|

市場調查報告書

商品編碼

1755345

氫氣市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hydrogen Generation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

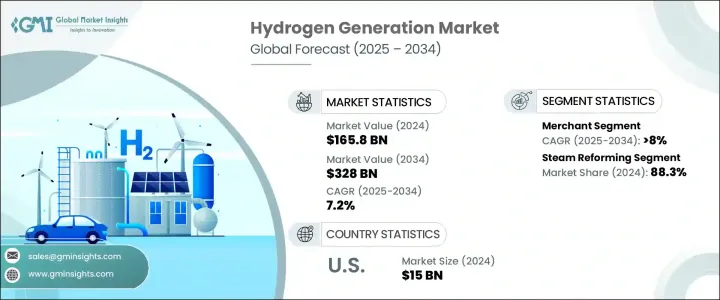

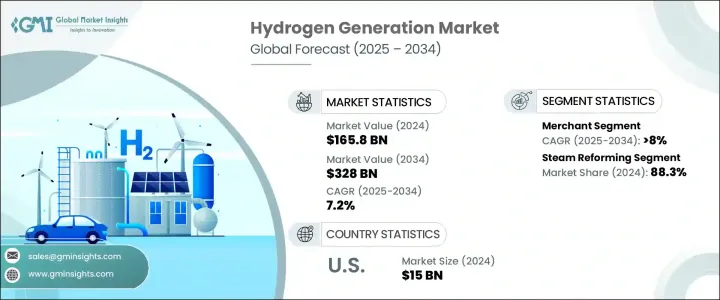

2024年,全球氫氣生產市場規模達1,658億美元,預計到2034年將以7.2%的複合年成長率成長,達到3,280億美元。這主要得益於低碳工業燃料需求的不斷成長,以及從傳統化石燃料轉向更清潔替代品的轉變。此外,氨生產、煉油和合成燃料製造等產業持續專注於脫碳,將顯著推動低碳氫化合物的普及。氫燃料電池汽車(FCV),包括公車、卡車和船舶,以及加氫站的擴張,將進一步刺激市場成長。

氫氣在鋼鐵生產、化學製造和煉油等行業日益廣泛的應用,旨在減少碳排放,也將在推動市場發展方面發揮關鍵作用。針對發展氫能基礎設施和技術的財政誘因、撥款和補貼增強了市場前景。然而,對進口氫氣設備和零件徵收的關稅可能會影響成長,增加開發商的資本支出,並可能推遲專案進度。氫氣生產市場分為蒸汽重整、電解等多個領域,其中蒸汽重整因其成本效益高且基礎設施完善而佔據最大佔有率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1658億美元 |

| 預測值 | 3280億美元 |

| 複合年成長率 | 7.2% |

2024年,蒸汽重整在氫氣生產市場中的佔有率達到88.3%。這主要歸功於其經濟高效的生產能力以及支持其廣泛應用的完善基礎設施。蒸汽重整長期以來一直是氫氣生產的首選方法,尤其是在煉油和石化等行業,它在生產各種工藝所需的氫氣方面發揮著至關重要的作用。

預計到2034年,自備氫能市場規模將達到2,680億美元,並將受益於工業和商業用現場氫氣投資的增加。這項轉變旨在降低供應鏈風險並提高能源安全。綠色氫能技術在內部消費的應用日益增多,尤其是在煉油和化學產業,將進一步刺激市場擴張。此外,鼓勵清潔能源整合的政策激勵措施將支持氫能技術在各領域的持續應用。

2024年,美國氫能發電市場規模達150億美元,這得益於氫能在發電和運輸領域日益成長的作用。提高電網靈活性、減少對化石燃料的依賴以及支持向清潔能源轉型的需求推動了對氫能解決方案的需求。氫能正日益成為重工業和交通運輸(包括貨運和公車)脫碳的關鍵因素。公共和私營部門為實現經濟脫碳而採取的措施正在進一步推動氫能技術的普及,預計未來幾年將帶來顯著的市場成長。

全球氫氣生產市場的主要參與者包括林德、空氣化學產品公司、液化空氣集團、麥克菲能源和普拉格能源等。這些公司正在採取各種策略來鞏固其市場地位,包括投資研發以提高氫氣生產技術的效率和永續性。許多公司正在透過整合再生氫能解決方案並與其他產業參與者建立策略合作夥伴關係來建立氫能基礎設施,從而擴大其產品供應。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 策略舉措

- 競爭基準測試

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依交付方式,2021 - 2034 年

- 主要趨勢

- 俘虜

- 商人

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 石油煉油廠

- 化學

- 金屬

- 其他

第7章:市場規模及預測:依工藝,2021 - 2034

- 主要趨勢

- 蒸氣重整器

- 電解

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第9章:公司簡介

- Air Liquide

- Air Products and Chemicals

- Ballard Power Systems

- Ally Hi-Tech

- Claind

- Engie

- Caloric

- HyGear

- Iwatani Corporation

- Linde

- Mahler

- Messer

- McPhy Energy

- Nel ASA

- Nuvera Fuel Cells

- Plug Power

- Resonac Holdings Corporation

- Taiyo Nippon Sanso Corporation

- Teledyne Technologies Incorporated

- Xebec Adsorption

The Global Hydrogen Generation Market was valued at USD 165.8 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 328 billion by 2034, driven by the increasing demand for low-carbon industrial fuels and a shift from traditional fossil-based feedstocks to cleaner alternatives. Additionally, the ongoing focus on decarbonizing sectors like ammonia production, refining, and synthetic fuel manufacturing will significantly boost the adoption of low-carbon hydrogen. The growing popularity of hydrogen fuel cell vehicles (FCVs), including buses, trucks, and ships, alongside the expansion of hydrogen refueling stations, will further stimulate market growth.

The rising application of hydrogen in industries such as steel production, chemical manufacturing, and refining, aimed at reducing carbon emissions, will also play a crucial role in driving the market. Financial incentives, grants, and subsidies for developing hydrogen infrastructure and technologies enhance the market outlook. However, tariffs imposed on imported hydrogen production equipment and components may affect growth, raising capital expenditures for developers and potentially delaying project timelines. The hydrogen generation market is divided into segments such as steam reforming, electrolysis, and others, with steam reforming holding the largest share due to its cost-effectiveness and established infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $165.8 Billion |

| Forecast Value | $328 Billion |

| CAGR | 7.2% |

The steam reforming segment in the hydrogen generation market held 88.3% share in 2024. This is largely due to its cost-effective production capabilities and the well-established infrastructure that supports its widespread use. Steam reforming has long been the preferred method for hydrogen production, especially within industries like refining and petrochemicals, where it plays a crucial role in generating the hydrogen needed for various processes.

The captive segment is expected to reach USD 268 billion by 2034 and will benefit from increasing investments in on-site hydrogen generation for industrial and commercial use. This shift is aimed at mitigating supply chain risks and improving energy security. The growing use of green hydrogen technologies for in-house consumption, particularly in the refining and chemical industries, will further stimulate market expansion. Additionally, policy incentives encouraging the integration of clean energy will support the ongoing adoption of hydrogen across various sectors.

United States Hydrogen Generation Market was valued at USD 15 billion in 2024, driven by the increasing role of hydrogen in both power generation and the transportation sector. The demand for hydrogen-based solutions is driven by the desire to improve grid flexibility, reduce dependence on fossil fuels, and support the transition to clean energy. Hydrogen is increasingly a key player in decarbonizing heavy industries and transportation, including freight and buses. Public and private sector initiatives to decarbonize the economy are further propelling the adoption of hydrogen technologies, which is expected to lead to significant market growth in the years ahead.

Key players in the Global Hydrogen Generation Market include Linde, Air Products and Chemicals, Air Liquide, McPhy Energy, and Plug Power, among others. These companies are employing various strategies to strengthen their market position, including investments in research and development to enhance the efficiency and sustainability of hydrogen production technologies. Many companies are expanding their product offerings by integrating renewable hydrogen solutions and forming strategic partnerships with other industry players to build hydrogen infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Delivery Mode, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Captive

- 5.3 Merchant

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Petroleum refinery

- 6.3 Chemical

- 6.4 Metal

- 6.5 Others

Chapter 7 Market Size and Forecast, By Process, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Steam reformer

- 7.3 Electrolysis

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Netherlands

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 Air Liquide

- 9.2 Air Products and Chemicals

- 9.3 Ballard Power Systems

- 9.4 Ally Hi-Tech

- 9.5 Claind

- 9.6 Engie

- 9.7 Caloric

- 9.8 HyGear

- 9.9 Iwatani Corporation

- 9.10 Linde

- 9.11 Mahler

- 9.12 Messer

- 9.13 McPhy Energy

- 9.14 Nel ASA

- 9.15 Nuvera Fuel Cells

- 9.16 Plug Power

- 9.17 Resonac Holdings Corporation

- 9.18 Taiyo Nippon Sanso Corporation

- 9.19 Teledyne Technologies Incorporated

- 9.20 Xebec Adsorption