|

市場調查報告書

商品編碼

1750288

建築氣門座圈市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Construction Valve Seat Insert Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

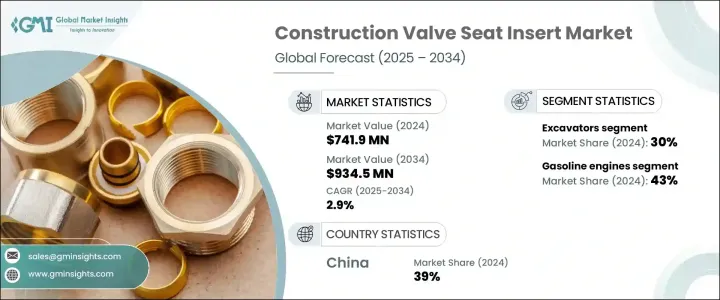

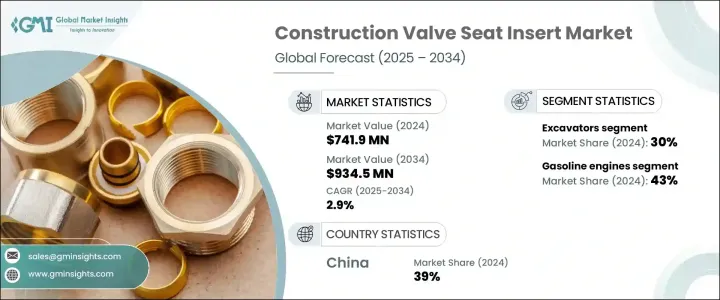

2024年,全球建築氣門座圈市場規模達7.419億美元,預計到2034年將以2.9%的複合年成長率成長,達到9.345億美元。公共和私營部門基礎設施投資的持續激增是推動這一成長的重要因素。隨著政府和企業投入大量資源用於交通系統、商業基礎設施和公用事業框架的開發和現代化改造,高性能建築設備的需求正在加速成長。這些機械依賴於堅固耐用的引擎內部零件,而氣門座圈在惡劣工況下維持運作效率和耐用性方面發揮著至關重要的作用。

全球建築活動持續升溫,尤其是在城市快速發展的地區。這股廣泛的建築熱潮推動了對能夠在極端環境下工作的重型機械的需求。裝載機、反鏟、起重機和挖土機等設備需要能夠承受高熱應力和機械應力的引擎部件,而先進的氣門座圈是延長機器壽命的關鍵部件。這些部件的耐用性可以減少停機時間並提高引擎的整體性能,從而直接提高專案效率。此外,由於引擎的持續使用需要及時維護和更換零件,以確保長期穩定的性能,氣門座圈的售後市場也在不斷成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.419億美元 |

| 預測值 | 9.345億美元 |

| 複合年成長率 | 2.9% |

就設備而言,市場細分為挖土機、裝載機、推土機、起重機、反鏟、平地機等。挖土機在2024年佔據市場主導地位,佔30%的佔有率,預計在預測期內,該細分市場的複合年成長率將超過4.2%。挖掘者因其能夠執行多種任務(包括起重、挖掘和開溝)而被廣泛應用於建築和工業領域。由於這些機器的運行時間長且暴露在嚴苛的環境中,其引擎需要能夠承受極端磨損的高品質氣門座圈,因此它們在市場上的需求量很大。

根據引擎類型,市場分為汽油引擎、柴油引擎、燃氣引擎(包括天然氣、壓縮天然氣 (CNG) 和液化石油氣 (LPG))、混合動力引擎和其他引擎。 2024 年,汽油引擎佔據最大佔有率,佔據 43% 的市場佔有率,預計 2025 年至 2034 年期間的複合年成長率將超過 4%。這類引擎常用於小型工程機械,因其易用性、成本效益以及與各種施工現場要求的兼容性而備受青睞。引擎效率的不斷提高也進一步提升了汽油引擎的受歡迎程度,從而刺激了對可靠耐用的氣門座圈的需求。

依材料分類,市場包括鐵合金、鋼、鎳基合金、鈷基合金等。其中,鐵合金憑藉著在耐用性、耐熱性和成本效益方面的平衡性,在2024年佔據了市場主導地位。這些材料特別適用於高溫操作,並廣泛應用於輕型和重型引擎零件。鐵基材料價格實惠,且具有良好的可加工性和耐磨性,使其成為眾多製造商滿足建築設備嚴格性能要求的首選材料。

從區域來看,中國在2024年引領全球建築氣門座圈市場,創造了約1.349億美元的收入,約佔全球市場佔有率的39%。這一主導地位得益於中國龐大的製造能力及其對基礎建設的持續投資。隨著城市發展,對可靠且高效的建築機械的需求也隨之成長,從而推動了對氣門座圈等性能關鍵型引擎部件的需求。此外,圍繞排放和燃油效率的監管措施也促使製造商採用先進的座圈技術,以維持合規性和競爭力。

該行業的領先公司包括AVL List、MAHLE、博格華納、Forvia SE(佛吉亞)、伊頓、吉凱恩汽車、LE Jones、三菱綜合材料、日本活塞環和天納克。這些公司正在積極投資材料創新,例如陶瓷複合材料和先進合金混合物,以提高產品的耐用性和性能。策略性舉措包括在關鍵地區的設備製造商附近建立生產中心、增強售後服務網路以及與引擎製造商建立合作夥伴關係。許多公司也注重永續實踐,採用可回收材料,並利用數位技術精簡供應鏈,以減少對環境的影響和營運成本。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 專業氣門座圈製造商

- 建築設備引擎製造商

- 建築設備OEM設備製造商

- 售後市場供應商和經銷商

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 地區

- 裝置

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 增加基礎建設投資

- 建築活動成長

- 對重型耐用設備的需求

- 非公路車輛的嚴格排放法規

- 建築設備的技術進步

- 產業陷阱與挑戰

- 原物料價格波動

- 向電動建築設備技術轉變

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 鐵合金

- 鋼

- 鎳基合金

- 鈷基合金

- 其他

第6章:市場估計與預測:按設備,2021 - 2034 年

- 主要趨勢

- 挖土機

- 裝載機

- 推土機

- 起重機

- 反鏟

- 評分員

- 其他

第7章:市場估計與預測:按引擎,2021 - 2034 年

- 主要趨勢

- 汽油引擎

- 柴油引擎

- 燃氣引擎(天然氣、CNG、LPG)

- 油電混合引擎

- 其他

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商(OEM)

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- AVR Valves

- BorgWarner

- Dura-Bond Bearing Company

- Eaton Corporation

- Forvia SE (Faurecia)

- GKN Automotive

- Goodson Tools & Supplies

- James Walker

- LE Jones

- MAHLE

- Mitsubishi Materials Corporation

- Nippon Piston Ring

- Precision Camshafts

- QualCast

- SMB Engine Valves

- SSV Valves

- Tenneco

- TPR

- Tucker Valve Seat

- Winsert

The Global Construction Valve Seat Insert Market was valued at USD 741.9 million in 2024 and is estimated to grow at a CAGR of 2.9% to reach USD 934.5 million by 2034. A significant contributor to this growth is the ongoing surge in infrastructure investment across both public and private sectors. As governments and corporations pour substantial resources into developing and modernizing transportation systems, commercial infrastructure, and utility frameworks, the demand for high-performance construction equipment is accelerating. These machines rely on robust internal engine components, with valve seat inserts playing a vital role in maintaining operational efficiency and durability under harsh working conditions.

Global construction activity continues to intensify, especially in regions experiencing rapid urban development. This widespread construction boom is fueling the need for heavy-duty machinery capable of performing in extreme environments. Equipment such as loaders, backhoes, cranes, and excavators requires engine parts that can endure high thermal and mechanical stress, making advanced valve seat inserts a critical component in sustaining machine longevity. The durability of these components reduces downtime and enhances the overall performance of engines, directly contributing to project efficiency. Furthermore, the aftermarket for valve seat inserts is growing, as continuous engine use demands timely maintenance and replacement parts, ensuring consistent performance in the long term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $741.9 Million |

| Forecast Value | $934.5 Million |

| CAGR | 2.9% |

In terms of equipment, the market is segmented into excavators, loaders, bulldozers, cranes, backhoes, graders, and others. Excavators led the market in 2024, holding a 30% share, and this segment is expected to grow at a CAGR of over 4.2% through the forecast period. Their widespread usage across construction and industrial sectors is attributed to their ability to perform multiple tasks, including lifting, digging, and trenching. Due to their prolonged operational hours and exposure to demanding environments, the engines in these machines require high-quality valve seat inserts that can handle extreme wear, making them a high-demand segment within the market.

Based on engine type, the market is divided into gasoline engines, diesel engines, gas engines (including natural gas, CNG, and LPG), hybrid engines, and others. In 2024, gasoline engines held the largest share, accounting for 43% of the market, and are anticipated to grow at a CAGR exceeding 4% between 2025 and 2034. These engines are frequently used in smaller construction machinery, favored for their ease of use, cost efficiency, and compatibility with various construction site requirements. Their popularity is also bolstered by ongoing improvements in engine efficiency, which in turn boosts demand for reliable and durable valve seat inserts.

When assessed by material, the market includes iron alloys, steel, nickel-based alloys, cobalt-based alloys, and others. Among these, iron alloys dominated the market in 2024 due to their balance of durability, heat resistance, and cost-effectiveness. These materials are especially suited for high-temperature operations and are widely adopted in both light and heavy-duty engine components. The affordability of iron-based materials, along with their machinability and resistance to wear, makes them the material of choice for many manufacturers aiming to meet the rigorous demands of construction equipment performance.

Regionally, China led the global construction valve seat insert market in 2024, generating around USD 134.9 million in revenue and accounting for approximately 39% of the global share. This dominant position is driven by the country's large-scale manufacturing capabilities and its continuous investment in infrastructure expansion. The need for reliable and efficient construction machinery has risen in tandem with urban development, driving the demand for performance-critical engine components like valve seat inserts. Additionally, regulatory measures around emissions and fuel efficiency are prompting manufacturers to adopt advanced insert technologies to stay compliant and competitive.

Leading companies operating in this industry include AVL List, MAHLE, BorgWarner, Forvia SE (Faurecia), Eaton, GKN Automotive, L.E. Jones, Mitsubishi Materials, Nippon Piston Ring, and Tenneco. These players are actively investing in material innovation, such as ceramic composites and advanced alloy blends, to improve product durability and performance. Strategic moves include establishing production hubs near equipment OEMs in key regions, enhancing aftermarket service networks, and forging partnerships with engine manufacturers. Many firms are also focusing on sustainable practices, incorporating recyclable materials and streamlining supply chains with digital technologies to reduce environmental impact and operational costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Specialized valve seat insert manufacturers

- 3.2.3 Engine manufacturers for construction equipment

- 3.2.4 Construction equipment OEM

- 3.2.5 Aftermarket suppliers and distributors

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.6.2 Equipment

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increased investment in infrastructure development

- 3.11.1.2 Growth in construction activities

- 3.11.1.3 Demand for heavy-duty and durable equipment

- 3.11.1.4 Stringent emission regulations for off-highway vehicles

- 3.11.1.5 Technological advancements in construction equipment

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Volatility in raw material prices

- 3.11.2.2 Technological shift toward electric construction equipment

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Iron alloys

- 5.3 Steel

- 5.4 Nickel-based alloys

- 5.5 Cobalt-based alloys

- 5.6 Other

Chapter 6 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Excavators

- 6.3 Loaders

- 6.4 Bulldozers

- 6.5 Cranes

- 6.6 Backhoes

- 6.7 Graders

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline engines

- 7.3 Diesel engines

- 7.4 Gas engines (Natural Gas, CNG, LPG)

- 7.5 Hybrid engines

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Original Equipment Manufacturers (OEM)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 AVR Valves

- 10.2 BorgWarner

- 10.3 Dura-Bond Bearing Company

- 10.4 Eaton Corporation

- 10.5 Forvia SE (Faurecia)

- 10.6 GKN Automotive

- 10.7 Goodson Tools & Supplies

- 10.8 James Walker

- 10.9 L.E. Jones

- 10.10 MAHLE

- 10.11 Mitsubishi Materials Corporation

- 10.12 Nippon Piston Ring

- 10.13 Precision Camshafts

- 10.14 QualCast

- 10.15 SMB Engine Valves

- 10.16 SSV Valves

- 10.17 Tenneco

- 10.18 TPR

- 10.19 Tucker Valve Seat

- 10.20 Winsert