- 3.14.3 Organizational Adoption Patterns and Change Management

- 3.15 Regulatory Environment and Compliance Framework

- 3.15.1 Data Privacy and Protection Regulations

- 3.15.2 Employment Law and Anti-Discrimination Compliance

- 3.15.3 Industry-Specific Regulatory Requirements

- 3.16 Sustainability and Environmental Aspects

- 3.16.1 Sustainable Practices

- 3.16.2 Waste Reduction Strategies

- 3.16.3 Energy Efficiency in Production

- 3.16.4 Eco-friendly Initiatives

- 3.16.5 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Deployment Mode, 2021-2034 ($Bn)

- 5.1 Key trends

- 5.2 Cloud

- 5.3 On-premises

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Component, 2021-2034 ($Bn)

- 6.1 Key trends

- 6.2 Software

- 6.3 Services

- 6.3.1 Professional Services

- 6.3.1.1 Consulting Services

- 6.3.1.2 Integration And Implementation

- 6.3.1.3 Training And Support

- 6.3.2 Managed services

- 6.3.1 Professional Services

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021-2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021-2034 ($Bn)

- 8.1 Key trends

- 8.2 IT & Telecommunications

- 8.3 Healthcare

- 8.4 BFSI

- 8.5 Manufacturing

- 8.6 Retail

- 8.7 Government

- 8.8 Education

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Leaders

- 10.1.1 ADP

- 10.1.2 Cornerstone OnDemand

- 10.1.3 Greenhouse Software

- 10.1.4 iCIMS

- 10.1.5 Lever

- 10.1.6 Oracle

- 10.1.7 SAP

- 10.1.8 SmartRecruiters

- 10.1.9 Ultimate Software

- 10.1.10 Workday

- 10.2 Regional Champions

- 10.2.1 BambooHR

- 10.2.2 Bullhorn

- 10.2.3 JazzHR

- 10.2.4 PageUp

- 10.2.5 Personio

- 10.2.6 Recruitee

- 10.2.7 Talentsoft

- 10.2.8 Zoho

- 10.3 Emerging Players/Disruptors

- 10.3.1 Ashby

- 10.3.2 Dover

- 10.3.3 Freshworks

- 10.3.4 Gem

- 10.3.5 Jobvite

- 10.3.6 Manatal

- 10.3.7 Teamtailor