|

市場調查報告書

商品編碼

1773425

鈦鋁化物 (TiAl) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Titanium Aluminides (TiAl) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

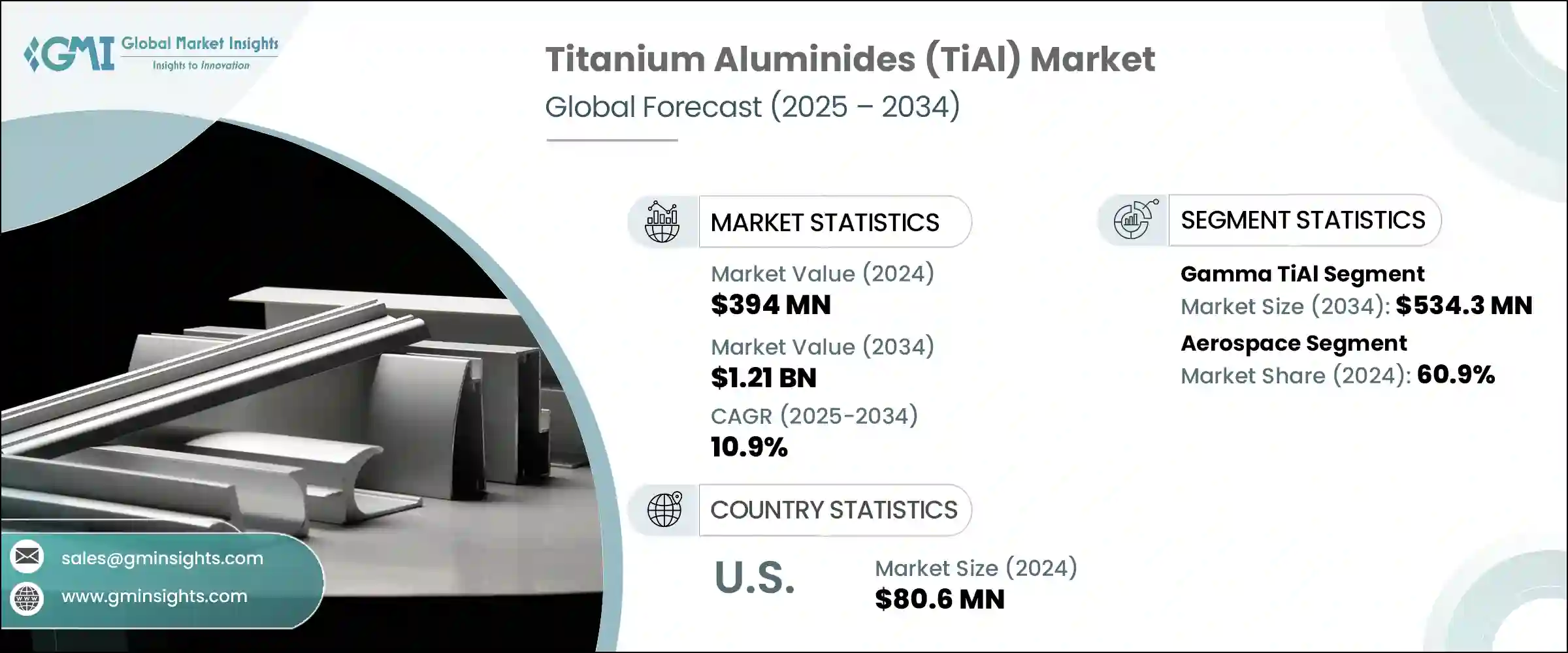

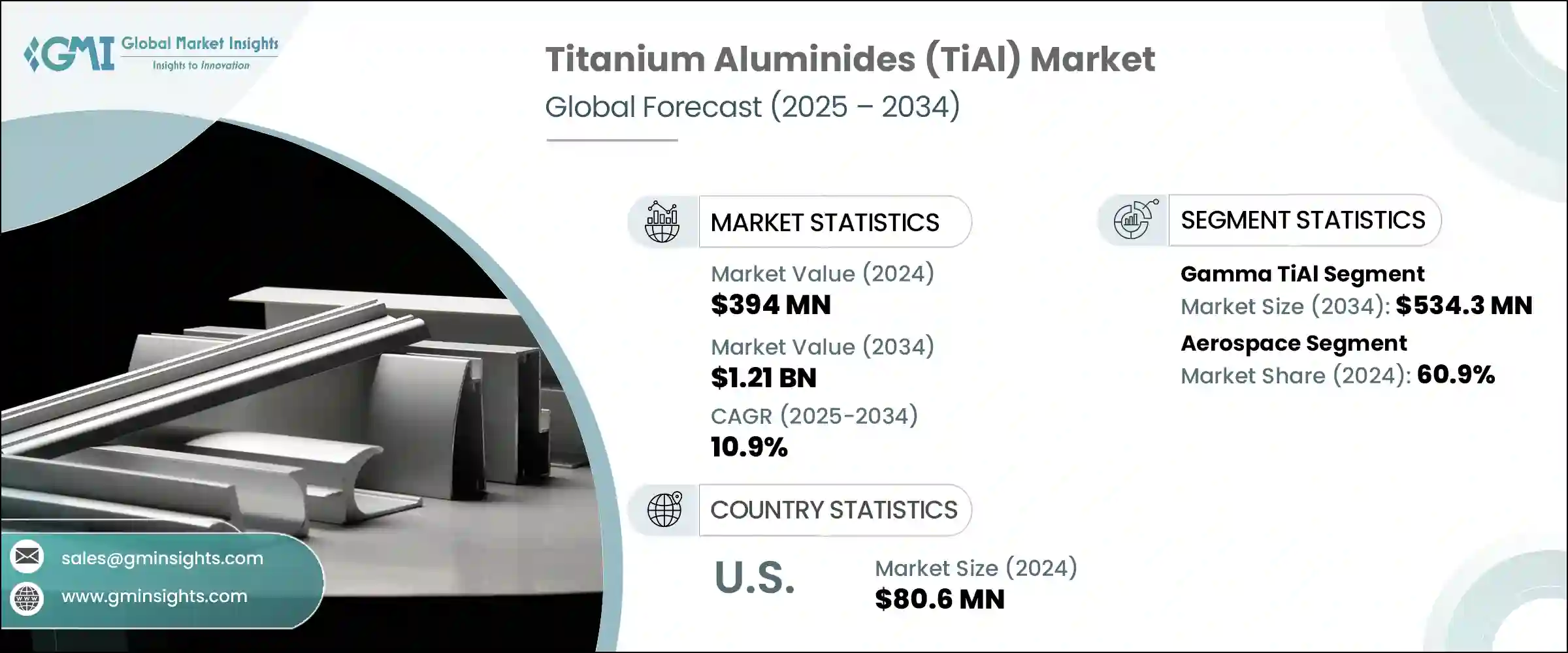

2024年,全球鈦鋁化物 (TiAl) 市場規模達3.94億美元,預計到2034年將以10.9%的複合年成長率成長,達到12.1億美元。鈦鋁化物卓越的機械性能推動了其需求的成長,尤其是在重量、耐熱性和耐用性至關重要的行業。鈦鋁化物比鋼鐵等傳統材料輕得多,在航太和汽車領域,透過降低整體重量和提高能源效率,展現出顯著優勢。其卓越的高溫性能使其能夠承受極端的熱應力和機械應力,使其成為飛機引擎零件和高性能汽車零件等應用的理想選擇。

對抗氧化、在應力下保持剛度並降低油耗的材料的需求,正在鞏固其在先進工程應用中的地位。隨著全球國防開支的增加以及汽車製造商轉向先進複合材料和更輕的結構,鈦鋁化物正獲得顯著發展。包括美國和印度在內的各國國防部門正在加大對技術和材料的投資,以提高性能,而鈦鋁化物滿足了這些發展所要求的高標準,尤其是在噴氣渦輪機和下一代推進系統方面。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.94億美元 |

| 預測值 | 12.1億美元 |

| 複合年成長率 | 10.9% |

鈦鋁化物憑藉其低密度、優異的抗蠕變性和出色的高溫強度等特性,成為許多高要求領域的頂級材料。鈦鋁化物能夠耐受高溫操作條件,並具有極強的抗腐蝕和抗氧化性能,尤其適用於航太結構、渦輪零件以及其他傳統合金無法勝任的應用。與傳統材料不同,鈦鋁化物不會為了減輕重量而犧牲強度,這種平衡使其在挑戰材料極限的環境中備受青睞。隨著全球日益重視交通運輸和國防領域的永續性、輕量化和效率,這些金屬間化合物的性能和可靠性將為製造商帶來競爭優勢。

2024年,γ-鈦鋁(Gamma TiAl)細分市場產值達1.771億美元,預計2034年將達到5.343億美元。這種特殊形態的鈦鋁化物因其在超過600°C的溫度下仍能保持機械完整性並抗氧化而備受青睞。 γ-鈦鋁合金是鎳基高溫合金的高性能替代品,特別適用於兼顧強度和重量的領域。由於在熱應力下表現出色,這些合金正逐漸取代渦輪引擎關鍵零件中的傳統金屬。隨著更節能、更輕量化的飛機平台的開發,γ-鈦鋁在高應力環境中的應用也日益增多,一些主要製造商已將其應用於渦輪葉片零件。

2024年,航太領域佔了60.9%的市場。航空引擎及相關零件對輕質耐熱材料的持續偏好推動了其廣泛應用。鈦鋁化物目前被用於渦輪葉片和其他經常暴露在高溫下的零件,從而減輕了飛機總重量並提高了燃油效率。其高模量、高溫強度維持率和較低的熱膨脹特性使其成為航太應用的理想選擇。隨著國防和商用航空領域對引擎性能和排放的更高要求,鈦鋁化物在材料創新中發揮著至關重要的作用。它們能夠在不影響性能的情況下承受惡劣環境,這使得它們在航空部件設計和製造中不可或缺,尤其是在材料故障不容許的情況下。

2024年,美國鈦鋁化物 (TiAl) 市場產值達8,060萬美元。作為全球主要的國防和航太設備出口國之一,美國在採用先進材料以提高飛機效率方面繼續保持領先地位。美國國內鈦產量一直保持成長,為新機身和引擎產量激增提供所需的原料。輕型、省油飛機型號的大量訂單正在影響材料的選擇,而鈦鋁化物與下一代機身中日益普及的碳纖維增強結構具有出色的兼容性。這種相容性支援該材料整合到新設計的平台中,這些平台的設計重點是強度重量比最佳化和降低燃料消耗。

鈦鋁化物 (TiAl) 市場表現優異的公司包括 Howmet 航太 Inc.、Precision Castparts Corp、KBM Affilips BV、VSMPO-AVISMA Corporation 和 ATI。這些公司在開發滿足多個終端應用領域特定性能要求的先進合金方面處於領先地位。鈦鋁化物市場的公司正在加強研發力度,以改善合金成分,從而提高熱穩定性和可製造性。

各企業正在對先進的鑄造、鍛造和積層製造技術進行戰略投資,以生產機械性能更強的複雜零件。此外,各企業也與航太原始設備製造商 (OEM) 和國防承包商結盟,以確保長期供應合約並簡化創新週期。此外,全球市場領導者正在擴大產能並進行垂直整合,以確保原料供應和品質控制。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依類型,2021-2034

- 主要趨勢

- γ-TiAl

- Alpha2-Ti3Al(α2-Ti3Al)

- 正交 Ti2AlNb(O-Ti2AlNb)

- BETA型(BETA-TiAl)

- 其他

第6章:市場規模及預測:依製造程序,2021-2034

- 主要趨勢

- 錠冶金學

- 真空電弧重熔(VAR)

- 電子束熔煉(EBM)

- 等離子弧熔煉(PAM)

- 真空感應熔煉(VIM)

- 粉末冶金

- 氣體霧化

- 等離子旋轉電極製程(PREP)

- 機械合金化

- 積層製造

- 粉末床熔合(PBF)

- 直接能量沉積(DED)

- 其他

- 其他

第7章:市場規模及預測:依應用,2021-2034

- 主要趨勢

- 航太

- 低壓渦輪葉片

- 高壓壓縮機葉片

- 結構部件

- 其他

- 汽車

- 渦輪增壓器葉輪

- 閥門

- 排氣系統

- 其他

- 工業的

- 瓦斯渦輪機

- 化學加工設備

- 其他

- 醫療的

- 植入物

- 手術器械

- 其他

- 其他

第 8 章:市場規模與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 航太與國防

- 商業航空

- 軍事航空

- 空間應用

- 汽車

- 搭乘用車

- 商用車

- 賽車和高性能車輛

- 工業的

- 發電

- 化學加工

- 石油和天然氣

- 其他

- 衛生保健

- 骨科植入物

- 牙科應用

- 其他

- 其他

第9章:市場規模及預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- ATI

- VSMPO-AVISMA Corporation

- Precision Castparts

- Howmet Aerospace

- KBM Affilips

- GfE Metalle und Materialien

- AMG Advanced Metallurgical Group

- Alcoa Corporation

- Western Superconducting Technologies

- Carpenter Technology Corporation

- American Elements

- Toho Titanium

- Titanium Metals Corporation

- Stanford Advanced Materials

- Aerospace Alloys

- 6K

- Arconic Corporation

- Daido Steel

- Kobe Steel

The Global Titanium Aluminides (TiAl) Market was valued at USD 394 million in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 1.21 billion by 2034. Rising demand is driven by the material's exceptional mechanical properties, especially in industries where weight, heat resistance, and durability are critical. Titanium aluminides are far lighter than conventional materials like steel, offering significant advantages in the aerospace and automotive sectors by reducing overall weight and improving energy efficiency. Their superior high-temperature performance enables them to withstand extreme thermal and mechanical stress, making them ideal for applications like aircraft engine parts and high-performance automotive components.

The need for materials that resist oxidation, maintain stiffness under stress, and lower fuel consumption is reinforcing their position in advanced engineering applications. With global defense spending on the rise and automotive manufacturers turning to advanced composites and lighter structures, titanium aluminides are gaining significant ground. The defense sectors in countries including the U.S. and India are experiencing increased investment in technology and materials to enhance performance, and titanium aluminides meet the high standards demanded by these developments, especially in jet turbines and next-gen propulsion systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $394 Million |

| Forecast Value | $1.21 Billion |

| CAGR | 10.9% |

The properties of titanium aluminides such as low density, excellent creep resistance, and outstanding high-temperature strength, are turning them into top-performing materials in multiple demanding fields. Their ability to endure elevated operating conditions, coupled with high corrosion and oxidation resistance, makes them especially suited for aerospace structures, turbine components, and other applications where conventional alloys fall short. Unlike traditional materials, titanium aluminides do not compromise strength for weight, and that balance makes them highly desirable in environments that push material limits. With a rising global emphasis on sustainability, lightweight, and efficiency in both transportation and defense, the performance and reliability of these intermetallic compounds offer manufacturers a competitive advantage.

In 2024, the Gamma TiAl segment generated USD 177.1 million and is forecasted to reach USD 534.3 million by 2034. This specific form of titanium aluminide is highly sought after for its ability to retain mechanical integrity and resist oxidation at temperatures exceeding 600°C. Gamma TiAl alloys offer a high-performance alternative to nickel-based superalloys, particularly in applications where both strength and weight-saving are essential. These alloys are increasingly replacing traditional metals in critical turbine engine parts due to their impressive stability under thermal stress. The push to develop more energy-efficient and lightweight aircraft platforms has elevated the use of gamma TiAl in high-stress environments, with several major manufacturers incorporating it into turbine blade components.

The aerospace segment held a 60.9% share in 2024. The continued preference for lightweight yet heat-resistant materials in aircraft engines and related components has driven widespread adoption. Titanium aluminides are now being used in turbine blades and other parts that face constant exposure to high temperatures, reducing total aircraft weight and improving fuel efficiency. Their high modulus, strength retention under heat, and lower thermal expansion properties make them ideal for aerospace applications. As the defense and commercial aviation sectors demand higher engine performance and lower emissions, titanium aluminides play a critical role in material innovation. Their capacity to withstand harsh environments without compromising performance makes them indispensable in aviation component design and manufacturing, especially where material failure is not an option.

United States Titanium Aluminides (TiAl) Market generated USD 80.6 million in 2024. As one of the major global exporters of defense and aerospace equipment, the country continues to lead in adopting advanced materials that boost aircraft efficiency. Domestic titanium production has kept pace with demand, supplying the raw materials required for the surge in new airframe and engine production. High-volume orders for lighter, fuel-efficient aircraft models are influencing material choices, and titanium aluminides offer superior compatibility with carbon-fiber-reinforced structures increasingly used in next-gen airframes. This compatibility has supported the material's integration into newly engineered platforms, where design emphasis is placed on strength-to-weight optimization and reduced fuel usage.

The top-performing companies in the Titanium Aluminides (TiAl) Market include Howmet Aerospace Inc., Precision Castparts Corp, KBM Affilips B.V., VSMPO-AVISMA Corporation, and ATI. These players lead in developing advanced alloys tailored to specific performance requirements across multiple end-use sectors. Companies in the titanium aluminides market are intensifying R&D efforts to improve alloy compositions for higher thermal stability and manufacturability.

Strategic investments are being made in advanced casting, forging, and additive manufacturing technologies to produce complex parts with enhanced mechanical performance. Firms are also forming alliances with aerospace OEMs and defense contractors to secure long-term supply contracts and streamline innovation cycles. Additionally, global market leaders are expanding production capacity and vertically integrating to secure raw material supply and ensure quality control.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Manufacturing process

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Gamma TiAl (γ-TiAl)

- 5.3 Alpha2-Ti3Al (α2-Ti3Al)

- 5.4 Orthorhombic Ti2AlNb (O-Ti2AlNb)

- 5.5 Beta Type (β-TiAl)

- 5.6 Others

Chapter 6 Market Size and Forecast, By Manufacturing Process, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Ingot metallurgy

- 6.2.1 Vacuum arc remelting (VAR)

- 6.2.2 Electron beam melting (EBM)

- 6.2.3 Plasma arc melting (PAM)

- 6.2.4 Vacuum induction melting (VIM)

- 6.3 Powder metallurgy

- 6.3.1 Gas atomization

- 6.3.2 Plasma rotating electrode process (PREP)

- 6.3.3 Mechanical alloying

- 6.4 Additive manufacturing

- 6.4.1 Powder bed fusion (PBF)

- 6.4.2 Direct energy deposition (DED)

- 6.4.3 Others

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Aerospace

- 7.2.1 Low pressure turbine blades

- 7.2.2 High pressure compressor blades

- 7.2.3 Structural components

- 7.2.4 Others

- 7.3 Automotive

- 7.3.1 Turbocharger wheels

- 7.3.2 Valves

- 7.3.3 Exhaust systems

- 7.3.4 Others

- 7.4 Industrial

- 7.4.1 Gas turbines

- 7.4.2 Chemical processing equipment

- 7.4.3 Others

- 7.5 Medical

- 7.5.1 Implants

- 7.5.2 Surgical instruments

- 7.5.3 Others

- 7.6 Others

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.2.1 Commercial aviation

- 8.2.2 Military aviation

- 8.2.3 Space applications

- 8.3 Automotive

- 8.3.1 Passenger vehicles

- 8.3.2 Commercial vehicles

- 8.3.3 Racing & high-performance vehicles

- 8.4 Industrial

- 8.4.1 Power generation

- 8.4.2 Chemical processing

- 8.4.3 Oil & gas

- 8.4.4 Others

- 8.5 Healthcare

- 8.5.1 Orthopedic implants

- 8.5.2 Dental applications

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 ATI

- 10.2 VSMPO-AVISMA Corporation

- 10.3 Precision Castparts

- 10.4 Howmet Aerospace

- 10.5 KBM Affilips

- 10.6 GfE Metalle und Materialien

- 10.7 AMG Advanced Metallurgical Group

- 10.8 Alcoa Corporation

- 10.9 Western Superconducting Technologies

- 10.10 Carpenter Technology Corporation

- 10.11 American Elements

- 10.12 Toho Titanium

- 10.13 Titanium Metals Corporation

- 10.14 Stanford Advanced Materials

- 10.15 Aerospace Alloys

- 10.16 6K

- 10.17 Arconic Corporation

- 10.18 Daido Steel

- 10.19 Kobe Steel