|

市場調查報告書

商品編碼

1773219

化學品及石化產品靜電集塵器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Chemicals and Petrochemicals Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

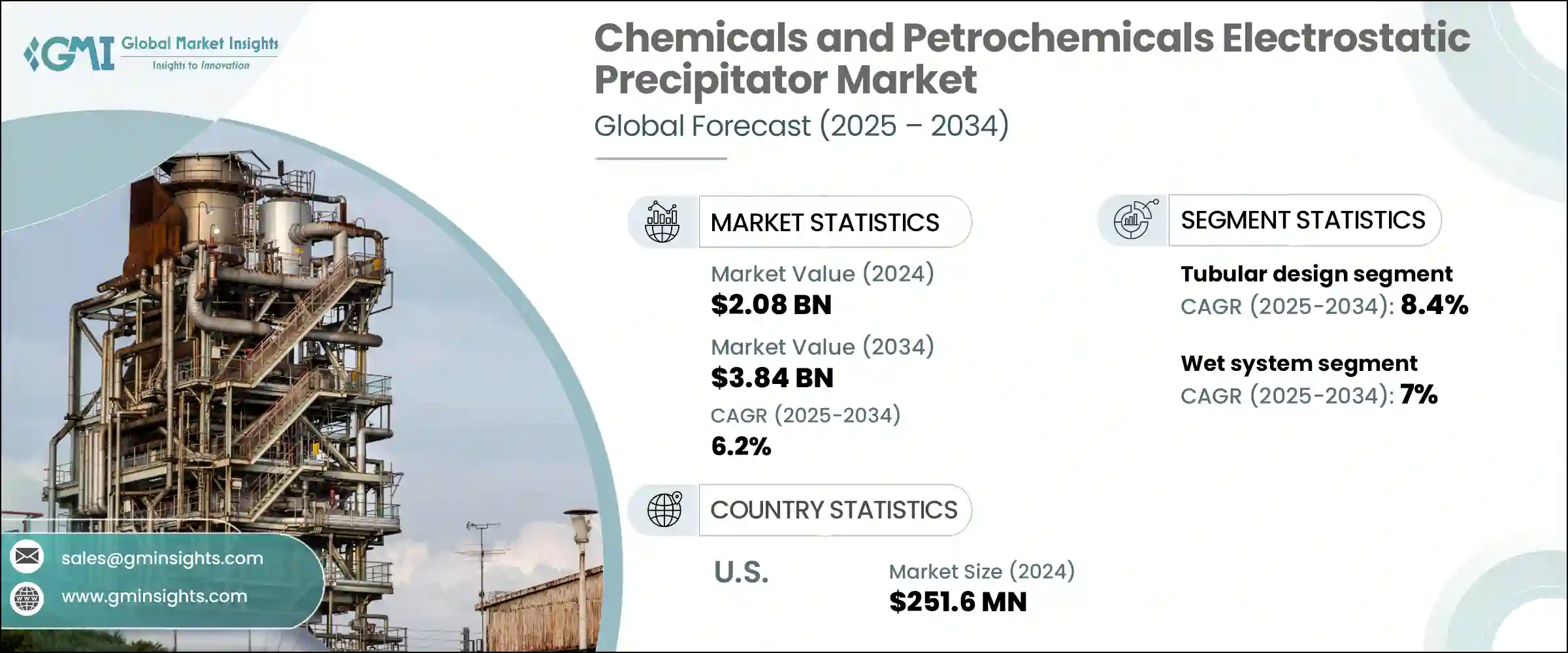

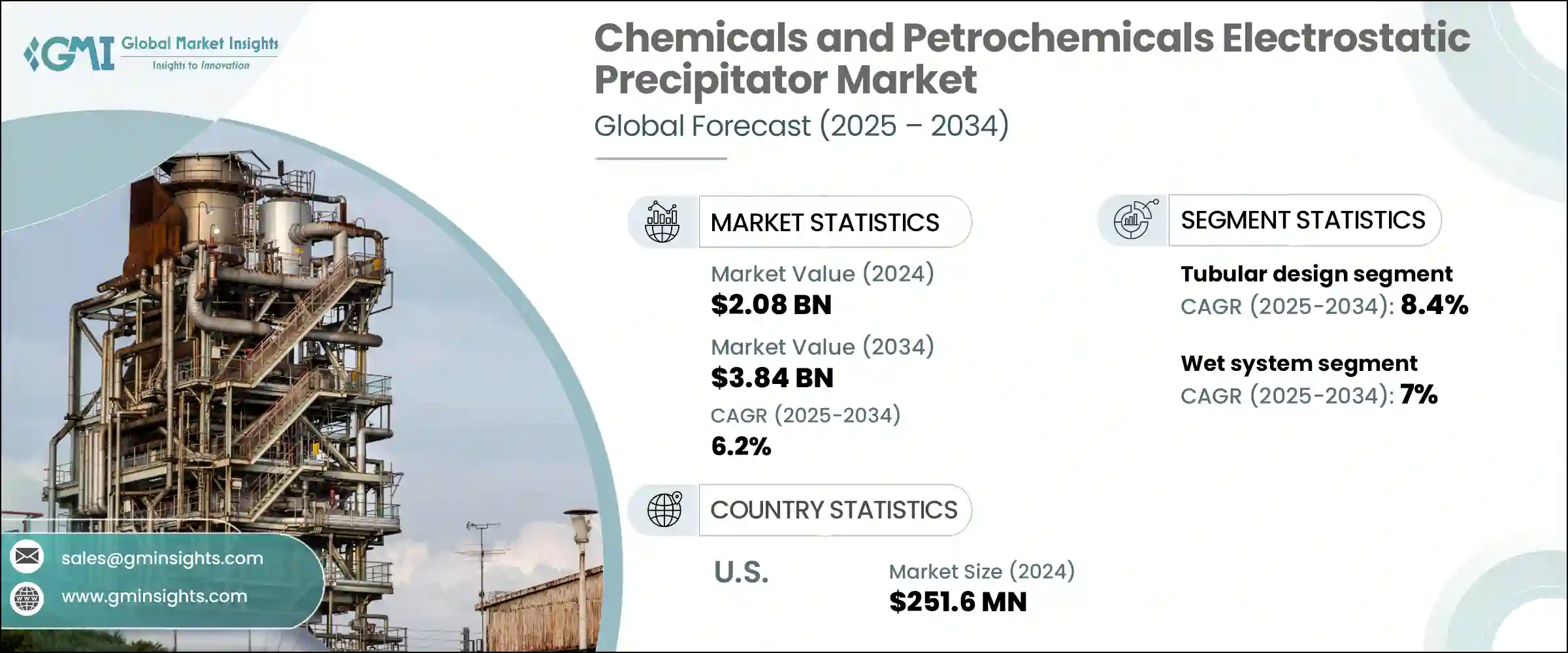

2024 年全球化學品和石化產品靜電集塵器市場規模為 20.8 億美元,預計到 2034 年將以 6.2% 的複合年成長率成長至 38.4 億美元。隨著能夠同時捕捉顆粒物和回收有價值副產品的系統日益普及,市場需求正在加速成長。這些副產品可以重新融入生產循環,從而提高整體製程效率和回收利用率。石化加工能力的提升以及現有煉油廠的營運,持續支援靜電除塵器部署的擴展。人們對空氣品質的認知不斷提高(尤其是在高排放工業區),加上對工作場所安全的擔憂,正促使工廠營運商投資先進的排放控制系統。合成化學品產量的不斷增加以及對永續營運實踐的追求,進一步推動了靜電除塵器在大容量裝置中的整合。

更嚴格的環境合規規則(尤其是在化學工業)也加速了成熟經濟體和發展中經濟體的產品採用。隨著法規日益嚴格,尤其是在危險污染物方面,採用清潔生產技術仍將一直是全球工廠的首要任務。工業營運商越來越重視減排解決方案,這些解決方案不僅要符合環境合規性,還要提高能源效率和營運效率。這種日益成長的重視正促使企業普遍轉向整合脫硫、顆粒物去除和即時排放監測等多種功能的綜合空氣污染控制系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 20.8億美元 |

| 預測值 | 38.4億美元 |

| 複合年成長率 | 6.2% |

預計到2034年,板式靜電集塵器市場規模將達到32億美元,這得益於其高去除效率以及適用於大型加工廠處理乾氣流的優勢。這類系統因其在高吞吐量工業環境中相容於連續運作且易於維護而備受青睞。各化工生產基地煙氣處理系統的持續升級將持續推動板式靜電集塵器的安裝。

2024年,乾式靜電集塵器系統市場佔86.6%。此優勢歸功於其經濟高效的設計、能夠管理50°C至450°C範圍內的煙氣溫度以及強大的除塵效率。隨著各行各業優先考慮清潔排放,乾式靜電集塵器因其維護需求低且運作可靠而仍是首選解決方案。這些系統中數位控制和即時監控技術的日益普及,增強了其在大規模工業部署中的吸引力。

預計到2034年,亞太地區化學品和石化產品靜電集塵器市場規模將達到18億美元。推動該市場成長的因素包括工業的快速發展、公眾對空氣污染日益成長的擔憂以及主要國家/地區排放標準的嚴格執行。隨著環保合規投資的增加,該地區各國都優先在現有和新建的化學和石化設施中安裝先進的靜電除塵器 (ESP) 技術。

對化學品和石化靜電除塵器市場競爭格局做出貢獻的關鍵參與者包括 HIMENVIRO、Wood、Enviropol Engineers、Valmet、ELEX、Babcock & Wilcox、ANDRITZ GROUP、GEA Group、Alstom、FLSmidth、KC Cottrell India、PPC Austria Holding、Isgec Hey Engineering、Themaxr Group 和 Themax、Themax、Themax 和 Themax、Themax、Themax、Themax Group 和 Themax。化學品和石化靜電除塵器市場的領先公司正在透過投資研發來加強其影響力,重點是提高捕獲效率、最佳化能源並降低維護成本。許多公司正在與石化和化學品製造商結成策略聯盟,以確保長期合約。企業也透過在地化製造和服務支援擴大其在亞太等快速成長地區的影響力。此外,將數位監控系統和人工智慧驅動的診斷功能整合到除塵器單元中,使公司能夠提供預測性維護解決方案,確保不間斷的效能。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依設計,2021 - 2034 年

- 主要趨勢

- 盤子

- 管狀

第6章:市場規模及預測:依系統,2021 - 2034 年

- 主要趨勢

- 乾燥

- 濕的

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 安哥拉

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

第8章:公司簡介

- ANDRITZ GROUP

- Alstom

- Babcock & Wilcox

- Enviropol Engineers

- ELEX

- FLSmidth

- GEA Group

- HIMENVIRO

- Isgec Heavy Engineering

- KC Cottrell India

- PPC Austria Holding

- Thermax Group

- Valmet

- Wood

The Global Chemicals and Petrochemicals Electrostatic Precipitator Market was valued at USD 2.08 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 3.84 billion by 2034. Demand is accelerating due to the growing use of systems capable of capturing particulate matter while simultaneously recovering valuable by-products. These by-products can be reintegrated into the production cycle, boosting overall process efficiency and recycling efforts. The addition of petrochemical processing capacity alongside existing refinery operations continues to support the expansion of electrostatic precipitator deployments. Greater awareness of air quality, especially in high-emission industrial zones, along with workplace safety concerns, is pushing plant operators to invest in advanced emissions control systems. Increasing synthetic chemical output and the push for sustainable operational practices are further fueling the integration of electrostatic precipitators in large-capacity units.

Tighter environmental compliance rules, particularly across the chemicals sector, are also accelerating product adoption in both mature and developing economies. With regulations becoming more rigorous, particularly for hazardous pollutants, the use of cleaner production technologies will remain a top priority across global facilities. Industrial operators are increasingly prioritizing emission-reduction solutions that not only meet environmental compliance but also enhance energy efficiency and operational productivity. This growing emphasis is prompting a widespread shift toward integrated air pollution control systems that combine multiple functions such as desulfurization, particulate removal, and real-time emissions monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.08 Billion |

| Forecast Value | $3.84 Billion |

| CAGR | 6.2% |

The plate-type electrostatic precipitator segment is expected to reach USD 3.2 billion by 2034, driven by its high removal efficiency and suitability for handling dry gas streams in large processing plants. These systems are favored for their compatibility with continuous operations and ease of maintenance in high-throughput industrial environments. Ongoing upgrades to flue gas treatment systems across various chemical manufacturing sites will continue to drive the installation of plate-type ESPs.

Dry electrostatic precipitator systems segment accounted for 86.6% in 2024. This dominance is attributed to their cost-effective design, ability to manage flue gas temperatures ranging between 50°C and 450°C, and strong collection efficiency. As industries prioritize cleaner emissions, dry ESPs remain the preferred solution due to low maintenance needs and operational reliability. The growing use of digital controls and real-time monitoring technology in these systems is enhancing their appeal for large-scale industrial deployment.

Asia Pacific Chemicals and Petrochemicals Electrostatic Precipitator Market is expected to reach USD 1.8 billion by 2034. Factors driving growth include rapid industrial development, heightened public concern over air pollution, and stricter enforcement of emission standards across key countries. As investments in environmental compliance increase, countries across the region are prioritizing the installation of advanced ESP technologies in both existing and newly built chemical and petrochemical facilities.

Key players contributing to the competitive landscape of the Chemicals and Petrochemicals Electrostatic Precipitator Market include HIMENVIRO, Wood, Enviropol Engineers, Valmet, ELEX, Babcock & Wilcox, ANDRITZ GROUP, GEA Group, Alstom, FLSmidth, KC Cottrell India, PPC Austria Holding, Isgec Heavy Engineering, Thermax Group, and the Thermax Group. Leading companies in the chemicals and petrochemicals electrostatic precipitator market are strengthening their presence by investing in R&D focused on improving capture efficiency, energy optimization, and reducing maintenance costs. Many firms are forming strategic alliances with petrochemical and chemical manufacturers to secure long-term contracts. Businesses are also expanding their footprints in fast-growing regions like Asia Pacific through localized manufacturing and service support. Additionally, integrating digital monitoring systems and AI-driven diagnostics into precipitator units allows companies to offer predictive maintenance solutions, ensuring uninterrupted performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Design, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Plate

- 5.3 Tubular

Chapter 6 Market Size and Forecast, By System, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Wet

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.5.5 Angola

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

- 7.6.4 Peru

Chapter 8 Company Profiles

- 8.1 ANDRITZ GROUP

- 8.2 Alstom

- 8.3 Babcock & Wilcox

- 8.4 Enviropol Engineers

- 8.5 ELEX

- 8.6 FLSmidth

- 8.7 GEA Group

- 8.8 HIMENVIRO

- 8.9 Isgec Heavy Engineering

- 8.10 KC Cottrell India

- 8.11 PPC Austria Holding

- 8.12 Thermax Group

- 8.13 Valmet

- 8.14 Wood