|

市場調查報告書

商品編碼

1750448

衛星相控陣天線市場機會、成長動力、產業趨勢分析及2025-2034年預測Satellite Phased Array Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

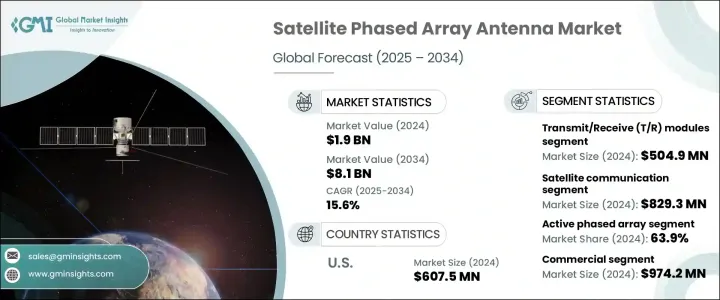

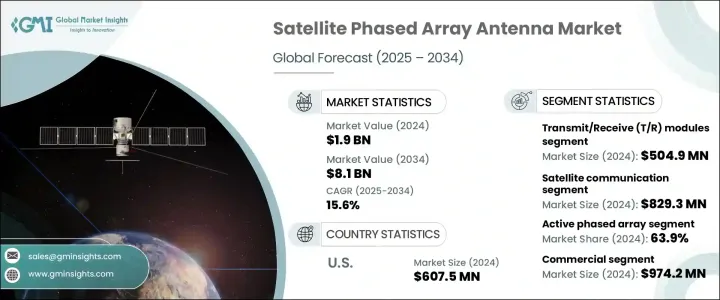

2024年,全球衛星相控陣天線市場規模達19億美元,預計2034年將以15.6%的複合年成長率成長,達到81億美元。這主要得益於政府和私營部門投資的增加、5G技術的推廣、物聯網(IoT)設備的興起以及低地球軌道(LEO)衛星應用的不斷擴展。隨著越來越多的組織和政府致力於改善通訊基礎設施和太空探索,高性能波束控制天線對於可靠的連接和監控至關重要。

然而,尤其是川普政府對中國進口產品徵收關稅等挑戰,對市場產生了顯著影響。這些關稅提高了半導體和射頻模組等組裝零件的價格,從而提高了美國製造商的生產成本,而這些零件通常來自中國。全球供應鏈的中斷促使企業探索新的貿易來源並調整生產策略,增加了市場的複雜性。此外,正在進行的國防現代化計畫以及政府在太空探索和衛星基礎設施方面增加的投資,極大地促進了對先進衛星通訊系統的需求。隨著各國優先增強軍事能力,對可靠、高性能衛星通訊技術的需求已成為國家安全、情報收集和監視的關鍵。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 81億美元 |

| 複合年成長率 | 15.6% |

2024年,發射/接收(T/R)模組貢獻了5.049億美元的市場規模。這些模組在確保衛星通訊系統所需的高速、低延遲功能方面發揮著至關重要的作用。軍用和商用領域對整合微型T/R模組的小型化、節能天線的需求日益成長。這些天線具有卓越的訊號完整性和熱管理性能,為高性能、電子可控衛星通訊系統提供了增強的多功能性。

市場也按陣列類型細分,預計有源相控陣將在2024年佔據主導地位,市佔率達63.9%。主動陣列在波束靈活性、訊號增益和精度方面具有顯著優勢。這些天線的每個單元都有獨立的發射/接收模組,可實現動態波束成形、冗餘和更高的訊號強度。這些特性使主動相控陣成為低地球軌道衛星星座、國防系統和行動通訊平台等應用的理想選擇,因為快速追蹤和穩健的連接至關重要。

受衛星通訊、國防和太空探索領域投資增加的推動,美國衛星相控陣天線市場在2024年實現了6.075億美元的產值。在美國國家航空暨太空總署(NASA)和國防部等機構的大力支持下,對低地球軌道衛星星座和先進軍事通訊系統的需求持續推動市場的發展。

全球衛星相控陣天線市場中的公司,包括ViaSat、波音、霍尼韋爾國際和ALCAN系統,正在採取關鍵策略來鞏固其地位。這些公司專注於擴展其產品供應,尤其是在波束控制技術領域,以滿足對高性能衛星系統日益成長的需求。與政府機構和私人航太公司的合作也是一項關鍵策略,使他們能夠利用資金用於太空探索和國防計畫。此外,市場領導者正在大力投資研發,以提高天線效率和小型化,確保在對更靈活、可擴展解決方案的需求不斷成長的情況下保持競爭力。這些策略確保了他們在全球市場的持續主導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 全球連結需求激增

- 政府和私部門投資成長

- 5G技術的推出與物聯網(IoT)設備的普及

- 衛星相控陣天線在軍事和國防領域的應用日益增多

- 天線技術的不斷進步

- 產業陷阱與挑戰

- 衛星相控陣天線製造成本高

- 光束控制的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依組件,2021-2034

- 主要趨勢

- 微控制器/微處理器

- 現場可程式閘陣列(FPGA)

- 功率放大器 (PA)

- 低雜訊放大器(LNA)

- 移相器

- 發射/接收 (T/R) 模組

- 其他

第6章:市場估計與預測:按陣列類型,2021-2034

- 主要趨勢

- 主動相控陣

- 被動相控陣

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 衛星通訊

- 雷達與感測

- 導航和追蹤

- 行動連接

- 地球觀測

- 電子戰

- 其他

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 商業的

- 國防和安全

- 研究與學術機構

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Airbus

- Av-Comm Space & Defence

- ALCAN Systems

- Anokiwave

- AST & Science

- Boeing

- C-COM Satellite Systems

- Chengdu Ruidiwei

- Get SAT Ltd

- Honeywell International Inc.

- Iridium Communications Inc

- KEYCOM Corporation

- Requtech

- ThinKom Solutions, Inc.

- ViaSat

The Global Satellite Phased Array Antenna Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 15.6% to reach USD 8.1 billion by 2034, driven by increasing investments from both government and private sectors, the roll-out of 5G technology, the rise of Internet of Things (IoT) devices, and the expanding use of Low Earth Orbit (LEO) satellites. As more organizations and governments focus on improving communications infrastructure and space exploration, the need for high-performance, beam-steering antennas becomes critical for reliable connectivity and surveillance.

However, challenges such as tariffs imposed on Chinese imports, particularly by the Trump administration, had a notable impact on the market. These tariffs raised the production costs for U.S.-based manufacturers by increasing the price of assembly components such as semiconductors and RF modules, which are often sourced from China. This disruption in the global supply chain led companies to explore new trade sources and adjust production strategies, adding complexity to the market. Additionally, the ongoing defense modernization initiatives and increased government investments in space exploration and satellite-based infrastructure are significantly contributing to the demand for advanced satellite communication systems. As countries prioritize enhancing their military capabilities, the need for reliable, high-performance satellite communication technologies has become essential for national security, intelligence gathering, and surveillance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $8.1 Billion |

| CAGR | 15.6% |

In 2024, Transmit/Receive (T/R) modules contributed USD 504.9 million. These modules play a vital role in ensuring the high-speed, low-latency functionality required for satellite communication systems. The increasing demand for smaller, energy-efficient antennas that incorporate miniaturized T/R modules is expanding across both military and commercial sectors. These antennas, with superior signal integrity and thermal management, provide enhanced versatility for high-performance, electronically steerable satellite communication systems.

The market is also segmented by array type, with active phased arrays expected to dominate with a market share of 63.9% in 2024. Active arrays offer significant advantages in beam agility, signal gain, and precision. These antennas have individual transmit/receive modules for each element, enabling dynamic beamforming, redundancy, and improved signal strength. These features make active phased arrays ideal for applications in LEO satellite constellations, defense systems, and mobile communication platforms, where rapid tracking and robust connectivity are essential.

United States Satellite Phased Array Antenna Market generated USD 607.5 million in 2024, driven by increasing investments in satellite communication, defense, and space exploration. The demand for LEO satellite constellations and advanced military communication systems continues to drive the market forward, with strong support from agencies like NASA and the Department of Defense.

Companies in the Global Satellite Phased Array Antenna Market, including ViaSat, Boeing, Honeywell International, and ALCAN Systems, are adopting key strategies to solidify their positions. These companies are focusing on expanding their product offerings, particularly in beam-steering technology, to meet the growing demand for high-performance satellite systems. Collaboration with government organizations and private space companies has also been a critical strategy, enabling them to leverage funding for space exploration and defense projects. Additionally, market leaders are investing heavily in research and development to enhance antenna efficiency and miniaturization, ensuring that they remain competitive as the demand for more agile, scalable solutions rises. These strategies ensure their ongoing dominance in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for global connectivity

- 3.7.1.2 Growth in government and private sector investments

- 3.7.1.3 Rollout of 5G technology and the proliferation of Internet of Things (IoT) devices

- 3.7.1.4 Increasing applications of satellite phased array antenna in military and defense

- 3.7.1.5 Rising advancements in antenna technology

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High manufacturing cost associated with the satellite phased array antenna

- 3.7.2.2 Complexity in beam steering and control

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Microcontrollers / microprocessors

- 5.3 Field programmable gate arrays (FPGAs)

- 5.4 Power amplifiers (PAs)

- 5.5 Low noise amplifiers (LNAs)

- 5.6 Phase shifters

- 5.7 Transmit/receive (T/R) modules

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Array Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Active phased array

- 6.3 Passive phased array

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Satellite communication

- 7.3 Radar & sensing

- 7.4 Navigation & tracking

- 7.5 Mobile connectivity

- 7.6 Earth observation

- 7.7 Electronic warfare

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Defense & security

- 8.4 Research & academic institutions

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 Av-Comm Space & Defence

- 10.3 ALCAN Systems

- 10.4 Anokiwave

- 10.5 AST & Science

- 10.6 Boeing

- 10.7 C-COM Satellite Systems

- 10.8 Chengdu Ruidiwei

- 10.9 Get SAT Ltd

- 10.10 Honeywell International Inc.

- 10.11 Iridium Communications Inc

- 10.12 KEYCOM Corporation

- 10.13 Requtech

- 10.14 ThinKom Solutions, Inc.

- 10.15 ViaSat