|

市場調查報告書

商品編碼

1750283

發電廠重型燃氣渦輪機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Power Plants Heavy Duty Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

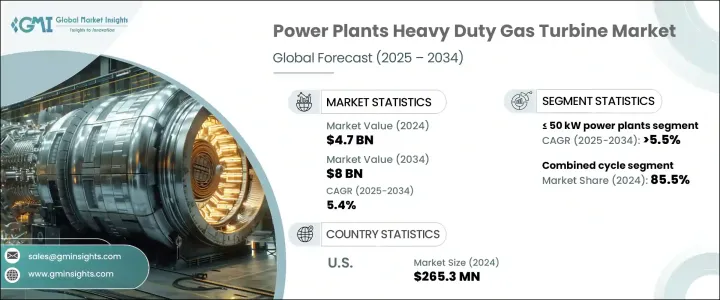

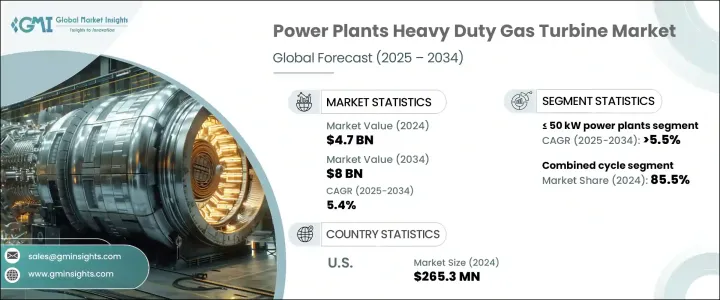

2024 年全球發電廠重型燃氣渦輪機市場價值為 47 億美元,預計到 2034 年將以 5.4% 的複合年成長率成長,達到 80 億美元,這得益於向可靠、按需能源的持續轉變,這促使主要公用事業和公共部門機構增加對燃氣發電的投資。在快速工業化和全球能源需求的推動下,對尖峰負載和基荷能源解決方案的需求不斷成長,該市場正在獲得發展動力。對能源安全的日益關注,加上天然氣探勘和貿易活動的增加,正在進一步塑造市場。此外,隨著各國尋求提高能源基礎設施的效率,整合數位技術和智慧電網解決方案正在加速應用。降低排放和減少大型電廠資本支出的推動支持向燃氣渦輪機發電的過渡。

重型燃氣渦輪機因其能夠產生高功率輸出,同時保持營運靈活性和環保合規性而備受青睞。這些燃氣渦輪機透過先進的空氣壓縮、燃料混合和點火工藝運行,產生高壓氣體,使渦輪葉片高速旋轉,從而提供卓越的發電性能。該行業面臨一些阻力,尤其是由於最近實施的貿易關稅,這提高了鋁、鋼和特殊合金等關鍵原料的成本。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 47億美元 |

| 預測值 | 80億美元 |

| 複合年成長率 | 5.4% |

預計到2034年,50千瓦及以下發電廠重型燃氣渦輪機市場的複合年成長率將超過5.5%,這得益於其在分散式能源系統中的日益普及。這些緊湊型機組對於需要可靠現場發電的工業和偏遠地區至關重要。其靈活性、運作效率和緊湊的佔地面積使其成為電網連接有限或不穩定的分散式電網的理想選擇。隨著工業設施尋求經濟高效的方式來確保不間斷供電,同時最大限度地減少碳排放,這些低容量燃氣渦輪機的吸引力持續增強。

在技術方面,聯合循環發電領域在2024年將佔據85.5%的市場佔有率,這得益於聯合循環系統的卓越效率,該系統利用燃氣渦輪機和蒸汽渦輪機從同一燃料源中獲取最大能量。這些系統顯著減少了排放並最佳化了燃料使用,符合環境目標和嚴格的監管標準。向清潔能源發電的轉變促使公用事業公司和獨立電力生產商逐步淘汰傳統燃煤電廠,並採用聯合循環解決方案作為更永續的替代方案。

2024年,美國重型燃氣渦輪機市場規模達2.653億美元,反映出美國對可靠清潔電力的需求日益成長。快速的工業化進程、人工智慧資料中心等能源密集產業的興起,以及煤炭向天然氣的廣泛轉型,是推動這一成長的關鍵因素。頁岩氣供應的不斷增加,進一步鞏固了美國作為天然氣強國的地位,為燃氣渦輪機運作提供了穩定的供應鏈。

市場領導者包括瓦錫蘭、西門子能源、通用電氣 Vernova、Vericor、MAN Energy Solutions、Flex Energy Solutions、南京蒸汽渦輪機電機(集團)、索拉透平、川崎重工、凱普斯通綠色能源控股、貝克休斯、三菱重工、斗山能源、勞斯萊斯、巴拉特重型電氣、Destinus Energy Energy、安薩爾多能源、濱電電氣。為了提升市場佔有率,各企業正專注於多項策略,包括透過數位化升級和遠端監控解決方案擴展服務組合,從而最佳化渦輪機性能並減少停機時間。企業投資模組化渦輪機設計,以便在公用事業和工業場所靈活部署。與能源供應商的策略合作和長期供應協議有助於鞏固市場地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率分析

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- ≤ 50 千瓦

- > 50 千瓦至 500 千瓦

- > 500 千瓦至 1 兆瓦

- > 1 兆瓦至 30 兆瓦

- > 30 兆瓦至 70 兆瓦

- > 70 兆瓦至 200 兆瓦

- > 200 兆瓦

第6章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 開放式循環

- 複合循環

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 荷蘭

- 芬蘭

- 希臘

- 丹麥

- 羅馬尼亞

- 波蘭

- 瑞典

- 亞太地區

- 中國

- 澳洲

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 孟加拉

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 約旦

- 南非

- 奈及利亞

- 阿爾及利亞

- 肯亞

- 迦納

- 拉丁美洲

- 巴西

- 阿根廷

- 秘魯

- 智利

第8章:公司簡介

- Ansaldo Energia

- Baker Hughes

- Bharat Heavy Electricals

- Capstone Green Energy Holdings

- Destinus Energy

- Doosan Enerbility

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Nanjing Steam Turbine Motor (Group)

- Rolls Royce

- Siemens Energy

- Solar Turbines

- Vericor

- Wartsilä

The Global Power Plants Heavy Duty Gas Turbine Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 8 billion by 2034, driven by the ongoing shift toward reliable, on-demand energy sources is prompting major utilities and public sector bodies to increase investments in gas-based power generation. This market is gaining momentum with the rising demand for peak-load and base-load energy solutions, driven by rapid industrialization and global energy needs. The growing focus on energy security, combined with increasing natural gas exploration and trade activity, is further shaping the market. Additionally, as countries look to enhance the efficiency of their energy infrastructure, integrating digital technologies and smart grid solutions is accelerating adoption. The push for lower emissions and reduced capital expenditure on large-scale plants supports the transition toward gas turbine-based generation.

Heavy-duty gas turbines are favored for their ability to produce high power outputs while maintaining operational flexibility and environmental compliance. These turbines function through an advanced process of air compression, fuel mixing, and ignition, resulting in high-pressure gases that spin turbine blades at intense speeds, delivering remarkable power generation performance. The industry has faced some headwinds, particularly due to trade tariffs introduced recently, which raised the cost of key input materials such as aluminum, steel, and specialized alloys.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $8 Billion |

| CAGR | 5.4% |

The <= 50 kW power plants heavy-duty gas turbine segment is forecasted to grow at a CAGR of over 5.5% through 2034, driven by its increasing adoption in decentralized energy systems. These compact units are proving vital for industries and remote facilities that require reliable, on-site power generation. Their flexibility, operational efficiency, and compact footprint make them ideal for distributed power networks where grid connectivity is limited or inconsistent. As industrial facilities seek cost-effective ways to ensure uninterrupted power while minimizing carbon output, the appeal of these lower-capacity turbines continues to strengthen.

On the technology front, the combined cycle segment held 85.5% share in 2024, driven by the superior efficiency of combined cycle systems, which utilize gas and steam turbines to extract maximum energy from the same fuel source. These systems significantly cut emissions and optimize fuel usage, aligning with environmental goals and stringent regulatory standards. The shift toward clean energy generation prompts utilities and independent power producers to phase out conventional coal plants and adopt combined cycle solutions as a more sustainable alternative.

United States Heavy Duty Gas Turbine Market was valued at USD 265.3 million in 2024, reflecting the country's accelerating demand for reliable and clean electricity. Rapid industrialization, the rise of energy-intensive sectors like artificial intelligence data centers, and the widespread transition from coal to natural gas are key contributors to this growth. The increasing availability of shale gas has further strengthened the U.S. position as a natural gas powerhouse, enabling stable supply chains for gas turbine operations.

Leading companies in the market include Wartsila, Siemens Energy, GE Vernova, Vericor, MAN Energy Solutions, Flex Energy Solutions, Nanjing Steam Turbine Motor (Group), Solar Turbines, Kawasaki Heavy Industries, Capstone Green Energy Holdings, Baker Hughes, Mitsubishi Heavy Industries, Doosan Enerbility, Rolls Royce, Bharat Heavy Electricals, Destinus Energy, Ansaldo Energia, Harbin Electric, and others. To enhance market presence, companies are focusing on several strategies. These include expanding their service portfolios through digital upgrades and remote monitoring solutions, which optimize turbine performance and reduce operational downtime. Firms invest in modular turbine designs for flexible deployment across utility and industrial sites. Strategic collaborations with energy providers and long-term supply agreements are helping solidify market positions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 kW to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 MW to 30 MW

- 5.6 > 30 MW to 70 MW

- 5.7 > 70 MW to 200 MW

- 5.8 > 200 MW

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Open cycle

- 6.3 Combined cycle

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.3.7 Finland

- 7.3.8 Greece

- 7.3.9 Denmark

- 7.3.10 Romania

- 7.3.11 Poland

- 7.3.12 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Thailand

- 7.4.7 Malaysia

- 7.4.8 Bangladesh

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Kuwait

- 7.5.5 Oman

- 7.5.6 Egypt

- 7.5.7 Turkey

- 7.5.8 Bahrain

- 7.5.9 Iraq

- 7.5.10 Jordan

- 7.5.11 South Africa

- 7.5.12 Nigeria

- 7.5.13 Algeria

- 7.5.14 Kenya

- 7.5.15 Ghana

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Peru

- 7.6.4 Chile

Chapter 8 Company Profiles

- 8.1 Ansaldo Energia

- 8.2 Baker Hughes

- 8.3 Bharat Heavy Electricals

- 8.4 Capstone Green Energy Holdings

- 8.5 Destinus Energy

- 8.6 Doosan Enerbility

- 8.7 Flex Energy Solutions

- 8.8 GE Vernova

- 8.9 Harbin Electric

- 8.10 Kawasaki Heavy Industries

- 8.11 MAN Energy Solutions

- 8.12 Mitsubishi Heavy Industries

- 8.13 Nanjing Steam Turbine Motor (Group)

- 8.14 Rolls Royce

- 8.15 Siemens Energy

- 8.16 Solar Turbines

- 8.17 Vericor

- 8.18 Wartsilä