|

市場調查報告書

商品編碼

1740998

濕式真空幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Wet Vacuum Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

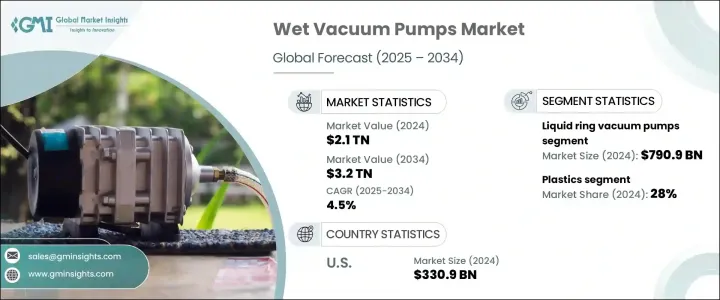

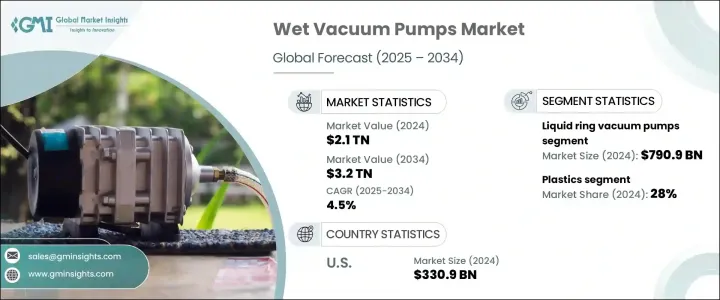

2024年,全球濕式真空幫浦市場規模達2.1兆美元,預計在電子和半導體產業崛起的推動下,該市場將以4.5%的複合年成長率成長,到2034年達到3.2兆美元。濕式真空幫浦在化學加工、食品飲料生產、製藥、塑膠和發電等各工業領域不可或缺。隨著這些產業的發展,對濕式真空幫浦的需求也隨之成長。這些泵浦有助於控制有害氣體和環境污染物,並幫助各行各業遵守嚴格的法規。此外,各行各業在研發方面投入了大量資金,以生產符合不斷演變的標準、節能環保的型號。

濕式真空幫浦有助於維持清潔安全的生產環境,尤其是在電子製造等清潔度對產品品質至關重要的產業。這些泵浦旨在去除水分並處理各種工業過程中產生的氣體,確保周圍環境保持無污染。然而,先進真空幫浦技術的高成本對製造商來說是一個重大挑戰。這些複雜系統的初始投資可能非常巨大,這限制了小型企業的採用,並給市場參與者帶來了壓力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.1兆美元 |

| 預測值 | 3.2兆美元 |

| 複合年成長率 | 4.5% |

在各類濕式真空幫浦中,液環真空幫浦細分市場在2024年創造了7,909億美元的市場規模,預計在2025年至2034年期間將持續以4.4%的複合年成長率成長,這得益於其能夠有效管理工業製程產生的氣體。液環真空幫浦因其多功能性、易於維護以及在極端條件下的出色適應性而廣受歡迎,這使其成為化學、食品加工和製藥行業高要求應用的理想選擇。液環泵的強勁性能確保其始終是尋求可靠且經濟高效的泵送系統的行業的首選解決方案。

2024年,塑膠產業佔了28%的市場。濕式真空幫浦在塑膠成型過程中至關重要,去除水分對於提高產品品質和降低生產成本至關重要。此外,這些泵浦有助於管理塑膠生產過程中產生的有害排放,使企業能夠滿足嚴格的環境法規。隨著環保合規在各行各業的重要性日益凸顯,對高效可靠的真空幫浦的需求,尤其是在塑膠產業,預計將持續成長。

2024年,美國濕式真空幫浦市場規模達3,309億美元,主要得益於化工、製藥和食品加工等主要產業的蓬勃發展。這些行業高度依賴濕式真空泵來確保其運作的高效性和清潔度。對排放管理和污染控制的日益重視,進一步推動了濕式真空幫浦在美國市場的普及,因為美國製造商熱衷於維持高標準的環保合規性。隨著各行各業對永續性的重視,濕式真空幫浦的需求預計將持續成長,從而進一步支撐美國乃至全球市場的成長。

全球濕式真空幫浦產業的主要參與者包括阿特拉斯·科普柯公司、普發真空有限公司、泰悉爾公司、荏原公司、加德納·丹佛控股公司、愛德華真空公司和布希真空解決方案公司。為了提升市場佔有率,各公司正專注於產品創新,尤其是在打造節能環保的幫浦方面。透過投資研發,製造商旨在提供技術先進的產品,以滿足日益成長的環保解決方案需求。與食品加工和電子等行業的終端用戶的合作也幫助公司根據特定需求客製化產品。此外,他們重視售後服務,包括維護和支持,以提高客戶滿意度和忠誠度,鞏固其在競爭激烈的市場中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 監管格局

- 技術格局

- 衝擊力

- 成長動力

- 增加工業應用

- 不斷發展的電子和半導體產業

- 嚴格的環境法規

- 技術進步

- 產業陷阱與挑戰

- 競爭激烈的市場

- 成本高昂

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 液環真空幫浦

- 旋片真空泵

- 旋轉活塞真空泵

- 其他

第6章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 低容量(高達 100 m3/h)

- 中等處理能力(100-1,000 m3/h)

- 高處理能力(1,000 m3/h 以上)

第7章:市場估計與預測:按應用 2021 - 2034

- 主要趨勢

- 化學加工

- 製藥

- 塑膠

- 力量

- 冶金

- 食品加工

- 其他

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Atlas Copco AB

- Gardner Denver Holdings, Inc.

- Busch Vacuum Solutions

- Pfeiffer Vacuum GmbH

- Edwards Vacuum

- ULVAC, Inc.

- Leybold GmbH

- Ebara Corporation

- Becker Pumps Corporation

- Dekker Vacuum Technologies, Inc.

- Tuthill Corporation

- Hokaido Co., Ltd.

- Pfeiffer Vacuum Technology AG

- Graham Corporation

- Flowserve Corporation

The Global Wet Vacuum Pumps Market was valued at USD 2.1 trillion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 3.2 trillion by 2034, driven by the rise of the electronics and semiconductor industries. Wet vacuum pumps are indispensable in various industrial sectors such as chemical processing, food and beverage production, pharmaceuticals, plastics, and power generation. As these industries grow, the demand for wet vacuum pumps increases. These pumps help manage harmful gases and environmental pollutants, helping industries comply with strict regulations. Additionally, there is significant investment in research and development to produce energy-efficient and environmentally friendly models that meet evolving standards.

Wet vacuum pumps help in maintaining clean and safe production environments, especially in industries like electronics manufacturing, where cleanliness is vital for product quality. These pumps are designed to remove moisture and handle gases that are produced during various industrial processes, ensuring that the surroundings remain contaminant-free. However, the high cost associated with advanced vacuum pump technologies is a significant challenge for manufacturers. The initial investment in these sophisticated systems can be substantial, limiting adoption for smaller businesses and adding pressure on market players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Trillion |

| Forecast Value | $3.2 Trillion |

| CAGR | 4.5% |

Among the various types of wet vacuum pumps, the liquid ring vacuum pumps segment generated USD 790.9 billion in 2024 and is expected to continue growing at a CAGR of 4.4% from 2025 to 2034 due to their ability to manage gases produced during industrial processes. Their popularity is due to their versatility, ease of maintenance, and resilience under extreme conditions, which make them ideal for demanding applications in the chemical, food processing, and pharmaceutical sectors. The robust performance of liquid ring pumps ensures they remain a go-to solution for industries seeking reliable and cost-effective pumping systems.

In 2024, the plastics segment accounted for a 28% share. Wet vacuum pumps are important in plastic molding and shaping processes, where moisture removal is essential for improving product quality and reducing production costs. Moreover, these pumps help manage harmful emissions generated during plastic production, enabling companies to meet stringent environmental regulations. As environmental compliance becomes increasingly important across industries, the demand for efficient and reliable vacuum pumps, particularly in plastics, is expected to grow.

United States Wet Vacuum Pumps Market generated USD 330.9 billion in 2024, driven by the presence of major industries like chemicals, pharmaceuticals, and food processing. These industries rely heavily on wet vacuum pumps to ensure the effectiveness and cleanliness of their operations. The increased focus on managing emissions and reducing pollution further boosts the adoption of wet vacuum pumps in the U.S. market, where manufacturers are keen on maintaining high standards of environmental compliance. As industries prioritize sustainability, the demand for wet vacuum pumps is expected to increase, further supporting market growth in the U.S. and globally.

Key players in the Global Wet Vacuum Pumps Industry include Atlas Copco AB, Pfeiffer Vacuum GmbH, Tuthill Corporation, Ebara Corporation, Gardner Denver Holdings, Inc., Edwards Vacuum, and Busch Vacuum Solutions. To enhance their market presence, companies are focusing on product innovation, particularly in creating energy-efficient and environmentally sustainable pumps. By investing in R&D, manufacturers aim to offer technologically advanced products that meet the growing demand for eco-friendly solutions. Collaborations with end-users in industries such as food processing and electronics have also helped companies tailor their products to specific needs. Furthermore, they emphasize after-sales services, including maintenance and support, to improve customer satisfaction and loyalty, strengthening their position in the competitive market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact on trade

- 3.2.1 Trade volume disruptions

- 3.2.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.2 Demand-side impact (selling price)

- 3.3.2.1 Price transmission to end markets

- 3.3.2.2 Market share dynamics

- 3.3.2.3 Consumer response patterns

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Key companies impacted

- 3.5 Strategic industry responses

- 3.5.1 Supply chain reconfiguration

- 3.5.2 Pricing and product strategies

- 3.6 Policy engagement

- 3.7 Regulatory landscape

- 3.8 Technological landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing industrial applications

- 3.9.1.2 Growing electronics and semiconductors industry

- 3.9.1.3 Strict environmental regulations

- 3.9.1.4 Technological advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Competitive market

- 3.9.2.2 High costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By product Type, 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Liquid ring vacuum pumps

- 5.3 Rotary vane vacuum pumps

- 5.4 Rotary piston vacuum pumps

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Low capacity (Up to 100 m3/h)

- 6.3 Medium capacity (100-1,000 m3/h)

- 6.4 High capacity (Above 1,000 m3/h)

Chapter 7 Market Estimates & Forecast, By Application 2021 - 2034, (USD Billion)

- 7.1 Key trends

- 7.2 Chemical processing

- 7.3 Pharmaceutical

- 7.4 Plastics

- 7.5 Power

- 7.6 Metallurgy

- 7.7 Food processing

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Atlas Copco AB

- 10.2 Gardner Denver Holdings, Inc.

- 10.3 Busch Vacuum Solutions

- 10.4 Pfeiffer Vacuum GmbH

- 10.5 Edwards Vacuum

- 10.6 ULVAC, Inc.

- 10.7 Leybold GmbH

- 10.8 Ebara Corporation

- 10.9 Becker Pumps Corporation

- 10.10 Dekker Vacuum Technologies, Inc.

- 10.11 Tuthill Corporation

- 10.12 Hokaido Co., Ltd.

- 10.13 Pfeiffer Vacuum Technology AG

- 10.14 Graham Corporation

- 10.15 Flowserve Corporation