|

市場調查報告書

商品編碼

1766307

乾式靜電集塵器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dry Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

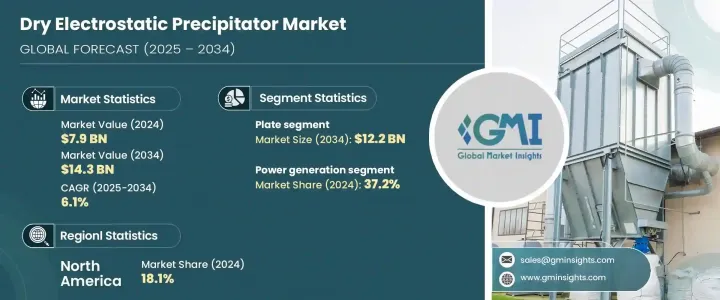

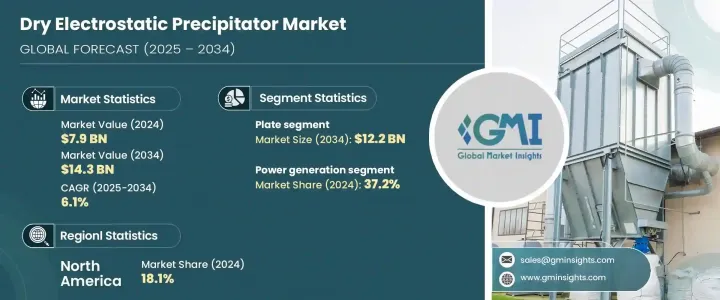

2024年,全球乾式靜電集塵器市場規模達79億美元,預計複合年成長率為6.1%,到2034年將達到143億美元。全球範圍內旨在減少空氣污染和控制工業源顆粒物排放的更嚴格的環境法規,對乾式靜電除塵器的應用產生了強烈的影響。此外,快速的工業化和城鎮化進程,尤其是在亞太等新興市場,正在推動對有效空氣污染控制解決方案的需求,從而推動乾式靜電集塵器的普及。

市場的成長也得益於對先進技術的大量投資,這些技術提升了靜電除塵器系統的性能和效率。電極設計、先進材料和精密控制系統的創新正在提高這些系統的除塵效率和可靠性。乾式靜電集塵器結構緊湊,在處理相同氣體量的情況下,所需的垂直空間可減少兩到三倍,使其成為空間有限的安裝的理想選擇。這些系統對PM2.5等細懸浮微粒的除塵效率可達99%以上,適用於發電、水泥和冶金等產業的高容量煙氣應用。此外,其連續運作能力以及處理高粉塵負荷且維護成本極低的能力,使其成為經濟可行的工業長期解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 79億美元 |

| 預測值 | 143億美元 |

| 複合年成長率 | 6.1% |

到2034年,板式乾式靜電集塵器市場規模可望達到122億美元,這得益於其卓越的細懸浮微粒捕集能力。這些系統表現出極高的捕集效率,尤其適用於較小的顆粒物,使其在控制空氣污染方面非常有效。從小型工業營運到大型發電廠,它們用途廣泛,這推動了其廣泛應用。板式靜電集塵器需求的成長歸因於其在各種環境下的適應性和高效性,確保更清潔的排放並改善空氣品質。這使得它們成為需要先進空氣污染控制解決方案的行業的首選,尤其是需要處理大量廢氣的行業。

製造業預計將經歷強勁成長,預計2025年至2034年間的複合年成長率為6.7%。推動這一成長的因素有很多,例如對工業現代化的日益重視、工作場所空氣品質法規的日益嚴格以及人們對呼吸系統健康風險的日益關注。對更清潔、更永續的生產流程的需求也推動了乾式靜電集塵器的廣泛應用。企業正在採用自動化除塵系統來減少空氣中的顆粒物,這進一步刺激了對這些技術的需求。隨著各行各業努力改善其環境足跡並遵守更嚴格的監管要求,製造業對乾式靜電除塵器等有效污染控制技術的需求預計將大幅成長。

預計到2034年,亞太地區乾式靜電集塵器市場規模將達67億美元。該地區燃煤發電的持續擴張是市場成長的重要推動力。由於煤炭仍然是許多國家的主要能源,因此對用於減輕污染的排放控制系統的需求正在增加。此外,水泥和金屬產業先進空氣污染控制技術的採用也進一步推動了乾式靜電集塵器的應用。旨在減少空氣污染的監管措施正在鼓勵各行各業投資於更清潔的技術。該地區各工業領域的投資也在增加,這將加速尖端顆粒物控制解決方案的採用,從而促進乾式靜電除塵器市場的發展。

全球乾式靜電集塵器行業的知名企業包括 GEAGroup Aktiengesellschaft、Babcock and Wilcox Enterprises、西門子能源、三菱重工、安德里茨集團、Duconenv、Thermax、PPC Industries、住友重工、Wood、Enviropol Engineers、DURR Group、WETAPC、KIX Cottrell。為加強在乾式靜電集塵器市場的地位,各公司正專注於持續創新和策略夥伴關係。透過投資開發符合嚴格環境標準的更有效率的系統,他們旨在滿足對先進污染控制技術日益成長的需求。各公司也專注於擴大其全球影響力,特別是在新興市場,工業成長和環境法規為這些市場創造了機會。許多公司也正在使其產品多樣化,為從發電到製造的不同行業提供客製化解決方案,進一步鞏固其市場地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依設計,2021 - 2034 年

- 主要趨勢

- 盤子

- 管狀

第6章:市場規模與預測:依排放產業,2021 - 2034 年

- 主要趨勢

- 發電

- 化學品和石化產品

- 水泥

- 金屬加工和採礦

- 製造業

- 海洋

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 安哥拉

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

第8章:公司簡介

- ANDRITZ GROUP

- Babcock and Wilcox Enterprises

- Duconenv

- DURR Group

- Enviropol Engineers

- GEA Group Aktiengesellschaft

- KC Cottrell India

- Mitsubishi Heavy Industries

- PPC Industries

- Siemens Energy

- Sumitomo Heavy Industries

- Thermax

- TAPC

- Wood

The Global Dry Electrostatic Precipitator Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 14.3 billion by 2034. The adoption of these systems is being strongly influenced by stricter environmental regulations worldwide aimed at reducing air pollution and controlling emissions of particulate matter from industrial sources. Additionally, rapid industrialization and urbanization, especially in emerging markets like the Asia Pacific, are driving the demand for effective air pollution control solutions, which is propelling the adoption of dry electrostatic precipitators.

The growth of the market is also being fueled by significant investments in advanced technologies that enhance the performance and efficiency of electrostatic precipitator systems. Innovations in electrode designs, advanced materials, and sophisticated control systems are improving the collection efficiency and reliability of these systems. The compact nature of dry ESPs, requiring up to two or three times less vertical space for the same gas volume, makes them ideal for installations with limited space. These systems can achieve collection efficiencies of more than 99% for fine particles like PM2.5, making them suitable for high-capacity flue gas applications in industries such as power generation, cement, and metallurgy. Moreover, their continuous operation capabilities, along with their ability to handle heavy dust loads with minimal maintenance, make them an economically viable long-term solution for industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 6.1% |

The plate-based segment of the dry electrostatic precipitator market is poised to reach USD 12.2 billion by 2034, owing to their superior ability to capture fine particulate matter. These systems have demonstrated high collection efficiency, particularly for smaller particles, making them highly effective in controlling air pollution. Their versatility across a wide range of applications, from small-scale industrial operations to large power plants, has fueled their widespread adoption. The increased demand for plate ESPs is attributed to their adaptability and efficiency in diverse settings, ensuring cleaner emissions and improved air quality. This makes them a preferred choice for industries that require advanced air pollution control solutions, especially those dealing with high volumes of exhaust gases.

The manufacturing sector is expected to experience a robust growth rate, with a projected CAGR of 6.7% between 2025 and 2034. Several factors are driving this growth, such as the increasing emphasis on industrial modernization, stricter workplace air quality regulations, and growing awareness of respiratory health risks. The demand for cleaner, more sustainable production processes is also encouraging the widespread adoption of dry electrostatic precipitators. Companies are adopting automated dust control systems to mitigate airborne particulate matter, further boosting the need for these technologies. As industries strive to improve their environmental footprint and comply with stricter regulatory requirements, the demand for effective pollution control technologies like dry ESPs is expected to grow significantly in the manufacturing sector.

Asia Pacific Dry Electrostatic Precipitator Market is anticipated to reach USD 6.7 billion by 2034. The ongoing expansion of coal-based power generation in the region is a significant contributor to the market growth. As coal remains a primary energy source in many countries, the demand for emission control systems to mitigate pollution is rising. Additionally, the installation of advanced air pollution control technologies in cement and metal industries is further propelling the adoption of dry electrostatic precipitators. Regulatory measures aimed at reducing air pollution are encouraging industries to invest in cleaner technologies. The region is also experiencing increased investments in various industrial sectors, which will accelerate the adoption of cutting-edge particulate control solutions, bolstering the dry ESP market.

Prominent players in the Global Dry Electrostatic Precipitator Industry include GEAGroup Aktiengesellschaft, Babcock and Wilcox Enterprises, Siemens Energy, Mitsubishi Heavy Industries, ANDRITZ GROUP, Duconenv, Thermax, PPC Industries, Sumitomo Heavy Industries, Wood, Enviropol Engineers, DURR Group, TAPC, KC Cottrell India, and WEIXIAN. To strengthen their presence in the dry electrostatic precipitator market, companies are focusing on continuous innovation and strategic partnerships. By investing in the development of more efficient systems that meet stringent environmental standards, they aim to cater to the growing demand for advanced pollution control technologies. Companies are also focusing on expanding their global footprint, particularly in emerging markets, where industrial growth and environmental regulations are creating opportunities. Many companies are also diversifying their product offerings to provide tailored solutions for different industries, from power generation to manufacturing, further cementing their market positions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Design, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Plate

- 5.3 Tubular

Chapter 6 Market Size and Forecast, By Emitting Industry, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Power generation

- 6.3 Chemicals and petrochemicals

- 6.4 Cement

- 6.5 Metal processing & mining

- 6.6 Manufacturing

- 6.7 Marine

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.5.5 Angola

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

- 7.6.4 Peru

Chapter 8 Company Profiles

- 8.1 ANDRITZ GROUP

- 8.2 Babcock and Wilcox Enterprises

- 8.3 Duconenv

- 8.4 DURR Group

- 8.5 Enviropol Engineers

- 8.6 GEA Group Aktiengesellschaft

- 8.7 KC Cottrell India

- 8.8 Mitsubishi Heavy Industries

- 8.9 PPC Industries

- 8.10 Siemens Energy

- 8.11 Sumitomo Heavy Industries

- 8.12 Thermax

- 8.13 TAPC

- 8.14 Wood