|

市場調查報告書

商品編碼

1693719

中東和非洲瓦楞包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Middle-East and Africa Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

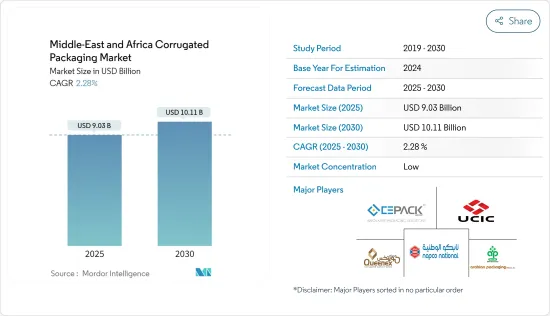

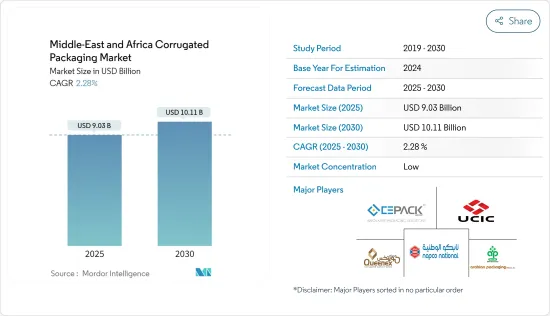

中東和非洲瓦楞包裝市場規模預計在 2025 年為 90.3 億美元,預計到 2030 年將達到 101.1 億美元,預測期內(2025-2030 年)的複合年成長率為 2.28%。

瓦楞包裝是食品和飲料包裝的良好選擇。它用於各種食品,包括湯、調味品和乳製品。與玻璃或金屬相比,它可以減輕最終產品的總重量,同時保持新鮮度。

關鍵亮點

- 由於嚴格禁止使用一次性塑膠的立法,對環保包裝材料(尤其是紙質包裝解決方案)的需求正在成長。此外,該地區電子商務平台的使用率正在增加,從而刺激了市場需求。原物料價格的波動影響瓦楞產品的生產成本。生產成本的波動會改變製造商的利潤。紙漿是從樹木上採摘的,在某些地區需求量很大,出口和進口的數量是固定的。

- 預計食品和飲料業將推動該地區對瓦楞包裝的需求。由於人們的生活方式忙碌,對簡便食品的需求日益增加。由於紙板包裝可以防止產品受潮並能承受長時間的運輸,因此企業紛紛採用紙板包裝來獲得更好的客戶體驗。麵包、肉類和其他生鮮產品等加工包裝食品正在推動需求。

- 由於都市化加快以及青睞更安全加工食品的遊客和外籍人士增多,阿拉伯聯合大公國的包裝食品消費量正在增加。預計這一趨勢將推動該地區的市場成長。零售業的興起和對環保包裝材料日益成長的需求是市場擴張的驅動力。

- 該地區的極端天氣條件可能會對市場造成限制。當濕度較高時,製造商必須注重乾燥紙板箱。這些因素可能會限制市場增加收益的能力。

- 儘管在新冠疫情期間,包裝供應端受到了顯著影響,但最終用戶對某些應用的需求卻大幅成長,大大擴展了瓦楞包裝行業的範圍。

中東和非洲瓦楞包裝市場的趨勢

電子商務領域不斷成長的需求正在推動市場

- 電子商務的成長極大地改變了零售市場。這一大趨勢改變了消費行為和零售經營模式的動態,正在中東地區蓬勃發展,為產業參與企業提供了巨大的潛力。中東,特別是沿岸地區電子商務成長的主要驅動力是高人均收入消費潛力、發達的交通和物流網路、不斷提高的網路普及率以及先進的技術。

- 年輕、精通技術且不斷成長的人口,加上較低的市場參與度,使得該市場成為電子商務投資的理想目的地。由於市場壁壘低、投資潛力大、基礎設施改善、許可便利性以及儲存設施改善,該地區的電子商務市場預計將成長。

- 根據國際貿易部的數據,到 2025 年,非洲的電子商務用戶將超過 5 億。由於疫情和封鎖限制,食品雜貨消費增加了 54%。大多數食品配送平台也實現了成長,包括食品雜貨和快餐/便利商店領域。消費者注重價格並享有線上促銷和優惠券。南非人花費大量時間在網路上搜尋更優惠的價格,並在社群媒體上查看產品推薦。預計這些因素將推動電子商務領域的瓦楞包裝市場的發展。

- 不斷發展的技術格局、智慧型手機和社交媒體的使用日益增加以及電子商務顛覆了該地區傳統的網路購物,正在推動該地區的顯著成長。許多企業主和企業家正在推出網路商店並透過社交媒體平台進行交易和銷售。

- 例如,非洲電商領導企業之一 Jumia 發布了 2021 年第二季業績,其中一項發現就是其電商平台的訂單量增加。該公司的電子商務平台年增13%,訂單總額成長近60%。上述數據表明,非洲大陸的電子商務應用日益普及,奈及利亞的電子商務服務在過去幾年中從中受益。

- 儘管在複雜的商業環境中面臨無數挑戰,但事實證明,電子商務公司是奈及利亞經濟成長和社會發展的關鍵推動力。電子商務公司繼續為該國的中小企業提供線上平台,使其能夠接觸到更廣泛的受眾,從而促進其發展。

阿拉伯聯合大公國正在經歷快速成長

- 預計在預測期內,瓦楞包裝的需求將會成長,這主要受到終端用戶產業(主要是食品和其他非食品領域)成長的推動。成年人口的成長導致受訪者的飲食習慣改變。在食品領域,對包裝食品、蔬菜和水果等產品的需求強勁。即食食品是以紙盒作為二次包裝形式的主要企業產品之一。

- 該國旅遊業的興起推動了對包裝食品和三道菜已烹調替代品的需求。近年來,政府和私營包裝公司紛紛轉向可生物分解的解決方案,從而增加了對瓦楞包裝解決方案的需求。

- 由於民眾環保意識的增強、對永續包裝解決方案的需求、電子商務市場的擴大、對電子產品、家庭和個人保健產品的需求增加,以及經濟發展和人均收入的提高,阿拉伯聯合大公國瓦楞包裝市場正在加速發展。

- 該國政府和監管機構對永續包裝及其成本效益的興趣日益濃厚,這推動了國內瓦楞包裝市場的成長。例如,阿布達比政府推出了減少一次性塑膠的新措施。由於其永續性和可回收性,以及一次性塑膠的禁令,預計許多終端行業對瓦楞包裝的需求將會成長。

- 2022 年杜拜 Propaper 展覽會的組織者 Verifair 表示,預計未來五年阿拉伯聯合大公國的包裝市場將大幅成長至 210 億迪拉姆。 Propaper 2022 展會正值中東和北非地區以及亞太地區造紙產業蓬勃發展的背景下,瓦楞包裝等細分領域呈現指數級成長,尤其是在後疫情時代。隨著消費者轉向電子商務管道,醫療、製藥和個人護理等終端行業對瓦楞包裝的需求正在增加。

中東和非洲瓦楞包裝產業概況

中東和非洲的瓦楞紙包裝市場是細分的。在該地區營運的主要供應商包括 Arabian Packaging Co. LLC、Napco National、Flacon Pack 和 Cepack Group。

- 2022 年 12 月,位於拉斯海馬經濟區 (RAKEZ) 的阿拉伯聯合大公國領先瓦楞紙箱製造商之一環球紙箱工業公司 (UCIC) 投資 5,500 萬迪拉姆(1,497 萬美元)擴大生產能力,以滿足國內外對永續包裝解決方案日益成長的需求。此次擴建將使 UCIC 的產能增加兩倍,達到每年 10 萬噸。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

- 定價分析

- 進出口分析

- PESTLE分析

- 資本投資背後的主要因素

- 瓦楞包裝生產對環境的影響

第5章市場動態

- 市場促進因素

- 電子商務領域的需求增加

- 輕量材料需求不斷成長,終端用戶領域成長空間龐大

- 市場限制

- 對瓦楞產品材料可得性和耐用性的擔憂

第6章市場區隔

- 按類型

- 開槽容器

- 模切容器

- 5 面板資料夾盒

- 其他

- 按最終用戶

- 食物

- 飲料

- 電器

- 個人護理

- 其他

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 其他中東和非洲地區

第7章競爭格局

- 公司簡介

- Arabian Packaging Co. LLC

- Queenex Corrugated Carton Factory

- United Carton Industries Company(UCIC)

- Napco National

- Cepack Group

- Falcon Pack

- World Pack Industries LLC

- Universal Carton Industries Group

- Express Pack Print

- Green Packaging Boxes IND. LLC

- Tarboosh Packaging Co. LLC

- Unipack Containers & Carton Products LLC

- Al Rumanah Packaging

- NBM Pack

第8章:中東地區主要瓦楞包裝製造商名單

第9章:市場的未來

The Middle-East and Africa Corrugated Packaging Market size is estimated at USD 9.03 billion in 2025, and is expected to reach USD 10.11 billion by 2030, at a CAGR of 2.28% during the forecast period (2025-2030).

Corrugated packaging is a preferred option for food and beverage packaging. It can be found in various foods, including soups, seasonings, and dairy products. Compared to glass and metal, it helps reduce the final product's total weight while maintaining its freshness.

Key Highlights

- The need for green packaging materials, particularly paper packaging solutions, is fueled by the enforcement of strict legislation regarding the ban on single-use plastic. In addition, the increasing use of e-commerce platforms in the region is boosting market demand. Fluctuations in raw material prices affect the production costs of corrugated products. Changes in production costs change manufacturers' profits. Pulp is harvested from trees and is in high demand in certain regions, and it is imported and exported in specified amounts.

- Food and beverage segments are expected to drive the region's demand for corrugated packaging. The need for convenience foods is on the rise due to the busy lifestyle of individuals. As corrugated packaging keeps moisture from the products and withstands long shipping times, companies are increasingly adopting it for a better customer experience. Processed and packaged foods, such as bread, meat, and other perishable items, drive the demand.

- The United Arab Emirates has an increased rate of packaged food consumption, owing to rapid urbanization and an increasing number of tourists and ex-pats that often prefer safer processed foods. This trend is expected to boost the market's growth in the region. The rising retail industries and the growing need for eco-friendly packaging materials are driving the market's expansion.

- The region's extreme weather conditions may act as a restraint for the market. Manufacturers must focus more on drying cardboard boxes when humidity levels are high. These factors can limit the market's ability to increase earnings.

- Despite a significant effect on the supply side of the packaging during the COVID-19 pandemic, considerable growth in end-user demand in specific applications significantly expanded the scope of the corrugated packaging industry.

MEA Corrugated Packaging Market Trends

Increased Demand from the E-commerce Sector to Drive the Market

- The growth of e-commerce dramatically changed the retail market. This megatrend that changed the dynamics of consumer behavior and retail business models is witnessing growth in the Middle East and offers significant potential for industry players. The main drivers of e-commerce growth in the Middle East, especially in the Gulf region, are high per capita income spending potential, well-developed transportation and logistics networks, increased internet penetration, and advanced technology.

- A growing young population that is tech-savvy and few market players are making the market an attractive destination for e-commerce investments. The region's e-commerce market is projected to grow due to low market barriers, high investment potential, improved infrastructure, easier licensing, and improved storage facilities.

- According to the International Trade Administration, Africa will have over 500 million e-commerce users by 2025. Grocery grew by 54% due to the pandemic and lockdown restrictions. Growth was also seen in most food delivery platforms, both in the grocery and fast food/convenience sectors. Consumers are price-sensitive and enjoy online promotions and coupons. South Africans spend much time looking for better prices online and checking social media for product recommendations. Such factors would leverage the market for corrugated packaging in the e-commerce sector.

- The evolving technological environment, increasing use of smartphones and social media, and changes in the region's traditional online shopping through e-commerce are driving significant growth. Many business owners and entrepreneurs are setting up online stores to trade and sell through social media platforms.

- For instance, one of the African e-commerce leaders, Jumia, released its Q2 2021 results, and one of the findings was an increase in orders on its e-commerce platform. The company's e-commerce platform witnessed an increase of 13% Y-o-Y, and total orders increased by almost 60%. The above figures show the increasing adoption of e-commerce on the African continent, and e-commerce services in Nigeria have benefited in the last few years.

- E-commerce companies are proving to be significant enablers of economic growth and social development in the country, despite the myriad challenges faced with the complex business environment. By providing online platforms for merchants, these companies continue to drive the growth of small and medium-sized businesses in the country, allowing them to reach a broader target audience.

United Arab Emirates to Register Significant Growth

- With the growth of end-user industries, primarily food and other non-food sectors, the demand for corrugated packaging is expected to grow over the forecast period. The food habits of the studied demographics are changing due to the increasing adult population. In the food sector, there is a strong demand for products like packaged foods, vegetables, and fruits. Ready-to-eat meal products are among the top adopters of cartons as the secondary form of packaging.

- Increasing tourism in the country led to the demand for packaging food or ready-to-eat substitute for three-course meals. In recent years, government and private packaging firms have switched to bio-degradable solutions, thus increasing the demand for corrugated packaging solutions.

- The accelerated growth of the UAE corrugated market is due to the increasing environmental awareness of the population, the demand for sustainable packaging solutions, the growing e-commerce market, and the increasing demand for electronic products and household and personal care products, along with economic development and rising per capita incomes.

- A growing concern from governments and regulators across the country relates to sustainable packaging and its cost benefits, which is driving the growth of the domestic corrugated market. For instance, the Abu Dhabi government introduced new policies to reduce single-use plastics. Due to its sustainability and recyclability properties and the ban on single-use plastics, the demand for corrugated packaging is expected to grow in many end-use industries.

- Propaper Dubai 2022 exhibition organizer, Verifair, stated that the UAE packaging market is projected to grow significantly to an estimated AED 21 billion over the next five years. Propaper 2022 was held amid the growth landscape of the MEA and Asia-Pacific paper industries, with niche segments, such as corrugated packaging, showing exponential growth, especially in the post-COVID scenario. The demand for corrugated boards in end-use industries such as medical, pharmaceutical, and personal care is increasing as consumers move toward e-commerce channels.

MEA Corrugated Packaging Industry Overview

The Middle East and African corrugated packaging market is fragmented. Some key market vendors operating in the region include Arabian Packaging Co. LLC, Napco National, Flacon Pack, and Cepack Group.

- In December 2022, Universal Carton Industries Company (UCIC), one of the United Arab Emirates' leading corrugated cardboard box manufacturing companies located in Ras Al Khaimah Economic Zone (RAKEZ), invested AED 55 million (USD 14.97 million) to expand its production volume to meet the growing demand for sustainable packaging solutions in the country and overseas. This expansion may help increase UCIC's production capacity by threefold to 100,000 tons per annum.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Pricing Analysis

- 4.6 Import and Export Analysis

- 4.7 Pestle Analysis

- 4.8 Capex Key Factors

- 4.9 Impact of Corrugated Box Production on the Environment

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand from the E-commerce Sector

- 5.1.2 Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments

- 5.2 Market Restraints

- 5.2.1 Concerns About Material Availability and Durability of Corrugated Products

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Slotted Containers

- 6.1.2 Die-cut Containers

- 6.1.3 Five-panel Folder Boxes

- 6.1.4 Other Types

- 6.2 By End User

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Electric Goods

- 6.2.4 Personal Care and Household Care

- 6.2.5 Other End Users

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Egypt

- 6.3.4 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Arabian Packaging Co. LLC

- 7.1.2 Queenex Corrugated Carton Factory

- 7.1.3 United Carton Industries Company (UCIC)

- 7.1.4 Napco National

- 7.1.5 Cepack Group

- 7.1.6 Falcon Pack

- 7.1.7 World Pack Industries LLC

- 7.1.8 Universal Carton Industries Group

- 7.1.9 Express Pack Print

- 7.1.10 Green Packaging Boxes IND. LLC

- 7.1.11 Tarboosh Packaging Co. LLC

- 7.1.12 Unipack Containers & Carton Products LLC

- 7.1.13 Al Rumanah Packaging

- 7.1.14 NBM Pack