|

市場調查報告書

商品編碼

1740974

低溫空氣分離裝置市場機會、成長動力、產業趨勢分析及2025-2034年預測Cryogenic Air Separation Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

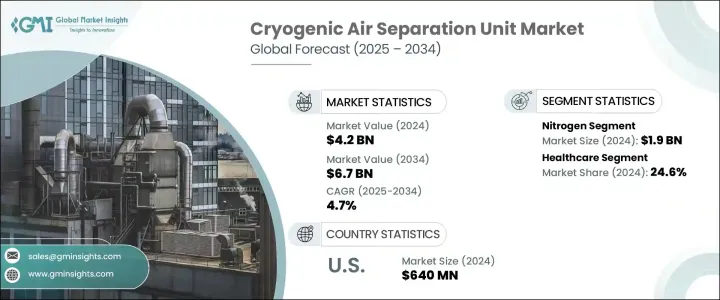

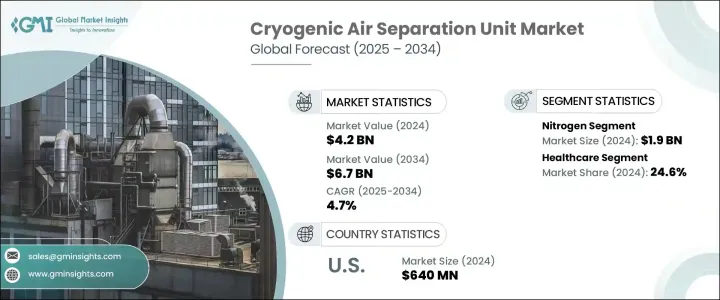

2024年,全球低溫空氣分離裝置市場規模達42億美元,預計2034年將以4.7%的複合年成長率成長,達到67億美元。這主要得益於鋼鐵、化工和製造業等各行各業對氧氣、氮氣和氬氣等工業氣體需求的不斷成長。隨著工業活動的擴張,尤其是在發展中國家,對這些氣體的需求激增,從而推動了對空氣分離技術的投資。

此外,新冠疫情凸顯了全球醫療體系的脆弱性,尤其是在危機高峰期,醫用級氧氣的短缺尤為突出。這種迫切性促使各國政府和私人醫療機構優先投資醫用氣體基礎設施。因此,對能夠大規模生產高純度氧氣的低溫空氣分離裝置的需求激增。醫院和急救機構開始升級其製氧能力,包括新建和改造。除了當前的危機應對措施外,這一趨勢還在持續,成為增強醫療韌性的更廣泛努力的一部分,尤其是在醫療服務可近性迅速擴大的新興市場。這種轉變也鼓勵了醫用氣體的本地生產,減少了對進口的依賴,並確保了各地區的長期供應穩定。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 67億美元 |

| 複合年成長率 | 4.7% |

預計到2034年,氬氣市場規模將達到14億美元,這得益於其在建立惰性氣體環境方面發揮的重要作用,而惰性氣體環境對於精密驅動的工業應用至關重要。隨著製造技術日益專業化,對穩定、無反應環境的需求也日益成長。氬氣在TIG焊接、電子製造、雷射切割以及特殊玻璃和太陽能板生產等製程的廣泛應用,凸顯了其日益成長的重要性。清潔能源轉型,尤其是太陽能技術的擴展,將繼續成為氬氣需求的主要催化劑,因為氬氣在高溫製程中對於保護材料免受污染至關重要。

醫療保健產業在2024年將佔24.6%的市場佔有率,仍是低溫空氣分離裝置的主要終端應用領域。醫院、診所和長期照護中心越來越依賴這些系統來現場生產醫用級氧氣。隨著人口老化和慢性呼吸系統疾病對全球醫療保健系統造成更大壓力,這項需求也變得越來越迫切。因此,對醫用氣體基礎設施的投資不斷成長,尤其是在那些尋求提高醫療可及性和緊急準備水準的地區。

2024年,美國低溫空氣分離裝置市場規模達6.4億美元。受頁岩氣探勘開發增加和清潔氫燃料解決方案推動,北美工業成長催生了對本地化、高容量空分裝置的需求。許多此類設施位於偏遠或高需求地區,現場天然氣生產比運輸效率更高。此外,農業和製藥業不斷成長的氮氣需求也強化了空分裝置在支持該地區關鍵供應鏈方面的作用。

全球低溫空氣分離裝置市場的主要參與者包括液化空氣集團、空氣產品和化學品公司、AIR WATER INC、AMCS Corporation、CRYOTEC Anlagenbau GmbH、Enerflex Ltd.、開封空氣分離Group Limited、林德公司、梅塞爾、普萊克斯技術公司、Ranch Cryogenics, Inc.、市場公司、林德公司、梅塞爾、普萊克斯技術公司、Ranch Cryogenics, Inc.、市場公司、林德公司、大陽品牌級氣體股會、市場級氣體股會、市場級電株式產業節和股式工業公司。這些公司專注於合併、收購和合作等策略性舉措,以增強其市場地位和技術能力。為了加強其市場地位,公司正在採取幾項關鍵策略。首先,他們正在投資研發,以提高其產品的效率和環境永續性。這包括將再生能源整合到空氣分離裝置中以減少碳足跡。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 對貿易的影響

- 展望與未來考慮

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依天然氣,2021 - 2034 年

- 主要趨勢

- 氮

- 氧

- 氬氣

- 其他

第6章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 鋼鐵

- 石油和天然氣

- 衛生保健

- 化學品

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Evoqua Water Technologies LLC

- Air Liquide

- Air Products and Chemicals, Inc.

- AIR WATER INC

- AMCS Corporation

- CRYOTEC Anlagenbau GmbH

- Enerflex Ltd.

- KaiFeng Air Separation Group Co., LTD.

- Linde plc

- Messer

- Praxair Technology, Inc.

- Ranch Cryogenics, Inc.

- Sichuan Air Separation Plant Group

- TAIYO NIPPON SANSO CORPORATION

- Technex

- Universal Industrial Gases, Inc.

- Yingde Gases

The Global Cryogenic Air Separation Unit Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 6.7 billion by 2034, driven by the increasing demand for industrial gases such as oxygen, nitrogen, and argon across various sectors including steel, chemicals, and manufacturing. As industrial activities expand, particularly in developing nations, the need for these gases has surged, prompting investments in air separation technologies.

Additionally, the COVID-19 pandemic highlighted vulnerabilities in global healthcare systems, particularly the shortage of medical-grade oxygen during peak crisis periods. This urgency pushed governments and private healthcare providers to prioritize investments in medical gas infrastructure. As a result, demand surged for cryogenic air separation units capable of producing high-purity oxygen at scale. Hospitals and emergency care facilities began upgrading their oxygen generation capabilities, leading to new installations and retrofits. Beyond the immediate crisis response, this trend has continued as part of broader efforts to strengthen healthcare resilience, especially in emerging markets where healthcare access is expanding rapidly. The shift also encouraged local production of medical gases, reducing reliance on imports and ensuring long-term supply stability across regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 4.7% |

The argon segment is projected to hit USD 1.4 billion by 2034, driven by its essential role in establishing inert atmospheres crucial for precision-driven industrial applications. As manufacturing technologies become more specialized, the need for stable, non-reactive environments has intensified. Argon's widespread adoption in processes such as TIG welding, electronics fabrication, laser cutting, and the production of specialty glass and solar panels underscores its growing relevance. The clean energy transition, particularly the expansion of solar technology, continues to be a major catalyst for argon demand, as the gas is indispensable in protecting materials from contamination during high-temperature procedures.

The healthcare industry, accounting for a 24.6% share in 2024, remains a major end-use segment for cryogenic air separation units. Hospitals, clinics, and long-term care centers increasingly depend on these systems to generate medical-grade oxygen onsite. This need is becoming more pressing as aging populations and chronic respiratory conditions place greater strain on healthcare systems worldwide. In response, investments in medical gas infrastructure have grown, particularly in regions seeking to enhance healthcare access and emergency readiness.

U.S. Cryogenic Air Separation Unit Market reached USD 640 million in 2024. Industrial growth in North America, supported by increased exploration of shale gas and a push for cleaner hydrogen fuel solutions, has created demand for localized, high-capacity ASU installations. Many of these facilities are in remote or high-demand zones where on-site gas generation is more efficient than transportation. Additionally, rising nitrogen demand in agriculture and pharmaceutical manufacturing reinforces the role of ASUs in supporting critical supply chains across the region.

Key players in the Global Cryogenic Air Separation Unit Market include Air Liquide, Air Products and Chemicals, Inc., AIR WATER INC, AMCS Corporation, CRYOTEC Anlagenbau GmbH, Enerflex Ltd., KaiFeng Air Separation Group Co., LTD, Linde plc, Messer, Praxair Technology, Inc., Ranch Cryogenics, Inc., Sichuan Air Separation Plant Group, TAIYO NIPPON SANSO CORPORATION, Technex, Universal Industrial Gases, Inc., and Yingde Gases. These companies focus on strategic initiatives such as mergers, acquisitions, and partnerships to enhance their market presence and technological capabilities. To strengthen their presence in the market, companies are adopting several key strategies. Firstly, they are investing in research and development to enhance the efficiency and environmental sustainability of their products. This includes integrating renewable energy sources into air separation units to reduce carbon footprints.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Gas, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nitrogen

- 5.3 Oxygen

- 5.4 Argon

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Iron & steel

- 6.3 Oil & gas

- 6.4 Healthcare

- 6.5 Chemicals

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Evoqua Water Technologies LLC

- 8.2 Air Liquide

- 8.3 Air Products and Chemicals, Inc.

- 8.4 AIR WATER INC

- 8.5 AMCS Corporation

- 8.6 CRYOTEC Anlagenbau GmbH

- 8.7 Enerflex Ltd.

- 8.8 KaiFeng Air Separation Group Co., LTD.

- 8.9 Linde plc

- 8.10 Messer

- 8.11 Praxair Technology, Inc.

- 8.12 Ranch Cryogenics, Inc.

- 8.13 Sichuan Air Separation Plant Group

- 8.14 TAIYO NIPPON SANSO CORPORATION

- 8.15 Technex

- 8.16 Universal Industrial Gases, Inc.

- 8.17 Yingde Gases