|

市場調查報告書

商品編碼

1773224

功能性麵粉市場機會、成長動力、產業趨勢分析及2025-2034年預測Functional Flours Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球功能性麵粉市場規模達9,49億美元,預計到2034年將以8.2%的複合年成長率成長,達到2,089億美元。推動這一成長的動力源於人們日益意識到強化麵粉的健康益處,尤其是在控制肥胖和糖尿病等生活方式相關疾病方面。消費者日益尋求營養豐富的替代品,促使製造商在麵粉中添加纖維、蛋白質和微量營養素。此外,烘焙、零食和簡便食品等應用領域(尤其是清潔標籤和無麩質食品領域)的需求不斷成長,也增強了市場發展勢頭。製粉和生產技術的進步也提高了麵粉的標準,使得人們能夠生產出質地、營養價值和功能性都得到改善的麵粉。

這些進步使生產商能夠滿足多樣化的消費者期望,並進一步推動市場擴張,因為這些產品能夠根據特定的飲食偏好、健康需求和文化趨勢來客製化高度專業化的麵粉產品。隨著消費者對透明度、功能性和清潔標籤成分的要求日益提高,製造商正在利用這些創新來生產營養價值更高、消化率更高、保存期限更長的麵粉。客製化麵粉配方——無論是無麩質、低碳水化合物、高蛋白還是防過敏——的能力使品牌能夠滿足利基市場的需求,同時擴大其整體消費者群體。反過來,這種與不斷發展的食品趨勢的策略契合,既支持高階產品定位,也支持大眾市場的可擴展性,從而增強了全球功能性麵粉行業的發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 949億美元 |

| 預測值 | 2089億美元 |

| 複合年成長率 | 8.2% |

預計2034年,穀物及雜糧市場規模將達871億美元,複合年成長率為5.4%。其強大的市場地位得益於其廣泛融入麵包、早餐穀物、零食棒和即食食品等日常產品中。消費者對「更健康」食品(尤其是無麩質、全穀物和高纖維配方)的偏好激增,這推動了該領域的成長。隨著健康和保健趨勢持續影響全球飲食習慣,穀物及雜糧市場在已開發市場和新興市場都依然佔有重要地位。儘管發展勢頭強勁,但原料價格波動、運輸成本以及偶爾出現的供應鏈中斷仍構成持續的風險。為了應對這些挑戰,生產者正致力於透過添加纖維、維生素和礦物質來提高穀物粉的營養密度,以吸引注重健康的消費者。

2024年,高蛋白麵粉市場佔30.5%的市佔率。預計到2034年,該市場的複合年成長率將達到5.2%,這主要得益於高蛋白飲食需求的激增。高蛋白飲食與提升體能、肌肉健康、飽足感和體重管理息息相關。消費者,尤其是老年人和特定人群,對蛋白質缺乏負面影響的認知不斷提高,這加劇了人們對添加蛋白質的功能性麵粉的興趣。為此,製造商正在開發使用扁豆、豌豆和大豆等植物蛋白的創新產品,以滿足日益成長的素食者和純素食者的需求,同時也滿足乳製品或大豆過敏消費者的需求。

2024年,北美功能性麵粉市場佔有33.9%的市佔率。該地區領先的市場佔有率主要歸功於人們對飲食客製化意識的不斷提升,消費者積極尋求適合麩質不耐症、乳糜瀉和其他基於生活方式的飲食模式的麵粉。這種需求推動了鷹嘴豆、藜麥和糙米等營養豐富的麵粉的生產和消費。一些老牌產業參與者透過創新和產品多元化不斷拓展產品組合,這進一步支撐了市場的成長。

市場主要參與者包括羅蓋特公司 (Roquette Freres)、宜瑞安公司 (Ingredion Incorporated)、阿徹丹尼爾斯米德蘭公司 (ADM)、SunOpta 公司和英國聯合食品公司 (Associated British Foods plc)。功能性麵粉領域的頂尖公司正專注於多元化發展、健康驅動創新和供應鏈穩健性。他們正在擴大產品範圍,將植物蛋白粉和替代穀物納入其中。在研發方面的大量投入使得客製化麵粉混合物的開發成為可能,這些混合物有助於血糖控制、腸道健康或高蛋白飲食。與烘焙和食品製造商的策略聯盟正在提高產品滲透率和最終用途相容性。這些參與者正在透過採購合作夥伴關係和倉儲基礎設施來加強全球供應鏈,以對沖原料價格波動。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 主要製造商

- 經銷商

- 整個產業的利潤率

- 供應鏈和分銷分析

- 原物料採購

- 生產製造

- 冷鏈基礎設施

- 分銷管道

- 供應鏈挑戰與最佳化

- 永續實踐

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要出口國

(註:以上貿易統計僅提供重點國家)

- 衝擊力

- 成長動力

- 健康意識不斷增強

- 無麩質產品需求不斷成長

- 增加蛋白質攝取

- 清潔標籤趨勢

- 產業陷阱與挑戰

- 與傳統麵粉相比成本較高

- 保存期限有限

- 加工挑戰

- 口味和質地的限制

- 市場機會

- 亞太新興市場

- 植物性產品的創新

- 功能性食品應用

- 電子商務擴張

- 成長動力

- 原料景觀

- 製造業趨勢

- 技術演進

- 加工技術

- 強化方法

- 品質測試與分析

- 包裝創新

- 定價分析和成本結構

- 價格趨勢(美元/噸)

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 定價因素(原料、能源、勞力)

- 區域價格差異

- 成本結構細分

- 獲利能力分析

- 價格趨勢(美元/噸)

- 監管框架和標準

- FDA 法規(美國)

- 歐盟法規

- 食品法典標準

- 區域監管機構

- 標籤要求

- 品質標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司熱圖分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- Expansion

- Mergers & acquisition

- Collaborations

- New product launches

- Research & development

- 主要參與者的最新發展和影響分析

- 公司分類

- 參與者概述

- 財務表現

- 產品基準測試

第5章:市場估計與預測:按來源,2021-2034

- 主要趨勢

- 穀物和穀類

- 小麥

- 米

- 玉米

- 燕麥

- 大麥

- 藜麥

- 其他穀物

- 豆類

- 鷹嘴豆

- 扁豆

- 豌豆

- 豆子

- 其他豆類

- 堅果和種子

- 杏仁

- 椰子

- 葵花籽

- 亞麻籽

- 其他堅果和種子

- 水果和蔬菜

- 香蕉

- 甘藷

- 木薯

- 其他水果和蔬菜

- 其他來源

- 昆蟲

- 藻類

- 菇

第6章:市場估計與預測:依功能,2021-2034

- 主要趨勢

- 富含蛋白質

- 富含纖維

- 不含麩質

- 強化維生素和礦物質

- 低碳水化合物

- 益生菌

- 富含抗氧化劑

- 其他功能

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 烘焙和糖果

- 麵包

- 蛋糕和糕點

- 餅乾和餅乾

- 鬆餅和紙杯蛋糕

- 其他烘焙產品

- 小吃

- 擠壓零食

- 餅乾

- 洋芋片

- 其他小吃

- 飲料

- 蛋白質飲料

- 冰沙

- 功能性飲料

- 其他飲料

- 義大利麵和麵條

- 早餐麥片

- 湯和醬汁

- 肉類替代品

- 其他

第8章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 粉末

- 顆粒

- 薄片

- 顆粒

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- B2b(企業對企業)

- 食品製造商

- 麵包店

- 餐飲服務

- 其他 B2B 頻道

- B2c(企業對消費者)

- 超市和大賣場

- 專賣店

- 網路零售

- 便利商店

- 其他B2C頻道

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Associated British Foods plc

- General Mills, Inc.

- Ingredion Incorporated

- Roquette Freres

- Tate & Lyle PLC

- SunOpta Inc.

- The Scoular Company

- Agrana Beteiligungs-AG

- Limagrain

- Bunge Limited

- The Andersons, Inc.

- Grain Millers, Inc.

- Hodgson Mill, Inc.

- Lifeway Foods, Inc.

- Manildra Group

- Unicorn Grain Specialties

- Bluebird Grain Farms

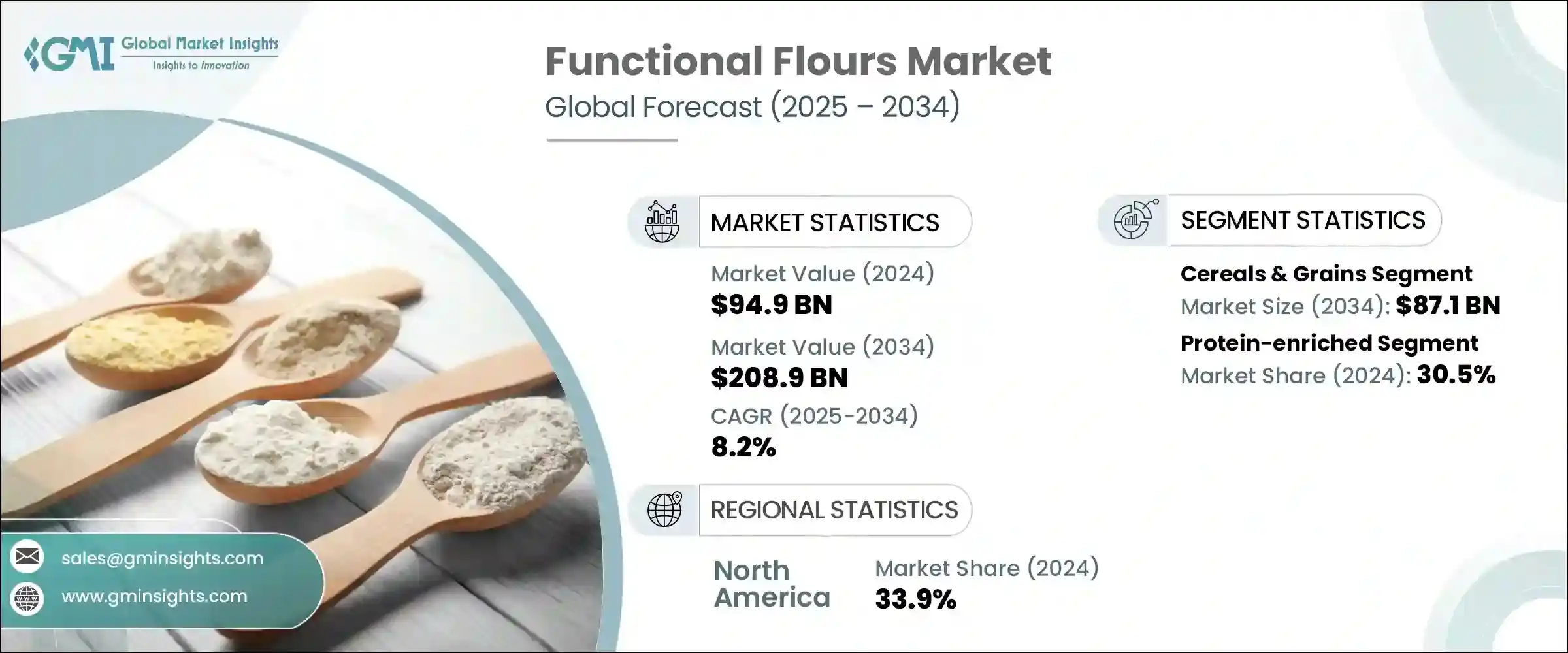

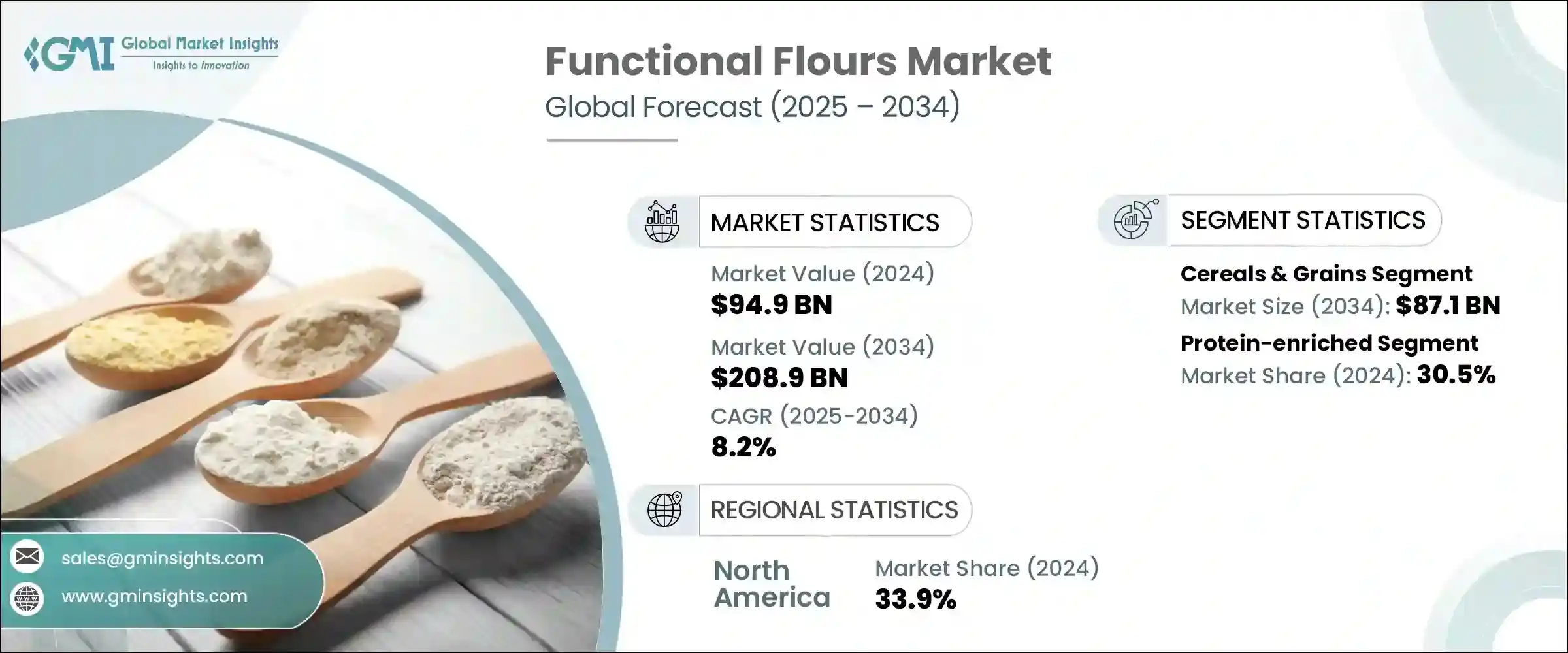

The Global Functional Flours Market was valued at USD 94.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 208.9 billion by 2034. This surge is being driven by growing awareness of the health advantages that fortified flours offer-particularly their roles in managing lifestyle-related conditions like obesity and diabetes. Consumers increasingly seek nutritious alternatives, leading manufacturers to enrich flours with fibers, proteins, and micronutrients. Additionally, rising demand across applications such as bakery, snacks, and convenience foods-especially clean-label and gluten-free segments-has strengthened market momentum. Technological enhancements in milling and production have also raised the bar, enabling the creation of flours with improved texture, nutritional value, and functional performance.

These advancements allow producers to meet diverse consumer expectations, further fueling market expansion by enabling the development of highly specialized flour products tailored to specific dietary preferences, health needs, and cultural trends. As consumers increasingly demand transparency, functionality, and clean-label ingredients, manufacturers are leveraging these innovations to create flours with enhanced nutritional value, better digestibility, and improved shelf life. The ability to customize flour formulations-whether gluten-free, low-carb, protein-rich, or allergen-friendly-empowers brands to cater to niche markets while broadening their overall consumer base. In turn, this strategic alignment with evolving food trends supports both premium product positioning and mass-market scalability, reinforcing the momentum of the global functional flour industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $94.9 Billion |

| Forecast Value | $208.9 Billion |

| CAGR | 8.2% |

The cereals & grains segment is forecasted to reach USD 87.1 billion by 2034, expanding at a CAGR of 5.4%. Its strong market presence is supported by widespread incorporation in everyday products like bread, breakfast cereals, snack bars, and ready-to-eat foods. A surge in consumer preference for better-for-you options-especially gluten-free, whole-grain, and high-fiber formulations-is fueling this segment's growth. As health and wellness trends continue to shape eating habits globally, this segment remains a staple in both developed and emerging markets. Despite this momentum, fluctuating raw material prices, transportation costs, and occasional supply chain interruptions pose ongoing risks. To counteract these challenges, producers are focusing on increasing the nutritional density of cereal-based flours by fortifying them with added fiber, vitamins, and minerals to appeal to health-conscious buyers.

In 2024, protein-enriched flours segment held 30.5% share. This segment is projected to grow at a CAGR of 5.2% through 2034, driven by surging demand for protein-rich diets, which are widely associated with improved physical performance, muscle health, satiety, and weight management. Heightened consumer awareness of the negative impacts of protein deficiency, especially among older adults and specific demographic groups, is intensifying interest in functional flours with added protein. In response, manufacturers are developing innovative offerings using plant-based proteins like lentils, peas, and soy to support growing vegetarian and vegan populations, while also catering to consumers with dairy or soy allergies.

North America Functional Flours Market held a 33.9% share in 2024. The region's leading share is largely attributed to rising awareness around dietary customization, with consumers actively seeking flours suited for gluten intolerance, celiac disease, and other lifestyle-based eating patterns. This demand is driving the production and consumption of flours derived from nutrient-dense sources like chickpeas, quinoa, and brown rice. The strong presence of established industry players, who are consistently expanding their product portfolios through innovation and product diversification, is further supporting market growth.

Major players in the market include Roquette Freres, Ingredion Incorporated, Archer Daniels Midland Company (ADM), SunOpta Inc., and Associated British Foods plc. Top companies in the functional flour space are focusing on diversification, health-driven innovation, and supply chain robustness. They are expanding their product ranges to include plant-based protein flours and alternative grains. Heavy investment in R&D is enabling the development of custom-tailored flour blends that support blood sugar control, gut health, or high-protein diets. Strategic alliances with bakery and food manufacturers are improving product penetration and end-use compatibility. These players are strengthening global supply chains through sourcing partnerships and storage infrastructure to hedge against raw material price fluctuations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.1.4.1 Raw material sourcing

- 3.1.4.2 Production and manufacturing

- 3.1.4.3 Cold chain infrastructure

- 3.1.4.4 Distribution channels

- 3.1.4.5 Supply chain challenges and optimization

- 3.1.4.6 Sustainable practices

- 3.2 Trade statistics (HS code)

- 3.2.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.2.2 Major exporting countries, 2021-2024 (Kilo Tons)

( Note: the above trade statistics will be provided for key countries only)

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising health consciousness

- 3.3.1.2 Growing demand for gluten-free products

- 3.3.1.3 Increasing protein consumption

- 3.3.1.4 Clean label trends

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High cost compared to conventional flour

- 3.3.2.2 Limited shelf life

- 3.3.2.3 Processing challenges

- 3.3.2.4 Taste and texture limitations

- 3.3.3 Market opportunity

- 3.3.3.1 Emerging markets in Asia-Pacific

- 3.3.3.2 Innovation in plant-based products

- 3.3.3.3 Functional food applications

- 3.3.3.4 E-commerce expansion

- 3.3.1 Growth drivers

- 3.4 Raw material landscape

- 3.4.1 Manufacturing trends

- 3.4.2 Technology evolution

- 3.4.2.1 Processing technologies

- 3.4.2.2 Fortification methods

- 3.4.2.3 Quality testing & analysis

- 3.4.2.4 Packaging innovations

- 3.5 Pricing analysis and cost structure

- 3.5.1 Pricing trends (USD/Ton)

- 3.5.1.1 North America

- 3.5.1.2 Europe

- 3.5.1.3 Asia Pacific

- 3.5.1.4 Latin America

- 3.5.1.5 Middle East Africa

- 3.5.2 Pricing factors (raw materials, energy, labor)

- 3.5.3 Regional price variations

- 3.5.4 Cost structure breakdown

- 3.5.5 Profitability analysis

- 3.5.1 Pricing trends (USD/Ton)

- 3.6 Regulatory framework and standards

- 3.6.1 FDA regulations (U.S.)

- 3.6.2 EU regulations

- 3.6.3 Codex alimentarius standards

- 3.6.4 Regional regulatory bodies

- 3.6.5 Labeling requirements

- 3.6.6 Quality standards

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.6.1 Expansion

- 4.6.2 Mergers & acquisition

- 4.6.3 Collaborations

- 4.6.4 New product launches

- 4.6.5 Research & development

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cereals & grains

- 5.2.1 Wheat

- 5.2.2 Rice

- 5.2.3 Corn

- 5.2.4 Oats

- 5.2.5 Barley

- 5.2.6 Quinoa

- 5.2.7 Other cereals & grains

- 5.3 Legumes

- 5.3.1 Chickpeas

- 5.3.2 Lentils

- 5.3.3 Peas

- 5.3.4 Beans

- 5.3.5 Other legumes

- 5.4 Nuts & seeds

- 5.4.1 Almonds

- 5.4.2 Coconut

- 5.4.3 Sunflower seeds

- 5.4.4 Flax seeds

- 5.4.5 Other nuts & seeds

- 5.5 Fruits & vegetables

- 5.5.1 Banana

- 5.5.2 Sweet potato

- 5.5.3 Cassava

- 5.5.4 Other fruits & vegetables

- 5.6 Other sources

- 5.6.1 Insects

- 5.6.2 Algae

- 5.6.3 Mushrooms

Chapter 6 Market Estimates & Forecast, By Functionality, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Protein enriched

- 6.3 Fiber enriched

- 6.4 Gluten-free

- 6.5 Vitamin & mineral fortified

- 6.6 Low carbohydrate

- 6.7 Probiotic

- 6.8 Antioxidant rich

- 6.9 Other functionalities

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery & confectionery

- 7.2.1 Bread

- 7.2.2 Cakes & pastries

- 7.2.3 Cookies & biscuits

- 7.2.4 Muffins & cupcakes

- 7.2.5 Other bakery products

- 7.3 Snacks

- 7.3.1 Extruded snacks

- 7.3.2 Crackers

- 7.3.3 Chips

- 7.3.4 Other snacks

- 7.4 Beverages

- 7.4.1 Protein drinks

- 7.4.2 Smoothies

- 7.4.3 Functional beverages

- 7.4.4 Other beverages

- 7.5 Pasta & noodles

- 7.6 Breakfast cereals

- 7.7 Soups & sauces

- 7.8 Meat alternatives

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Granules

- 8.4 Flakes

- 8.5 Pellets

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2b (business-to-business)

- 9.2.1 Food manufacturers

- 9.2.2 Bakeries

- 9.2.3 Foodservice

- 9.2.4 Other b2b channels

- 9.3 B2c (business-to-consumer)

- 9.3.1 Supermarkets & hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retail

- 9.3.4 Convenience stores

- 9.3.5 Other b2c channels

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Cargill, Incorporated

- 11.2 Archer Daniels Midland Company (ADM)

- 11.3 Associated British Foods plc

- 11.4 General Mills, Inc.

- 11.5 Ingredion Incorporated

- 11.6 Roquette Freres

- 11.7 Tate & Lyle PLC

- 11.8 SunOpta Inc.

- 11.9 The Scoular Company

- 11.10 Agrana Beteiligungs-AG

- 11.11 Limagrain

- 11.12 Bunge Limited

- 11.13 The Andersons, Inc.

- 11.14 Grain Millers, Inc.

- 11.15 Hodgson Mill, Inc.

- 11.16 Lifeway Foods, Inc.

- 11.17 Manildra Group

- 11.18 Unicorn Grain Specialties

- 11.19 Bluebird Grain Farms