|

市場調查報告書

商品編碼

1766329

電力及蒸汽發電廢熱回收系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electricity and Steam Generation Waste Heat Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

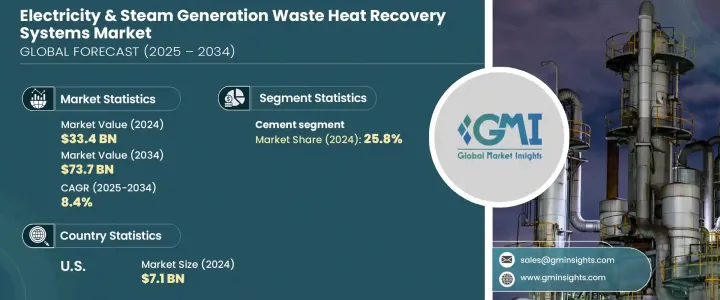

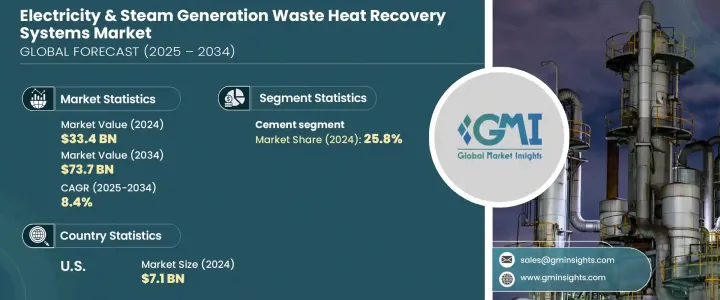

2024年,全球發電和蒸汽發電廢熱回收系統市場規模達334億美元,預計到2034年將以8.4%的複合年成長率成長,達到737億美元。這一成長主要得益於全球範圍內強調能源效率和更嚴格環保要求的政策轉變。事實證明,政府的支持在為廢熱回收技術的部署創造有利條件方面發揮了重要作用。隨著企業力求在降低營運成本的同時提高整體能源效能,工業營運中廢熱回收技術的採用率持續成長。支持性法規加上不斷上漲的能源成本,促使各產業將回收系統作為永續的解決方案進行整合。

餘熱回收在區域供熱基礎設施供電中的作用日益重要。這些系統利用了生產過程或發電過程中原本閒置的剩餘熱能。當這些能量被輸送到集中供熱網時,可以顯著減少對傳統燃料的依賴,從而降低排放。隨著城市尋求實施更綠色的能源框架,這些解決方案為循環利用資源和更智慧的能源規劃提供了途徑。這些優勢吸引了那些專注於減少浪費和提高全系統性能的能源規劃人員,從而增強了市場潛力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 334億美元 |

| 預測值 | 737億美元 |

| 複合年成長率 | 8.4% |

蒸汽朗肯循環仍是玻璃、鋼鐵和水泥等高溫製造業熱回收的基石。監管機構日益重視降低工業碳強度,加速了這些系統的現代化進程。此外,在公共投資的支持下,有機朗肯循環因其適用於中低溫環境而日益受到青睞。儘管卡利納循環的佔有率較小,但它仍在持續獲得資金,用於需要高熱效率的特定應用。總而言之,這些循環表明,國際社會正更積極地實施更清潔的能源轉換技術,以增強永續性。

2024年,水泥業佔25.8%。作為能源密集型產業之一,水泥生產商正擴大採用餘熱回收系統來實現排放目標。各地區的獎勵計畫和再生能源義務(RPO)為企業投資餘熱回收系統提供了強大的動力。在某些司法管轄區,透過這些系統產生的能源符合再生能源的條件,從而為生產商帶來額外的合規性和經濟效益。

2024年,美國電力和蒸汽發電餘熱回收系統市場規模達71億美元,其中北美佔21.3%的佔有率。能源政策改革的重點,加上再生能源技術的整合,在該地區對餘熱回收解決方案的需求成長中發揮了關鍵作用。對清潔能源的追求,加上不斷成長的工業能源需求,繼續推動這些系統在電力和蒸汽發電應用中的應用。

影響電力和蒸汽發電廢熱回收系統市場的關鍵參與者包括西門子能源、Climeon、三菱重工有限公司、Thermax Limited、博世工業有限公司、Fortum、IHI 公司、福布斯馬歇爾、通用電氣、Ormat、HRS、AURA、Viessman、Promec Engineering、Exergy International SRL、BIHL、Rentech BoilHL、Viessman、Sinterof、Sinterdran、BIHL、Rentech BoilHL、Sinterof

電力和蒸汽發電餘熱回收系統市場的公司正專注於技術升級和整合解決方案,以鞏固其市場地位。許多公司正在投資研發,以開發更緊湊、更有效率的系統,以滿足高溫和低溫工業流程的需求。與鋼鐵、水泥和石化等能源密集產業的策略合作,使客製化安裝能夠滿足客戶需求。企業也透過併購和合作擴大其地理覆蓋範圍,尤其是在工業基礎不斷發展的地區。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依類型,2021 - 2034

- 主要趨勢

- 蒸汽朗肯循環

- 有機朗肯循環

- 卡林納循環

第6章:市場規模及預測:依溫度,2021 - 2034 年

- 主要趨勢

- 230 攝氏度

- 230 攝氏度 - 650 攝氏度

- > 650 攝氏度

第7章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 石油精煉

- 水泥

- 重金屬製造

- 化學

- 紙漿和造紙

- 食品和飲料

- 玻璃

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- AURA

- BIHL

- Bosch Industriekessel GmbH

- Climeon

- Cochran

- Durr Group

- Exergy International SRL

- Forbes Marshall

- Fortum

- General Electric

- HRS

- IHI Corporation

- Mitsubishi Heavy Industries Ltd.

- Ormat

- Promec Engineering

- Rentech Boilers

- Siemens Energy

- Sofinter Spa

- Thermax Limited

- Viessman

The Global Electricity and Steam Generation Waste Heat Recovery Systems Market was valued at USD 33.4 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 73.7 billion by 2034. This surge is largely supported by policy shifts emphasizing energy efficiency and stricter environmental compliance worldwide. Government support has proven instrumental in creating favorable conditions for the deployment of waste heat recovery technologies. Adoption across industrial operations continues to grow as businesses aim to cut operational expenses while improving overall energy performance. Supportive regulations, coupled with rising energy costs, are prompting industry to integrate recovery systems as a sustainable solution.

Waste heat recovery's role in powering district heating infrastructure is becoming increasingly relevant. These systems make use of residual thermal energy that would otherwise go unused during production processes or power generation. When redirected to centralized heating grids, this energy significantly reduces reliance on conventional fuels, thus lowering emissions. As cities seek to implement greener energy frameworks, these solutions offer a pathway to circular resource use and smarter energy planning. These benefits strengthen the market potential by appealing to energy planners focused on reducing waste and boosting system-wide performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.4 Billion |

| Forecast Value | $73.7 Billion |

| CAGR | 8.4% |

The steam Rankine cycle remains the cornerstone for recovering heat from high-temperature manufacturing sectors like glass, steel, and cement. Growing regulatory focus on lowering industrial carbon intensity is accelerating the modernization of these systems. Additionally, the Organic Rankine Cycle is gaining traction due to its suitability in low- to medium-temperature settings, supported by public investment. Although the Kalina Cycle holds a smaller share, it continues to receive funding for selective applications that require high thermal efficiency. Altogether, these cycles point to a broader international momentum around implementing cleaner energy conversion technologies for enhanced sustainability.

In 2024, the cement segment generated a 25.8% share. Known for being one of the most energy-intensive industries, cement producers are increasingly adopting waste heat recovery systems to meet emission goals. Incentive programs and renewable power obligations (RPOs) across various regions have provided strong motivation for companies to invest in WHRS. In some jurisdictions, energy generated through these systems qualifies as renewable, giving producers additional compliance and economic benefits.

United States Electricity & Steam Generation Waste Heat Recovery Systems Market reached USD 7.1 billion in 2024, with North America capturing a 21.3% share. A focus on energy policy reform, combined with the integration of renewable technologies, has played a pivotal role in increasing demand for waste heat recovery solutions across the region. The push for cleaner energy, coupled with rising industrial energy demand, continues to drive the adoption of these systems in electricity and steam generation applications.

Key players shaping the Electricity & Steam Generation Waste Heat Recovery Systems Market include Siemens Energy, Climeon, Mitsubishi Heavy Industries Ltd., Thermax Limited, Bosch Industriekessel GmbH, Fortum, IHI Corporation, Forbes Marshall, General Electric, Ormat, HRS, AURA, Viessman, Promec Engineering, Exergy International SRL, BIHL, Rentech Boilers, Sofinter S.p.A, Durr Group, and Cochran.

Companies in the electricity & steam generation waste heat recovery systems market are focusing on technology upgrades and integrated solutions to solidify their market presence. Many are investing in R&D to develop more compact, efficient systems that cater to both high- and low-temperature industrial processes. Strategic collaborations with energy-intensive sectors such as steel, cement, and petrochemicals are enabling customized installations tailored to client requirements. Firms are also expanding their geographic footprint through mergers, acquisitions, and partnerships, especially in regions with growing industrial bases.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Steam rankine cycle

- 5.3 Organic rankine cycle

- 5.4 Kalina cycle

Chapter 6 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 230 °C

- 6.3 230 °C - 650 °C

- 6.4 > 650 °C

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Petroleum refining

- 7.3 Cement

- 7.4 Heavy metal manufacturing

- 7.5 Chemical

- 7.6 Pulp & paper

- 7.7 Food & beverage

- 7.8 Glass

- 7.9 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 AURA

- 9.2 BIHL

- 9.3 Bosch Industriekessel GmbH

- 9.4 Climeon

- 9.5 Cochran

- 9.6 Durr Group

- 9.7 Exergy International SRL

- 9.8 Forbes Marshall

- 9.9 Fortum

- 9.10 General Electric

- 9.11 HRS

- 9.12 IHI Corporation

- 9.13 Mitsubishi Heavy Industries Ltd.

- 9.14 Ormat

- 9.15 Promec Engineering

- 9.16 Rentech Boilers

- 9.17 Siemens Energy

- 9.18 Sofinter S.p.a

- 9.19 Thermax Limited

- 9.20 Viessman