|

市場調查報告書

商品編碼

1773253

瓦楞包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Corrugated Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

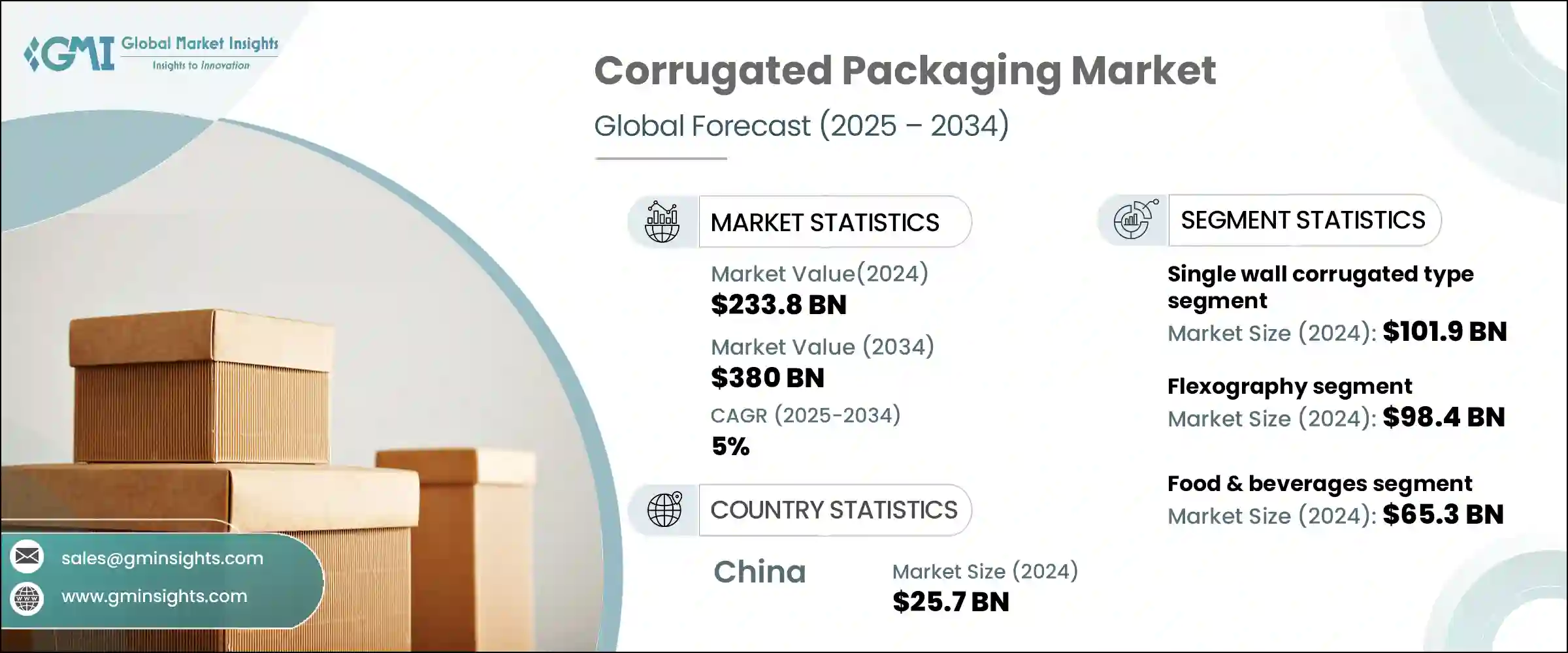

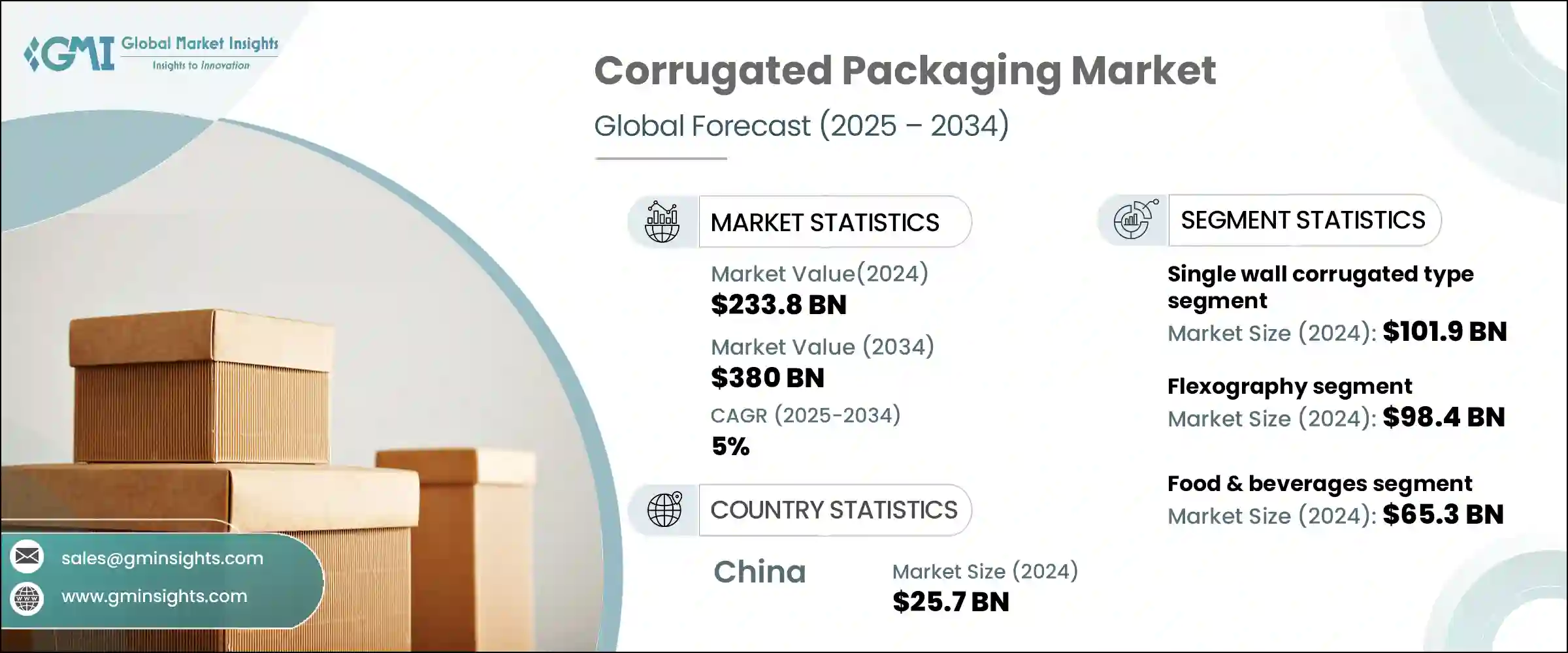

2024年,全球瓦楞包裝市場規模達2,338億美元,預計到2034年將以5%的複合年成長率成長,達到3,800億美元。這一成長主要源於電子商務活動的蓬勃發展,以及對兼顧功能性和永續性的現代包裝解決方案的需求。該行業持續發展,採用可回收材料和環保實踐,以減少其整體生態足跡。回收製程的進步、更堅固輕量化包裝的開發以及再生材料的使用,正在重塑企業在數位時代的包裝方式。隨著全球零售業日益向線上轉移,符合負責任消費概念的永續包裝正變得不可或缺。

數位印刷包裝在產品差異化和效率提升方面發揮關鍵作用。隨著高解析度圖形和按需生產技術的出現,營運成本得以精簡,同時提升了消費者的吸引力。融合了2D碼和感測器等元素的智慧包裝也透過提高透明度、可追溯性和產品安全性而日益普及。隨著電子商務的持續擴張,尤其是在數位優先的市場中,包裝功能和創新的轉變正變得越來越迅速,也越來越重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2338億美元 |

| 預測值 | 3800億美元 |

| 複合年成長率 | 5% |

2024年,單壁瓦楞紙板市場價值達1,019億美元,預計到2034年將以5.4%的複合年成長率成長。其吸引力在於輕質結構、柔韌性和價格實惠,使其成為消費性電子、零售、食品和飲料等行業的首選。單壁瓦楞紙板由兩層襯板之間的單層瓦楞紙板製成,可提供經濟高效的保護,並廣泛應用於性能和價格同等重要的運輸包裝領域。

在印刷領域,柔版印刷市場在2024年的估值為984億美元,預計在預測期內將以5.2%的複合年成長率成長。這種以高速生產和成本效益著稱的印刷技術,仍然是大規模包裝應用的首選。它與環保油墨的兼容性增強了其在綠色包裝策略中的作用。柔版印刷支援快乾工藝,並在各種材料上表現良好,這進一步增強了其在生產美觀、永續的包裝解決方案方面的實用性。

2024年,中國瓦楞包裝市場規模達257億美元,預計到2034年將以5.6%的複合年成長率成長。中國市場佔據主導地位,得益於其龐大的電商生態系統和先進的製造能力。持續的包裝研發投入,以及向環保材料和更智慧設計的明顯轉變,使中國成為亞太地區的驅動力。製造商正透過提供更永續和視覺吸引力的解決方案,來適應不斷變化的消費者行為和監管標準。

瓦楞包裝市場的知名公司包括 Danhil、Rengo、Evergreen Packaging、Montebello Container、Cascades、Smurfit Kappa Group、Mondi Group、Georgia-Pacific、Packaging Corporation of America、CESCO、Sultana Packaging、DS Smith、Lee & Man Paper Manufacturing Corporation of America、CESCO、Sultana Packaging、DS Smith、Lee & Man Paper Manufacturing、WestnationalRock 和國際紙業 (International Papernational)。瓦楞包裝領域的領先公司正在透過多項重點策略鞏固其市場地位。主要措施包括擴大產能以滿足日益成長的電商需求,以及投資永續材料開發以滿足更嚴格的環境法規。許多公司正在整合數位印刷和自動化技術,以縮短週轉時間並提高設計靈活性。他們還利用與物流和零售公司的策略合作夥伴關係來改善服務交付並最佳化供應鏈。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依牆體類型,2021-2034

- 主要趨勢

- 單壁瓦楞

- 雙壁瓦楞

- 三壁瓦楞

第6章:市場估計與預測:按箱體類型,2021-2034 年

- 主要趨勢

- 開槽盒

- 望遠鏡盒

- 硬質(幸福)盒子

- 自立箱

- 其他(內部形式、模切)

第7章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- A型長笛

- B型長笛

- C型長笛

- E型槽紋

- F型槽

第8章:市場估計與預測:依印刷技術,2021-2034 年

- 主要趨勢

- 光刻

- 柔版印刷

- 數位印刷

- 其他(輪轉凹版印刷等)

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 食品和飲料

- 個人護理和家庭護理

- 醫療的

- 家用電器和電子產品

- 農業

- 工業的

- 化學品和塑膠

- 紙張和紙箱

- 其他

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Cascades

- CESCO

- Danhil of Mexico

- DS Smith

- Evergreen Packaging

- Georgia-Pacific

- International Paper

- Lee & Man Paper Manufacturing

- Mondi Group

- Montebello Container

- Packaging Corporation of America

- Rengo

- Smurfit Kappa Group

- Sultana Packaging

- WestRock

The Global Corrugated Packaging Market was valued at USD 233.8 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 380 billion by 2034. Much of this growth stems from rising e-commerce activity and the demand for modern packaging solutions that emphasize both functionality and sustainability. The sector continues to evolve by embracing recyclable materials and environmentally friendly practices that reduce its overall ecological footprint. Advancements in recycling processes, the development of stronger lightweight packaging, and the use of reclaimed materials are reshaping how businesses approach packaging in the digital age. With global retail increasingly shifting online, sustainable packaging that aligns with responsible consumption is becoming indispensable.

Digitally printed packaging is playing a key role in product differentiation and efficiency. With technologies enabling high-resolution graphics and on-demand production, operational costs are streamlined while enhancing consumer appeal. Smart packaging, incorporating elements like QR codes and sensors, is also gaining ground by improving transparency, traceability, and product safety. As e-commerce continues expanding-particularly in digital-first markets-the shift in packaging functionality and innovation is becoming more rapid and essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $233.8 Billion |

| Forecast Value | $380 Billion |

| CAGR | 5% |

The single-wall corrugated board segment was valued at USD 101.9 billion in 2024 and is forecasted to grow at 5.4% CAGR through 2034. Its appeal lies in its lightweight structure, flexibility, and affordability, making it a preferred option across sectors like consumer electronics, retail, food, and beverage. Made with a single fluted layer between two liners, it delivers cost-efficient protection and is widely used in transit packaging where performance and price matter equally.

In terms of printing, the flexography segment was valued at USD 98.4 billion in 2024 and is expected to grow at a 5.2% CAGR through the forecast period. This printing technique, known for high-speed production and cost efficiency, remains the go-to option for large-scale packaging applications. Its compatibility with eco-conscious inks enhances its role in green packaging strategies. Flexography supports fast-drying processes and performs well on varied materials, reinforcing its utility in producing visually appealing, sustainable packaging solutions.

China Corrugated Packaging Market generated USD 25.7 billion in 2024 and is projected to grow at a CAGR of 5.6% through 2034. The country's dominance is fueled by its massive e-commerce ecosystem and advanced manufacturing capabilities. Continued investment in packaging R&D and a clear shift toward eco-friendly materials and smarter designs position China as a driving force in the Asia-Pacific region. Manufacturers are now aligning with shifting consumer behavior and regulatory standards by offering more sustainable and visually engaging solutions.

Notable companies in the Corrugated Packaging Market include Danhil, Rengo, Evergreen Packaging, Montebello Container, Cascades, Smurfit Kappa Group, Mondi Group, Georgia-Pacific, Packaging Corporation of America, CESCO, Sultana Packaging, DS Smith, Lee & Man Paper Manufacturing, WestRock, and International Paper. Leading companies in the corrugated packaging space are reinforcing their market presence through several focused strategies. Key initiatives include expanding production capacity to meet growing e-commerce demands and investing in sustainable material development to meet stricter environmental regulations. Many firms are integrating digital printing and automation technologies to reduce turnaround time and improve design flexibility. Strategic partnerships with logistics and retail companies are also being leveraged to improve service delivery and optimize supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Wall type

- 2.2.3 Boxes styles

- 2.2.4 Flutes

- 2.2.5 Printing technology

- 2.2.6 End Use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Wall Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single wall corrugated

- 5.3 Double wall corrugated

- 5.4 Triple-wall corrugated

Chapter 6 Market Estimates & Forecast, By Boxes Style, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Slotted boxes

- 6.3 Telescope boxes

- 6.4 Rigid (bliss) boxes

- 6.5 Self-erecting boxes

- 6.6 Others (interior forms, die cut)

Chapter 7 Market Estimates & Forecast, By Flutes, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Type A flute

- 7.3 Type B flute

- 7.4 Type C flute

- 7.5 Type E flute

- 7.6 Type F flute

Chapter 8 Market Estimates & Forecast, By Printing Technology, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lithography

- 8.3 Flexography

- 8.4 Digital printing

- 8.5 Others (rotogravure, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 9.1 Key Trends

- 9.2 Food & beverages

- 9.3 Personal care & home care

- 9.4 Medical

- 9.5 Home appliances & electronics

- 9.6 Agriculture

- 9.7 Industrial

- 9.8 Chemical & plastics

- 9.9 Paper & Carton

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Cascades

- 12.2 CESCO

- 12.3 Danhil of Mexico

- 12.4 DS Smith

- 12.5 Evergreen Packaging

- 12.6 Georgia-Pacific

- 12.7 International Paper

- 12.8 Lee & Man Paper Manufacturing

- 12.9 Mondi Group

- 12.10 Montebello Container

- 12.11 Packaging Corporation of America

- 12.12 Rengo

- 12.13 Smurfit Kappa Group

- 12.14 Sultana Packaging

- 12.15 WestRock