|

市場調查報告書

商品編碼

1773221

乾式煙氣脫硫系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Dry Flue Gas Desulfurization System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

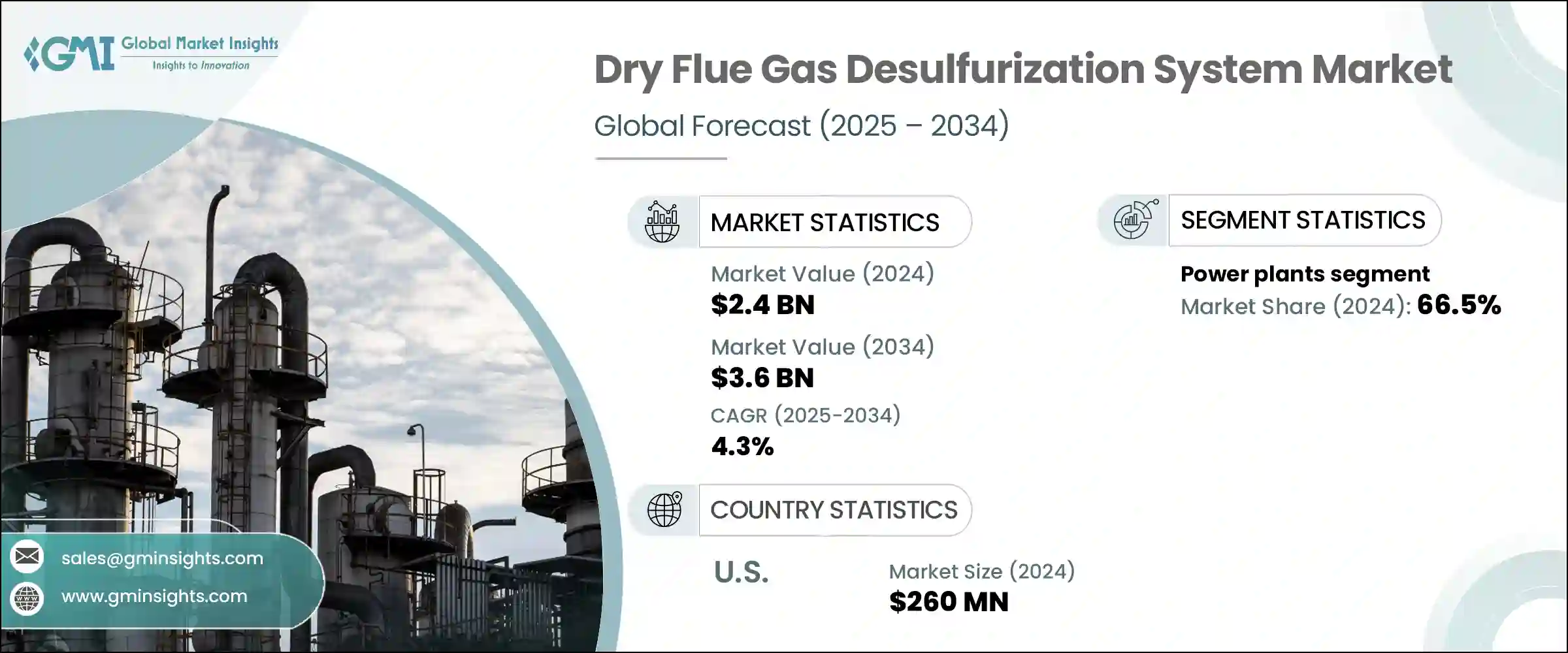

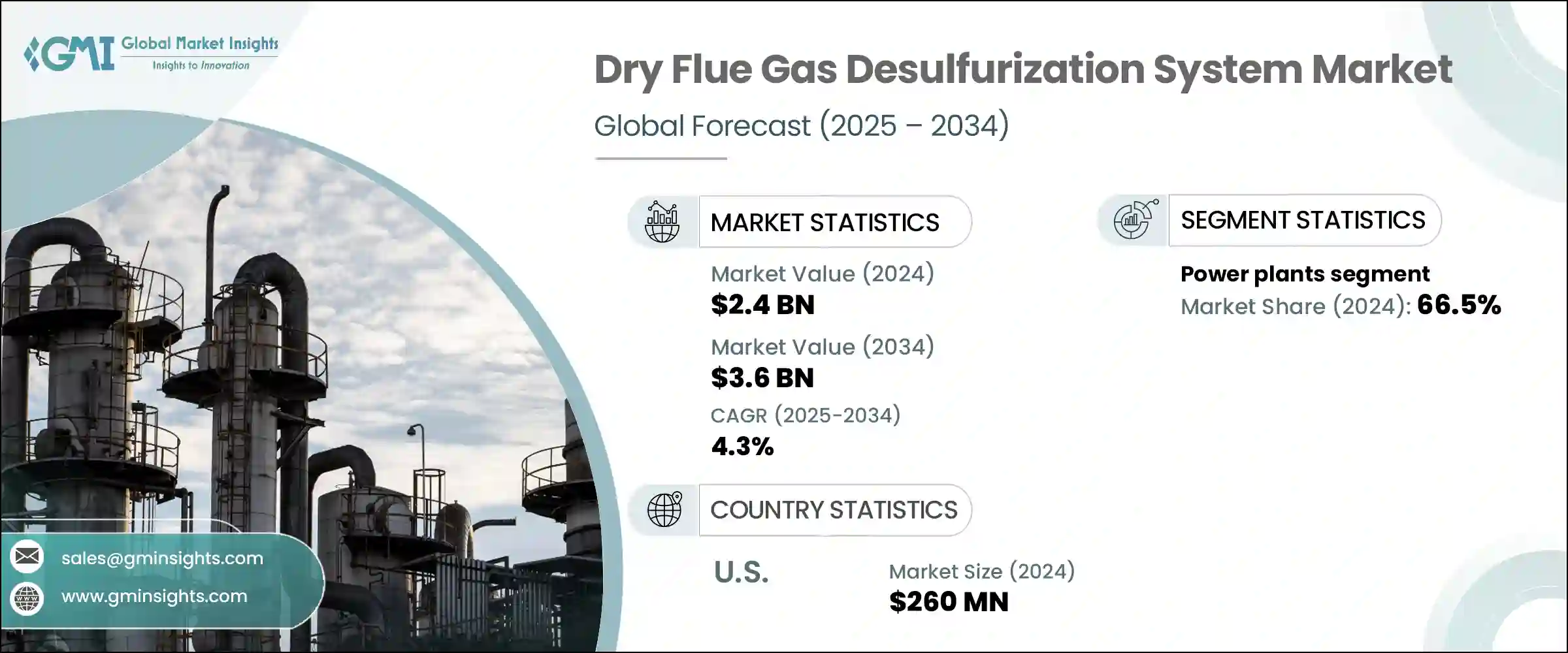

2024年,全球乾式煙氣脫硫系統市場規模達24億美元,預計到2034年將以4.3%的複合年成長率成長,達到36億美元。受日益嚴格的環境法規和全球清潔生產理念的推動,工業領域對高效二氧化硫(SO2)排放控制的需求不斷成長,推動了市場成長。乾式煙氣脫硫技術具有許多優勢,包括耗水量低、系統複雜性降低以及易於與現有基礎設施整合。發電、化工製造、水泥生產和金屬加工等行業擴大安裝此類系統,將其作為合規和永續發展策略的一部分。

科技升級不斷提升乾式煙氣脫硫系統的性能和可靠性,使其成為那些希望在不影響生產力的情況下降低排放的企業的首選。隨著公眾和監管機構對減少空氣污染的壓力日益增大,快速發展經濟體的各行各業對這些系統的需求日益成長。由於乾式煙氣脫硫技術緊湊的設計和模組化功能,現有設施的改造變得更加容易。在歐洲和北美等地區,強力的政策執行和綠色環保舉措正在推動乾式煙氣脫硫系統得到廣泛採用,尤其是在法規合規性和環境績效受到優先考慮的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 36億美元 |

| 複合年成長率 | 4.3% |

在應用方面,發電領域在2024年佔據最大的市場佔有率,達到66.5%,預計到2034年將以3.6%的複合年成長率成長。這項成長主要受嚴格的排放法規驅動,這些法規要求對老舊的燃煤電廠進行快速且經濟高效的改造。乾式煙氣脫硫系統仍是理想的選擇,其耗水量極低、設計精簡、安裝時間更短。其可擴展和模組化的特性使公用事業公司能夠靈活地滿足排放標準,而無需在土木工程或電廠大修方面投入巨資,尤其是在全球能源轉型日益深化的背景下。

2024年,美國乾式煙氣脫硫系統市場產值達2.6億美元。該市場的強勁成長得益於嚴格的美國環保署(EPA)法規以及對減少工業過程中硫排放的重視。乾式煙氣脫硫技術憑藉其節水特性、易於在現有煙氣管道中安裝以及升級期間減少運行中斷的優勢,在該市場中脫穎而出。隨著環境責任的加強,這些系統在幫助美國工業有效滿足合規要求方面發揮著至關重要的作用。

塑造乾式煙氣脫硫系統市場的知名企業包括三菱重工、通用電氣 Vernova、希柯環境和巴布科克威爾科克斯企業。乾式煙氣脫硫系統市場的公司正專注於策略性舉措,例如與能源生產商建立合作夥伴關係、提供交鑰匙改造解決方案,以及擴展服務組合,包括數位監控和預測性維護工具。

透過優先考慮模組化系統設計和節水技術,企業正在滿足缺水地區各行各業的實際需求。研發投入旨在提高系統效率、降低能耗並提高二氧化硫捕集率。製造商也正透過瞄準新興市場來拓展其全球業務,這些市場正經歷產業擴張和嚴格的空氣品質法規的考驗。利用自動化和智慧控制整合,這些公司能夠提供更具客製化、合規性的解決方案,以滿足特定行業的排放控制標準和營運限制。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 策略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 發電廠

- 化工和石化

- 水泥

- 金屬加工和採礦

- 製造業

- 其他

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第7章:公司簡介

- Babcock & Wilcox Enterprises

- CECO Environmental

- Duconenv

- GE Vernova

- GEA Group Aktiengesellschaft

- Hitachi Zosen Inova AG

- John Cockerill

- KC Cottrell India

- MET

- Mitsubishi Heavy Industries

- Nederman Holding AB

- Thermax Limited.

- Tri-Mer Corporation

- Valmet

- Verantis Environmental Solutions Group

The Global Dry Flue Gas Desulfurization System Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 3.6 billion by 2034. The market growth is fueled by increasing industrial demand for efficient sulfur dioxide (SO2 ) emission control, driven by tightening environmental regulations and the global push toward cleaner production. These dry FGD technologies provide several advantages, including low water consumption, reduced system complexity, and simplified integration into existing infrastructure. Industries such as power generation, chemical manufacturing, cement production, and metal processing are increasingly installing these systems as part of compliance and sustainability strategies.

Technological upgrades continue to improve the performance and reliability of dry FGD systems, making them a preferred choice for businesses aiming to lower emissions without compromising productivity. As public and regulatory pressure mounts to cut air pollution, industries in fast-developing economies are seeing growing demand for these systems. Retrofitting existing facilities has become easier due to the compact design and modular capabilities of dry FGD technologies. In regions like Europe and North America, strong policy enforcement and green initiatives are leading to widespread adoption, especially where regulatory compliance and environmental performance are prioritized.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 4.3% |

In terms of application, the power generation segment held the largest market share at 66.5% in 2024 and is projected to grow at a CAGR of 3.6% through 2034. This growth is primarily driven by aggressive emission mandates that require older coal-based plants to be retrofitted quickly and cost-effectively. Dry FGD systems remain an ideal fit, offering minimal water usage, streamlined design, and quicker installation timelines. Their scalable, modular nature provides utilities with the flexibility to meet emission standards without heavy investment in civil engineering or plant overhaul, especially amid a broader global energy transition.

United States Dry Flue Gas Desulfurization System Market generated USD 260 million in 2024. The market's strength is supported by rigorous EPA regulations and a strong emphasis on reducing sulfur emissions in industrial processes. Dry FGD technologies stand out in this market for their water-saving features, ease of installation in pre-existing flue gas channels, and reduced operational interruptions during upgrades. As environmental accountability intensifies, these systems are playing a vital role in helping U.S. industries meet compliance requirements with efficiency.

Prominent players shaping the Dry Flue Gas Desulfurization System Market include Mitsubishi Heavy Industries, GE Vernova, CECO Environmental, and Babcock & Wilcox Enterprises. Companies in the dry flue gas desulfurization system market are focusing on strategic initiatives such as forming partnerships with energy producers, offering turnkey retrofit solutions, and expanding service portfolios to include digital monitoring and predictive maintenance tools.

By prioritizing modular system designs and water-efficient technologies, firms are addressing the practical needs of industries operating in water-scarce regions. Investments in R&D aim to enhance system efficiency, reduce energy consumption, and improve SO2 capture rates. Manufacturers are also expanding their global footprints by targeting emerging markets with industrial expansion and strict air quality regulations. Leveraging automation and smart control integration has allowed these companies to deliver more tailored, compliance-ready solutions that align with industry-specific emission control standards and operational constraints.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategy dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Power plants

- 5.3 Chemical & petrochemical

- 5.4 Cement

- 5.5 Metal processing & mining

- 5.6 Manufacturing

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Netherlands

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Chile

- 6.6.3 Argentina

Chapter 7 Company Profiles

- 7.1 Babcock & Wilcox Enterprises

- 7.2 CECO Environmental

- 7.3 Duconenv

- 7.4 GE Vernova

- 7.5 GEA Group Aktiengesellschaft

- 7.6 Hitachi Zosen Inova AG

- 7.7 John Cockerill

- 7.8 KC Cottrell India

- 7.9 MET

- 7.10 Mitsubishi Heavy Industries

- 7.11 Nederman Holding AB

- 7.12 Thermax Limited.

- 7.13 Tri-Mer Corporation

- 7.14 Valmet

- 7.15 Verantis Environmental Solutions Group