|

市場調查報告書

商品編碼

1750457

抗衰老和長壽補充和替代藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Complementary and Alternative Medicine for Anti-Aging and Longevity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

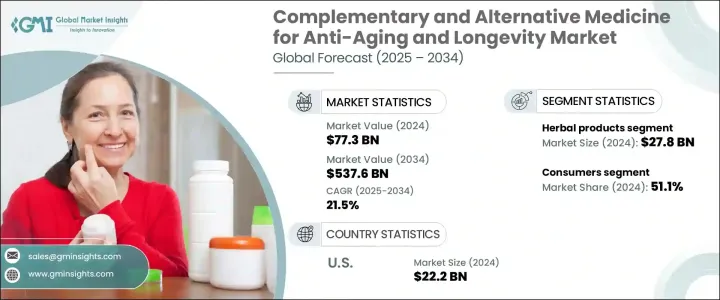

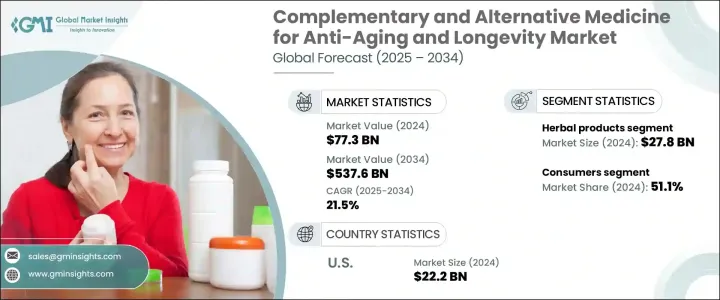

2024年,全球抗老和長壽補充及替代醫學市場規模達773億美元,預計到2034年將以21.5%的複合年成長率成長,達到5376億美元。這要歸功於越來越多的消費者選擇非侵入性和整體療法來應對老化並提升活力。人們對健康和預防的日益重視,也刺激了對支持細胞修復、調節荷爾蒙平衡和緩解壓力的補充及替代醫學療法的需求。

全球消費者在應對老化方面日益積極主動,尋求傳統藥物治療以外的替代方案。他們轉向自然療法,認為這些療法不僅有望增強活力、改善容貌,還能延長壽命。隨著健康產業日益個人化,客製化養生方案正成為顯著趨勢,這些方案將古老的療法與人工智慧和基因組學等尖端技術相結合。這種融合使得針對老化的個人化方法得以實現,比以往任何時候都更精準地滿足個人需求。人們對補充和替代醫學 (CAM) 日益成長的興趣是這一趨勢的關鍵促進因素。這反映了一種更廣泛的文化轉變,即轉向綜合健康方法,將整體療法與傳統醫學相結合,為老化提供更全面的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 773億美元 |

| 預測值 | 5376億美元 |

| 複合年成長率 | 21.5% |

2024年,草藥產品市場因其長期使用和日益成長的科學驗證而創造了278億美元的收入。採用植物成分配製的天然產品因其抗氧化和抗發炎特性而備受青睞,有助於促進健康老化。人們對精準萃取技術和智慧配方的興趣日益濃厚,這提升了產品功效和消費者體驗。

抗衰老和長壽補充替代藥物市場的消費者群體佔據了51%的市場佔有率,這得益於尋求整體老齡化支持的消費者需求的不斷成長。雖然老年人仍然佔據主要使用人群,但年輕人也正在加入這一行列,他們採用補充替代藥物來管理壓力、增強免疫力並延緩老化跡象。這種人口結構的變化是由健康文化、社交媒體的影響以及日益成長的預防性護理而非被動治療的偏好所驅動的。對長壽的渴望,加上對非藥物替代品的認知,影響著所有年齡層的購買行為。

2024年,美國抗老和長壽補充及替代醫學市場規模達222億美元,並將繼續成為補充及替代醫學應用的關鍵樞紐。以健康為中心的診所、療養水療中心和整合醫療機構的興起改變了這一格局。隨著人口老化和健康生活意識的不斷增強,美國消費者正在增加對整體醫療方案的投資,以支持認知健康、關節活動和皮膚再生。隨著補充及替代醫學可近性的提高以及與傳統醫療的融合,未來十年,美國各地的需求將大幅成長。

全球抗衰老和長壽補充和替代醫學市場中的公司正在大力投資個人化健康,擴大全球影響力,並使其天然產品線多樣化。 iHerb 和 Dabur India 利用電商平台滲透新地區並擴大分銷規模。 Herbivore Botanicals 和雪花秀專注於採用草本配方的高階護膚品,以逆轉可見的衰老。 Patanjali Ayurved 和 Kama Ayurveda 強調將傳統療法與現代科學相結合,以滿足消費者對清潔標籤解決方案日益成長的需求。同時,Mountain Rose Herbs 和 Rocky Mountain Oils 正在透過針對性補充劑和精油擴展其產品組合。 SEVA Experience 和 Maya Reiki School 等公司正透過體驗式健康服務提升品牌忠誠度。這些策略正在重塑市場動態,加劇全球競爭。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費者對整體健康和長壽的意識不斷提高

- 人口老化加劇,對年輕外表的需求不斷增加

- 天然配方和CAM技術的進步

- 產業陷阱與挑戰

- CAM 實務缺乏科學驗證

- 專門的抗衰老療法費用高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按干預類型,2021 - 2034 年

- 主要趨勢

- 草本產品

- 阿育吠陀

- 自然療法

- 中藥

- 臟腑理論

- 其他草本產品

- 身心介入

- 瑜珈

- 針灸和按摩

- 脊椎矯正療法

- 氣功和太極拳

- 冥想和正念

- 其他身心干預

- 外部能量療癒

- 磁療和電磁療法

- 脈輪療癒

- 靈氣

- 其他外在能量治療

- 感官療癒

- 芳香療法

- 聲音療癒

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 消費者

- 醫療保健從業者

- 企業健康計劃

- 其他最終用途

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Dabur India

- First Natural Brands

- Herb Pharm

- Herbivore Botanicals

- iHerb

- Kama Ayurveda

- Maya Reiki School

- Mountain Rose Herbs

- Patanjali Ayurved

- Rocky Mountain Oils

- SEVA Experience

- Sulwhasoo

- Wei Beauty

The Global Complementary and Alternative Medicine for Anti-Aging and Longevity Market was valued at USD 77.3 billion in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 537.6 billion by 2034, driven by the rapid growth of consumers increasingly opting for non-invasive and holistic methods to manage aging and boost vitality. The rising emphasis on wellness and prevention has amplified demand for CAM therapies that support cellular repair, hormonal balance, and stress reduction.

Consumers around the globe are becoming increasingly proactive in addressing the aging process, seeking alternatives beyond traditional pharmaceutical treatments. They are turning to natural therapies that promise not only to enhance energy and improve appearance but also to extend their lifespan. As the wellness industry becomes more personalized, there is a notable shift towards customized regimens that blend ancient healing practices with cutting-edge technology, such as AI and genomics. This fusion allows for tailored approaches to aging, targeting individual needs more precisely than ever. The growing interest in complementary and alternative medicine (CAM) is a key driver of this trend. It reflects a broader cultural shift towards integrative approaches to health, where holistic methods work alongside conventional medicine to provide a more comprehensive solution for aging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.3 Billion |

| Forecast Value | $537.6 Billion |

| CAGR | 21.5% |

The herbal products segment generated USD 27.8 billion in 2024 due to their long-standing use and increasing scientific validation. Natural products formulated with plant-based ingredients are favored for their antioxidant and anti-inflammatory properties that promote healthy aging. Growing interest in precision extraction techniques and smart formulations improves product potency and consumer outcomes.

Consumer segment in the complementary and alternative medicine for anti-aging and longevity market held 51% share, driven by the rising demand from consumers seeking holistic aging support. While older adults continue to dominate usage, younger populations are joining in, adopting CAM to manage stress, boost immunity, and slow visible signs of aging. This demographic shift is driven by wellness culture, social media influence, and a growing preference for preventative care rather than reactive treatment. The desire for longevity, combined with awareness of non-drug alternatives, influences buying behavior across all age groups.

United States Complementary and Alternative Medicine for Anti-Aging and Longevity Market was valued at USD 22.2 billion in 2024 and remains a critical hub for CAM adoption. The rise of wellness-focused clinics, therapeutic spas, and integrative healthcare practices has transformed the landscape. With an aging population and growing awareness around healthy living, US consumers are investing more in holistic options to support cognitive health, joint mobility, and skin rejuvenation. As accessibility improves and CAM merges with conventional care, demand across the country will grow significantly over the next decade.

Companies in the Global Complementary and Alternative Medicine for Anti-Aging and Longevity Market are investing heavily in personalized wellness, expanding global reach, and diversifying their natural product lines. iHerb and Dabur India leverage e-commerce platforms to penetrate new regions and scale distribution. Herbivore Botanicals and Sulwhasoo are focusing on premium skincare with herbal formulations to reverse visible aging. Patanjali Ayurved and Kama Ayurveda emphasize traditional remedies infused with modern science to capture the growing preference for clean-label solutions. Meanwhile, Mountain Rose Herbs and Rocky Mountain Oils are expanding their portfolios with targeted supplements and essential oils. Players like SEVA Experience and Maya Reiki School are enhancing brand loyalty through experiential wellness services. These strategies are reshaping market dynamics and intensifying global competition.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer awareness about holistic wellness and longevity

- 3.2.1.2 Growing aging population and rising demand for youthful appearances

- 3.2.1.3 Advancements in natural formulations and CAM techniques

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of scientific validation for CAM practices

- 3.2.2.2 High costs associated with specialized anti-aging therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Intervention Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Herbal products

- 5.2.1 Ayurveda

- 5.2.2 Naturopathic medicine

- 5.2.3 Traditional chinese medicine

- 5.2.4 Zang fu theory

- 5.2.5 Other herbal products

- 5.3 Mind-body intervention

- 5.3.1 Yoga

- 5.3.2 Acupuncture and massage

- 5.3.3 Chiropractic

- 5.3.4 Qigong and tai chi

- 5.3.5 Meditation and mindfulness

- 5.3.6 Other mind-body intervention

- 5.4 External energy healing

- 5.4.1 Magnetic and electromagnetic therapy

- 5.4.2 Chakra healing

- 5.4.3 Reiki

- 5.4.4 Other external energy healing

- 5.5 Sensory healing

- 5.5.1 Aromatherapy

- 5.5.2 Sound healing

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Consumers

- 6.3 Healthcare practitioners

- 6.4 Corporate wellness programs

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Dabur India

- 8.2 First Natural Brands

- 8.3 Herb Pharm

- 8.4 Herbivore Botanicals

- 8.5 iHerb

- 8.6 Kama Ayurveda

- 8.7 Maya Reiki School

- 8.8 Mountain Rose Herbs

- 8.9 Patanjali Ayurved

- 8.10 Rocky Mountain Oils

- 8.11 SEVA Experience

- 8.12 Sulwhasoo

- 8.13 Wei Beauty