|

市場調查報告書

商品編碼

1797760

瀝青塗料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bituminous Coatings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

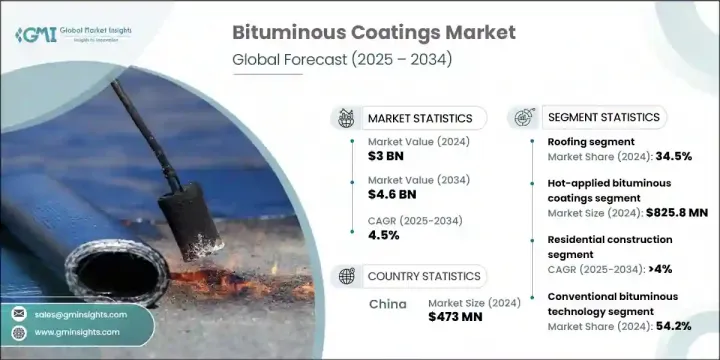

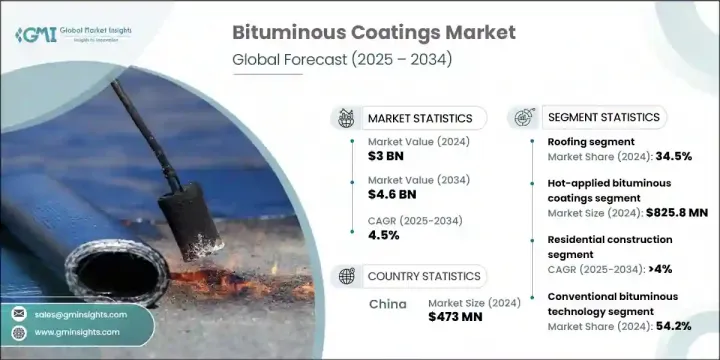

2024年,全球瀝青塗料市場規模達30億美元,預計到2034年將以4.5%的複合年成長率成長,達到46億美元。隨著時間的推移,該行業已從傳統的熱施瀝青系統過渡到更先進、更永續的塗料解決方案。歷史上,高溫塗料因其在大型基礎設施應用中能夠承受惡劣環境而備受青睞,但此後市場已轉向更高效、更環保的替代品。創新發揮了核心作用,製造商推出了乳液和熱塑性塑膠等增強配方,使其更易於施工,排放更低。

這種轉變很大程度上源於對適應現代建築需求的長效多功能塗料日益成長的需求。隨著永續性成為基礎設施發展的關鍵因素,市場正受益於持續的研發投入,以開發智慧、高效能的瀝青產品。聚合物改質瀝青 (PMB) 和冷塗乳液在城市和住宅項目中的應用日益增多,這直接反映了不斷變化的建築標準、安全隱患和氣候適應性。雖然熱塗塗料仍然是重防腐應用的首選,但新技術正在重塑全球多個地區的市場格局。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30億美元 |

| 預測值 | 46億美元 |

| 複合年成長率 | 4.5% |

熱塗瀝青塗料市場在2024年創造了8.258億美元的收入。這類塗料以其強大的附著力、耐潮性和超長的使用壽命而聞名,廣泛應用於隧道、地基和橋面等基礎設施項目,尤其是在易受機械磨損或極端天氣影響的環境中。其耐用性和成本效益使其成為土木工程領域可靠的解決方案,尤其是在北美和亞洲部分地區。

2024年,屋頂塗料市場佔有34.5%的佔有率。瀝青塗料因其防水、隔熱和抗紫外線損傷等特性而在該領域備受青睞。這些特性使其成為新建和翻新工程的理想選擇,尤其適用於平屋頂和低坡屋頂。其易於施工和價格實惠的特點進一步鞏固了其在住宅和商業建築中的主導地位。

2024年,中國瀝青塗料市場規模達4.73億美元,佔全球市場佔有率的40%。亞太地區是成長最快的市場,得益於交通、電信、衛生和電力基礎設施領域的大規模投資。受城市發展和政府支持大型計畫的推動,這項快速擴張持續推高了瀝青塗料的需求。越南、印尼和印度等國家基礎建設也呈現強勁勢頭,進一步推動了區域成長。

全球瀝青塗料市場的競爭格局涵蓋多家主要參與者,尤其是道達爾能源公司 (TotalEnergies SE)、埃克森美孚公司 (ExxonMobil Corporation)、巴斯夫公司 (BASF SE)、西卡公司 (Sika AG) 和尼納斯公司 (Nynas AB)。瀝青塗料市場的公司正在採取各種策略來鞏固其市場地位。產品創新是主要關注點,研發投資旨在開發環保配方,降低排放並保持耐用性。許多公司正在轉向冷施工和聚合物改質解決方案,以滿足不斷變化的環境和安全標準。與建築公司建立策略夥伴關係有助於提高產品的應用和分銷效率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 加大基礎建設投資和都市化

- 氣候變遷調適與極端天氣防護需求

- 能源效率和建築性能要求

- 維護和生命週期成本最佳化需求

- 產業陷阱與挑戰

- 原物料價格波動與成本壓力

- 環境法規和永續性要求

- 應用複雜性和熟練勞動力要求

- 來自替代防水技術的競爭

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 熱施工瀝青塗料

- 冷塗瀝青塗料

- 聚合物改質瀝青(PMB)塗料

- 瀝青乳液

- 自黏瀝青體系

- 生物基和永續瀝青塗料

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 屋頂

- 防水

- 道路和基礎設施

- 工業和防護塗料

- 專業應用

- 停車場塗料和交通承載

- 綠色屋頂系統與永續發展

- 運動設施及休閒場所

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅建築

- 單戶住宅

- 多戶住宅和公寓大樓

- 住宅翻新改造

- 商業建築

- 辦公大樓和商業房地產

- 零售和購物中心

- 飯店及娛樂設施

- 商業裝修及維護

- 工業建築

- 製造設施和工業廠房

- 倉儲和配送中心

- 能源和公用事業基礎設施

- 工業維護

- 基礎設施和公共工程

- 交通基礎設施和高速公路

- 水和廢水處理設施

- 政府大樓及公共設施

- 特殊最終用途

- 醫療機構和醫院

- 教育機構及學校建築

- 體育和娛樂設施

- 緊急情況和災難復原

第8章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 傳統瀝青技術

- 傳統瀝青基配方

- 標準應用方法與設備

- 先進的聚合物改質技術

- SBS(苯乙烯-丁二烯-苯乙烯)改質體系

- App(無規聚丙烯)改質技術

- 混合聚合物系統和先進配方

- 永續和生物基技術

- 生物瀝青和植物性替代品

- 再生材料整合與循環經濟解決方案

- 低揮發性有機化合物 (VOC) 和環保配方

- 智慧先進技術

- 自修復和自適應塗層技術

- 奈米科技增強配方

- 物聯網整合監控維護系統

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- BASF SE

- Carlisle Coatings & Waterproofing

- ExxonMobil Corporation

- GAF Materials Corporation

- Graco Inc.

- Johns Manville (Berkshire Hathaway)

- Nynas AB

- Owens Corning Corporation

- Polyglass USA, Inc

- Shell Global Solutions

- Sika AG

- SOPREMA Group

- Titan Tool Inc

- Total Energies SE

- Tremco Roofing and Building Maintenance

- Polyguard Products, Inc

- Sika AG

- Soprema Group

The Global Bituminous Coatings Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 4.6 billion by 2034. Over time, the industry has transitioned from traditional hot-applied bitumen systems to more advanced and sustainable coating solutions. Historically, high-temperature coatings were favored for their ability to withstand harsh environments in large infrastructure applications, but the market has since moved toward more efficient, environmentally friendly alternatives. Innovation has played a central role, with manufacturers introducing enhanced formulations like emulsions and thermoplastics that offer easier application and lower emissions.

This shift is largely driven by the increasing demand for long-lasting, versatile coatings that adapt to modern construction needs. As sustainability becomes a key factor in infrastructure development, the market is benefitting from continued investment in R&D to develop intelligent, high-performance bituminous products. The growing use of polymer-modified bitumen (PMB) and cold-applied emulsions in urban and residential projects is a direct response to changing construction standards, safety concerns, and climate adaptability. While hot-applied coatings remain a top choice for heavy-duty applications, newer technologies are reshaping the market dynamics across multiple global regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 4.5% |

The hot-applied bituminous coatings segment generated USD 825.8 million in 2024. Known for their strong adhesion, moisture resistance, and extended service life, these coatings are widely used in infrastructure projects like tunnels, foundations, and bridge decks, particularly in environments subject to mechanical wear or extreme weather. Their durability and cost-effectiveness continue to make them a reliable solution in civil engineering, especially in North America and parts of Asia.

The roofing segment held 34.5% share in 2024. Bituminous coatings are favored in this segment for their waterproofing capabilities, thermal insulation, and resistance to UV damage. These attributes make them ideal for both new construction and renovation projects, especially for flat and low-pitched roofs. Their ease of application and affordability contribute further to their dominance in both residential and commercial buildings.

China Bituminous Coatings Market generated USD 473 million and accounting for 40% share in 2024. The Asia Pacific region is the fastest-growing market, supported by massive investments in transport, telecommunications, sanitation, and power infrastructure. This rapid expansion-driven by urban growth and large-scale state-backed projects-continues to boost demand for bituminous coatings. Countries such as Vietnam, Indonesia, and India are also seeing strong momentum in infrastructure development, further fueling regional growth.

The competitive landscape of the Global Bituminous Coatings Market includes several major players, notably TotalEnergies SE, ExxonMobil Corporation, BASF SE, Sika AG, and Nynas AB. Companies in the bituminous coatings market are adopting a variety of strategies to reinforce their market position. A primary focus is on product innovation, with R&D investments targeted at creating eco-friendly formulations that lower emissions while maintaining durability. Many firms are transitioning toward cold-applied and polymer-modified solutions to meet changing environmental and safety standards. Strategic partnerships and collaborations with construction firms help improve product application and distribution efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End Use

- 2.2.5 Technology

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Infrastructure Investment and Urbanization

- 3.2.1.2 Climate Change Adaptation and Extreme Weather Protection Needs

- 3.2.1.3 Energy Efficiency and Building Performance Requirements

- 3.2.1.4 Maintenance and Lifecycle Cost Optimization Demands

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw Material Price Volatility and Cost Pressures

- 3.2.2.2 Environmental Regulations and Sustainability Requirements

- 3.2.2.3 Application Complexity and Skilled Labor Requirements

- 3.2.2.4 Competition from Alternative Waterproofing Technologies

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Hot-applied bituminous coatings

- 5.3 Cold-applied bituminous coatings

- 5.4 Polymer-modified bitumen (PMB) coatings

- 5.5 Bituminous emulsions

- 5.6 Self-adhesive bituminous systems

- 5.7 Bio-based and sustainable bituminous coatings

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Roofing

- 6.3 Waterproofing

- 6.4 Road and infrastructure

- 6.5 Industrial and protective coatings

- 6.6 Specialty applications

- 6.6.1 Parking deck coatings and traffic-bearing

- 6.6.2 Green roof systems and sustainable

- 6.6.3 Sports facility and recreational surface

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 Single-family housing

- 7.2.2 Multi-family housing and apartment complex

- 7.2.3 Residential renovation and retrofit

- 7.3 Commercial construction

- 7.3.1 Office buildings and commercial real estate

- 7.3.2 Retail and shopping center

- 7.3.3 Hospitality and entertainment facility

- 7.3.4 Commercial renovation and maintenance

- 7.4 Industrial construction

- 7.4.1 Manufacturing facilities and industrial plants

- 7.4.2 Warehouse and distribution center

- 7.4.3 Energy and utility infrastructure

- 7.5 Industrial maintenance

- 7.5.1 Infrastructure and public works

- 7.5.2 Transportation infrastructure and highway

- 7.5.3 Water and wastewater treatment facilities

- 7.5.4 Government buildings and public facilities

- 7.6 Specialty end use

- 7.6.1 Healthcare facilities and hospital

- 7.6.2 Educational institutions and school buildings

- 7.6.3 Sports and recreation facilities

- 7.6.4 Emergency and disaster recovery

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Conventional bituminous technology

- 8.2.1 Traditional asphalt-based formulations

- 8.2.2 Standard application methods and equipment

- 8.3 Advanced polymer-modified technology

- 8.3.1 SBS (styrene-butadiene-styrene) modification systems

- 8.3.2 App (atactic polypropylene) modification technologies

- 8.3.3 Hybrid polymer systems and advanced formulations

- 8.4 Sustainable and bio-based technology

- 8.4.1 Bio-bitumen and plant-based alternative

- 8.4.2 Recycled content integration and circular economy solutions

- 8.4.3 Low-voc and environmentally friendly formulations

- 8.5 Smart and advanced technology

- 8.5.1 Self-healing and adaptive coating technologies

- 8.5.2 Nanotechnology-enhanced formulations

- 8.5.3 IOT-integrated monitoring and maintenance systems

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Carlisle Coatings & Waterproofing

- 10.3 ExxonMobil Corporation

- 10.4 GAF Materials Corporation

- 10.5 Graco Inc.

- 10.6 Johns Manville (Berkshire Hathaway)

- 10.7 Nynas AB

- 10.8 Owens Corning Corporation

- 10.9 Polyglass U.S.A., Inc

- 10.10 Shell Global Solutions

- 10.11 Sika AG

- 10.12 SOPREMA Group

- 10.13 Titan Tool Inc

- 10.14 Total Energies SE

- 10.15 Tremco Roofing and Building Maintenance

- 10.16 Polyguard Products, Inc

- 10.17 Sika AG

- 10.18 Soprema Group

![中國瀝青市場評估:依類型[鋪路瀝青、氧化瀝青、聚合物改質瀝青、其他]、應用[道路建設、防水、黏合劑、其他]、地區、機會及預測(2018-2032)](/sample/img/cover/42/default_cover_mx.png)