|

市場調查報告書

商品編碼

1766318

真空包裝機市場機會、成長動力、產業趨勢分析及2025-2034年預測Vacuum Packing Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

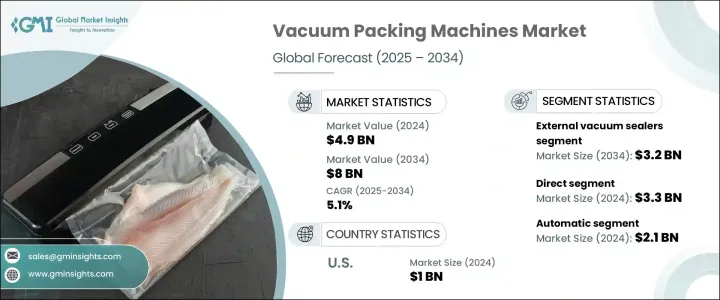

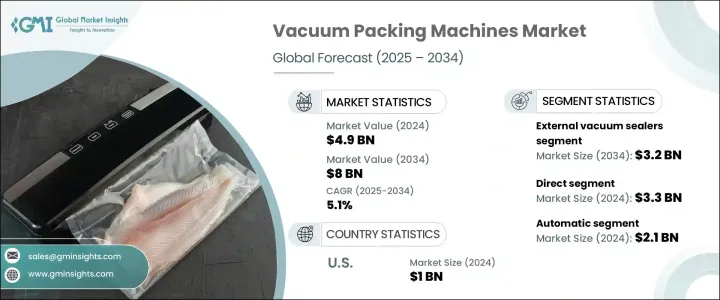

2024年,全球真空包裝機市場規模達49億美元,預計到2034年將以5.1%的複合年成長率成長,達到80億美元。市場擴張的主要動力源於人們對延長保存期限和減少食品浪費日益成長的需求。隨著消費者對新鮮預包裝食品的需求不斷成長,包裝技術也不斷發展。真空密封製程可以消除氧氣,減緩食品腐敗,並保護易腐爛產品的完整性。隨著對減少浪費和維持食品品質的重視,即食食品、乳製品和肉類等行業正在採用先進的真空解決方案。

此外,全球食品貿易和電子商務的興起,也增加了對能夠承受長途運輸的安全包裝的需求。真空包裝在保持品質、防止污染和避免氧化方面發揮著至關重要的作用。隨著人們的購買習慣轉向更多包裝產品,真空密封在維護長距離供應鏈中的產品安全方面的作用變得更加關鍵。出口商和食品配送平台現在更加關注產品的包裝方式,尤其是在溫度敏感性和腐敗風險較高的情況下,以確保食品無論距離多遠都能保持最佳狀態。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 49億美元 |

| 預測值 | 80億美元 |

| 複合年成長率 | 5.1% |

2024年,外部真空封口機市場規模達19億美元,預計2034年將達32億美元。該市場憑藉其經濟實惠、操作簡便以及在小規模包裝環境中的適應性而佔據主導地位。這類機器廣泛應用於食品相關行業的中小型企業,能夠有效率地去除空氣並進行密封,且無需複雜的設定。它們在緊湊空間中的實用性以及便攜性和設計的持續改進,也使其在店內和家用領域都頗具吸引力。隨著減少食品變質和延長保鮮期的需求不斷成長,外部真空封口機仍然是關鍵的解決方案。使用者友善機型的改進也推動了它們日益普及,這些機型能夠在各種環境下實現高效包裝。

2024年,直接分銷市場規模達33億美元,預計2034年的複合年成長率將達到5.3%。由於這種方式能夠實現生產商和買家之間的直接互動,因此仍然是全球範圍內的首選。透過消除中間商,製造商可以更好地了解客戶需求,提供專業協助,並提供對資本密集型設備至關重要的客製化解決方案。直銷通路不僅可以提高供應商的利潤率,還能支持技術合作、個人化諮詢和長期服務協議,這些在製藥、電子和食品加工等機械客製化較為普遍的行業中都至關重要。

2024年,北美真空包裝機市場規模達10億美元,預計2025年至2034年期間的複合年成長率將達到5.2%。美國憑藉其成熟的食品加工基礎設施以及消費者對包裝和簡便食品日益成長的需求,繼續保持領先地位。節能系統、自動化和智慧包裝技術的創新正在提升機器性能,並使其與業界標準接軌。這些改進對於乳製品和海鮮等監管嚴格的行業尤其重要,因為包裝的一致性對於合規性和產品安全至關重要。監管支援、技術創新以及不斷變化的飲食習慣共同推動該地區的需求。

全球真空包裝機市場的主要參與者包括 ULMA、Henkelman、Sammic、MULTIVAC、Cekoi、VC999、Echo、SELO、Koch、Promarks、AMAC、Orved、VAC-STAR、Fischbein 和 Henkovac。真空包裝機市場的領先公司正在採取多項策略措施來鞏固其市場地位。許多公司專注於研發,以創造技術先進、節能且結構緊湊的機器,以滿足各行業的需求。戰略夥伴關係和合作關係可以進入更廣闊的市場並交流技術專長。一些公司正在透過直接和間接管道加強其全球分銷網路,以覆蓋更廣泛的客戶群。客製化已成為關鍵賣點,公司提供旨在滿足特定客戶要求的設備。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 外部真空封口機

- 單室

- 雙腔

- 噴嘴

- 桌面

- 落地式

- 熱成型機

- 托盤封口機

第6章:市場估計與預測:按自動化,2021-2034 年

- 主要趨勢

- 手動的

- 半自動

- 自動的

第7章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 軟包裝

- 硬包裝

- 貼體包裝

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 食品和飲料

- 製藥

- 消費品

- 其他

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第 10 章:市場估計與預測:按地區,2021 年至 2034 年,

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- AMAC

- Cekoi

- Echo

- Fischbein

- Henkelman

- Henkovac

- Koch

- MULTIVAC

- Orved

- Promarks

- Sammic

- SELO

- ULMA

- VAC-STAR

- VC999

The Global Vacuum Packing Machines Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 8 billion by 2034. This market expansion is primarily driven by the increasing demand to extend shelf life and minimize food waste. As consumer demand increases for fresh, pre-packaged food options, packaging technologies continue to evolve. The vacuum sealing process eliminates oxygen, slowing spoilage and protecting the integrity of perishable products. With a heightened emphasis on minimizing waste and preserving food quality, industries such as ready-made meals, dairy, and meat are incorporating advanced vacuum solutions.

Additionally, the rise in global food trade and e-commerce has increased the necessity for secure packaging that can withstand extended transport. Vacuum packaging plays a critical role in maintaining quality, preventing contamination, and avoiding oxidation. As purchasing habits shift toward more packaged products, the role of vacuum sealing becomes even more critical in maintaining product safety across long-distance supply chains. Exporters and food delivery platforms now pay greater attention to how products are packed, especially when temperature sensitivity and spoilage risks are high, ensuring food arrives in prime condition regardless of distance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $8 Billion |

| CAGR | 5.1% |

The external vacuum sealers segment accounted for USD 1.9 billion in 2024 and is projected to reach USD 3.2 billion by 2034. This segment has gained dominance due to its affordability, operational simplicity, and adaptability in small-scale packaging environments. Widely utilized by small to mid-sized businesses in food-related operations, these machines are highly effective at air removal and sealing, all without the need for complex setup. Their practicality in compact spaces and continued improvements in portability and design have also made them appealing for in-store and residential use. As the demand for reducing spoilage and extending freshness rises, external vacuum sealers remain a key solution. Their growing popularity is also backed by advancements in user-friendly models that enable efficient packaging across a variety of settings.

The direct distribution segment was valued at USD 3.3 billion in 2024 and is anticipated to grow at a CAGR of 5.3% throughout 2034. This method remains the preferred choice globally due to the direct interaction it allows between producers and buyers. By eliminating intermediaries, manufacturers can better understand client needs, provide specialized assistance, and deliver tailor-made solutions essential for capital-intensive equipment. The direct sales channel not only boosts profit margins for suppliers but also supports technical engagement, personalized consultation, and long-term service agreements, all of which are critical in sectors such as pharmaceuticals, electronics, and food processing where machinery customization is common.

North America Vacuum Packing Machines Market was valued at USD 1 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2034. The United States continues to lead due to a mature food processing infrastructure and increasing consumer demand for packaged and convenient meals. Innovations in energy-efficient systems, automation, and smart packaging technologies are elevating machine capabilities and aligning with industry standards. These improvements are especially crucial for high-regulation sectors like dairy and seafood, where consistency in packaging is essential for compliance and product safety. The combination of regulatory support, technology innovation, and evolving food habits continues to drive demand in the region.

Some of the major players in the Global Vacuum Packing Machines Market include ULMA, Henkelman, Sammic, MULTIVAC, Cekoi, VC999, Echo, SELO, Koch, Promarks, AMAC, Orved, VAC-STAR, Fischbein, and Henkovac. Leading companies in the vacuum packing machines market are employing several strategic initiatives to reinforce their market positions. Many focus on research and development to create technologically advanced, energy-efficient, and compact machines that cater to various industries. Strategic partnerships and collaborations allow access to wider markets and the exchange of technological expertise. Several firms are enhancing their global distribution networks through both direct and indirect channels to reach a broader customer base. Customization has become a key selling point, with companies offering equipment designed to meet specific client requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Automation

- 2.2.4 Packaging type

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 External vacuum sealers

- 5.2.1 Single chamber

- 5.2.2 Double chamber

- 5.2.3 Nozzle

- 5.2.4 Tabletop

- 5.2.5 Floor-standing

- 5.3 Thermoforming machines

- 5.4 Tray sealing machines

Chapter 6 Market Estimates & Forecast, By Automation, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Automatic

Chapter 7 Market Estimates & Forecast, By Packaging type, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Flexible packaging

- 7.3 Rigid packaging

- 7.4 Skin packaging

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Consumer goods

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 The U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 AMAC

- 11.2 Cekoi

- 11.3 Echo

- 11.4 Fischbein

- 11.5 Henkelman

- 11.6 Henkovac

- 11.7 Koch

- 11.8 MULTIVAC

- 11.9 Orved

- 11.10 Promarks

- 11.11 Sammic

- 11.12 SELO

- 11.13 ULMA

- 11.14 VAC-STAR

- 11.15 VC999