|

市場調查報告書

商品編碼

1750554

水泥餘熱回收系統市場機會、成長動力、產業趨勢分析及2025-2034年預測Cement Waste Heat Recovery System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

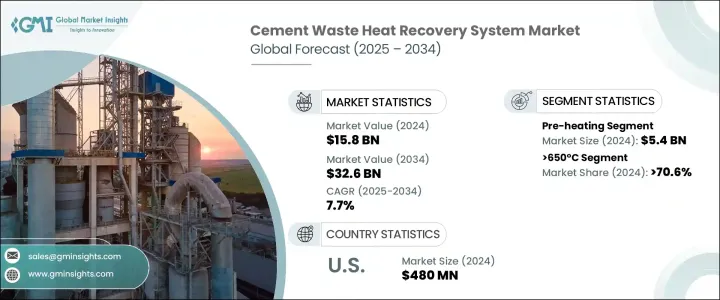

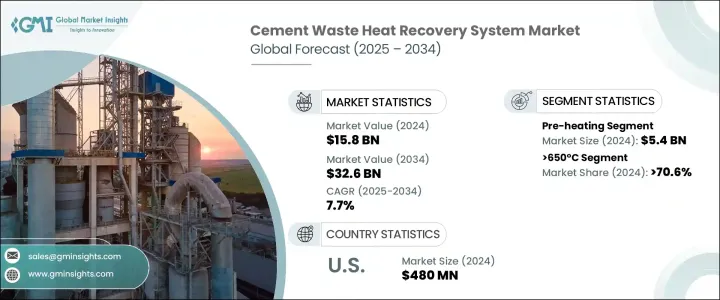

2024年全球水泥餘熱回收系統市場規模達158億美元,預計2034年將以7.7%的複合年成長率成長至326億美元。水泥生產製程是能源密集型工業製程之一,在生產過程中會產生大量熱量,且經常會損失。餘熱回收系統正逐漸成為一種重要的解決方案,可以捕獲這些未利用的熱能並將其用於發電或製程加熱,從而大幅節省成本並減少對外部能源的依賴。隨著水泥製造商持續面臨最佳化能耗、減少排放和提高利潤率的壓力,對節能系統的需求正在穩步成長。這些回收解決方案在提高工廠效率方面發揮關鍵作用,它們可以減少營運所需的燃料量,同時提升整體永續性指標。環境法規和監管框架鼓勵在重工業中使用更清潔的技術,這進一步推動了餘熱回收系統的普及。

餘熱回收系統應用於水泥生產流程的多個階段。關鍵應用領域包括預熱、發電和蒸汽生產以及其他製程改進。其中,預熱環節在2024年的市場規模達54億美元。此環節回收高溫廢氣,用於在原料進入窯爐之前加熱。採用這種方法可以顯著降低燃料消耗、縮短生產時間並提高營運效率。透過最佳化生產早期階段的能源再利用,製造商能夠維持穩定的產量,同時降低整體生產成本。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 158億美元 |

| 預測值 | 326億美元 |

| 複合年成長率 | 7.7% |

就溫度類別而言,市場細分為運行溫度為 230°C、230°C 至 650°C 之間以及 650°C 以上的系統。 2024 年,捕獲 650°C 以上溫度的系統佔據了最大的收入佔有率,佔全球市場的 70.6% 以上。由於熟料生產階段會產生極高的熱量,這些高溫系統對水泥廠特別有效。同時,運作溫度較低的系統通常用於材料預乾燥或設施內的環境空間加熱等任務。雖然它們不能提供與高溫系統相同水平的能量回收,但它們相對簡單且經濟實惠,因此對於那些仍希望在不進行大量資本支出的情況下降低能源成本的小型水泥企業來說,它們是一個實用的選擇。

在北美,美國水泥餘熱回收系統的採用率穩定成長。該國市場估值從2022年的4.4億美元成長至2023年的4.6億美元,並在2024年達到4.8億美元。日益成長的減碳壓力以及水泥基礎設施的老化,促使企業升級到更節能的系統。聯邦政府的支持和激勵措施也在推動熱回收技術融入老舊工廠方面發揮著至關重要的作用。隨著企業努力滿足能源合規要求並提高營運產出,先進熱能回收系統的採用率持續上升。

全球水泥餘熱回收系統市場格局適度整合,少數幾家關鍵企業佔了相當大的市場。西門子能源、三菱重工、Thermax Limited和川崎重工等領導企業在2024年合計佔據了約30%的市場。這些公司專注於提供高效的系統,將水泥窯產生的熱量轉化為可用的電能或蒸汽。他們的產品支持水泥生產商最大限度地減少能源浪費,同時幫助他們達到國際節能減排標準。透過技術創新和客製化解決方案,這些製造商在塑造水泥產業能源使用的未來方面發揮著重要作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 對貿易的影響

- 展望與未來考慮

- 產業衝擊力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 策略舉措

- 競爭基準測試

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 預熱

- 電力和蒸汽發電

- 蒸汽朗肯循環

- 有機朗肯循環

- 卡林納循環

- 其他

第6章:市場規模及預測:依溫度,2021 - 2034 年

- 主要趨勢

- 230°C

- 230°C - 650°C

- > 650 攝氏度

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- AURA

- Bosch Industriekessel GmbH

- Climeon

- CTP TEAM SRL

- Cochran

- Forbes Marshall

- IHI Corporation

- John Wood Group PLC

- Kawasaki Heavy Industries Ltd.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Promec Engineering

- Sofinter Spa

- Siemens Energy

- Turboden SpA

- Thermax Limited

The Global Cement Waste Heat Recovery System Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 32.6 billion by 2034. The cement manufacturing process is one of the most energy-intensive industrial operations, with massive quantities of heat generated and often lost during production. Waste heat recovery systems are emerging as an essential solution to capture this unused thermal energy and redirect it toward power generation or process heating, resulting in substantial cost savings and reduced reliance on external energy sources. As cement manufacturers continue to face pressure to optimize energy consumption, minimize emissions, and increase profit margins, the demand for energy-efficient systems is experiencing steady growth. These recovery solutions play a critical role in improving plant efficiency by reducing the amount of fuel needed for operations while enhancing overall sustainability metrics. Their adoption is being further boosted by environmental mandates and regulatory frameworks encouraging the use of cleaner technologies in heavy industries.

Waste heat recovery systems find application across several stages of the cement production process. Key application areas include pre-heating, electricity and steam generation, and other process enhancements. Among these, the pre-heating segment accounted for USD 5.4 billion in 2024. This segment involves recovering high-temperature exhaust gases to heat raw materials before they enter the kiln. Utilizing this approach significantly cuts down on fuel consumption, shortens production times, and improves operational efficiency. By optimizing energy reuse at earlier stages of production, manufacturers are able to maintain consistent output while trimming down overall production costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $32.6 Billion |

| CAGR | 7.7% |

In terms of temperature categories, the market is segmented into systems operating at 230°C, between 230°C and 650°C, and those above 650°C. The segment capturing temperatures greater than 650°C held the largest revenue share in 2024, accounting for more than 70.6% of the global market. These high-temperature systems are particularly effective for cement plants due to the extreme heat levels generated during the clinker production stage. Meanwhile, systems that operate at lower temperatures are generally implemented for tasks such as material pre-drying or ambient space heating within facilities. While they do not offer the same level of energy recapture as high-temperature systems, they are relatively simple and budget-friendly, making them a practical option for smaller-scale cement operations that still aim to reduce energy costs without undertaking large capital expenditures.

In North America, the United States has shown a steady increase in the adoption of cement waste heat recovery systems. Market valuation in the country grew from USD 440 million in 2022 to USD 460 million in 2023 and reached USD 480 million in 2024. A growing emphasis on reducing carbon emissions, along with aging cement infrastructure, is encouraging companies to upgrade to more energy-efficient systems. Federal support and incentives are also playing a vital role in driving the integration of heat recovery technologies into older plants. As companies strive to meet energy compliance requirements and enhance operational output, the adoption of advanced thermal energy recovery systems continues to rise.

The global cement waste heat recovery system market is moderately consolidated, with a few key players holding a significant portion of the industry share. Leading companies such as Siemens Energy, Mitsubishi Heavy Industries, Ltd., Thermax Limited, and Kawasaki Heavy Industries Ltd. collectively accounted for approximately 30% of the market share in 2024. These companies focus on delivering high-efficiency systems capable of converting heat generated from cement kilns into usable electricity or steam. Their offerings support cement producers in minimizing energy waste while helping them meet international standards for energy efficiency and emissions reduction. Through technological innovation and customized solutions, these manufacturers are instrumental in shaping the future of energy use in the cement industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Pre-heating

- 5.3 Electricity & steam generation

- 5.3.1 Steam rankine cycle

- 5.3.2 Organic rankine cycle

- 5.3.3 Kalina cycle

- 5.4 Other

Chapter 6 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 230°C

- 6.3 230°C - 650 °C

- 6.4 > 650 °C

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 AURA

- 8.2 Bosch Industriekessel GmbH

- 8.3 Climeon

- 8.4 CTP TEAM S.R.L

- 8.5 Cochran

- 8.6 Forbes Marshall

- 8.7 IHI Corporation

- 8.8 John Wood Group PLC

- 8.9 Kawasaki Heavy Industries Ltd.

- 8.10 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 8.11 Promec Engineering

- 8.12 Sofinter S.p.a

- 8.13 Siemens Energy

- 8.14 Turboden S.p.A.

- 8.15 Thermax Limited