|

市場調查報告書

商品編碼

1782155

航空衍生型燃氣渦輪機服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aeroderivative Gas Turbine Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

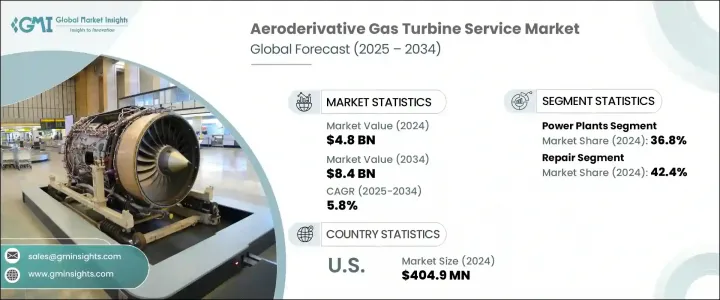

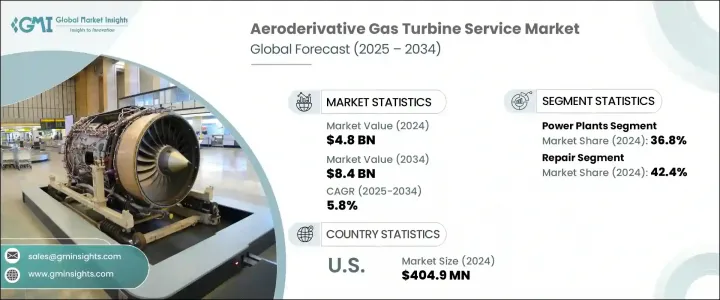

2024年,全球航改型燃氣渦輪機服務市場規模達48億美元,預計2034年將以9.2%的複合年成長率成長,達到84億美元。人們越來越重視使用沼氣和氨等低碳排放燃料來提高燃氣渦輪機效率,這推動了市場發展勢頭。航改型燃氣渦輪機最初設計用於航空領域,現已廣泛應用於工業和發電領域,其維護、大修和維修等服務對於延長其使用壽命和維持尖峰效率至關重要。隨著日益嚴格的環保政策要求降低二氧化碳和二氧化氮排放,營運商正在積極改造現有燃氣渦輪機,為其配備燃料靈活的燃燒器和低排放燃燒器系統,而不是完全更換機組。

長期服務合約和風力渦輪機租賃安排也在最大限度地降低營運商的財務風險方面發揮著重要作用,它們提供了可預測的維護成本和保證的系統正常運行時間。許多風力渦輪機隊,尤其是2005年之前部署的風力渦輪機隊,其使用壽命已超過二十年,這引發了一波強勁的升級需求,預計隨著全球風力渦輪機隊進入關鍵的中後期生命週期,這一需求將在2026年至2030年之間達到峰值。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 48億美元 |

| 預測值 | 84億美元 |

| 複合年成長率 | 9.2% |

2024年,發電廠領域貢獻了36.8%的佔有率,預計到2034年將以6%的複合年成長率成長。對排放監測和持續合規性(尤其是氮氧化物限值相關法規)的需求不斷成長,延長了維護間隔,並加劇了服務需求。渦輪機的頻繁循環,尤其是在峰值負載運行期間,加速了轉子組件和燃料控制系統等部件的磨損,從而推動了對跨地區全面服務支援的需求。

維修服務領域在2024年佔據42.4%的佔有率,預計2025年至2034年的複合年成長率將達到5.5%。等離子塗層、先進積層製造和精密焊接技術的日益普及,有助於延長渦輪機關鍵零件的使用壽命。這在海洋和石油天然氣領域尤其重要,因為這些領域對耐腐蝕部件的需求正在激增,這將進一步增強服務組合,並刺激售後市場的需求。

2024年,美國航空衍生型燃氣渦輪機服務市場佔據89.6%的市場佔有率,規模達4.049億美元。人口成長和尖峰負載上升帶來的能源需求成長加速了航空衍生型燃氣渦輪機的部署,這些渦輪機通常採用固定價格維護協議。國家政策支持和針對能源轉型計畫的資金投入,尤其是在政府支持的主要項目下,正推動人們對這些燃氣渦輪機的興趣,將其作為再生能源的重要備用解決方案。氫燃料和雙燃料燃氣渦輪機計畫的擴張也鼓勵了對技術人員培訓、燃燒系統升級和密封件更換專案的投資,從而增強了對專業燃氣渦輪機服務的需求。

產業頂尖企業包括西門子能源、曼恩能源解決方案、通用電氣 Vernova、安薩爾多能源和三菱重工。為了提昇在航改型燃氣渦輪機服務市場的競爭力,各企業正採取多管齊下的策略,並專注於生命週期支援、創新和在地化。主要企業正在投資數位診斷和預測性維護平台,以最大限度地減少燃氣渦輪停機時間並提高服務響應速度。擴大全球服務中心和部署遠端監控功能可以更快地解決服務問題。企業還與營運商合作簽訂長期服務契約,以提供成本可預測性和性能保證。專門的研發投資正在推動低氮氧化物燃燒器、耐腐蝕塗層和燃料彈性系統的開發,以符合清潔能源目標。員工培訓計畫正在加強,以滿足混合動力和氫混合系統不斷變化的技術需求,確保為下一代能源基礎設施做好服務準備。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依服務,2021 - 2034 年

- 主要趨勢

- 維護

- 維修

- 大修

- 其他

第6章:市場規模及預測:依服務供應商,2021 - 2034 年

- 主要趨勢

- OEM

- 非OEM

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 發電廠

- 石油和天然氣

- 加工廠

- 航空

- 海洋

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 荷蘭

- 芬蘭

- 希臘

- 丹麥

- 羅馬尼亞

- 波蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 約旦

- 黎巴嫩

- 南非

- 奈及利亞

- 阿爾及利亞

- 肯亞

- 拉丁美洲

- 巴西

- 阿根廷

- 秘魯

- 智利

第9章:公司簡介

- Ansaldo Energia

- Centrax Gas Turbines

- Destinus Energy

- EthosEnergy

- GE Vernova

- JSC United Engine

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MJB International

- MTU Aero Engines

- PROENERGY

- RWG

- Siemens Energy

- Solar Turbines

- Sulzer

- TRS SERVICES

- VERICOR

The Global Aeroderivative Gas Turbine Service Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 8.4 billion by 2034. Growing emphasis on improving turbine efficiency with lower carbon-emission fuels like biogas and ammonia is fueling market momentum. Aeroderivative turbines, originally engineered for aviation, are now widely adapted for industrial and power generation, and their servicing-including maintenance, overhauls, and repairs-is vital to prolong their lifespan and maintain peak efficiency. As tightening environmental policies demand lower CO2 and NO2 emissions, operators are actively retrofitting existing turbines with fuel-flexible combustors and low-emission burner systems instead of replacing units entirely.

Long-term service contracts and turbine leasing arrangements are also playing a significant role in minimizing financial risks for operators, offering predictable maintenance costs and guaranteed system uptime. Many turbine fleets, especially those deployed before 2005, have surpassed two decades of service life, creating a strong wave of upgrade demand that is expected to peak between 2026 and 2030 as global fleets enter critical mid-to-end-of-life cycles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 9.2% |

In 2024, the power plant segment contributed a 36.8% share and is forecast to grow at a CAGR of 6% through 2034. Increasing demand for emission monitoring and ongoing regulatory compliance, particularly related to NOx limits, is extending maintenance intervals and intensifying service needs. Frequent cycling of turbines, especially in peak load operations, is accelerating wear in components like rotor assemblies and fuel control systems, driving up the need for comprehensive service support across various geographies.

The repair services segment held a 42.4% share in 2024 and is anticipated to grow at a CAGR of 5.5% from 2025 to 2034. The rising adoption of plasma coatings, advanced additive manufacturing, and precision welding techniques is helping extend the operational life of critical components in turbines. This is particularly important in the marine and oil & gas sectors, where demand for corrosion-resistant parts is surging, further strengthening the service portfolio and fueling aftermarket demand.

United States Aeroderivative Gas Turbine Service Market held an 89.6% share in 2024 and recorded USD 404.9 million. Rising energy demand tied to population growth and peak load increases has accelerated the deployment of aeroderivative turbines, often under fixed-price maintenance agreements. National policy support and funding directed at energy transition initiatives, especially under major government-backed programs, are driving interest in these turbines as essential backup solutions for renewable sources. The expansion of hydrogen-fueled and dual-fuel turbine projects is also encouraging investment in technician training, combustion system upgrades, and seal replacement programs, strengthening the demand for specialized turbine servicing.

Top industry players include Siemens Energy, MAN Energy Solutions, GE Vernova, Ansaldo Energia, and Mitsubishi Heavy Industries. To enhance their competitiveness in the aeroderivative gas turbine service market, companies are adopting multi-pronged strategies focused on lifecycle support, innovation, and localization. Major players are investing in digital diagnostics and predictive maintenance platforms to minimize turbine downtime and boost service responsiveness. Expanding global service hubs and deploying remote monitoring capabilities allow for quicker resolution of service issues. Firms are also partnering with operators on long-term service contracts to provide cost predictability and performance guarantees. Specialized R&D investments are driving the development of low-NOx combustors, corrosion-resistant coatings, and fuel-flexible systems to align with clean energy goals. Workforce training programs are being ramped up to meet the evolving technical demands of hybrid and hydrogen-blended systems, ensuring service readiness for next-gen energy infrastructures.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Service, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Maintenance

- 5.3 Repair

- 5.4 Overhaul

- 5.5 Others

Chapter 6 Market Size and Forecast, By Service Provider, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Non-OEM

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Power plants

- 7.3 Oil & gas

- 7.4 Process plants

- 7.5 Aviation

- 7.6 Marine

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Denmark

- 8.3.10 Romania

- 8.3.11 Poland

- 8.3.12 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Australia

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Thailand

- 8.4.8 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 Lebanon

- 8.5.12 South Africa

- 8.5.13 Nigeria

- 8.5.14 Algeria

- 8.5.15 Kenya

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Centrax Gas Turbines

- 9.3 Destinus Energy

- 9.4 EthosEnergy

- 9.5 GE Vernova

- 9.6 JSC United Engine

- 9.7 Kawasaki Heavy Industries

- 9.8 MAN Energy Solutions

- 9.9 Mitsubishi Heavy Industries

- 9.10 MJB International

- 9.11 MTU Aero Engines

- 9.12 PROENERGY

- 9.13 RWG

- 9.14 Siemens Energy

- 9.15 Solar Turbines

- 9.16 Sulzer

- 9.17 TRS SERVICES

- 9.18 VERICOR