|

市場調查報告書

商品編碼

1773473

益生菌膳食補充劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Probiotics Based Dietary Supplement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

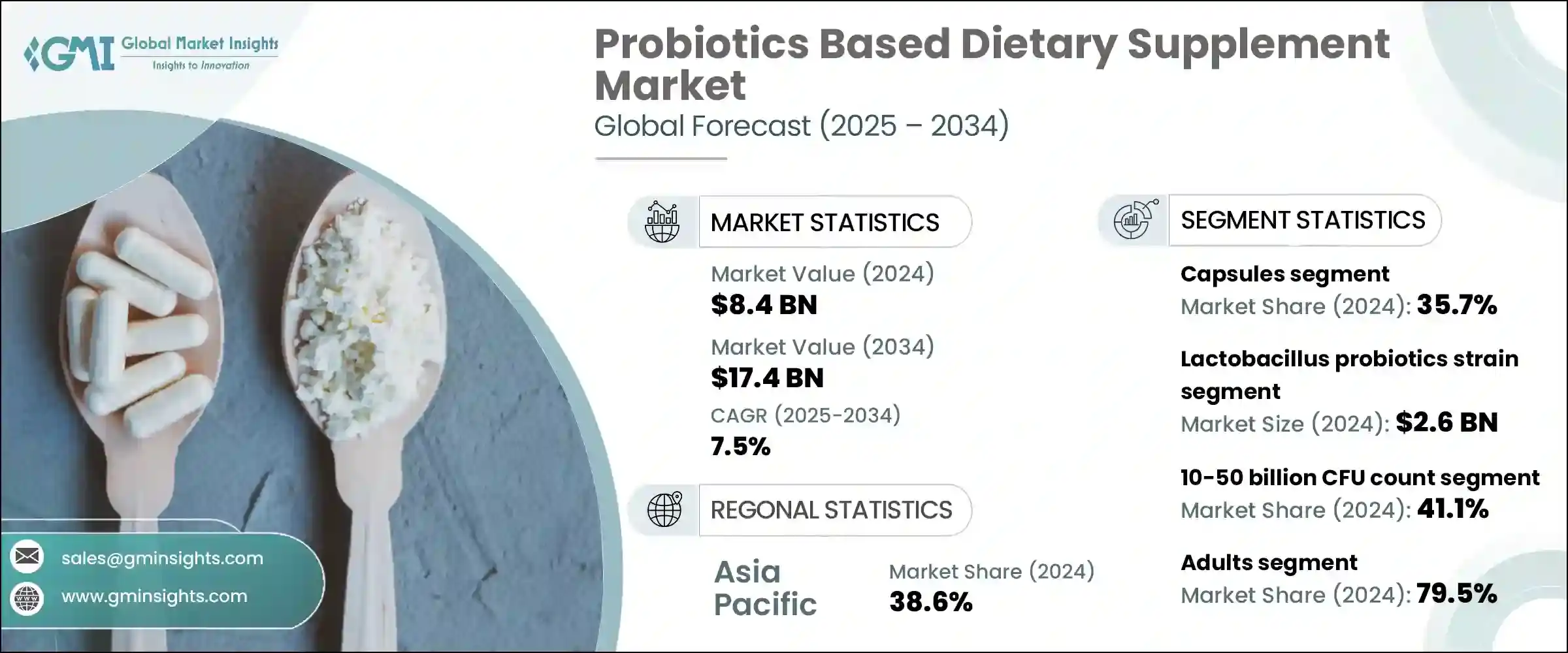

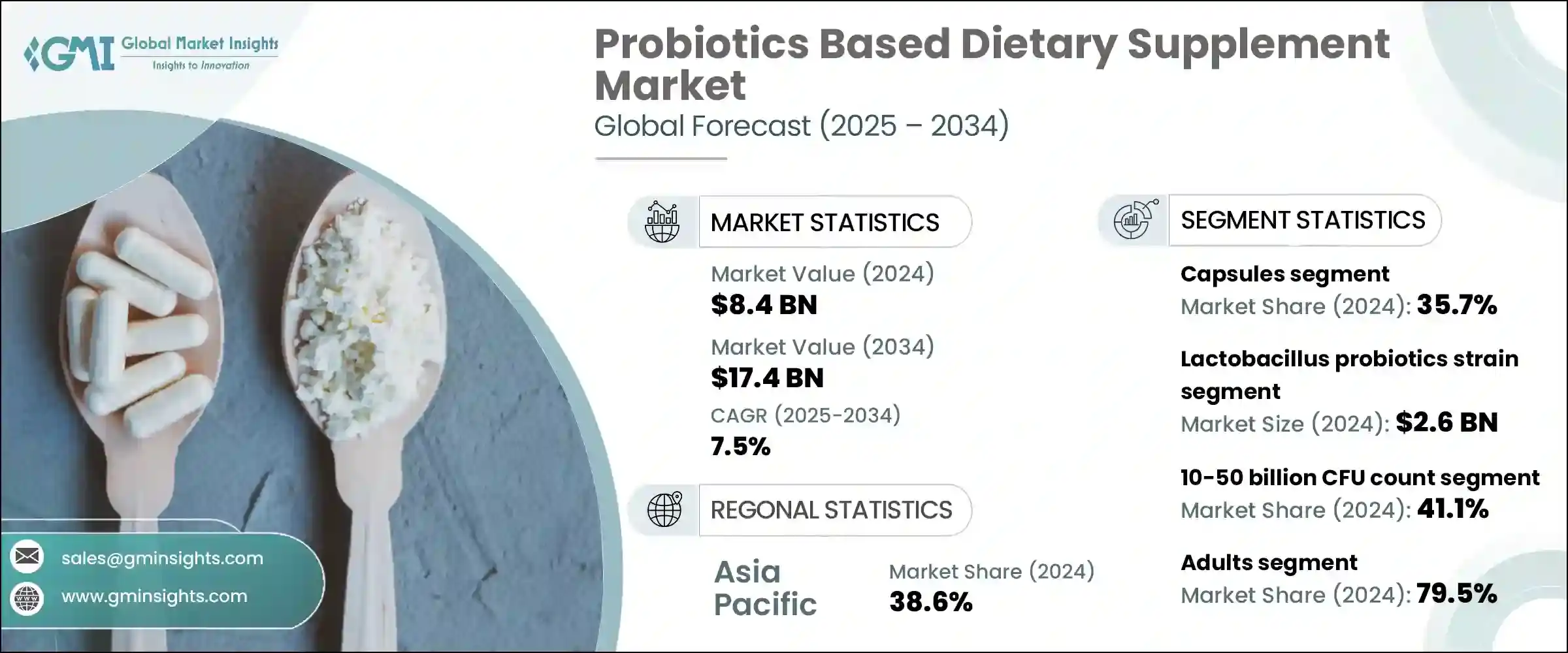

2024年,全球益生菌膳食補充劑市場規模達84億美元,預計複合年成長率為7.5%,到2034年將達到174億美元。這些補充劑採用乳酸桿菌、雙歧桿菌和釀酒酵母等活性菌株精製而成,有助於維持消化平衡、增強免疫力並改善腸腦健康。人們對消化健康、預防性保健和無過敏原產品的關注度不斷提高,刺激了市場需求。現今的消費者更青睞高菌落形成單位(CFU)、多菌株配方,以及軟糖和小袋裝等便利的包裝形式。益生菌在嬰兒、老年人和注重健康的成年人(尤其是在北美和亞太地區)中的應用日益廣泛,為臨床驗證、給藥系統和清潔標籤產品的創新創造了空間。

向無乳製品、注重透明度的產品和永續採購的轉變反映了健康意識和環保意識在營養領域的廣泛趨勢,將益生菌定位為預防性保健的核心支柱。消費者越來越嚴格地審查成分錶,要求符合道德價值和飲食限制的清潔標籤配方。這種行為轉變加速了對植物性和無過敏原益生菌補充劑的需求,促使品牌在非乳製品載體、天然香料和可生物分解包裝方面進行創新。隨著人們對腸道在免疫力、情緒和整體活力方面作用的認知不斷提高,益生菌不再被視為小眾補充劑,而是日常必需品。這種演變正在改變製造商的產品開發方式,使其具備可追溯性、環境責任以及根據現代生活方式量身定做的個人化健康效果。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 174億美元 |

| 複合年成長率 | 7.5% |

膠囊類產品佔市場主導地位,佔35.7%,2024年總額達30億美元。其成功源自於精準劑量、長保存期限和便利使用。素食、明膠和緩釋劑型滿足了消費者的多樣化需求,確保益生菌能夠承受胃酸侵蝕到達腸道。隨著個人化腸道健康方案日益受到關注,針對消化、免疫和心理健康量身定做的高菌落形成單位(CFU)膠囊產品尤其受到追捧。

乳酸桿菌菌株市場佔30.4%,2024年價值26億美元。這些經過臨床驗證的菌株,如嗜酸乳桿菌、鼠李糖乳桿菌和植物乳桿菌,以改善腸道菌叢、增強免疫力和緩解乳糖不耐症而聞名。它們對胃酸的耐受性強,無論單菌或多菌種混合都具有良好的適應性,這使得它們在無乳製品和純素益生菌產品中廣受歡迎,尤其是在北美和亞洲市場。

2024年,亞太地區益生菌膳食補充劑市場佔38.6%的市佔率。該地區的成長動力源於日益增強的消化和免疫健康意識、更高的乳糖不耐症發病率、城鎮化進程以及對功能性食品日益成長的需求。為了滿足消費者的需求,本地和國際品牌正在擴大零售業務和研發規模,提供無乳糖、植物性益生菌產品。政府主導的健康運動、日益壯大的中產階級以及發酵食品在該地區的熱度,都推動了益生菌的大規模普及。

全球主要創新者和經銷商包括養樂多株式會社 (Yakult Honsha Co., Ltd.)、BioGaia AB、雀巢公司 (Nestle SA)、達能公司 (Danone SA) 和科漢森控股公司 (Chr. Hansen Holding A/S)。領先的公司正在透過菌株多樣化和透明標籤來增強競爭優勢,以吸引注重健康和過敏原敏感的消費者。他們也投資臨床試驗,以驗證對腸腦、免疫和消化系統健康的功效。產品形式的創新——包括純素膠囊、緩釋產品、軟糖和粉末——正在擴大不同人群的可及性。各公司正在擴展電子商務管道和直接面對消費者的模式,同時與醫療保健專業人士和食品品牌建立合作夥伴關係,以提升信譽。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品形式,2021 - 2034 年

- 主要趨勢

- 膠囊

- 素食膠囊

- 明膠膠囊

- 緩釋膠囊

- 其他

- 平板電腦

- 咀嚼片

- 腸溶片

- 其他

- 粉末

- 單份小袋

- 散裝容器

- 其他

- 液體

- 鏡頭

- 掉落

- 其他

- 軟糖

- 明膠基

- 果膠基

- 其他

- 其他

第6章:市場估計與預測:按益生菌菌株,2021 - 2034 年

- 主要趨勢

- 乳酸桿菌

- 嗜酸乳桿菌

- 鼠李糖乳桿菌

- 植物乳酸桿菌

- 乾酪乳桿菌

- 羅伊氏乳桿菌

- 其他

- 雙歧桿菌

- 雙歧桿菌

- 長雙歧桿菌

- 乳酸雙歧桿菌

- 短雙歧桿菌

- 其他

- 鏈球菌

- 嗜熱鏈球菌

- 其他

- 芽孢桿菌

- 凝結芽孢桿菌

- 枯草桿菌

- 其他

- 酵母菌

- 布拉氏酵母菌

- 其他

- 多菌株配方

- 其他

第7章:市場估計與預測:按 CFU 計數,2021 - 2034 年

- 主要趨勢

- 低於10億CFU

- 10億至100億CFU

- 100-500億CFU

- 超過500億CFU

第8章:市場估計與預測:按消費者人口統計,2021 - 2034 年

- 主要趨勢

- 成年人

- 18-34歲

- 35-54歲

- 55歲以上

- 孩子們

- 嬰兒(0-2歲)

- 兒童(3-12歲)

- 青少年(13-17歲)

第9章:市場估計與預測:按健康應用,2021 - 2034 年

- 主要趨勢

- 消化健康

- 腸躁症(IBS)

- 發炎性腸道疾病(IBD)

- 抗生素相關腹瀉

- 其他

- 免疫健康

- 女性健康

- 體重管理

- 大腦健康

- 口腔健康

- 其他

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 零售藥局

- 健康與保健商店

- 超市和大賣場

- 網路零售

- 電子商務平台

- 品牌網站

- 網路藥局

- 直銷

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Chr. Hansen Holding A/S

- Danone SA (Activia, Actimel)

- Yakult Honsha Co., Ltd.

- Nestle SA (Garden of Life)

- Probi AB

- BioGaia AB

- Probiotics International Ltd (Protexin)

- Lallemand Inc.

- DuPont (IFF)

- Lifeway Foods, Inc.

- Morinaga Milk Industry Co., Ltd.

- Bifodan A/S

- Culturelle (i-Health, Inc.)

- Jarrow Formulas, Inc.

- NOW Foods

The Global Probiotics Based Dietary Supplement Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 17.4 billion by 2034. These supplements, crafted with live strains like Lactobacillus, Bifidobacterium, and Saccharomyces, support digestive balance, bolster immunity, and enhance gut-brain health. Rising awareness around digestive wellness, preventive health, and allergen-free options is spurring demand. Today's consumers are opting for high-CFU, multi-strain formulations, as well as convenient formats like gummies and sachets. Broadening use among infants, seniors, and health-conscious adults-especially across North America and Asia-Pacific-is creating space for innovations in clinical validation, delivery systems, and clean-label offerings.

The shift toward dairy-free, transparency-focused products and sustainable sourcing reflects a wider trend in health-conscious and eco-minded nutrition, positioning probiotics as a central pillar of preventive wellness. Consumers are increasingly scrutinizing ingredient lists, demanding clean-label formulations that align with ethical values and dietary restrictions. This behavioral shift is accelerating the demand for plant-based and allergen-free probiotic supplements, pushing brands to innovate with non-dairy carriers, natural flavorings, and biodegradable packaging. As awareness grows around the gut's role in immunity, mood, and overall vitality, probiotics are no longer viewed as niche supplements but rather as daily essentials. This evolution is transforming how manufacturers approach product development, with traceability, environmental responsibility, and personalized health outcomes tailored to modern lifestyles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $17.4 Billion |

| CAGR | 7.5% |

The capsule segment dominated the market with a 35.7% share, totaling USD 3 billion in 2024. Their success is due to precise dosage, long shelf-life, and ease of use. Vegetarian, gelatin, and delayed-release versions cater to diverse consumer needs, ensuring probiotics survive stomach acid to reach the gut. High-CFU capsule options tailored for digestion, immunity, and mental health are particularly sought after amid growing interest in personalized gut health regimens.

Lactobacillus strains segment made up 30.4% share, worth USD 2.6 billion in 2024. These clinically backed strains-such as L.acidophilus, L.rhamnosus, and L.plantarum-are known for improving gut flora, strengthening immunity, and aiding lactose intolerance. Their resilience against stomach acid and adaptability in both single- and multi-strain blends make them popular in dairy-free and vegan probiotic products, especially prevalent in North American and Asian markets.

Asia-Pacific Probiotics Based Dietary Supplement Market held a 38.6% share in 2024. Growth in this region is driven by increasing digestive and immune health awareness, higher lactose intolerance rates, urbanization, and rising demand for functional foods. Local and international brands are expanding their retail presence and R&D to meet consumer needs, offering lactose-free, plant-based probiotic options. Government-led wellness campaigns, a growing middle class, and the regional popularity of fermented foods are contributing to mass adoption.

Key global innovators and distributors include Yakult Honsha Co., Ltd., BioGaia AB, Nestle S.A., Danone S.A., and Chr. Hansen Holding A/S. Leading firms are sharpening their competitive edge through strain diversification and transparent labeling, appealing to health-conscious and allergen-sensitive consumers. They're also investing in clinical trials to validate gut-brain, immune, and digestive health claims. Format innovation-with vegan capsules, delayed-release options, gummies, and powders-is broadening access across demographics. Companies are expanding e-commerce channels and direct-to-consumer models while forming partnerships with healthcare professionals and food brands to boost credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Format, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Capsules

- 5.2.1 Vegetarian capsules

- 5.2.2 Gelatin capsules

- 5.2.3 Delayed-release capsules

- 5.2.4 Others

- 5.3 Tablets

- 5.3.1 Chewable tablets

- 5.3.2 Enteric-coated tablets

- 5.3.3 Others

- 5.4 Powders

- 5.4.1 Single-serve sachets

- 5.4.2 Bulk containers

- 5.4.3 Others

- 5.5 Liquids

- 5.5.1 Shots

- 5.5.2 Drops

- 5.5.3 Others

- 5.6 Gummies

- 5.6.1 Gelatin-based

- 5.6.2 Pectin-based

- 5.6.3 Others

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lactobacillus

- 6.2.1 L. acidophilus

- 6.2.2 L. rhamnosus

- 6.2.3 L. plantarum

- 6.2.4 L. casei

- 6.2.5 L. reuteri

- 6.2.6 Others

- 6.3 Bifidobacterium

- 6.3.1 B. bifidum

- 6.3.2 B. longum

- 6.3.3 B. lactis

- 6.3.4 B. breve

- 6.3.5 Others

- 6.4 Streptococcus

- 6.4.1 S. thermophilus

- 6.4.2 Others

- 6.5 Bacillus

- 6.5.1 B. coagulans

- 6.5.2 B. subtilis

- 6.5.3 Others

- 6.6 Saccharomyces

- 6.6.1 S. boulardii

- 6.6.2 Others

- 6.7 Multi-strain formulations

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By CFU Count, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Below 1 billion CFU

- 7.3 1-10 billion CFU

- 7.4 10-50 billion CFU

- 7.5 Above 50 billion CFU

Chapter 8 Market Estimates and Forecast, By Consumer Demographics, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Adults

- 8.2.1 18-34 Years

- 8.2.2 35-54 Years

- 8.2.3 55+ Years

- 8.3 Children

- 8.3.1 Infants (0-2 Years)

- 8.3.2 Children (3-12 Years)

- 8.3.3 Adolescents (13-17 Years)

Chapter 9 Market Estimates and Forecast, By Health Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Digestive health

- 9.2.1 Irritable bowel syndrome (IBS)

- 9.2.2 Inflammatory bowel disease (IBD)

- 9.2.3 Antibiotic-associated diarrhea

- 9.2.4 Others

- 9.3 Immune health

- 9.4 Women's health

- 9.5 Weight management

- 9.6 Brain health

- 9.7 Oral health

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Retail pharmacies

- 10.3 Health & wellness stores

- 10.4 Supermarkets & hypermarkets

- 10.5 Online retail

- 10.5.1 E-commerce platforms

- 10.5.2 Brand websites

- 10.5.3 Online pharmacies

- 10.6 Direct selling

- 10.7 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Chr. Hansen Holding A/S

- 12.2 Danone S.A. (Activia, Actimel)

- 12.3 Yakult Honsha Co., Ltd.

- 12.4 Nestle S.A. (Garden of Life)

- 12.5 Probi AB

- 12.6 BioGaia AB

- 12.7 Probiotics International Ltd (Protexin)

- 12.8 Lallemand Inc.

- 12.9 DuPont (IFF)

- 12.10 Lifeway Foods, Inc.

- 12.11 Morinaga Milk Industry Co., Ltd.

- 12.12 Bifodan A/S

- 12.13 Culturelle (i-Health, Inc.)

- 12.14 Jarrow Formulas, Inc.

- 12.15 NOW Foods