|

市場調查報告書

商品編碼

1773462

改質瀝青市場機會、成長動力、產業趨勢分析及2025-2034年預測Modified Bitumen Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

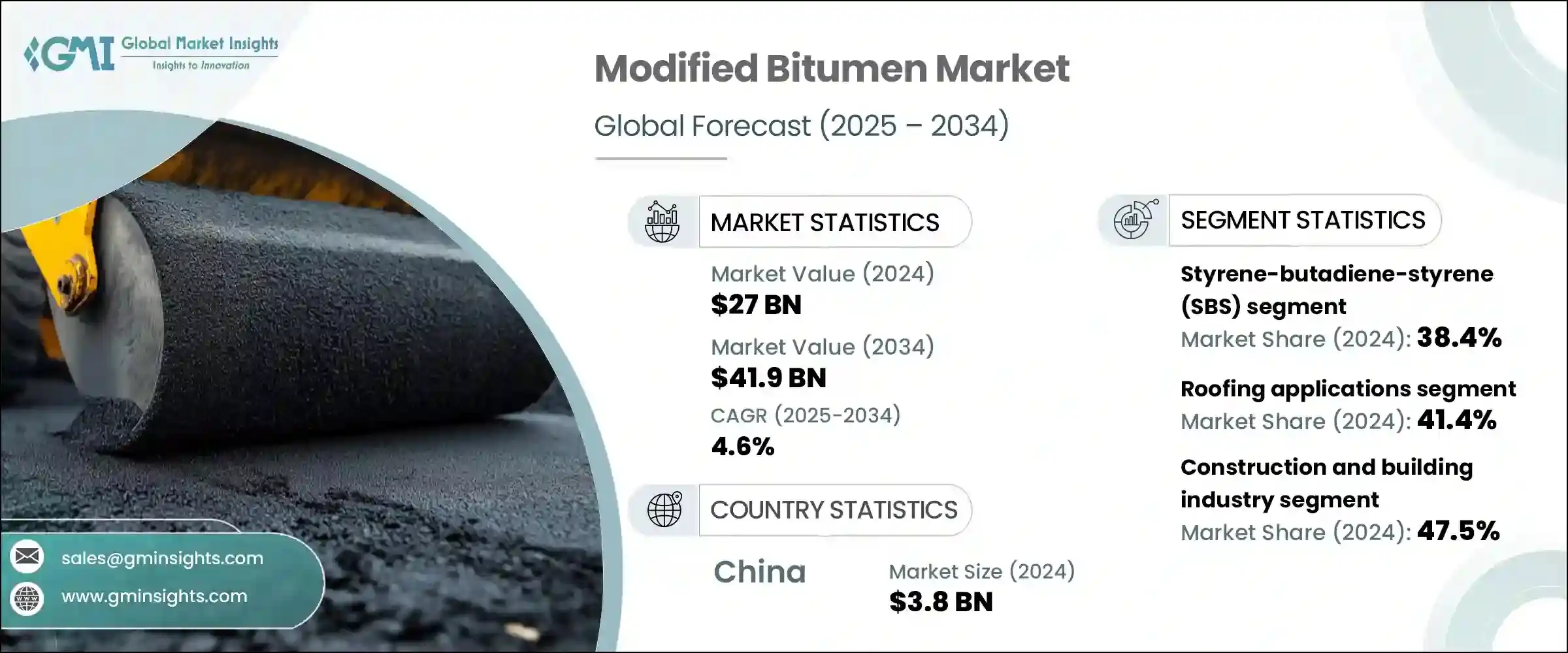

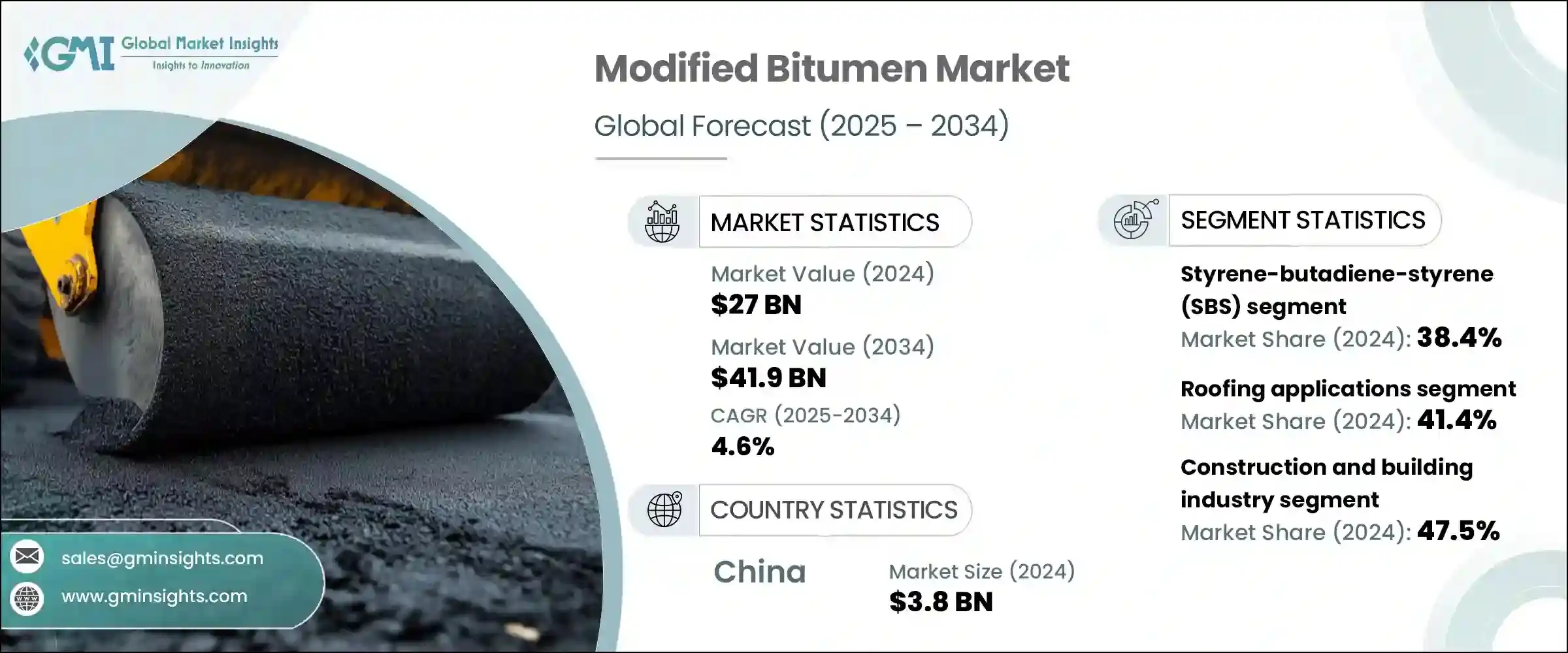

2024 年全球改質瀝青市場價值為 270 億美元,預計到 2034 年將以 4.6% 的複合年成長率成長至 419 億美元。隨著全球建築業將重點轉向高性能、耐用的屋頂和路面材料,對增強瀝青配方的需求正在穩步成長。對能夠承受惡劣環境條件的道路和基礎設施的需求日益成長,推動了具有更高彈性和耐久性的改性瀝青黏合劑的應用。對氣候適應性的日益重視也促使人們使用具有更好抗熱波動、開裂和氧化性能的瀝青變體。行業營運商擴大選擇聚合物改性替代品,以滿足高流量區域和惡劣天氣區域的性能要求。此外,人們對永續基礎設施發展的認知不斷提高,促使製造商生產符合環境標準並減少建築活動碳影響的材料。

世界許多地方的政府都在追求雄心勃勃的基礎設施建設目標,這促使煉油廠和瀝青生產商擴大其高性能瀝青的產能。公共和私營部門專案的材料選擇擴大受到氣候意識工程標準和生命週期成本評估的指導。改質瀝青在極端條件下保持性能的能力使其成為要求長期價值和低維護成本項目的首選。黏合劑化學領域的創新促進了聚合物配方的開發,這些配方具有更高的彈性、卓越的溫度穩定性和更高的抗紫外線性能。這些特性延長了路面和屋頂系統的使用壽命,並有助於提高基礎設施投資的整體成本效益。因此,在對現代永續建築實踐不斷增加的投資的支持下,改質瀝青正成為長期交通和城市發展規劃中不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 270億美元 |

| 預測值 | 419億美元 |

| 複合年成長率 | 4.6% |

旨在減少排放和促進建築投入循環利用的嚴格監管轉變也推動了市場的成長。隨著各國政府加強綠建築認證並鼓勵氣候適應型城鎮化,摻入再生橡膠或低排放聚合物等環保材料的改質瀝青混合料正日益受到青睞。聚合物改質品種特別突出,對兼顧性能與永續性目標的方案的需求激增。研究工作持續關注混合相容性、低溫鋪路解決方案和減碳添加劑,所有這些都反映了環境因素對材料選擇日益成長的影響。在這種不斷變化的情況下,製造商正在透過重新設計兼具高性能和環保性的配方來應對,使其能夠在符合永續性框架的同時滿足更廣泛的基礎設施需求。

在市面上使用的各種改質劑中,苯乙烯-丁二烯-苯乙烯 (SBS) 因其增強彈性、抗疲勞性和耐溫性而繼續佔據主導地位。這些特性使 SBS 改質黏合劑特別適用於溫度變化頻繁或車輛負載較重的嚴苛環境。 SBS 改質可顯著提高表面耐久性,減少變形和開裂,最終延長道路和屋頂系統的使用壽命。其優異的機械性能使其成為新建和翻新項目的首選,這也解釋了其在不同區域市場中佔據的強勁地位。

改質瀝青依應用領域可分為道路建設和鋪路、屋頂、防水和密封以及工業和特殊用途。受耐候節能建築材料需求不斷成長的推動,2024年屋頂應用佔據全球市場佔有率的41.4%。 SBS和無規聚丙烯(APP)在屋頂防水卷材中的使用增強了其柔韌性和抗紫外線分解性能,使其成為現代城市建築的理想選擇。商業和住宅建築的穩定成長,尤其是在快速城市化地區,推動了屋頂系統向這些先進材料的轉變。增強的隔熱性能和對更嚴格建築規範的合規性,使得改性屋頂防水卷材在已開發經濟體和發展中經濟體都越來越受歡迎。

生產技術也會影響產品品質和適應性。間歇式製程仍廣泛用於生產聚合物改質瀝青,尤其適用於客製化量或配方,這些配方必須符合特定的性能標準(例如黏度或彈性)。這種方法使生產商能夠更靈活地回應不同的區域要求和特殊專案需求。對於需要調整配方的研發應用或小批量專案尤其有利。

亞太地區在全球改性瀝青市場持續保持領先地位,這得益於強勁的建築活動、不斷成長的交通投資以及不斷擴張的城市擴張。該地區各國正大力投資基礎設施升級和新開發項目,推動對性能改質路面材料的持續需求。政府支持的措施以及越來越多的大型交通和住房計畫進一步增強了該地區市場的成長勢頭,而這些計畫都依賴高品質、高韌性的投入。

全球市場的主要參與者包括殼牌全球、道達爾能源公司、埃克森美孚公司、尼納斯公司和科騰公司。這些公司憑藉其豐富的SBS、APP和混合改質產品組合,保持著強大的市場地位,這些產品專為不同的環境和交通狀況而設計。他們在產品配方、技術支援和供應可靠性方面的專業知識,使其成為大型基礎設施和工業項目的首選供應商。這些公司還透過開發生物基因改造劑、再生材料相容性以及旨在減少環境影響的下一代黏合劑,引領著永續發展的轉變。透過持續的研發和對低碳創新的關注,這些公司持續塑造改質瀝青技術的未來,同時滿足全球對耐用、耐氣候材料的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 基礎建設和城市化成長

- 氣候適應力和極端天氣適應

- 永續發展要求和環境法規

- 效能增強和生命週期成本最佳化

- 產業陷阱與挑戰

- 初始成本高且經濟障礙多(溢價 60-70%)

- 儲存穩定性和處理複雜性

- 熟練的安裝勞動力有限

- 原物料價格波動和供應鏈依賴性

- 市場機會

- 新興市場和基礎設施投資計劃

- 生物基和再生聚合物整合

- 智慧基礎設施和物聯網整合

- 抗災建設要求

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按聚合物改質劑類型,2021 - 2034 年

- 主要趨勢

- 苯乙烯-丁二烯-苯乙烯(SBS)改質瀝青

- SBS聚合物等級和規格

- 無規聚丙烯(APP)改質瀝青

- 乙烯醋酸乙烯酯 (EVA) 改質瀝青

- 熱塑性彈性體 (TPE) 和其他改質劑

- 生物基和再生聚合物改質劑

- 混合和多聚合物體系

- SBS-APP組合產品

- 聚合物-橡膠混合改質

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 屋頂應用

- 低坡度和平屋頂系統

- 商業和工業建築應用

- 多層系統配置和效能

- 陡坡屋頂應用

- 住宅屋頂

- 底層和冰壩保護

- 木瓦和瓷磚整合系統

- 低坡度和平屋頂系統

- 道路建設和鋪設

- 高速公路和州際應用

- 城市和市政道路系統

- 城市街道和主幹道應用

- 交叉口和高應力區解決方案

- 維護和修復項目

- 機場和工業鋪路

- 防水和密封應用

- 地下防水系統

- 地基和地下室應用

- 隧道及地下結構防護

- 橋面及基礎設施防水

- 地上防水解決方案

- 廣場甲板和陽台系統

- 綠色屋頂和花園應用

- 停車結構與平台保護

- 地下防水系統

- 工業和專業應用

- 黏合劑和密封劑

- 塗層和保護系統

- 管道塗層和防腐保護

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 建築業

- 住宅建築市場

- 單戶住宅及多戶住宅

- 翻新和改造項目

- 能源效率和綠建築要求

- 商業建築領域

- 辦公大樓和零售中心

- 醫療保健和教育設施

- 飯店及娛樂場所

- 工業建築應用

- 製造和加工設施

- 倉儲和配送中心

- 資料中心和技術基礎設施

- 住宅建築市場

- 交通基礎設施

- 公路和道路基礎設施

- 州際公路系統維護

- 州和地方公路網

- 橋樑和立體交叉建設

- 機場基礎建設發展

- 跑道和航站樓擴建項目

- 貨運設施開發

- 港口和海洋基礎設施

- 貨櫃碼頭及碼頭建設

- 海岸防護和海堤項目

- 公路和道路基礎設施

- 能源和公用事業部門

- 發電設施

- 太陽能發電場和風能基礎設施

- 傳統發電廠維護

- 石油和天然氣基礎設施

- 煉油廠及加工設施應用

- 管道和儲罐保護

- 水和廢水處理

- 處理廠基礎設施

- 水庫及儲存設施防水

- 發電設施

- 政府和公共基礎設施

- 聯邦和州政府項目

- 市政和地方政府申請

- 軍事和國防基礎設施

- 私人和專業市場

- 體育和娛樂設施

- 農業和農村基礎設施

- 採礦和採礦業

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- CertainTeed Corporation

- Colas Group

- Dynasol Group

- Ergon Inc.

- ExxonMobil Corporation

- Johns Manville

- Kraton Corporation

- LG Chem Ltd

- MBTechnology

- Nynas AB

- Polyglass USA, Inc

- Shell Global

- Siplast (Icopal Group)

- TotalEnergies SE

- Versalis SpA

The Global Modified Bitumen Market was valued at USD 27 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 41.9 billion by 2034. The demand for enhanced bitumen formulations is steadily rising as the construction sector worldwide shifts focus toward high-performance, long-lasting materials for both roofing and paving. The increasing necessity for roads and infrastructure that can withstand harsh environmental conditions has fueled the adoption of modified binders with improved resilience and durability. A growing emphasis on climate adaptability has also prompted the use of bitumen variants that offer better resistance to thermal fluctuations, cracking, and oxidation. Industry operators are increasingly selecting polymer-modified alternatives to meet the performance requirements of high-traffic areas and challenging weather zones. In addition, growing awareness around sustainable infrastructure development is motivating manufacturers to produce materials that align with environmental standards and reduce the carbon impact of construction activities.

Governments in many parts of the world are pursuing ambitious infrastructure goals, prompting refiners and bitumen producers to expand their capacity for high-performance grades. Material choices in public and private sector projects are increasingly guided by climate-conscious engineering standards and lifecycle cost assessments. Modified bitumen's capacity to retain performance under extreme conditions has made it a preferred option for projects demanding long-term value and lower maintenance. Innovations in binder chemistry have contributed to the development of polymer formulations that exhibit improved elasticity, superior temperature stability, and higher UV resistance. These characteristics extend the life of pavements and roofing systems and contribute to the overall cost-efficiency of infrastructure investments. As a result, the material is becoming integral to long-term transportation and urban development plans, supported by rising investment in modern, sustainable construction practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27 Billion |

| Forecast Value | $41.9 Billion |

| CAGR | 4.6% |

The market's growth is also supported by stringent regulatory shifts aimed at reducing emissions and promoting circularity in construction inputs. Modified bitumen blends incorporating eco-conscious materials-such as recycled rubber or low-emission polymers-are gaining traction as governments enforce green building certifications and encourage climate-resilient urbanization. Polymer-modified variants are especially prominent, with demand surging for options that balance performance with sustainability goals. Research efforts continue to focus on blending compatibility, low-temperature paving solutions, and carbon-reducing additives, all of which reflect the growing influence of environmental considerations on material selection. In this evolving landscape, manufacturers are responding by reengineering formulations that are both high performing and eco-friendly, allowing them to cater to a broader range of infrastructure needs while complying with sustainability frameworks.

Among the various modifiers used in the market, Styrene-Butadiene-Styrene (SBS) continues to dominate due to its ability to enhance elasticity, fatigue resistance, and temperature tolerance. These properties make SBS-modified binders particularly suitable for demanding environments with frequent temperature changes or heavy vehicular load. SBS modifications significantly improve surface durability by reducing deformation and cracking, ultimately extending the service life of roads and roofing systems. Its mechanical performance makes it a preferred choice in both new construction and rehabilitation projects, which helps explain its strong presence across diverse regional markets.

Modified bitumen is segmented by application into road construction and paving, roofing, waterproofing and sealing, and industrial and specialty uses. Roofing applications accounted for 41.4% of the global market share in 2024, driven by increasing demand for weather-resistant and energy-efficient building materials. The use of SBS and Atactic Polypropylene (APP) in roofing membranes enhances flexibility and resistance to UV degradation, making them ideal for modern urban buildings. The steady rise in commercial and residential construction, especially in regions undergoing rapid urbanization, has supported the shift toward these advanced materials in roofing systems. Enhanced insulation properties and compliance with stricter building codes have made modified roofing membranes increasingly popular in both developed and developing economies.

Manufacturing techniques also influence product quality and adaptability. The batch process remains widely used for producing polymer-modified bitumen, particularly for customized volumes or formulations where specific performance criteria-such as viscosity or elasticity-must be met. This method allows producers to respond to varying regional requirements and specialty project demands with more flexibility. It is especially beneficial for R&D applications or lower-volume projects where formulation adjustments are necessary.

Asia Pacific continues to hold a leading position in the global modified bitumen market, driven by robust construction activity, growing investments in transportation, and rising urban expansion. Countries across the region are investing heavily in infrastructure upgrades and new development, driving consistent demand for performance-modified surfacing materials. The market's upward momentum in the region is reinforced by government-backed initiatives and a growing number of large-scale transport and housing projects, all of which rely on high-quality, resilient inputs.

Key players in the global market include Shell Global, TotalEnergies SE, ExxonMobil Corporation, Nynas AB, and Kraton Corporation. These companies maintain a strong presence through a wide-ranging portfolio of SBS, APP, and hybrid-modified products designed for varying environmental and traffic conditions. Their expertise in product formulation, technical support, and supply reliability positions them as preferred suppliers for large infrastructure and industrial projects. These firms are also leading the shift toward sustainability by developing bio-based modifiers, recycled content compatibility, and next-generation binders aimed at reducing environmental impact. Through ongoing R&D and a focus on low-carbon innovations, these companies continue to shape the future of modified bitumen technologies while meeting global demand for durable, climate-resilient materials.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Polymer modified type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development and urbanization growth

- 3.2.1.2 Climate resilience and extreme weather adaptation

- 3.2.1.3 Sustainability mandates and environmental regulations

- 3.2.1.4 Performance enhancement and lifecycle cost optimization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs and economic barriers (60-70% premium)

- 3.2.2.2 Storage stability and handling complexities

- 3.2.2.3 Limited skilled installation workforce

- 3.2.2.4 Raw material price volatility and supply chain dependencies

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets and infrastructure investment programs

- 3.2.3.2 Bio-based and recycled polymer integration

- 3.2.3.3 Smart infrastructure and IoT integration

- 3.2.3.4 Disaster-resilient construction requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Polymer Modifier Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Styrene-butadiene-styrene (SBS) modified bitumen

- 5.2.1 SBS polymer grades and specifications

- 5.3 Atactic polypropylene (APP) modified bitumen

- 5.4 Ethylene vinyl acetate (EVA) modified bitumen

- 5.5 Thermoplastic elastomers (TPE) and other modifiers

- 5.6 Bio-based and recycled polymer Modifiers

- 5.7 Hybrid and multi-polymer systems

- 5.7.1 SBS-APP combination products

- 5.7.2 Polymer-rubber hybrid modifications

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Roofing applications

- 6.2.1 Low-slope and flat roofing systems

- 6.2.1.1 Commercial and industrial building applications

- 6.2.1.2 Multi-ply system configurations and performance

- 6.2.2 Steep-slope roofing applications

- 6.2.2.1 Residential roofing

- 6.2.2.2 Underlayment and ice dam protection

- 6.2.2.3 Shingle and tile integration systems

- 6.2.1 Low-slope and flat roofing systems

- 6.3 Road construction and paving

- 6.3.1 Highway and interstate applications

- 6.3.2 Urban and municipal road systems

- 6.3.2.1 City street and arterial applications

- 6.3.2.2 Intersection and high-stress zone solutions

- 6.3.2.3 Maintenance and rehabilitation projects

- 6.3.3 Airport and industrial paving

- 6.4 Waterproofing and sealing applications

- 6.4.1 Below-grade waterproofing systems

- 6.4.1.1 Foundation and basement applications

- 6.4.1.2 Tunnel and underground structure protection

- 6.4.1.3 Bridge deck and infrastructure waterproofing

- 6.4.2 Above-grade waterproofing solutions

- 6.4.2.1 Plaza deck and balcony systems

- 6.4.2.2 Green roof and garden applications

- 6.4.2.3 Parking structure and podium deck protection

- 6.4.1 Below-grade waterproofing systems

- 6.5 Industrial and specialty applications

- 6.5.1 Adhesives and sealants

- 6.5.2 Coatings and protective systems

- 6.5.3 Pipe coating and corrosion protection

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Construction and Building Industry

- 7.2.1 Residential Construction Market

- 7.2.1.1 Single-Family and Multi-Family Housing

- 7.2.1.2 Renovation and Retrofit Projects

- 7.2.1.3 Energy Efficiency and Green Building Requirements

- 7.2.2 Commercial Construction Sector

- 7.2.2.1 Office Buildings and Retail Centers

- 7.2.2.2 Healthcare and Educational Facilities

- 7.2.2.3 Hospitality and Entertainment Venues

- 7.2.3 Industrial Construction Applications

- 7.2.3.1 Manufacturing and Processing Facilities

- 7.2.3.2 Warehousing and Distribution Centers

- 7.2.3.3 Data Centers and Technology Infrastructure

- 7.2.1 Residential Construction Market

- 7.3 Transportation Infrastructure

- 7.3.1 Highway and Road Infrastructure

- 7.3.1.1 Interstate Highway System Maintenance

- 7.3.1.2 State and Local Road Networks

- 7.3.1.3 Bridge and Overpass Construction

- 7.3.2 Airport Infrastructure Development

- 7.3.2.1 Runway and Terminal Expansion Projects

- 7.3.2.2 Cargo and Freight Facility Development

- 7.3.3 Port and Marine Infrastructure

- 7.3.3.1 Container Terminal and Wharf Construction

- 7.3.3.2 Coastal Protection and Seawall Projects

- 7.3.1 Highway and Road Infrastructure

- 7.4 Energy and Utilities Sector

- 7.4.1 Power Generation Facilities

- 7.4.1.1 Solar Farm and Wind Energy Infrastructure

- 7.4.1.2 Traditional Power Plant Maintenance

- 7.4.2 Oil and Gas Infrastructure

- 7.4.2.1 Refinery and Processing Facility Applications

- 7.4.2.2 Pipeline and Storage Tank Protection

- 7.4.3 Water and Wastewater Treatment

- 7.4.3.1 Treatment Plant Infrastructure

- 7.4.3.2 Reservoir and Storage Facility Waterproofing

- 7.4.1 Power Generation Facilities

- 7.5 Government and Public Infrastructure

- 7.5.1 Federal and State Government Projects

- 7.5.2 Municipal and Local Government Applications

- 7.5.3 Military and Defense Infrastructure

- 7.6 Private and Specialty Markets

- 7.6.1 Sports and Recreation Facilities

- 7.6.2 Agricultural and Rural Infrastructure

- 7.6.3 Mining and Extractive Industries

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 CertainTeed Corporation

- 9.2 Colas Group

- 9.3 Dynasol Group

- 9.4 Ergon Inc.

- 9.5 ExxonMobil Corporation

- 9.6 Johns Manville

- 9.7 Kraton Corporation

- 9.8 LG Chem Ltd

- 9.9 MBTechnology

- 9.10 Nynas AB

- 9.11 Polyglass U.S.A., Inc

- 9.12 Shell Global

- 9.13 Siplast (Icopal Group)

- 9.14 TotalEnergies SE

- 9.15 Versalis S.p.A