|

市場調查報告書

商品編碼

1741016

非低溫空氣分離裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Non-Cryogenic Air Separation Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

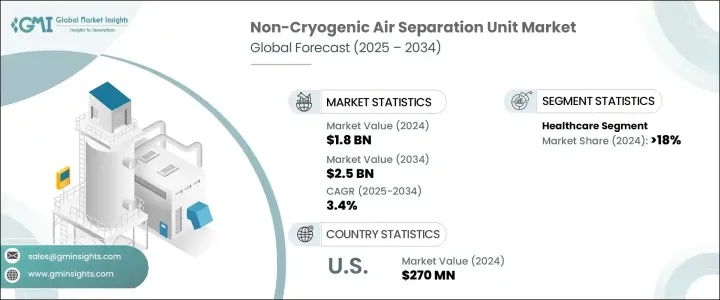

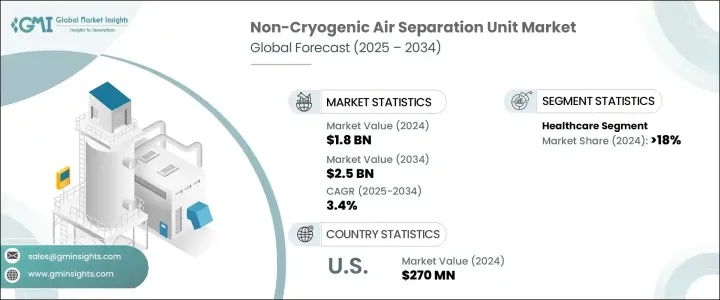

2024年,全球非低溫空氣分離裝置市場規模達18億美元,預計2034年將以3.4%的複合年成長率成長,達到25億美元。公共部門措施和有利政策框架的日益支持,推動了各行各業對非低溫空氣分離系統的需求。這些系統正被工業營運商廣泛採用,不僅是為了滿足環境合規目標,也是為了與更廣泛的永續發展目標和企業社會責任驅動的議程保持一致。隨著越來越多的企業致力於脫碳減排,無需依賴低溫處理即可實現能源效率的空氣分離系統正受到廣泛青睞。

環境法規和全球對低碳技術的推動顯著提升了這些系統在化學、醫療保健、鋼鐵和能源等領域的價值。各組織正在採用非低溫技術,以實現更清潔的營運,同時降低傳統低溫工廠的營運複雜性和成本負擔。國際環境協定和地方綠色政策推動的監管勢頭持續激發新興市場和成熟市場的自願需求。從小型模組化裝置到先進的PSA系統,非低溫裝置的靈活性與清潔能源和本地化工業生產不斷變化的需求相契合。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 3.4% |

根據氣體類型,氮氣仍然是非低溫空氣分離裝置成長的主要驅動力。它廣泛應用於多個行業,尤其是食品飲料、電子和製藥行業,使其成為生產和包裝作業中不可或缺的能源。食品加工產業對氣調包裝 (MAP) 的日益依賴是推動這一需求成長的最重要因素之一。除了食品應用外,氮氣對於在敏感製造製程(例如半導體製造和製藥生產)中創造惰性環境也至關重要,因為在這些製程中,氧化控制和污染預防至關重要。

2024年,醫療保健產業佔18%,反映出現場製氧技術使用量的增加。在終端用戶方面,石油天然氣、鋼鐵和化學等行業的核心運作都依賴氧氣和氮氣。尤其是在煉鋼過程中,氧氣可以提高爐效,而氬氣則可以確保去除雜質。隨著工業脫碳策略的實施,現場富氧燃燒系統的採用率正在上升。在醫療保健領域,對透過攜帶式PSA裝置生產的醫用級氧氣的需求正在激增,尤其是在偏遠和服務不足的地區。

在監管規定和基礎設施投資的推動下,美國非低溫空氣分離裝置市場規模在2024年達到2.7億美元。氫氣開發和氨氣生產的資金投入,正在創造對非低溫氧氣和氮氣裝置的強勁需求。管道安全監管措施也推動了頁岩地區氮氣生產裝置的安裝量增加。這些趨勢,加上工業天然氣基礎設施的現代化建設,將繼續塑造美國市場的長期成長。

活躍於全球非低溫空氣分離裝置產業的主要公司包括梅塞爾、AIR WATER INC、Enerflex Ltd.、Technex、盈德氣體、Ranch Cryogenics, Inc.、AMCS Corporation、大陽日酸株式會社、空氣產品和化學公司、開封空分Group Limited、CRYOTEC Anlagenbau GmbH、液化空氣集團公司和化學公司、黑色分公司、工業公司四川工業公司。為了保持競爭力,領先的企業專注於擴展其模組化產品組合,同時整合基於物聯網的自動化和數位監控解決方案。公司正在與能源、醫療保健和工業氣體分銷商建立策略合作夥伴關係,以加強其區域影響力。此外,研發的重點是提高系統能源效率,提高氣體純度水平,以及為分散和移動用例開發基於 PSA 的緊湊型模型。這些策略正在幫助供應商滿足不斷成長的市場需求,同時為清潔能源轉型做好準備。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 川普政府關稅對貿易和整體產業的影響

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依天然氣,2021 - 2034 年

- 主要趨勢

- 氮

- 氧

- 氬氣

- 其他

第6章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 鋼鐵

- 石油和天然氣

- 衛生保健

- 化學品

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Air Liquide

- Air Products and Chemicals, Inc.

- AIR WATER INC

- AMCS Corporation

- CRYOTEC Anlagenbau GmbH

- Enerflex Ltd.

- KaiFeng Air Separation Group Co.,LTD.

- Linde plc

- Messer

- Praxair Technology, Inc.

- Ranch Cryogenics, Inc.

- Sichuan Air Separation Plant Group

- Taiyo Nippon Sanso Corporation

- Technex

- Universal Industrial Gases, Inc.

- Yingde Gases

The Global Non-Cryogenic Air Separation Unit Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 2.5 billion by 2034. Growing support from public sector initiatives and favorable policy frameworks fuel the demand for non-cryogenic air-separation systems across industries. These systems are being widely adopted by industrial operators not only to meet environmental compliance targets but also to align with broader sustainability goals and CSR-driven agendas. As more corporations commit to decarbonization and emission reduction, air separation systems that offer energy efficiency without relying on cryogenic processing are gaining preference across the board.

Environmental regulations and the global push for low-carbon technologies have significantly elevated the value of these systems in sectors such as chemicals, healthcare, steel, and energy. Organizations are embracing non-cryogenic technologies to achieve cleaner operations while reducing operational complexities and cost burdens associated with traditional cryogenic plants. Regulatory momentum driven by international environmental agreements and local green policies continues generating voluntary demand from emerging and mature markets. From smaller-scale modular units to advanced PSA systems, the flexibility of non-cryogenic setups aligns with the shifting demands for clean energy and localized industrial production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 3.4% |

Based on gas type, nitrogen continues to be the primary driver for the growth of non-cryogenic air separation units. Its widespread use across multiple industries-especially food and beverage, electronics, and pharmaceuticals-has made it essential in production and packaging operations. One of the most significant contributors to this demand is the increasing reliance on modified atmosphere packaging (MAP) within the food processing sector. Beyond food applications, nitrogen is also crucial for creating inert environments in sensitive manufacturing processes, such as in semiconductor fabrication and pharmaceutical production, where oxidation control and contamination prevention are critical.

The healthcare industry accounted for an 18% share in 2024, reflecting increased usage of on-site oxygen production technologies. On the end-user front, sectors such as oil & gas, iron & steel, and chemicals rely on oxygen and nitrogen in their core operations. Particularly in steelmaking, oxygen improves furnace performance while argon ensures the removal of impurities. The adoption of on-site systems for oxygen-enriched combustion is rising with industrial decarbonization strategies. In healthcare, demand for medical-grade oxygen produced via portable PSA units is surging, especially in remote and underserved areas.

U.S. Non-Cryogenic Air Separation Unit Market reached USD 270 million in 2024, supported by regulatory mandates and infrastructure investments. Funding for hydrogen development and ammonia production is creating robust demand for non-cryogenic oxygen and nitrogen units. Regulatory actions concerning pipeline safety are also contributing to higher installations of nitrogen generation units across shale regions. These trends, along with modernization efforts in industrial gas infrastructure, continue to shape long-term growth in the U.S. market.

Major companies active in the Global Non-Cryogenic Air Separation Unit Industry include Messer, AIR WATER INC, Enerflex Ltd., Technex, Yingde Gases, Ranch Cryogenics, Inc., AMCS Corporation, Taiyo Nippon Sanso Corporation, Air Products and Chemicals, Inc., KaiFeng Air Separation Group Co., LTD., CRYOTEC Anlagenbau GmbH, Air Liquide, Universal Industrial Gases, Inc., Linde plc, Sichuan Air Separation Plant Group, and Praxair Technology, Inc. To remain competitive, leading players focus on expanding their modular product portfolios while integrating IoT-based automation and digital monitoring solutions. Companies are entering strategic partnerships with energy, healthcare, and industrial gas distributors to strengthen their regional footprints. Additionally, R&D is centered on boosting system energy efficiency, improving gas purity levels, and developing compact PSA-based models for decentralized and mobile use cases. These tactics are helping suppliers meet rising market demand while positioning themselves for the clean energy transition.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Impact of Trump administration tariffs on trade & overall industry

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Gas, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nitrogen

- 5.3 Oxygen

- 5.4 Argon

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Iron & steel

- 6.3 Oil & gas

- 6.4 Healthcare

- 6.5 Chemicals

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Air Liquide

- 8.2 Air Products and Chemicals, Inc.

- 8.3 AIR WATER INC

- 8.4 AMCS Corporation

- 8.5 CRYOTEC Anlagenbau GmbH

- 8.6 Enerflex Ltd.

- 8.7 KaiFeng Air Separation Group Co.,LTD.

- 8.8 Linde plc

- 8.9 Messer

- 8.10 Praxair Technology, Inc.

- 8.11 Ranch Cryogenics, Inc.

- 8.12 Sichuan Air Separation Plant Group

- 8.13 Taiyo Nippon Sanso Corporation

- 8.14 Technex

- 8.15 Universal Industrial Gases, Inc.

- 8.16 Yingde Gases