|

市場調查報告書

商品編碼

1801939

固氮菌生物肥料市場機會、成長動力、產業趨勢分析及2025-2034年預測Azotobacter-based Biofertilizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

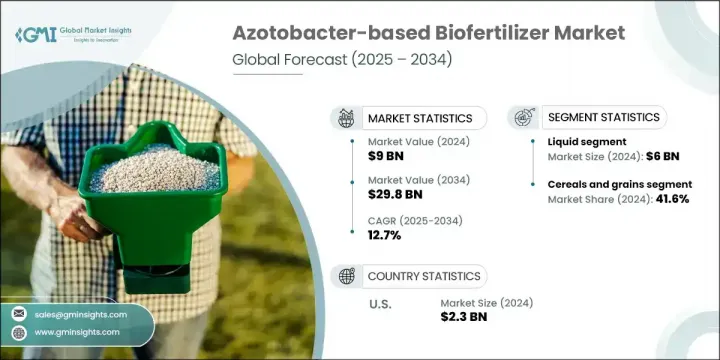

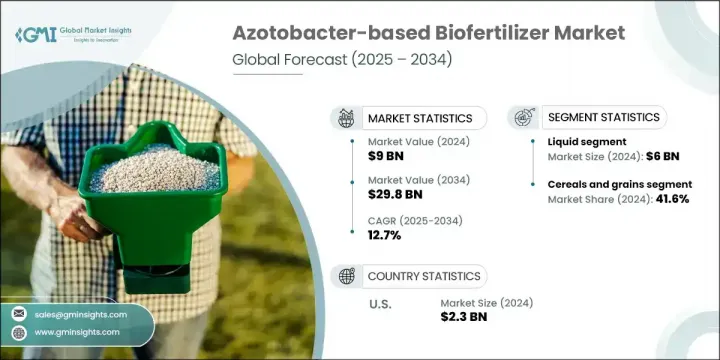

2024年,全球固氮菌生物肥料市場規模達90億美元,預計到2034年將以12.7%的複合年成長率成長,達到298億美元。這一快速成長的動力源於全球人口成長、對永續農業的日益重視以及向有機農業實踐的轉變。隨著人們對合成肥料有害影響的擔憂日益加深,農民正穩步轉向更環保的替代方案。消費者對無化學成分農產品的需求進一步推動了生物肥料的普及。各國政府也紛紛透過激勵計劃,積極推廣永續農業實踐,為生物肥料產業注入了新的動力。固氮菌產品尤其受到青睞,因為它們能夠自然地固定大氣中的氮,改善土壤質量,並促進植物生長——同時,它們還能最大限度地減少環境負擔,並且與傳統解決方案相比,是一種經濟高效的解決方案。

由於環境變化,基於固氮菌的生物肥料在性能一致性方面面臨挑戰。土壤pH值、溫度和水分含量等因素都會影響產量,當不同地區的產量波動時,農民可能會感到沮喪。保存期限短是另一個障礙,因為任何產品功效的損失都可能導致用戶體驗不佳,並在某些地區限制其採用,從而可能減緩其廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 90億美元 |

| 預測值 | 298億美元 |

| 複合年成長率 | 12.7% |

2024年,液體製劑市場規模達60億美元,憑藉其高效能施用、均勻覆蓋和易於操作的優勢佔據領先地位。這些特性使其成為首選,尤其適用於大規模農業經營。液體製劑與農業施用系統的兼容性進一步支持了其在多種農業環境中的廣泛應用。

2024年,穀物佔比41.6%,繼續保持作物類型中的最大佔有率。這一主導地位得益於全球對糧食安全日益成長的需求、政府支持的有機農業計劃,以及基於固氮菌的生物肥料在提高穀物和穀類作物產量方面的成熟功效。隨著人們對土壤健康的認知不斷提高,許多農民正在採用這些生物肥料,以實現永續發展目標,同時保持生產力。

2024年,美國固氮菌生物肥料市場規模達23億美元,這得益於現代農業技術、大力推廣有機農業以及成熟的農業部門。支持性監管框架和土壤保護意識的提升,持續推動美國固氮菌生物肥料的普及率。在加拿大,隨著越來越多人遵守環保實踐並重視永續農業,生物肥料市場正在快速成長。研究機構與關鍵參與者之間的合作正在推動新型高效產品品種的開發,並擴大固氮菌解決方案的使用範圍。

固氮菌生物肥料市場的主要參與者包括 Growtech Agri Science、Biotech International、KN BIO SCIENCES、Unisun Agro、IFFCO、Rizobacter、FARMADIL INDIA LLP、Green Vision Life Sciences、Gujarat State Fertilizers & Chemicals 和 Jaipur Bio Fertilizers。全球固氮菌生物肥料市場的公司正透過專注於產品創新、有針對性的合作和配方多樣化來擴大其市場佔有率。領先的公司正在投資研發,以開發適用於不同土壤和氣候條件的穩定、持久的生物肥料。與研究機構和大學的策略合作夥伴關係提高了產品性能和區域適應性。一些公司正在強調針對不同作物的客製化解決方案,並擴大其分銷網路以涵蓋服務不足的農業地區。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 液體

- 載體型(粉末或顆粒)

第6章:市場估計與預測:依作物類型,2021-2034

- 主要趨勢

- 穀物和穀類

- 油籽和豆類

- 水果和蔬菜

- 其他(包括經濟作物、纖維作物等)

第7章:市場估計與預測:按應用方法,2021-2034 年

- 主要趨勢

- 土壤處理

- 種子處理

- 葉面施肥

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 農民/耕種者

- 研究機構

- 農業合作社

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Biotech International

- FARMADIL INDIA LLP

- Green Vision Life Sciences

- Growtech Agri Science

- Gujarat State Fertilizers & Chemicals

- IFFCO

- Jaipur Bio Fertilizers

- KN BIO SCIENCES

- Rizobacter

- Unisun Agro

The Global Azotobacter-based Biofertilizer Market was valued at USD 9 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 29.8 billion by 2034. This rapid growth is being driven by the rising global population, increasing focus on sustainable farming, and a shift toward organic agricultural practices. As concerns around the harmful effects of synthetic fertilizers grow, farmers are steadily moving toward more eco-friendly alternatives. Consumers' demand for chemical-free produce is further encouraging the switch to biofertilizers. Governments are also stepping in to promote sustainable practices through incentive-based programs, creating momentum in the biofertilizer industry. Azotobacter-based products are particularly gaining traction as they naturally fix atmospheric nitrogen, enrich soil quality, and support plant development-all while minimizing the environmental burden and offering a cost-effective solution compared to conventional options.

Azotobacter-based biofertilizers face challenges around consistency in performance due to environmental variability. Factors such as soil pH, temperature, and moisture content influence outcomes and may discourage farmers when results fluctuate across different regions. Limited shelf life is another hurdle, as any loss in product efficacy can lead to poor user experience and restrained adoption in some areas, potentially slowing down widespread use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9 Billion |

| Forecast Value | $29.8 Billion |

| CAGR | 12.7% |

The liquid formulations segment generated USD 6 billion in 2024, holding a leading position due to their application efficiency, uniform coverage, and ease of handling. These attributes make them a preferred option, particularly for large-scale farming operations. Their compatibility with agricultural application systems further supports their widespread use across multiple farming environments.

The cereals and grains accounted for 41.6% share in 2024, maintaining the largest share by crop type. This dominance is supported by rising global demand for food security, government-backed organic farming initiatives, and the proven ability of azotobacter-based biofertilizers to improve grain and cereal crop yields. With growing awareness around soil health, many farmers are adopting these biofertilizers to meet sustainability goals while maintaining productivity.

U.S. Azotobacter-based Biofertilizer Market was valued at USD 2.3 billion in 2024, driven by modern agricultural techniques, a strong push toward organic farming, and a well-established farming sector. Supportive regulatory frameworks and heightened awareness around soil conservation continue to boost adoption rates across the country. In Canada, the market is growing rapidly with increasing adherence to environmentally responsible practices and an emphasis on sustainable agriculture. Collaboration between research organizations and key players is helping bring out new, efficient product variants and expanding the usage scope of azotobacter-based solutions.

Key participants in the Azotobacter-based Biofertilizer Market include Growtech Agri Science, Biotech International, K. N. BIO SCIENCES, Unisun Agro, IFFCO, Rizobacter, FARMADIL INDIA LLP, Green Vision Life Sciences, Gujarat State Fertilizers & Chemicals, and Jaipur Bio Fertilizers. Companies in the global azotobacter-based biofertilizer market are expanding their market presence by focusing on product innovation, targeted collaborations, and diversification of formulations. Leading players are investing in R&D to develop stable, long-lasting biofertilizers suitable for diverse soil and climate conditions. Strategic partnerships with research institutions and universities enhance product performance and regional adaptability. Several firms are emphasizing tailored solutions for different crops and expanding their distribution networks to reach under-served agricultural regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Crop type trends

- 2.2.3 Application method trends

- 2.2.4 End user trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid

- 5.3 Carrier-based (powder or granules)

Chapter 6 Market Estimates and Forecast, By Crop Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cereals and grains

- 6.3 Oilseeds and pulses

- 6.4 Fruits and vegetables

- 6.5 Others (including cash crops, fiber crops, etc.)

Chapter 7 Market Estimates and Forecast, By Application Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Soil treatment

- 7.3 Seed treatment

- 7.4 Foliar application

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Farmers/cultivators

- 8.3 Research institutions

- 8.4 Agricultural cooperatives

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Biotech International

- 10.2 FARMADIL INDIA LLP

- 10.3 Green Vision Life Sciences

- 10.4 Growtech Agri Science

- 10.5 Gujarat State Fertilizers & Chemicals

- 10.6 IFFCO

- 10.7 Jaipur Bio Fertilizers

- 10.8 K. N. BIO SCIENCES

- 10.9 Rizobacter

- 10.10 Unisun Agro