|

市場調查報告書

商品編碼

1773319

軍用非可控天線市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Military Non-steerable Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

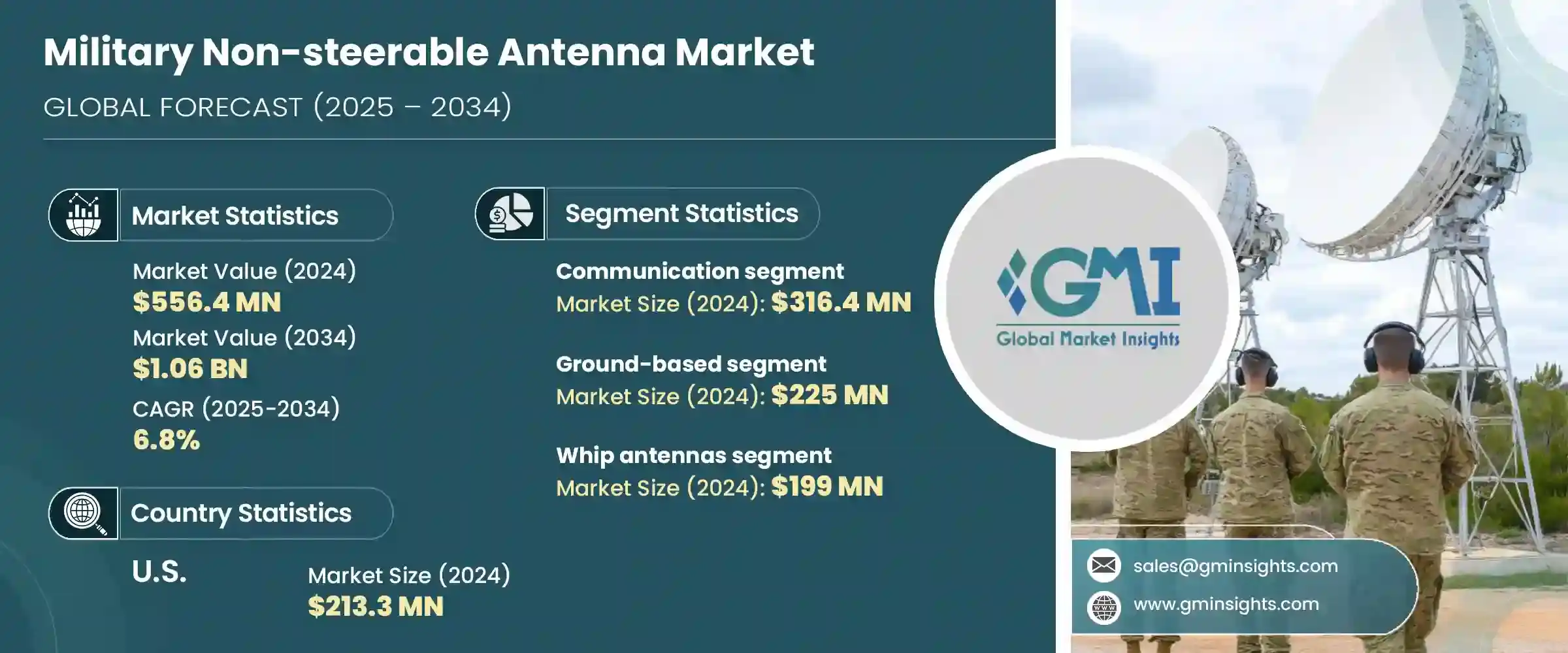

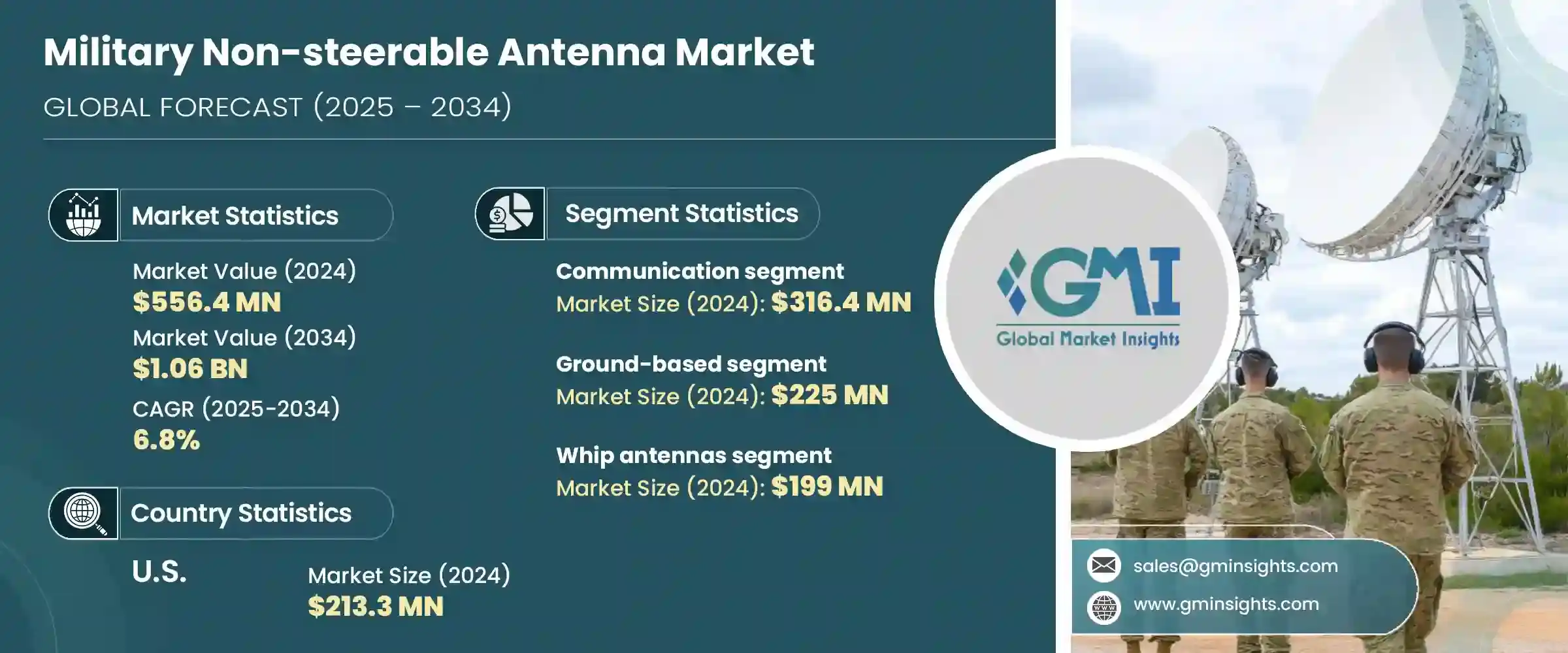

2024 年全球軍用非定向天線市場價值為 5.564 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長,達到 10.6 億美元。無人系統的興起和對遠端監視行動的日益關注推動了市場擴張。隨著各國國防預算的增加和戰術行動變得更加複雜,對堅固耐用和免維護通訊系統的需求也隨之增加。軍用非定向天線以其全方位覆蓋、快速部署和高耐用性而聞名,已成為國防通訊領域的重要資產。這些系統對於在動態和電子對抗環境中傳輸語音、資料和命令訊號至關重要,即使在存在主動干擾或訊號干擾的情況下也是如此。

由於現代戰爭強調聯合部隊協同和即時跨域通訊,這些天線正安裝在作戰車輛、海軍艦隊、前線作戰基地和監視基礎設施上。印度、美國、中國和北約成員國等全球大國正優先考慮安裝堅固耐用、輕基礎設施的系統。隨著對強化戰場通訊的需求日益成長,各國正積極投資於高可用性且降低後勤複雜性的系統,這使得非定向天線成為當今數位防禦架構的首選解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.564億美元 |

| 預測值 | 10.6億美元 |

| 複合年成長率 | 6.8% |

預計到2034年,電子戰領域將以8.6%的複合年成長率成長,這得益於非定向天線在干擾、訊號攔截和被動監視等支援行動中發揮的作用。輕型固定天線正擴大整合到電子戰系統中,以提供態勢感知並增強頻譜控制。這些系統正在進一步小型化,並適用於無人機平台,從而實現靈活的戰術部署,縮短設定時間並提高生存能力。

預計2025年至2034年間,機載平台市場將以8.2%的複合年成長率成長。這一成長主要源於對ISR(情報、監視和偵察)任務日益成長的需求,以及對有人駕駛和無人機日益成長的依賴。為了滿足這些新的需求,人們正在部署支援高頻通訊和電子戰能力的抗振、緊湊型非可控天線。現代國防計畫正在將這些天線嵌入機載通訊套件中,以確保跨戰區和戰略作戰區域的安全連接。

2024年,德國軍用非定向天線市場規模達2,000萬美元。德國致力於透過與北約的合作和內部現代化項目來加強其通訊基礎設施,這推動了市場需求的成長。德國正在投資安全的多頻系統,以實現任務彈性和戰略自主性。亨索爾特(HENSOLDT)和羅德與施瓦茨(Rohde & Schwarz)等知名國防企業在生產和系統開發中發揮著重要作用。旨在在軍事環境中採用5G技術並增強網路安全通訊的全國性計畫是推動該市場成長的主要因素。

引領軍用非定向天線市場的關鍵公司包括 MTI Wireless Edge、Abracon、HR Smith Group of Companies、L3Harris Technologies, Inc.、Hascall-Denke 和 Rohde & Schwarz。軍用非定向天線領域的領先公司正專注於策略創新、全球合作夥伴關係和材料改進,以增強其市場地位。許多公司正在開發緊湊、輕巧且堅固耐用的天線設計,並針對跨海陸空系統的多平台整合進行了最佳化。這些公司投資研發,以滿足不斷變化的頻率需求、電磁彈性和互通性標準。與國防部門和原始設備製造商 (OEM) 的合作,使得在關鍵任務項目中部署客製化系統成為可能。企業也在進行在地化生產,以遵守國防採購政策並縮短交貨時間。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 全球國防預算不斷增加

- 對強大的戰場通訊的需求不斷增加

- 擴大戰術和機動軍事單位

- 無人系統和遠端監控的成長

- 需要低維護且經濟高效的天線解決方案

- 產業陷阱與挑戰

- 方向控制有限,影響訊號精度

- 易受電子戰和訊號干擾

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按天線類型,2021 年至 2034 年

- 主要趨勢

- 刀片天線

- 鞭狀天線

- 貼片天線

- 共形天線

- 橡膠鴨天線

- 環形天線

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 溝通

- 導航

- 電子戰

第7章:市場估計與預測:按平台,2021 年至 2034 年

- 主要趨勢

- 地面

- 海軍

- 空降

- 攜帶式

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Abeillon

- Abracon

- Antcom

- CBG Systems

- Chelton Limited

- Comrod Communication AS

- Fei Teng Wireless Technology

- Hascall-Denke

- HR Smith Group of Companies

- KNL

- L3Harris Technologies, Inc.

- MTI Wireless Edge

- RAMI

- Rohde & Schwarz

- Rojone Pty Ltd

- Thales

The Global Military Non-steerable Antenna Market was valued at USD 556.4 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 1.06 billion by 2034. The market expansion is being propelled by the rise of unmanned systems and increased focus on remote surveillance operations. With countries expanding their defense budgets and tactical operations becoming more intricate, the demand for rugged and maintenance-free communication systems has intensified. Military non-steerable antennas, known for their all-directional reach, rapid deployment, and high durability, have become essential assets in the defense communication landscape. These systems are vital for transmitting voice, data, and command signals across dynamic and electronically contested environments, even where active jamming or signal interference exists.

As modern warfare emphasizes joint-force coordination and real-time cross-domain communication, these antennas are being mounted on combat vehicles, naval fleets, forward operating bases, and surveillance infrastructure. Global powers such as India, the United States, China, and members of NATO are prioritizing the installation of robust, infrastructure-light systems. With a growing push for hardened battlefield communications, countries are actively investing in systems that provide high availability with reduced logistical complexity, positioning non-steerable antennas as a preferred solution in today's digital defense architecture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $556.4 Million |

| Forecast Value | $1.06 Billion |

| CAGR | 6.8% |

The electronic warfare segment is expected to grow at a CAGR of 8.6% through 2034, driven by the role non-steerable antennas play in supporting operations such as jamming, signal interception, and passive surveillance. Lightweight fixed antennas are being increasingly integrated into electronic warfare systems to provide situational awareness and enhance spectrum control. These systems are being further miniaturized and adapted for unmanned aerial platforms, enabling flexible tactical deployments with reduced setup time and improved survivability.

The airborne platforms segment is expected to grow at a CAGR of 8.2% between 2025 and 2034. This surge is largely due to the intensifying need for ISR (intelligence, surveillance, and reconnaissance) missions and growing reliance on both manned and unmanned aircraft. Vibration-resistant, compact non-steerable antennas that support high-frequency communication and electronic warfare capabilities are being deployed to meet these new demands. Modern defense initiatives are embedding these antennas in airborne communication suites to ensure secure links across combat zones and strategic areas of operation.

Germany Military Non-steerable Antenna Market accounted for USD 20 million in 2024. The country's focus on strengthening its communication infrastructure through NATO collaboration and internal modernization programs is boosting demand. Germany is investing in secure, multi-frequency systems for mission resilience and strategic autonomy. Prominent defense companies such as HENSOLDT and Rohde & Schwarz are playing a major role in production and system development. Nationwide programs geared toward adopting 5G in military environments and enhancing cyber secure communications are major factors driving this market upward.

Key companies leading the Military Non-steerable Antenna Market include MTI Wireless Edge, Abracon, HR Smith Group of Companies, L3Harris Technologies, Inc., Hascall-Denke, and Rohde & Schwarz. Leading firms in the military non-steerable antenna space are focusing on strategic innovation, global partnerships, and material advancements to strengthen their presence. Many are developing compact, lightweight, and ruggedized antenna designs optimized for multi-platform integration across air, land, and sea systems. These companies invest in R&D to meet evolving frequency demands, electromagnetic resilience, and interoperability standards. Collaborations with defense ministries and OEMs allow tailored system deployment in mission-critical programs. Businesses are also localizing production to comply with defense procurement policies and enhance delivery timelines.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising defense budgets globally

- 3.3.1.2 Increased demand for robust battlefield communication

- 3.3.1.3 Expansion of tactical and mobile military units

- 3.3.1.4 Growth in unmanned systems and remote surveillance

- 3.3.1.5 Need for low-maintenance and cost-effective antenna solutions

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited directional control affecting signal precision

- 3.3.2.2 Vulnerability to electronic warfare and signal interference

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Antenna Type, 2021 – 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Blade antennas

- 5.3 Whip antennas

- 5.4 Patch antennas

- 5.5 Conformal antennas

- 5.6 Rubbery ducky antennas

- 5.7 Loop antennas

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Communication

- 6.3 Navigation

- 6.4 Electronic warfare

Chapter 7 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Ground-based

- 7.3 Naval

- 7.4 Airborne

- 7.5 Man-portable

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abeillon

- 9.2 Abracon

- 9.3 Antcom

- 9.4 CBG Systems

- 9.5 Chelton Limited

- 9.6 Comrod Communication AS

- 9.7 Fei Teng Wireless Technology

- 9.8 Hascall-Denke

- 9.9 HR Smith Group of Companies

- 9.10 KNL

- 9.11 L3Harris Technologies, Inc.

- 9.12 MTI Wireless Edge

- 9.13 RAMI

- 9.14 Rohde & Schwarz

- 9.15 Rojone Pty Ltd

- 9.16 Thales