|

市場調查報告書

商品編碼

1797682

智慧寵物餵食器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Pet Feeder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

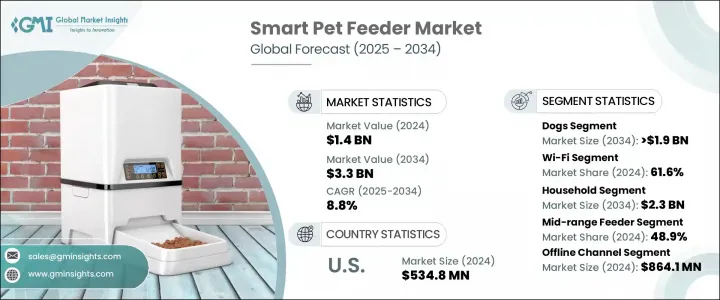

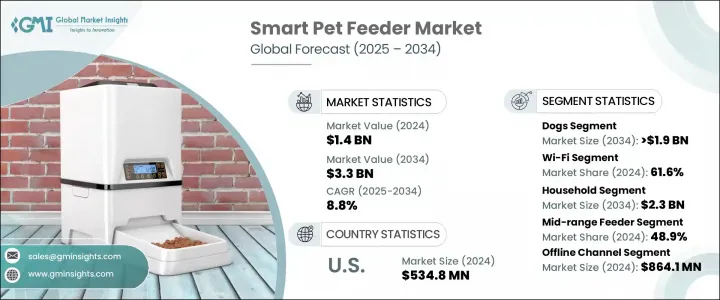

2024年,全球智慧寵物餵食器市場規模達14億美元,預計2034年將以8.8%的複合年成長率成長,達到33億美元。這一成長主要歸因於全球寵物擁有量的激增、可支配收入的提高,以及人們越來越傾向於將寵物視為家庭成員。年輕的寵物主人擴大將智慧科技融入寵物照護的日常中,以確保寵物的便利性、健康和合理的營養。能夠按預定時間間隔精準分配食物的自動餵食器越來越受歡迎,尤其是那些能夠連接手機應用程式、內建相機和語音功能的餵食器。

智慧家庭的蓬勃發展進一步激發了人們對連網寵物餵食解決方案的興趣,尤其是在消費者需要更多遠端控制和監控功能的情況下。電商平台正在大幅擴大這些產品的覆蓋範圍,協助其滲透成熟市場和發展中市場。這些設備配備了防堵塞分配器、防篡改蓋子和安全隔間,以保護食物並防止其他動物接觸,從而解決了污染和過度進食的問題。智慧餵食器高度重視自動化、安全性和使用者友善性,正迅速成為科技驅動寵物家庭的必備之選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 33億美元 |

| 複合年成長率 | 8.8% |

預計到2034年,貓咪餵食器市場的複合年成長率將達到9.2%,這得益於養貓人數的顯著成長以及人們對貓咪健康和營養的日益關注。貓主人正在積極尋求能夠有效分配和保存乾濕糧的自動化解決方案。專為貓咪設計的餵食器通常包含基於人工智慧的定時餵食、密封的儲藏室和冷藏功能,對於那些希望保持貓咪食物新鮮和規律餵食習慣的人來說,它們是一個實用的選擇。這些創新對於寵物主人可能長時間外出且需要可靠、定時餵食的家庭來說至關重要。

2024年,支援Wi-Fi的智慧餵食器佔據了市場主導地位,市場佔有率達61.6%,因為它們透過行動應用程式提供先進的遠端功能。這些餵食器允許寵物主人管理餵食時間、透過即時視訊監控寵物,並在任何有網路連線的地方調整餵食量。智慧型手機使用率的上升、家庭互聯互通的增強以及數位技術的日益普及,促使人們更傾向於選擇基於Wi-Fi的系統,而非藍牙或手動選項。這些解決方案能夠與更廣泛的智慧家庭生態系統無縫整合,對科技愛好者極具吸引力。

美國智慧寵物餵食器市場規模在2024年達到5.348億美元,高於2023年的4.993億美元。預計2025年至2034年期間,該市場的複合年成長率將達到8.6%,這得益於寵物飼養的普及、強大的數位基礎設施以及互聯寵物護理產品的快速普及。美國消費者尤其青睞創新的自動化解決方案,不僅能提供便利,還能提供更優質的動物照護。該地區擁有成熟的分銷網路、較高的可支配收入以及先進的獸醫醫療保健體系,所有這些都支持市場的持續成長。

全球智慧寵物餵食器市場的主要公司包括 Whisker、Dogness、PetSafe Brands、Tuya、Sure Petcare、Wopet、PETLIBRO、Geeni、小米、HONEYGUARDIAN、Pawbo、Aqara、Catit、Arf Pets、Okos Smart Pet Feeder 和 BeardPet。這些公司持續推動產品創新,以滿足日益成長的消費者需求。智慧寵物餵食器市場的領先公司正在大力投資產品創新,專注於增強功能,例如健康監測、即時視訊存取、AI 驅動的餵食演算法和語音整合。為了鞏固市場地位,各大品牌優先考慮無縫的行動應用介面以及與現有智慧家庭生態系統的兼容性。與電子商務平台和零售連鎖店的策略合作夥伴關係拓寬了產品的覆蓋範圍,同時公司也在強調以用戶為中心的設計和耐用的製造品質。許多公司正在使其產品組合多樣化,包括針對特定寵物需求(例如濕糧儲存或多寵物家庭)量身定做的餵食器。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有量不斷增加

- 不斷進步的技術

- 提高對寵物健康和營養的認知

- 產業陷阱與挑戰

- 對技術可靠性的擔憂

- 初始成本高

- 市場機會

- 拓展電子商務平台

- 與寵物食品品牌的合作

- 成長動力

- 成長潛力分析

- 監管格局

- 寵物數量統計

- 定價分析

- 技術進步

- 當前的技術趨勢

- 新興技術

- 消費者行為分析

- 差距分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

第5章:市場估計與預測:按寵物類型,2021 - 2034 年

- 主要趨勢

- 狗

- 貓

- 其他寵物類型

第6章:市場估計與預測:按連結類型,2021 - 2034 年

- 主要趨勢

- 藍牙

- 無線上網

- 其他連線類型

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 家庭

- 商業的

第8章:市場估計與預測:按價格區間,2021 年至 2034 年

- 主要趨勢

- 低成本餵料器

- 中程送料器

- 高階送料器

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上通路

- 線下通路

- 實體寵物店

- 實體大眾商店

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aqara

- Arf Pets

- BeardPet

- Catit (Rolf C Hagen)

- Dogness

- Geeni

- HONEYGUARDIAN

- Okos Smart Pet Feeder

- Pawbo

- Petlibro

- PetSafe Brands

- Sure Petcare (Merck)

- Tuya

- Whisker

- Wopet

- Xiaomi

The Global Smart Pet Feeder Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 3.3 billion by 2034. This growth is largely attributed to the surge in global pet ownership, paired with a rise in disposable income and a growing trend of treating pets as family members. Younger pet owners are increasingly integrating smart technologies into pet care routines to ensure convenience, wellness, and proper nutrition. Automated feeders that dispense food in accurate portions on scheduled intervals are gaining popularity, especially those with mobile app connectivity, built-in cameras, and voice functions.

The boom in smart home adoption has further driven interest in connected pet feeding solutions, especially as consumers demand more control and monitoring features from remote locations. E-commerce platforms are significantly enhancing the reach of these products, aiding their penetration into both mature and developing markets. These devices come equipped with anti-jam dispensers, tamper-resistant lids, and secure compartments to protect food and prevent access by other animals, addressing concerns of contamination and overeating. With a strong emphasis on automation, safety, and user-friendly features, smart feeders are fast becoming an essential addition to tech-driven pet households.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 8.8% |

The cat feeder segment is anticipated to register a CAGR of 9.2% through 2034, driven by a notable increase in cat ownership and a stronger focus on feline health and nutrition. Cat owners are actively seeking automated solutions that can efficiently portion and preserve both dry and wet food. Devices tailored for cats often incorporate AI-based schedules, sealed storage compartments, and refrigeration features, making them a practical option for those looking to maintain freshness and consistency in feeding routines. These innovations are becoming vital for households where pet owners may be away for extended periods and require reliable, scheduled feeding.

The Wi-Fi-enabled smart feeders dominated the market in 2024 with a share of 61.6%, as they offer advanced remote features through mobile applications. These feeders allow pet parents to manage feeding times, monitor pets via live video, and adjust meal portions from anywhere with internet access. The increase in smartphone usage, enhanced home connectivity, and rising adoption of digital technologies are driving preference for Wi-Fi-based systems over Bluetooth or manual options. These solutions offer seamless integration with broader smart home ecosystems, making them highly appealing to tech-savvy users.

United States Smart Pet Feeder Market generated USD 534.8 million in 2024, up from USD 499.3 million in 2023. This market is forecasted to grow at a CAGR of 8.6% from 2025 through 2034, fueled by widespread pet ownership, strong digital infrastructure, and the rapid uptake of connected pet care products. Consumers in the U.S. are particularly drawn to innovative, automated solutions that offer convenience and enhanced animal care. The region benefits from a mature distribution network, high disposable income, and an advanced veterinary healthcare system, all of which support sustained market growth.

Key companies operating in this Global Smart Pet Feeder Market include Whisker, Dogness, PetSafe Brands, Tuya, Sure Petcare, Wopet, PETLIBRO, Geeni, Xiaomi, HONEYGUARDIAN, Pawbo, Aqara, Catit, Arf Pets, Okos Smart Pet Feeder, and BeardPet. These players continue to push product innovations that cater to growing consumer demands. Leading companies in the smart pet feeder market are investing heavily in product innovation, focusing on enhanced features such as health monitoring, real-time video access, AI-driven feeding algorithms, and voice integration. To strengthen their foothold, brands are prioritizing seamless mobile app interfaces and compatibility with existing smart home ecosystems. Strategic partnerships with e-commerce platforms and retail chains have broadened product reach, while companies are also emphasizing user-centric design and durable build quality. Many players are diversifying their portfolios to include feeders tailored to specific pet needs, like wet food storage or multiple pet households.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Pet type trends

- 2.2.3 Connectivity type trends

- 2.2.4 Application trends

- 2.2.5 Price range trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership

- 3.2.1.2 Growing technological advancements

- 3.2.1.3 Increasing awareness for pet health & nutrition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Concerns for technical reliability

- 3.2.2.2 High initial costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding e-commerce platform

- 3.2.3.2 Partnerships with pet food brands

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pet population statistics

- 3.6 Pricing analysis

- 3.7 Technology advancement

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Consumer behavior analysis

- 3.9 Gap analysis

- 3.10 Future market trends

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

Chapter 5 Market Estimates and Forecast, By Pet Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dogs

- 5.3 Cats

- 5.4 Other pet types

Chapter 6 Market Estimates and Forecast, By Connectivity Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Bluetooth

- 6.3 Wi-Fi

- 6.4 Other connectivity types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Household

- 7.3 Commercial

Chapter 8 Market Estimates and Forecast, By Price Range, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Low-cost feeder

- 8.3 Mid-range feeder

- 8.4 High-end feeder

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Online channel

- 9.3 Offline channel

- 9.3.1 Physical pet store

- 9.3.2 Physical mass merchant store

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aqara

- 11.2 Arf Pets

- 11.3 BeardPet

- 11.4 Catit (Rolf C Hagen)

- 11.5 Dogness

- 11.6 Geeni

- 11.7 HONEYGUARDIAN

- 11.8 Okos Smart Pet Feeder

- 11.9 Pawbo

- 11.10 Petlibro

- 11.11 PetSafe Brands

- 11.12 Sure Petcare (Merck)

- 11.13 Tuya

- 11.14 Whisker

- 11.15 Wopet

- 11.16 Xiaomi