|

市場調查報告書

商品編碼

1693913

中東瓦楞包裝:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Middle East Corrugated Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

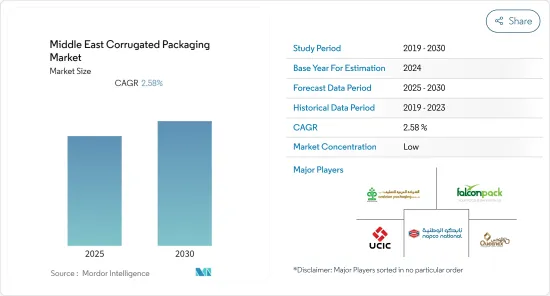

預測期內中東瓦楞包裝市場預計複合年成長率為 2.58%

關鍵亮點

- 瓦楞包裝產品在儲存和運輸過程中保護易碎、沉重、龐大或高價值的產品。多層瓦楞包裝使包裝產品具有剛性,使其比普通瓦楞包裝更堅固。市場正在擴大,以滿足建築和電子產業對瓦楞包裝產品的需求。

- 中東地區的瓦楞包裝產品市場正在擴大,這主要是因為人們越來越意識到減少傳統包裝材料的碳影響的必要性。卡達包裝政府根據其“2030國家願景”,啟動了多項綠色經濟計劃,透過限制廢物排放來減少不可再生資源的使用。

- 在阿拉伯聯合大公國、沙烏地阿拉伯和其他國家,禁止使用一次性塑膠的法律正在嚴格執行,這增加了對環保包裝解決方案的需求,尤其是紙張。由於人們的生活方式忙碌,對簡便食品的需求不斷增加。由於瓦楞包裝可以使產品遠離濕氣並且可以承受長時間的運輸,越來越多的企業開始採用瓦楞包裝來為客戶提供更好的結果,特別是作為二級或三級包裝的手段。

- 紙板包裝盒可靠、耐用且易於運輸,已經存在很多年了。但長壽也伴隨著挑戰。紙板包裝由纖維素纖維製成,可以是原生的,也可以是從消費後紙板包裝和其他材料中回收的。瓦楞包裝產業面臨原物料價格上漲、原物料供應瓶頸的挑戰。嚴重的供不應求和前所未有的價格上漲正將製造商推向破產的邊緣。

- 新冠疫情對包裝產業產生了負面影響,導致企業停工、從中國轉移採購以及重新審視包裝材料。儘管對包裝供應面產生了重大影響,但某些應用領域的最終用戶需求卻大幅成長,大大擴大了瓦楞包裝行業的範圍。

中東瓦楞包裝市場趨勢

食品業預計將顯著成長

- 食品業是該地區最大的包裝消費者之一。由於都市化加快以及偏好更安全加工食品的遊客和外籍人士增多,該地區對包裝食品和食品飲料的消費量很高。該地區對食品和飲料的包裝也有嚴格的規定。

- 該地區各國的旅遊業在經歷了 2020 年的下滑之後,正在復甦。沙烏地阿拉伯旅遊部長艾哈邁德·哈提卜表示,該國的目標是到 2023 年吸引 2,500 萬外國遊客。此外,沙烏地阿拉伯正在投入資金加強其旅遊基礎設施。

- 根據世界旅遊及旅遊理事會估計,阿拉伯聯合大公國旅遊資本投資的經濟貢獻將從 2018 年的 278 億迪拉姆(75.7 億美元)成長到 2028 年的 744 億迪拉姆(202.6 億美元)。預測期內,全部區域旅遊業的成長,以及食品宅配服務的相應成長和包裝食品銷售額的成長,可能會增強市場。

- 此外,國內對包裝食品的需求不斷成長,也推動了研究領域對瓦楞包裝的需求。根據展覽會統計,中東地區佔全球包裝商品消費量的5%,該地區的業務正在快速成長。

- 此外,食品零售佔阿拉伯聯合大公國零售市場的最大佔有率,預計未來仍將佔據主導地位。根據美國農業部食品零售報告,2019年線上零售食品銷售額強勁成長,達25.57億美元。到 2022 年,這一數字將進一步增加,達到 57.05 億美元。因此,隨著全部區域線上零售的不斷成長,預計對瓦楞包裝的需求將激增。

- 該地區加工食品、生鮮食品和肉類的消費量正在增加。健康和保健趨勢以及日益成長的消費者興趣將繼續推動該國新食品產品的成長。此外,預計在預測期內人口成長將成為生鮮食品需求的主要驅動力。

沙烏地阿拉伯佔主要市場佔有率

- 沙烏地阿拉伯擁有龐大的消費群和廣泛的工業活動(石油和天然氣行業除外),對紙質包裝解決方案的需求迅速增加。對客戶友善包裝和增強產品保護的需求不斷成長,預計將推動瓦楞包裝成為沙烏地阿拉伯可行且經濟高效的解決方案。

- 隨著沙烏地阿拉伯繼續實施“2030願景”,即向知識主導經濟轉型的綜合策略,該國的電子商務市場正在蓬勃發展。根據 Meta 的報告,沙烏地阿拉伯的電子商務成長軌跡始於疫情期間,全國各地的買家都傾向於電子商務。沙烏地阿拉伯所有領域的電子商務銷售額每年平均成長 60%,其中媒體產品在電子商務中佔據最強地位,其次是服裝和鞋類。值得注意的是,預計這種成長將在預測期內持續下去。該國電子商務的成長也支持了對瓦楞包裝解決方案的需求。

- 預計2022年沙烏地GDP將突破1兆美元,成為阿拉伯世界最大經濟體。預計預測期結束時沙烏地阿拉伯食品製造業的總投資將超過 700 億美元。沙烏地阿拉伯是該地區領先的高價值食品生產國。預計 2022 年沙烏地阿拉伯的零售總額將達到 500 億美元左右。其中約 50% 的銷售額透過現代零售通路實現,其餘 50% 透過傳統雜貨店實現。沙烏地阿拉伯的食品製造業是世界上成長最快的產業之一,受益於人口和收入的成長、生活方式的改變、政府的支持和有利的貿易協定。這導致對包裝食品的需求增加,越來越多的國際公司進入沙烏地阿拉伯市場。

- 該國的零售市場正在經歷顯著成長,從而推動了零售包裝(RRP)的發展。此外,由於零售商不斷尋找提高效率和貨架供應量的方法,RRP 是零售業變革的關鍵環節之一。值得注意的是,瓦楞包裝先前佔據全國零售包裝(RRP)的絕大部分。此外,預計預測期內全國各地對回收設施的投資增加將進一步推動所研究市場的成長。

中東瓦楞包裝產業概況

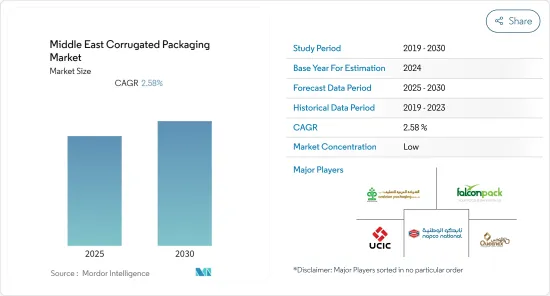

中東瓦楞包裝市場正在經歷當地供應商之間競爭的加劇。由於瓦楞紙包裝供應商範圍廣泛,買家可以從多個供應商中進行選擇。該地區的主要市場供應商包括 Arabian Packaging Co. LLC、Napco National、Flacon Pack、Queenex Corrugated Carton Factory 和 United Carton Industries Company (UCIC)。

- 2023 年 3 月 - Napco National 在其所有辦公室永久安裝 Kiswa 盒子並將其命名為“Reloved Boxes”,將其對永續性的承諾提升到一個新的觀點。該計劃是 Napco National永續性計畫的一部分,旨在推動聯合國永續發展目標 (SDG)。

- 2022 年 12 月-位於拉斯海馬經濟區 (RAKEZ) 的阿拉伯聯合大公國領先瓦楞包裝盒製造商之一 Universal Carton Industries (UCI) 已投資 5,500 萬迪拉姆(1,497 萬美元)擴大其生產能力,以滿足阿拉伯聯合大公國及海外對永續包裝解決方案日益成長的需求。此次擴建預計將使 UCI 的生產能力提高兩倍,達到每年 10 萬噸。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估近期烏克蘭-俄羅斯衝突對包裝器材產業的影響

- 原料趨勢

- 產品定義和規格

- 進出口分析

第5章市場動態

- 市場促進因素

- 電子商務領域的需求增加

- 輕量材料需求不斷成長,終端用戶領域成長空間龐大

- 市場限制

- 對瓦楞包裝產品材料可得性和耐用性的擔憂

第6章市場區隔

- 按類型

- 開槽容器

- 模切容器

- 5 面板資料夾盒

- 其他

- 按最終用戶

- 食物

- 飲料

- 電器

- 個人護理

- 其他

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊拉克

- 約旦

- 其他中東地區

第7章競爭格局

- 公司簡介

- Arabian Packaging Co. LLC

- Queenex Corrugated Carton Factory

- United Carton Industries Company(UCIC)

- Napco National

- Falcon Pack

- Cepack Group

- World Pack Industries LLC

- Universal Carton Industries Group

- Green Packaging Boxes Ind LLC

- Tarboosh Packaging Co. LLC

- Unipack Containers & Carton Products LLC

- Al Rumanah Packaging

第8章:未來市場展望

簡介目錄

Product Code: 50000913

The Middle East Corrugated Packaging Market is expected to register a CAGR of 2.58% during the forecast period.

Key Highlights

- Corrugated products protect fragile, heavy, bulky, or high-value products during storage and transportation. Multi-layer corrugated packaging adds rigidity to packaged products, making them stronger than regular corrugated boards. The market is expanding to meet the demand for corrugated products in the construction and electronics industries.

- The market for corrugated packaging products is expanding in the Middle East, mainly owing to the growing awareness of the need to lessen the carbon impact of traditional packaging materials. To reduce the use of non-renewable resources by limiting trash output in the nation, the Qatari government launched several green economy programs under the National Vision 2030.

- Strict enforcement of laws banning single-use plastics in the United Arab Emirates, Saudi Arabia, and other countries has increased the need for environmentally friendly packaging solutions, especially paper.The demand for convenience foods is on the rise due to the busy lifestyle of people. As corrugated box packaging keeps moisture away from the products and withstands long shipping times, companies are increasingly adopting it to offer customers better outcomes, especially as a means of secondary or tertiary packaging.

- The reliable, durable, and easily transportable corrugated boxes have been around for over a few years. However, longevity comes with challenges. Corrugated cardboard is made from cellulose fibers, virgin or recycled from used corrugated cardboard or other materials. The corrugated board industry is challenged with soaring raw material prices and bottlenecks in raw material supply. Severe shortages and unprecedented price increases push manufacturers to the brink of closure.

- The COVID-19 pandemic impacted the packaging industry negatively, resulting in lockdowns, corporations shifting their sourcing away from China, and reconsidering packaging materials. Despite a significant effect on the supply side of packaging, considerable growth in the end-user demand in specific applications significantly expanded the scope of the corrugated packaging industry.

Middle East Corrugated Packaging Market Trends

Food Segment is Expected to Witness Significant Growth

- The food industry is one of the biggest packaging consumers in the region. The region has a high rate of packaged food and beverage consumption, owing to rapid urbanization and an increasing number of tourists and expiates that often prefer safer processed foods. Also, the region has stringent packaging regulations regarding food and beverages.

- The tourism sector in the region's countries is gaining traction after a dip in 2020. According to Ahmed Al-Khateeb, Minister of Tourism, Saudi Arabia has targeted 25 million international tourists in 2023. Additionally, the country is investing capital in enhancing its tourism infrastructure.

- According to the World Travel and Tourism Council, the economic contribution of capital investment in tourism to the United Arab Emirates is estimated to reach AED 74.4 billion (USD 20.26 billion) in 2028 from AED 27.8 billion (USD 7.57 billion) in 2018. With the increasing number of tourists across the region, there is a proportionate increase in food delivery services and a rise in the sale of packaged food, which may bolster the market in the forecast period.

- Moreover, the increasing demand for packaged food in the country is augmenting the demand for corrugated board packaging in the studied segment. According to Interpack (a packaging trade fair), the Middle East accounts for five percent of global packaged goods consumption, and business in the region is growing rapidly.

- Further, food retail holds the largest share of the UAE retail market and is expected to continue to be the dominant market sector. According to the United States Department of Agriculture report on retail foods, online retail sales of food witnessed robust growth in 2019, amounting to USD 2.557 billion. The value increased further to USD 5.705 billion in 2022. Thus, the demand for corrugated packaging is expected to spike as a result of the rising trend of online retail sales across the region.

- The region is witnessing a rise in the consumption of processed food, fresh produce, and meat sectors. New food growth in the country continues to be fueled by health and wellness trends and the increase in consumer concerns. Additionally, population growth would be the key driver behind the demand for fresh food during the forecast period.

Saudi Arabia to Hold Major Market Share

- Saudi Arabia has a considerable consumer base and a wide range of industrial activities (apart from the oil and gas sector), adding to the rapid demand for paper packaging solutions. The growing demand for customer-friendly packages and heightened product protection is expected to boost corrugated packaging as a viable and cost-effective solution in Saudi Arabia.

- The Saudi e-commerce market is growing rapidly as the country continues to implement Vision 2030, a comprehensive strategy to transition the nation into a knowledge-driven economy. According to a Meta report, the growth trajectory of e-commerce business in Saudi Arabia started during the pandemic, which made buyers across the country gravitate toward e-commerce. E-commerce sales in Saudi Arabia increased by an average of 60% annually across all segments, with media products having the strongest e-commerce position, followed by apparel and footwear. Notably, this growth is anticipated to continue in the forecast period. The growth of e-commerce in the country has also significantly supported the demand for corrugated packaging solutions.

- Saudi Arabia's GDP exceeded USD 1 trillion in 2022, making it the biggest economy in the Arab world. Saudi Arabia's total investment in the Saudi food manufacturing sector is expected to surpass USD 70 billion by the end of the forecast period. Saudi Arabia is the region's leading producer of high-value food products. In 2022, Saudi Arabia's total retail sales were estimated at around USD 50 billion. About 50% of these sales were made through modern retail channels, while the remaining 50% were made through traditional grocery stores. The food manufacturing industry in Saudi Arabia is one of the fastest-growing in the world, benefiting from population and income increases, changing lifestyles, government support, and favorable trade agreements. As a result, the demand for packaged foods is rising, and more international companies are entering the Saudi market.

- The retail market in the country is witnessing significant growth, thus driving retail-ready packaging (RRP). In addition, the RRP has become one of the significant areas of change in retailing as retailers are constantly looking for ways of improving efficiency and on-shelf availability. Notably, corrugated packaging previously dominated retail-ready packaging (RRP) nationwide. Furthermore, the increasing investments in recycling facilities across the country are further expected to promote the growth of the studied market during the forecast period.

Middle East Corrugated Packaging Industry Overview

The competition among local vendors in the Middle East corrugated packaging market is increasing. Buyers can choose from multiple vendors due to the wide range of corrugated board suppliers. Some key market vendors in the region include Arabian Packaging Co. LLC, Napco National, Flacon Pack, Queenex Corrugated Carton Factory, and United Carton Industries Company (UCIC).

- March 2023 - Napco National brought its sustainability dedication to a new perspective by permanently installing Kiswa boxes in all its offices, calling them "Reloved Boxes." This initiative is part of Napco National's Sustainability Program initiatives, which aim to advance the Sustainable Development Goals (SDGs) of the United Nations.

- December 2022 - Universal Carton Industries (UCI), one of UAE's leading corrugated cardboard box manufacturing companies located in Ras Al Khaimah Economic Zone (RAKEZ), invested AED 55 million (USD 14.97 million) to expand its production volume to meet the growing demand for sustainable packaging solutions in the United Arab Emirates and overseas. This expansion is expected to increase UCI's production capacity by threefold to 100,000 tons per annum.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of the Recent Ukraine-Russia Standoff on the Packaging Machinery Industry

- 4.5 Raw Material Trends

- 4.6 Product Definitions and Specification

- 4.7 Import - Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand from the E-commerce Sector

- 5.1.2 Growing Demand for Lightweight Materials and Scope for Growth in End-User Segments

- 5.2 Market Restraints

- 5.2.1 Concerns About Material Availability and Durability of Corrugated-Based Products

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Slotted Containers

- 6.1.2 Die Cut Containers

- 6.1.3 Five Panel Folder Boxes

- 6.1.4 Other Types

- 6.2 By End User

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Electrical Goods

- 6.2.4 Personal Care and Household Care

- 6.2.5 Other End Users

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Iraq

- 6.3.4 Jordan

- 6.3.5 Rest of the Middle East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Arabian Packaging Co. LLC

- 7.1.2 Queenex Corrugated Carton Factory

- 7.1.3 United Carton Industries Company (UCIC)

- 7.1.4 Napco National

- 7.1.5 Falcon Pack

- 7.1.6 Cepack Group

- 7.1.7 World Pack Industries LLC

- 7.1.8 Universal Carton Industries Group

- 7.1.9 Green Packaging Boxes Ind LLC

- 7.1.10 Tarboosh Packaging Co. LLC

- 7.1.11 Unipack Containers & Carton Products LLC

- 7.1.12 Al Rumanah Packaging

8 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219